Andrew Yang says AI will wipe out millions of white-collar jobs in the next 12 to 18 months

The landscape of the American workforce is facing a period of unprecedented volatility. While previous industrial revolutions primarily automated manual labor, the current wave of artificial intelligence is targeting the professional, college-educated workforce. Insights from political figures, leading economists, and top-tier software engineers suggest that the transition is moving significantly faster than many anticipated, signaling a profound change in how “work” is defined in the 21st century.

Andrew Yang warns that mass white-collar layoffs are closer than people think

Former presidential candidate Andrew Yang has voiced concerns that the United States is on the precipice of a massive labor disruption. Yang suggests that many corporations have been “labor hoarding” following the lockdown, but as AI tools become more integrated and efficient, the need for large administrative staffs is evaporating. According to Yang, “mass white-collar layoffs are closer than people think,” as companies look to streamline operations and replace middle-management tasks with automated systems. He argues that the economic pressure to increase margins will eventually outweigh the desire to maintain high headcounts.

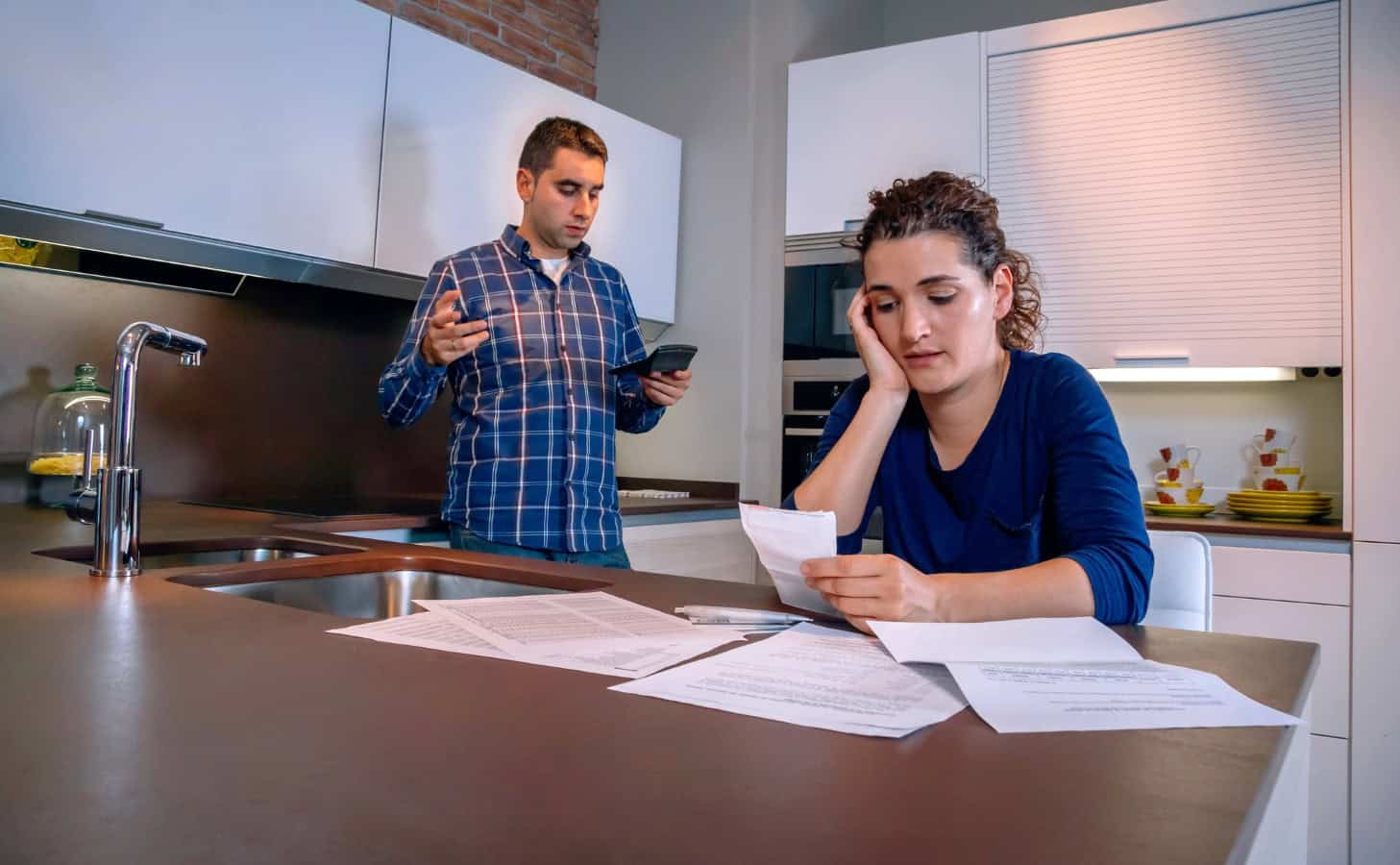

Millions of U.S. jobs are at serious risk as economists issue warnings

Recent reports from economic experts highlight a sobering reality for millions of American workers. Unlike previous technological shifts, the speed of AI adoption is leaving little room for worker retraining or natural attrition. Economists warn that “millions of US jobs at serious risk,” particularly in sectors that involve data processing, legal research, and routine administrative tasks. The concern is that the economy may not be able to generate new roles fast enough to compensate for the positions being eliminated by high-speed algorithms and generative models.

Top engineers at Anthropic and OpenAI say AI now writes 100% of their code

In the world of technology, the very people building AI are seeing their own roles transform. Top engineers at leading firms like Anthropic and OpenAI have revealed a startling shift in their daily workflows. These experts claim that “AI now writes 100% of their code,” a milestone that seemed decades away just a few years ago. Instead of manually typing lines of syntax, these high-level developers are shifting their focus toward architectural design and system oversight, leaving the execution entirely to the machines they created.

The big implications for the future of software development jobs

The revelation that AI is handling the bulk of coding tasks has sent shockwaves through the tech industry. For decades, software engineering was considered one of the most “future-proof” career paths available. However, the rise of automated coding suggests a future where fewer humans are needed to build and maintain complex software systems. This shift has “big implications for the future of software development jobs,” potentially raising the barrier to entry while simultaneously reducing the total number of developers required to bring a product to market.

Why entry-level and junior roles are the most vulnerable

As AI takes over the “grunt work” of coding and data entry, the traditional career ladder is losing its bottom rungs. Historically, junior employees learned the ropes by performing simpler tasks that senior staff didn’t have time for. With AI now performing these tasks with near-perfect accuracy and zero fatigue, companies are finding less reason to hire and train entry-level workers. This creates a “junior-level gap” that could make it increasingly difficult for recent graduates to enter the professional workforce and gain the experience necessary for senior roles.

The great decoupling of productivity and employment

One of the most concerning trends identified by economists is the widening gap between corporate output and human labor. As AI drives efficiency, companies can theoretically produce more goods and services with significantly fewer people. This phenomenon threatens the traditional link between economic growth and job creation. If a company can double its productivity using AI without hiring a single new person, the benefits of that growth may not reach the broader labor market, leading to increased wealth concentration and social friction.

Middle management faces a new kind of automation

For years, middle management was seen as a safe haven from automation because it required human communication and coordination. However, AI is proving remarkably adept at managing schedules, tracking project milestones, and even evaluating employee performance based on data. Andrew Yang and other observers suggest that this “coordination layer” of the workforce is now directly in the crosshairs of corporate cost-cutting measures. When AI can provide real-time updates and resource allocation, the need for human intermediaries begins to diminish.

The shift from “doing” to “prompting” and oversight

As the tools of production change, the required skill set for human workers is pivoting from technical execution to high-level “prompting” and critical oversight. In the new economy, the value of a worker is no longer measured by their ability to generate content or code, but by their ability to direct the AI and verify its output. This transition requires a different type of education and mindset; one that focuses on logic, ethics, and system-level thinking rather than specialized technical tasks that can be easily replicated by an LLM.

Policy challenges in a rapidly evolving labor market

The speed of the AI revolution is currently outpacing the ability of governments to regulate or respond. From potential tax revenue losses due to lower payrolls to the need for updated social safety nets, the policy implications are vast. Economists warn that without proactive intervention, the transition could lead to significant social unrest. The debate over solutions such as Universal Basic Income (UBI) or shortened work weeks is moving from the fringes of political discourse to the center as the reality of AI-driven displacement becomes harder to ignore.

While the outlook for traditional white-collar roles may seem grim, some experts believe this shift will eventually lead to the creation of entirely new categories of work. The challenge lies in the “interim” period; the years or decades it takes for the economy to rebalance. As AI handles the mechanical aspects of professional work, the human element may become more focused on empathy, complex negotiation, and multidisciplinary problem-solving. However, for those currently in the workforce, the immediate priority is staying adaptable in an environment where the rules of employment are being rewritten in real-time.

Like Financial Freedom Countdown content? Be sure to follow us!

The Retirement Divide: Why the Average 401(k) is $148,000 but the Median is Still Under $1,000

The headlines are startling: the typical American worker has just $955 saved for retirement. This figure, from the National Institute on Retirement Security (NIRS) 2026 report, paints a picture of a nation on the brink of a financial crisis. But while millions are falling through the cracks, others are leveraging new laws and record-high account balances to build a secure future.

The Retirement Divide: Why the Average 401(k) is $148,000 but the Median is Still Under $1,000

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.