Washington Governor Backs 9.9% Millionaire Tax as Critics Warn It Could Drive Wealthy Residents Out of the State

Washington Governor Bob Ferguson has endorsed a proposal from legislative Democrats to impose a 9.9 percent income tax on annual adjusted incomes above $1 million. The measure represents a significant shift for a state that has historically avoided personal income taxes, positioning the proposal as both a fiscal and political flashpoint as lawmakers prepare for the upcoming legislative session.

The proposal arrives as state leaders attempt to address growing budget concerns and affordability challenges across Washington. Critics warn the tax could prompt wealthy residents to leave Washington, raising concerns about potential revenue losses if top earners follow relocation trends seen among some billionaires in recent years.

Why Washington Leaders Say the Tax Matters

Washington is currently grappling with a $2.3 billion budget deficit and rising cost pressures tied to federal government policies, according to Ferguson. Speaking at a news conference, he framed the millionaire tax as part of a broader effort to stabilize the state’s finances and support residents facing higher living costs.

On the same day, Ferguson unveiled a spending proposal for the remainder of the current two-year budget cycle, aiming to close a projected $2.3 billion shortfall through mid-2027. The governor has emphasized that new revenue streams could help sustain key public services without placing additional burdens on middle- and lower-income residents.

Ferguson Frames Tax as Fix for “Outdated” System

Ferguson has argued that Washington’s current tax system places disproportionate pressure on lower-income households, relying heavily on sales taxes rather than income-based levies.

“We are facing an affordability crisis,” Ferguson said. “It is time to change our state’s outdated, upside down tax system to serve the needs of Washington today. To make our tax system more fair, millionaires should contribute more toward our shared prosperity.”

The governor has suggested that restructuring the tax system could help address long-standing inequality concerns while generating new funds for public programs.

Proposal Includes Potential Relief for Lower-Income Residents

Ferguson has emphasized that revenue generated by the millionaire tax would not simply increase state spending. Instead, he said part of the funding could be directed toward tax relief and economic support for lower-income residents.

He has suggested expanding the state’s working families tax credit or reducing sales taxes as possible ways to redistribute revenue. Ferguson also reiterated that he does not support any income tax on residents earning less than $1 million annually.

In a post on X, formerly Twitter, Ferguson said that tax cuts approved earlier this year by President Donald Trump have “made our state’s unfair tax structure even worse.”

Washington’s Unique Position Among States Without Income Taxes

Washington remains one of nine states without any personal income tax, joining Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming. However, many states have adopted special tax brackets targeting high earners.

California, for example, imposes an additional 1 percent tax on income above $1 million on top of its standard high rate. According to TurboTax, several states and Washington, DC, currently operate millionaire tax systems, including California, Connecticut, Massachusetts, New Jersey, and New York.

Supporters of Washington’s proposal argue the state is lagging behind others that have adopted similar revenue models.

How Many Residents Would Be Affected

Although Washington ranks among the top states nationwide for millionaire households, the tax would impact a relatively small portion of residents. Statista estimates that 7.85 percent of Washington residents qualify as millionaires.

However, according to a report by the Washington State Standard, the proposed tax would only affect less than 0.5 percent of Washingtonians. Legislative leaders have also estimated that roughly 30,000 taxpayers could fall under the new bracket if enacted.

Expected Revenue and Budget Implications

Democratic lawmakers estimate the millionaire tax could generate between $3 billion and $3.7 billion annually. Ferguson has proposed using some of those funds to support education, healthcare, and targeted tax cuts for working families.

Last month, Ferguson introduced a supplemental budget proposal to address the deficit, combining $1 billion from the state’s rainy day fund with roughly $800 million in spending reductions. If approved, the operating budget would increase to $79 billion per biennium, surpassing previous spending records.

Democratic leaders have acknowledged that revenue from the millionaire tax would likely not be available until 2029 if it survives legal challenges, making it a long-term fiscal strategy rather than an immediate budget fix.

Republican Lawmakers Warn of Spending and Economic Risks

Republican leaders have strongly opposed the proposal, arguing that Washington’s budget problems stem from excessive spending rather than insufficient revenue.

Representative Travis Couture, the ranking Republican on the House Appropriations Committee, said: “If record revenue couldn’t balance the budget, a ‘millionaire’ income tax won’t either. This is a spending problem, not a revenue problem.”

Republican lawmakers have also expressed concern that the measure could negatively impact small businesses and encourage wealthy residents to relocate to lower-tax states.

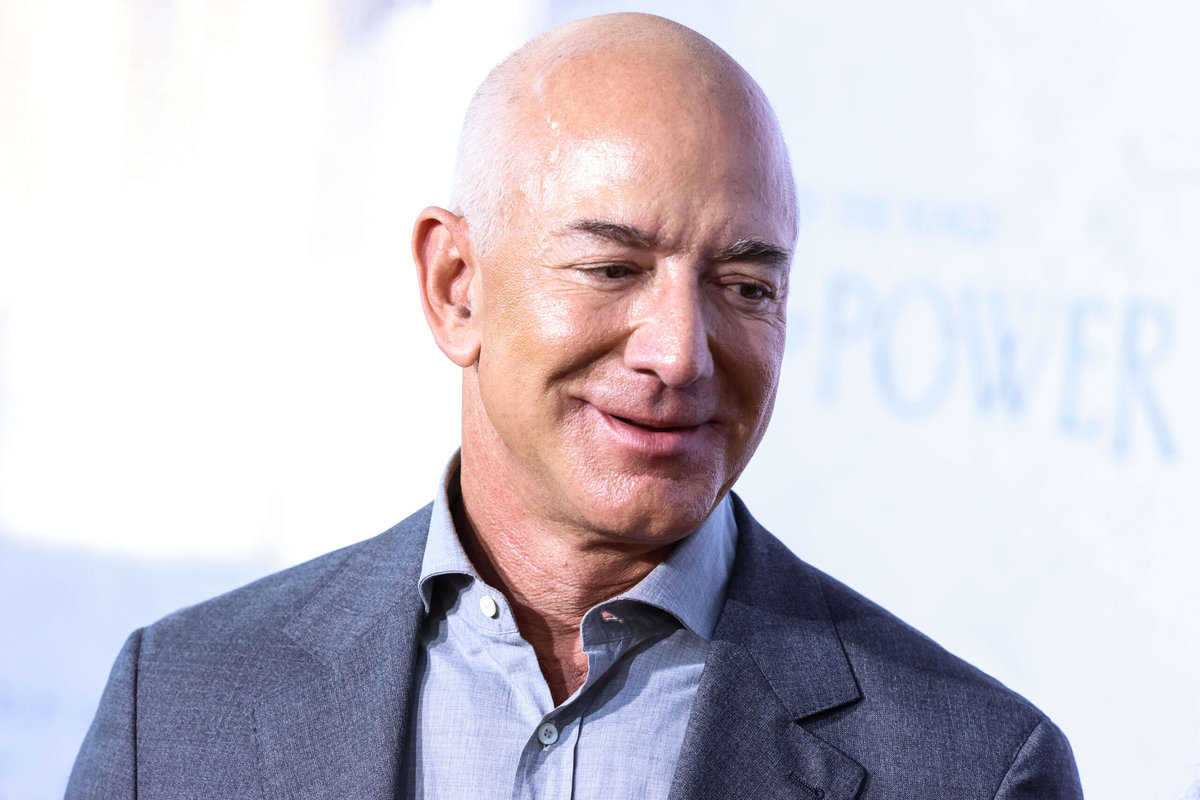

The “Bezos Effect”: Relocation and Revenue Realities

In late 2023, Jeff Bezos announced his departure from Seattle; his home of nearly 30 years, to relocate to Miami, Florida. Publicly, Bezos attributed the move to personal logistics, citing a desire to be closer to his parents and the Florida-based operations of Blue Origin. However, the timing was conspicuous; it occurred shortly after the Washington State Supreme Court upheld a 7% capital gains tax. By shifting his primary residence to Florida; a state with no income or capital gains tax; Bezos effectively shielded his massive stock liquidations from Washington’s reaching hand.

The Risk of a Counterproductive Exodus

The financial consequences for Washington’s treasury were immediate and staggering. By selling roughly 50 million Amazon shares as a Florida resident in early 2024, Bezos saved himself an estimated $600 million in taxes. Critics of the Millionaire Tax argue that this is just the beginning of a “wealth flight” that could cause the bill to have the opposite of its intended effect. Because Washington’s tax revenue is so heavily concentrated among a few hundred ultra-wealthy individuals, the departure of even a small percentage of high-earners can erode the tax base faster than the new rates can replenish it.

The Concentration Risk: One analysis suggested that a wealth tax exclusively targeting billionaires would have seen 97% of its revenue come from just five individuals. When the tax base is that narrow, the relocation of a single “whale” like Bezos doesn’t just lower revenue; it can create a massive structural deficit.

Furthermore, opponents warn of a “domino effect” among the state’s tech and startup sectors. With the proposed tax potentially pushing Seattle’s effective top rate to over 18% (when combined with local payroll taxes), founders and executives may choose to scale their next ventures in tax-friendly hubs like Austin or Miami. If the “Millionaire Tax” triggers a steady migration of high-value residents, Washington could find itself in a paradoxical trap: passing higher tax rates only to realize lower total collections as the state’s most mobile taxpayers—and the economic activity they generate; disappear across state lines.

Debate Intensifies Over Potential Expansion of Income Taxes

Opponents have warned that implementing a millionaire tax could open the door to broader income taxation in the future. Critics have pointed to Washington voters rejecting income tax proposals ten separate times.

Sen. Chris Gildon expressed skepticism about the long-term implications of the measure, saying, “I don’t think any of us should ever call this a millionaires’ tax again, because we know where this is heading. They want to get it into the courts, they want to pass the income tax, let it work its way through the courts and then eventually expand it to each in every person in Washington.”

Ferguson has attempted to ease those concerns but declined to clarify whether he would support lowering the $1 million threshold in the future.

“I don’t support [a threshold] less than $1 million a year,” Ferguson said. When pressed further, he added, “I can’t answer any more clearer than that.”

Democratic Leaders Argue Measure Targets Regressive Tax Structure

Democratic budget leaders have defended the proposal as a targeted policy designed to correct what they describe as one of the nation’s most regressive tax systems. They emphasize that fewer than 1 percent of households would pay the tax while millions could benefit from tax relief and expanded services.

Democratic Senate Majority Leader Jamie Pedersen said: “Our state is wonderful for so many reasons, but our broken, nearly century-old tax structure is holding us back. We have an opportunity to take a giant step forward by funding public schools, health care, and services that people across the state are counting on by increasing taxes on a few thousand very wealthy people and cutting taxes for millions more.”

Rep. Timm Ormsby also downplayed concerns about capital flight, saying lawmakers should focus on the current policy proposal rather than speculate about future tax expansions.

“Let’s focus on the policy that’s in front of us, not speculate about what that means in the future,” he said. “That would come in the future, and it would go through the same scrutinizing and unpacking process that any legislation in any committee that has any fiscal impact whatsoever would go through.”

Legal and Political Hurdles Ahead

The proposal is expected to face significant legal scrutiny, with many observers predicting the Washington Supreme Court could ultimately weigh in if lawmakers approve the tax. The state has long-standing legal restrictions on income taxation, which could complicate implementation.

If passed by the Legislature, the measure could also be sent to voters for approval. Lawmakers have scheduled hearings and aim to advance the bill during the 60-day legislative session, which is set to conclude March 12.

As debate intensifies, the millionaire tax proposal is shaping up as one of Washington’s most consequential economic policy battles, with the potential to reshape how the state funds public services.

Critics warn that higher taxes on top earners could push more wealthy residents and business owners to relocate to lower-tax states, potentially weakening Washington’s tax base and slowing job creation tied to investment and small business growth.

Like Financial Freedom Countdown content? Be sure to follow us!

Ray Dalio Warns World Is ‘On the Brink’ of a Capital War; Says Gold Is the Safest Money

Billionaire hedge fund manager Ray Dalio is warning that global tensions are shifting beyond traditional geopolitical conflicts and entering a new era where money itself becomes a weapon. The Bridgewater Associates founder said the world is not just facing a cold war or trade war, but a looming “capital war” in which nations could use financial leverage to pressure rivals. Dalio made the remarks during an interview at the World Governments Summit in Dubai, cautioning that escalating political and economic tensions could disrupt global markets and investment flows. Dalio described a scenario where countries could attack each other by controlling the flow of capital, particularly through debt ownership and financial sanctions. Such financial warfare, he warned, could create severe market instability and alter how investors and governments manage their money.

Ray Dalio Warns World Is ‘On the Brink’ of a Capital War; Says Gold Is the Safest Money

Zillow Identifies 7 U.S. Cities Where Buyers Now Hold the Most Leverage

The real estate landscape is shifting as we enter 2026, offering new opportunities for those who have been waiting on the sidelines. According to Zillow’s latest analysis, Indianapolis has emerged as the most buyer-friendly housing market in the United States. This ranking highlights a significant trend: while coastal hubs remain financially out of reach for many, “opportunity metros” are providing home shoppers with the breathing room and affordability they need to secure long-term value.

Zillow Identifies 7 U.S. Cities Where Buyers Now Hold the Most Leverage

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.