AARP Survey Exposes Alarming Fear of Financial Ruin in Retirement Among Over 50% of Americans Aged 50 and Up

A recent AARP survey paints a troubling picture for older Americans, revealing that 20% of adults aged 50 and older have no retirement savings whatsoever. This financial unpreparedness is fueling anxiety, with 61% of respondents in this age group fearing they won’t have enough funds to sustain themselves during retirement.

Decline in Financial Security Among Older Men

The survey also reveals a troubling decline in financial security among older men. In early 2022, 34% of men described their financial situation as “fair” or “poor.” This figure has now risen to 42%. Interestingly, 40% of men who regularly save for retirement believe they are saving enough, compared to just 30% of women.

Everyday Expenses: The Biggest Barrier to Savings

Everyday expenses continue to hinder retirement savings for many older adults. The lack of access to retirement savings options, combined with rising living costs, is making it difficult for people to decide when to retire. Some older Americans even anticipate never retiring due to financial constraints.

Credit Card Debt Among Older Adults

The burden of credit card debt is another significant issue. Nearly one-third of older adults carry a credit card balance month-to-month, with 30% reporting a balance of $10,000 or more.

Alarmingly, 12% have a balance of $20,000 or more, up from 8% a year ago.

The credit card debt has also been noted by the New York Fed’s Center for Microeconomic Data. As per the Quarterly Report on Household Debt and Credit, more borrowers are falling behind on credit card payments and 1 out of every 5 borrowers is maxed-out.

Delinquency Rates Among Borrowers

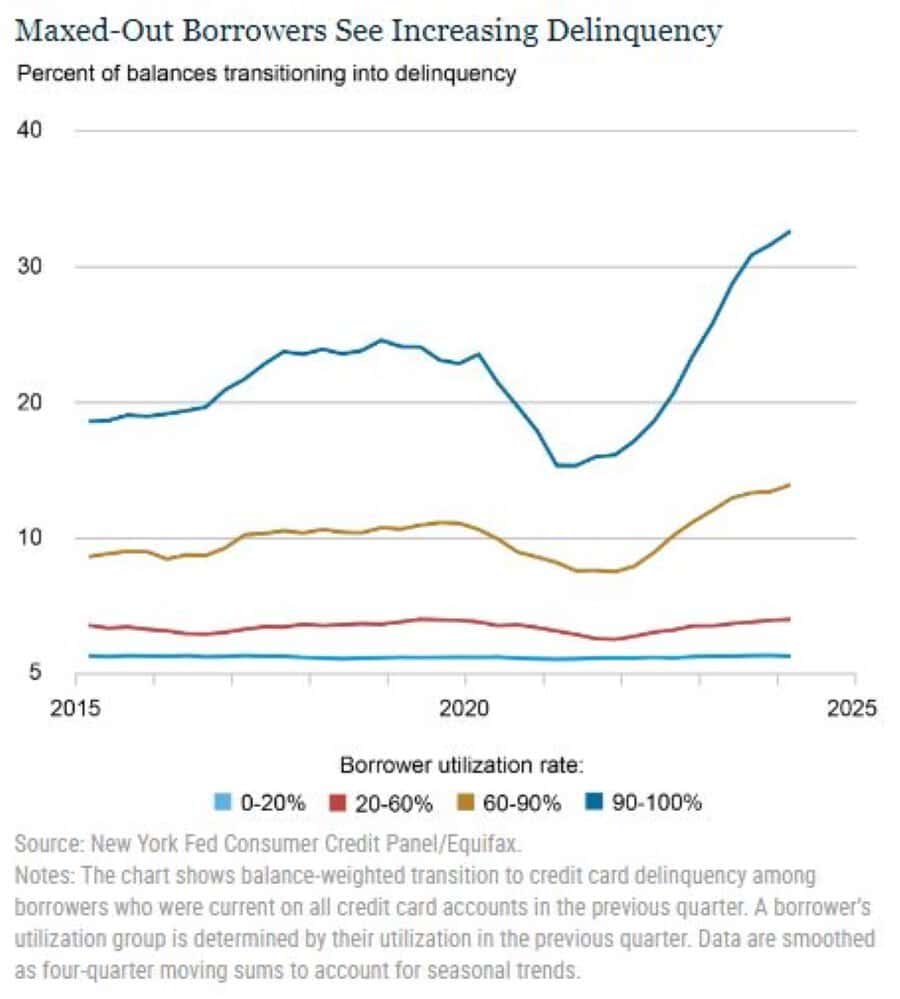

The chart by the New York Fed illustrates the shift of credit card balances into delinquency among current borrowers, segmented by their credit card utilization from the previous quarter.

Both the 0-20 percent and 20-60 percent utilization groups maintain low delinquency transition rates throughout the series—1 percent and 4 percent, respectively, returning to 2020 levels.

In addition to the increasing number of maxed-out borrowers, the delinquency rate is also skyrocketing.

Delinquency rates for those with over 60 percent utilization have not only surpassed 2020 figures but continue to climb, driving the overall increase in credit card delinquency rates.

Notably, the 90-100 percent utilization group shows a significant surge, with approximately one-third of the balances for maxed-out borrowers becoming delinquent in the past year, a marked rise from less than a quarter before 2020.

Surging Transportation, Food and Housing Costs Have Crushed Americans

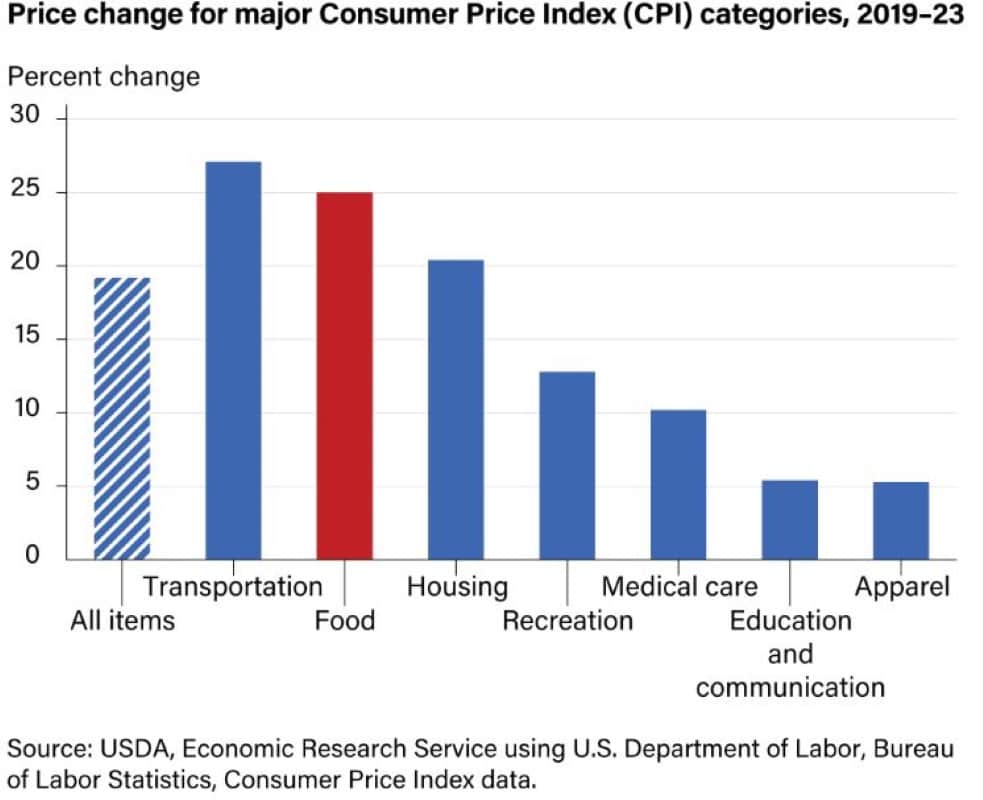

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period as per USDA data. Essentials such as food prices saw a 25% increase while transportation costs increased by 27.1%.

Americans would have no choice but to resort to credit cards.

Rising Costs and Inflation Concerns

Inflation and rising costs are major concerns for older Americans.

More than one-third (37%) are worried about covering basic expenses like food and housing. Additionally, 26% are concerned about family caregiving costs.

A staggering 70% are worried about prices increasing faster than their income.

Inflation Top Concern As Per Gallup Poll

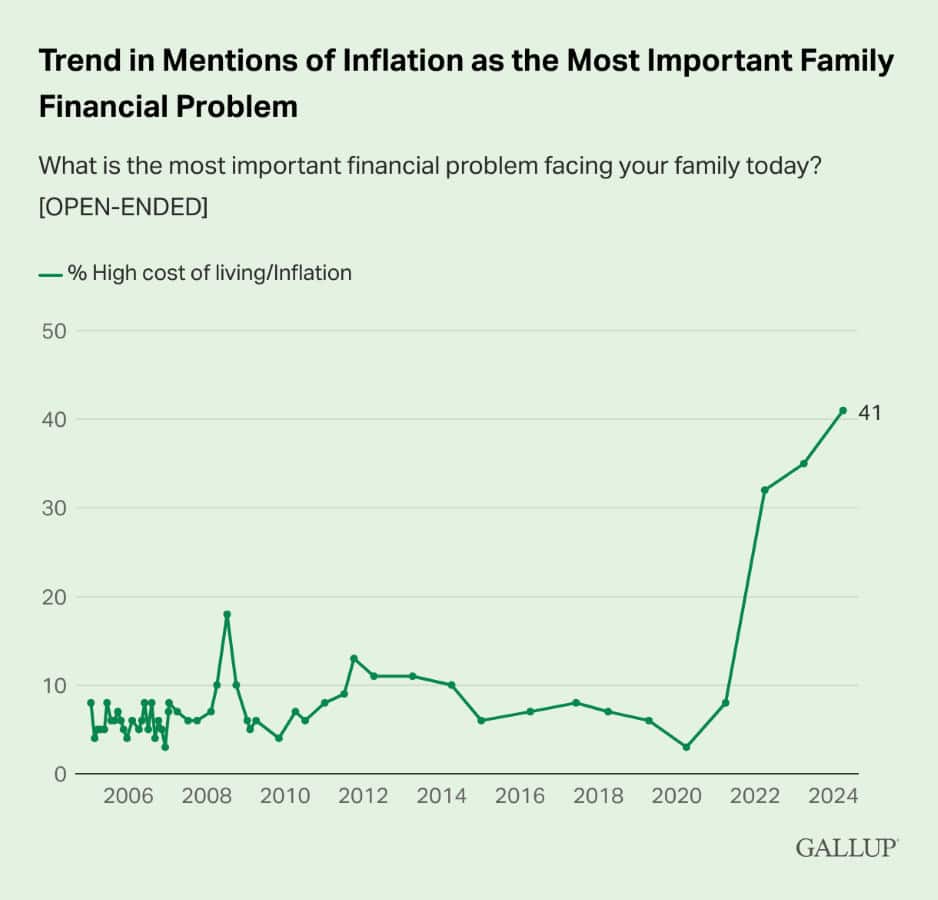

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak. This year, 41% cite the issue, a slight increase from 35% last year.

The latest findings come from Gallup’s annual Economy and Personal Finance poll, conducted between April 1 and 22, 2024. Since 2005, Gallup has asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

A Glimmer of Hope: Financial Optimism

Despite these challenges, there is a glimmer of hope. One-third (33%) of respondents believe their finances will improve over the next 12 months. However, the ongoing effects of inflation and high costs continue to cast a shadow over this optimism.

The Workplace Retirement Plan Gap

AARP believes, access to workplace retirement plans significantly increases the likelihood of saving for retirement. Unfortunately, nearly 57 million Americans lack access to such plans. Expanding these opportunities is crucial to addressing the retirement savings crisis.

State-Level Initiatives on Retirement Programs

Eight states, including California, Colorado, Connecticut, Illinois, Maine, Maryland, Oregon, and Virginia, have implemented auto-IRA programs. Massachusetts offers a multiple employer plan, while ten other states are in various stages of launching their initiatives. Washington recently signed auto-IRA legislation into law, marking a significant step forward.

Although state-level efforts are commendable, comprehensive federal action is essential. Congress is considering legislation like the bipartisan Retirement Savings for Americans Act of 2023 and the Automatic IRA Act of 2024, aimed at enhancing retirement security for all Americans.

A Call to Action

The retirement savings crisis among older Americans is a pressing issue that requires immediate attention. With 20% of adults aged 50+ having no retirement savings and over half worried about their financial future, it’s clear that more needs to be done.

Although retirement savings plans can solve accessibility issues, it does not address the cause for Americans over 50 having no money left in their budget to save.

Like Financial Freedom Countdown content? Be sure to follow us!

Check if Your State Taxes Social Security in 2024 as 10 States Continue and 2 Finally Stop

While many believe their golden years will be tax-friendly, residents in ten states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, two states are bringing relief by ending their practice of taxing these benefits. This shift highlights the complexity of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you residing in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Check if Your State Taxes Social Security in 2024 as 10 States Continue and 2 Finally Stop

Revealing the Income Needed to Join the Top 1% in Every State: Surprising Facts That Prove NYC Isn’t Number One!

SmartAsset’s latest study uncovers the earnings needed to join the top 1% in every state, highlighting surprising differences in living costs nationwide. Shockingly, New York doesn’t even make the top five, even though coastal states lead the list.

Home Equity Offers A Lifeline for Older Homeowners, but a Dire Future for Those Without

Many homeowners over 60 see their homes as more than just a place to live; they are cornerstones of their financial security and retirement plans. This group, which boasts a nearly 80% homeownership rate, has not only built emotional bonds with their homes but also views the equity accumulated as a vital safety net for their golden years. According to a Fannie Mae study, a significant portion of this demographic is planning to age in place, relying on their homes as a key part of their financial strategy for a comfortable retirement.

Home Equity Offers A Lifeline for Older Homeowners, but a Dire Future for Those Without

Protect Your Retirement: Crucial Strategies to Shield Your Savings During Financial Turbulence

In an era of growing financial risks, investors usually rely on the security of bonds. However, with rising inflation, many are seeing their retirement plans unravel as bond funds faced unprecedented losses in 2022 and continue to decline this year.

Protect Your Retirement: Crucial Strategies to Shield Your Savings During Financial Turbulence

Smart Retirement Planning: Should You Use Your 401(k) to Delay Social Security Until 70?

Deciding when to claim Social Security benefits is a critical decision for retirees. Two common strategies are claiming Social Security at age 62 and preserving retirement funds or using 401(k) savings and delaying Social Security until age 70. Each approach has its advantages and drawbacks, influenced by individual financial situations and goals.

Smart Retirement Planning: Should You Use Your 401(k) to Delay Social Security Until 70?

Thinking of Retiring Abroad? Hold on! Avoid These 9 Countries Where Claiming Social Security Isn’t an Option

Dreaming of retiring to picturesque locales? Many Americans yearn for foreign adventures in their golden years. Yet, securing Social Security benefits abroad isn’t guaranteed. Before jetting off, learn which nine countries may disrupt your retirement dreams.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.