Massive Job Growth Revision Slashes 598,000 Jobs—White House Shifts Blame to Biden

Total U.S. employment for the year ending March 2024 was revised downward by 598,000—a historically significant downgrade, though smaller than the 818,000 reduction initially estimated by the Labor Department in August.

The revision, based on state unemployment records that track actual payroll data rather than monthly survey estimates, indicates the nation added an average of 50,000 fewer jobs per month from April 2023 to March 2024.

Fed Report Had Revealed Overstated Job Growth in 25 States

Although the downward revisions may seem shocking to most Americans, the estimates released by the Federal Reserve Bank of Philadelphia in December revealed troubling discrepancies in reported employment data across the United States.

From March through June 2024, job growth estimates differed sharply in 27 states when compared to earlier figures provided by the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES).

The revised findings, based on more comprehensive employment data, show that 25 states posted lower-than-expected job changes, raising concerns over the accuracy of preliminary economic indicators and the pace of national employment recovery.

Employment Overstated in 25 States

According to the Fed’s early benchmarks, 25 states experienced lower job changes than initially reported by CES estimates.

These downward revisions signal slower-than-expected payroll growth in key regions, potentially impacting state-level economic planning and recovery projections.

Delaware Job Growth Significantly Lower

Delaware’s employment outlook took a sharp hit after incorporating QCEW data. Payroll jobs declined by 1.8% from March to June 2024, far below the CES’s earlier projection of 1.2% growth. Over the broader three-quarter period ending in June, job growth in Delaware was adjusted to just 1.0%, indicating a more subdued employment trend.

Pennsylvania Reports Major Revisions

Similarly, Pennsylvania showed a stark downward adjustment in employment growth. The Fed’s data reported a 1.3% decline in payroll jobs from March through June, contradicting the initial CES estimate of a robust 2.1% growth.

Over the same three-quarter period, Pennsylvania’s job growth was downgraded to just 0.7%, signaling weaker labor market conditions than previously believed.

Job Growth Trends in New Jersey

New Jersey’s employment data also saw a downward revision, though less severe than in Delaware and Pennsylvania. While not as drastic, the corrections highlight ongoing challenges in fully capturing state payroll trends through preliminary reporting methods.

Continuing Trend of Downward Revisions

Job openings declined in September, with August figures also revised downward, bringing the three-month moving average to its lowest point since the spring 2021 reopening.

In September, there were fewer than 1.1 job vacancies available for each unemployed worker.

In August, employers added 142,000 jobs on a seasonally adjusted basis, the Bureau of Labor Statistics reported on Friday. This marks a weaker-than-expected result for the second month in a row.

Additionally, job totals for June and July were revised downward by a combined 86,000 positions, dragging the three-month average to just 116,000 jobs—a significant signal that hiring is slowing. This downward revision comes on the heels of another massive revision a few weeks ago.

Massive Jobs Data Revision, Largest Since the Great Financial Crisis

Each year, the BLS revises the data from its monthly payroll survey of businesses and benchmarks the March employment level against figures from the Quarterly Census of Employment and Wages (QCEW) data.

This year’s preliminary data reveals the largest downward revision since 2009, indicating that the labor market wasn’t as robust as initially portrayed.

National Economic Council Director Kevin Hassett said, “I think the big news for us is that it was a weak jobs number and the downward revisions, which we’ve seen a pattern of over the last few years, were really, really stunningly bad.”

818,000 Fewer Jobs Revealed in August

The U.S. economy created 818,000 fewer jobs than originally reported in the 12 months leading up to March 2024, the Labor Department revealed on August 21st, 2024.

In its preliminary annual benchmark revisions to the nonfarm payroll numbers, the Bureau of Labor Statistics indicated that actual job growth was nearly 30% lower than the initially reported 2.9 million jobs from April 2023 to March 2024.

Focus Shifts to the Federal Reserve

The Federal Reserve cut the interest rates by a cumulative 100 basis points between September and December to help the job market. Although the Fed delivered the rate cuts, the employment numbers still look gloomy.

However, with the bond market pushing the 10-year higher; the Fed may have limited options. Chair Powell has indicated a pause for lowering rates further. The focus now shifts to the next Fed meeting.

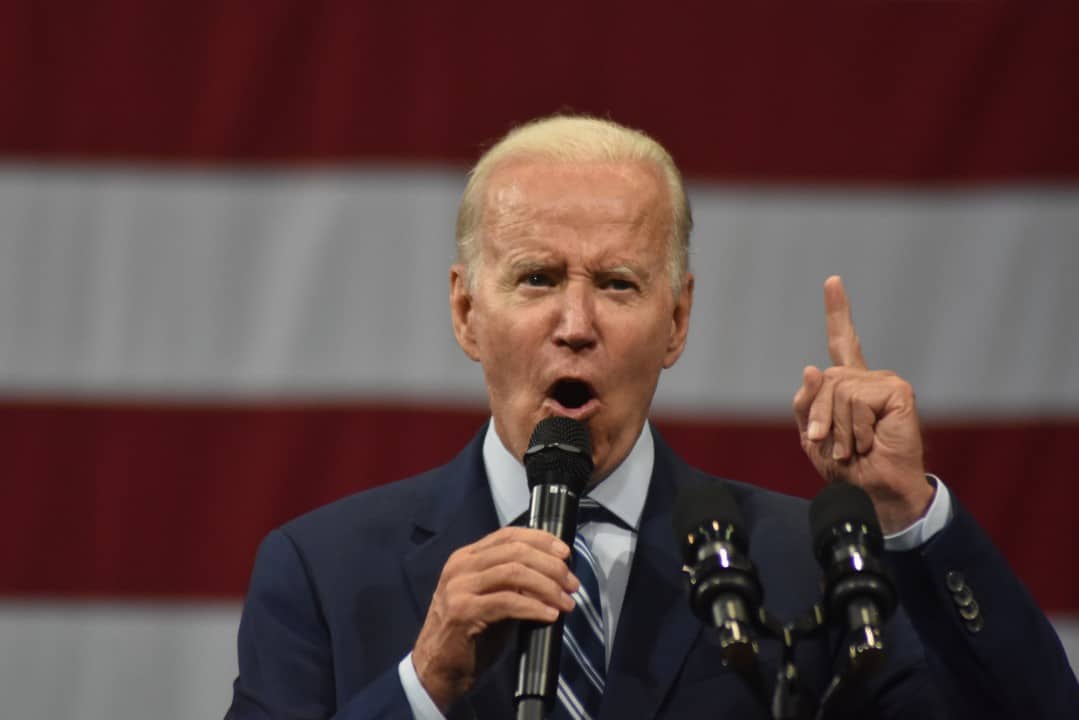

Biden-Harris Administration’s Economic Performance

The latest data comes after the election where Vice President Kamala Harris tried to reshape voters’ perceptions of the Biden administration’s economic performance.

The Biden-Harris administration, had struggled to persuade Americans that, despite widespread public unease about the U.S. economy, things are actually going well and that inflation has been controlled without severely harming the labor market.

Biden’s Job Creation Claim No Longer True

At the Democratic National Convention, Joe Biden proudly claimed to have created 16 million new jobs as president, rounding up from 15.8 million.

However, after the downward revision by BLS, that claim is no longer accurate.

California Expected to Have the Largest Downward Revisions

By state, the report from the Federal Reserve Bank of Philadelphia estimated that California will face the largest employment revision for the nine-month period ending in June 2024, with a staggering downward adjustment of 172,700 jobs.

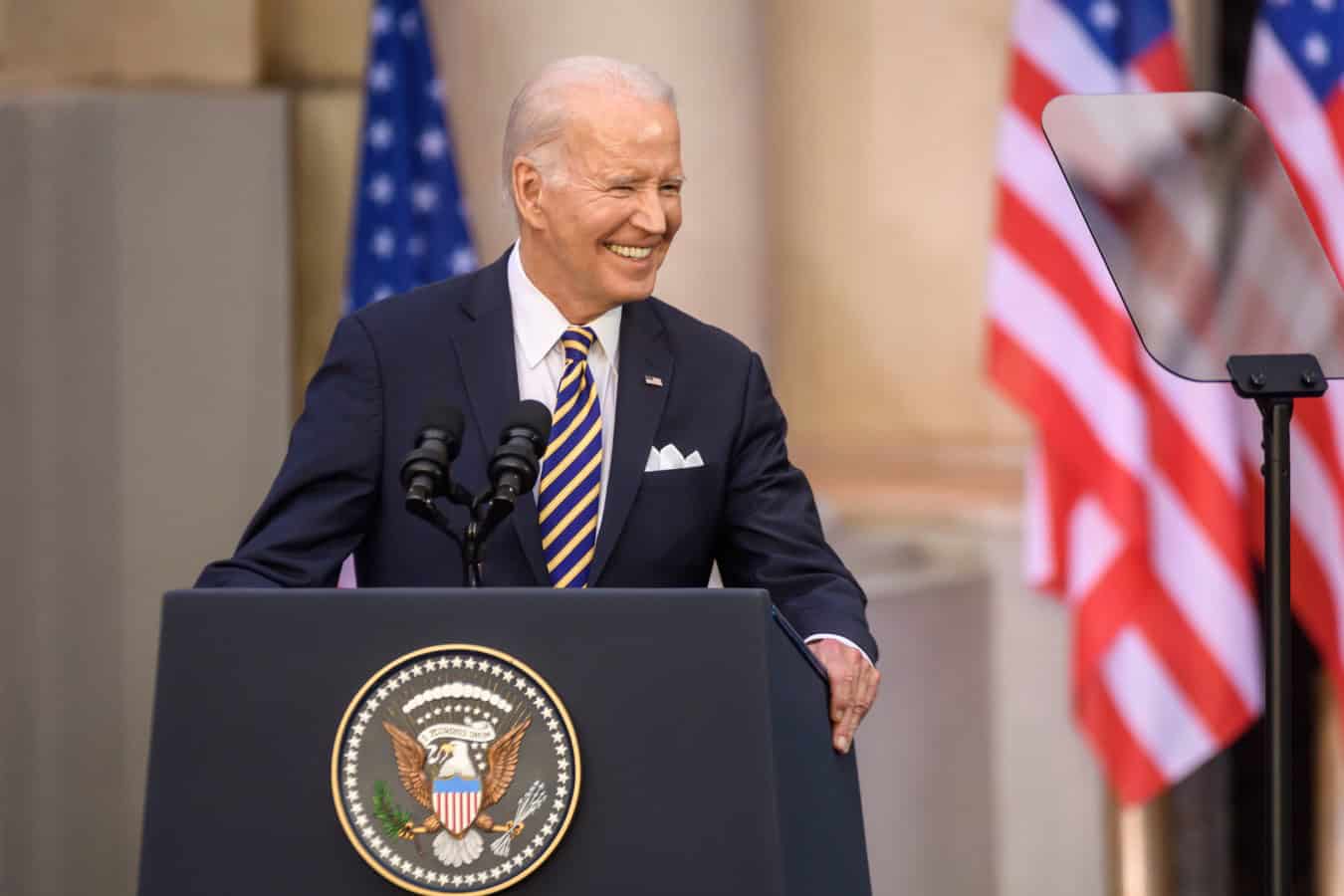

Trump’s Election Victory Improves Labor Market

Despite concerns over job growth, the labor market showed surprising resilience at the end of 2024, with payroll gains for the previous two months revised upward by 100,000 jobs.

The Labor Department reported Friday that the unemployment rate dropped from 4.1% to 4%, an eight-month low.

Economists had forecasted 170,000 new jobs for the past month, but revisions to prior months painted a stronger picture.

November’s employment gains were adjusted upward from 212,000 to 261,000, while December’s figures increased from 256,000 to 307,000.

These booming additions coincided with a surge in small business optimism following Trump’s election victory in early November.

Which Industries Are Driving Job Growth?

Health care continues to be a powerhouse in job creation, leading January’s employment gains with 44,000 new positions. Retail followed closely, adding 34,000 jobs, while the public sector expanded its workforce by 32,000.

However, not all industries saw growth. The leisure and hospitality sector, which includes restaurants and bars, unexpectedly lost 3,000 jobs.

Professional and business services—a broad category that includes white-collar and office jobs—shed 11,000 positions. Meanwhile, manufacturing added a modest 3,000 jobs, and construction gained just 4,000.

Are Wages Keeping Up?

Average hourly earnings climbed by 17 cents to $35.87, marking an annual wage increase of 4.1%, up from the previous 3.9% pace.

While wages continue to rise, overall growth has slowed compared to previous years. The fading of pandemic-related labor shortages has helped temper inflation, as employers are facing fewer pressures to pass higher labor costs onto consumers through price hikes.

Broader Implications for the Labor Market

The White House quickly placed the blame for the jobs report on Biden’s policies.

“Today’s jobs report reveals the Biden economy was far worse than anyone thought, and underscores the necessity of President Trump’s pro-growth policies,” White House press secretary Karoline Leavitt said in a statement.

National Economic Council Director Kevin Hassett added, “The truth is that we’re inheriting a very difficult jobs market because of Joe Biden’s terrible policies.”

Americans voted for Trump based on promises of a better economy. They will be watching closely the prices at the grocery store as well future employment data.

Americans crushed by inflation would have a harder time making ends meet if the job market worsened resulting in higher unemployment.

Like Financial Freedom Countdown content? Be sure to follow us!

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

As Americans approach retirement, their anxiety about the future intensifies. Economic challenges, rising healthcare costs, and high living expenses are creating a cloud of uncertainty over the choice of retirement destinations. A recent study, however, reveals the Mountain State region as a prime spot for those seeking affordable retirement options.

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

Maximize Your Social Security Benefits with These 14 Smart Strategies

Social Security serves as a critical lifeline for countless seniors, providing essential income support in their retirement years. In the current economic environment, Social Security’s inflation-adjusted benefits offer a safeguard against the worst inflation seen in four decades. Rising interest rates have disrupted many retirement portfolios, causing bond fund values to plummet. Social Security can act as a ballast for a typical stock-bond retirement portfolio. By implementing specific strategies, retirees can maximize their Social Security benefits and secure a stable financial future.

Maximize Your Social Security Benefits with These 14 Smart Strategies

The 9 States Taxing Social Security in 2024 and the 3 That Just Stopped

While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over three states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.