Trump Promises $1,776 ‘Warrior Dividend’ Checks; Even as Tariff Revenue Falls Short

President Donald Trump is sending $1,776 checks to nearly 1.5 million U.S. military personnel ahead of the holidays, branding the payments as a patriotic “warrior dividend.”

The White House says the money reflects respect for service members and the success of Trump’s tariff-driven economic strategy. But behind the headline-grabbing checks is a growing gap between tariff promises and tariff reality.

A Holiday Surprise for 1.45 Million Service Members

In a primetime address Wednesday night, Trump announced that 1.45 million active-duty and reserve military members would receive one-time payments before Christmas. The checks, totaling $1,776 each, are framed as a nod to the nation’s 1776 founding and as direct relief for troops facing rising living costs.

Trump emphasized that the checks are “already on the way,” signaling urgency as inflation and affordability concerns continue to weigh on household budgets.

Why $1,776? Patriotism Meets Politics

The specific dollar amount is no accident. Trump explicitly tied the figure to American independence, reinforcing a broader message that the payments are not just financial relief, but symbolic recognition of military service.

The patriotic framing also helps distinguish the checks from past stimulus-style payments, positioning them instead as a dividend earned through national strength and economic policy.

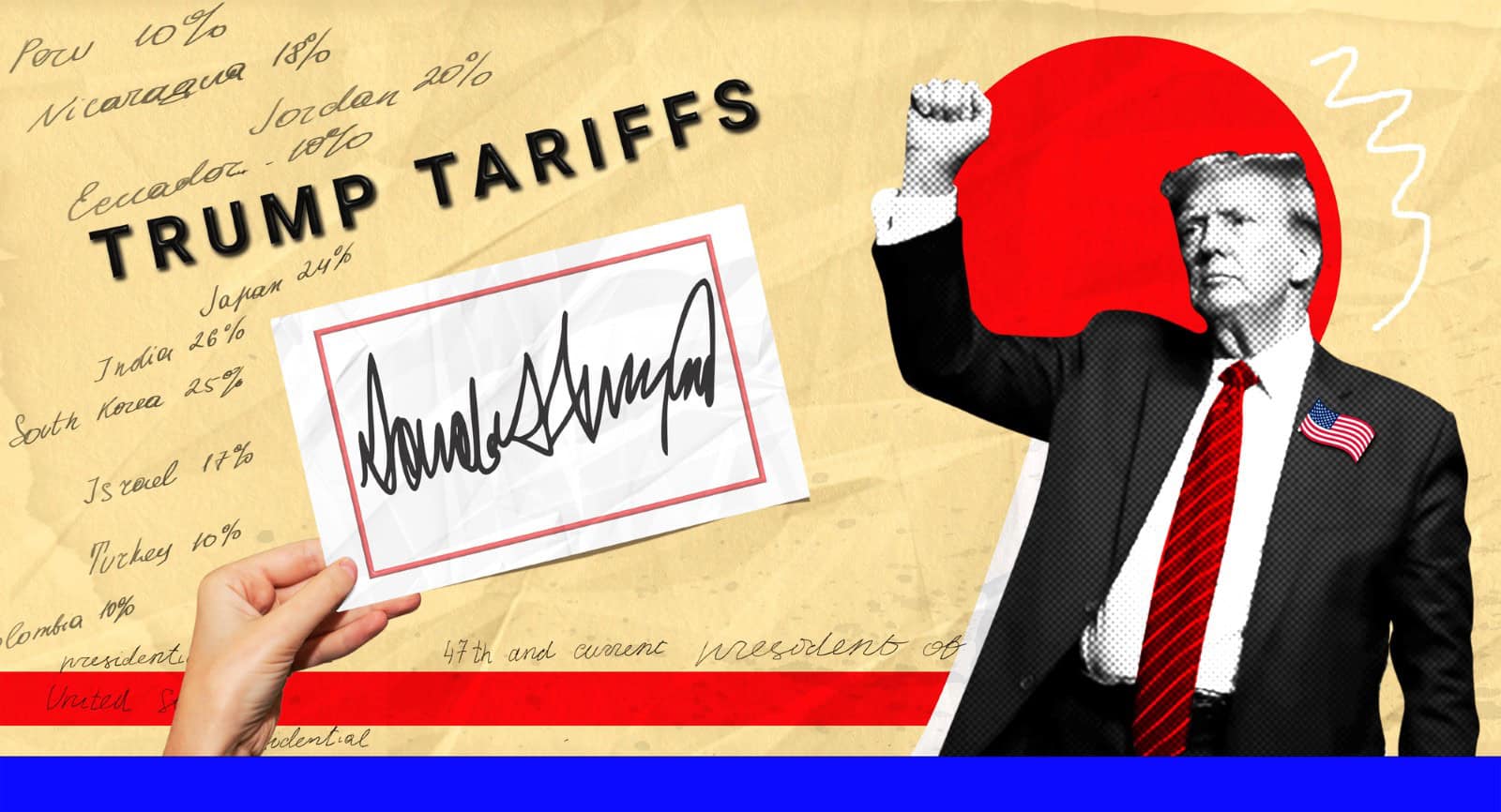

Tariffs as the Funding Story; At Least Publicly

Trump linked the “warrior dividend” to revenue raised through tariffs imposed earlier this year, alongside savings generated by the so-called One Big Beautiful Bill. He argued that tariffs have brought in “a lot more money than anybody thought,” making the payments possible.

However, the White House declined to specify exactly how tariff revenue is being used to finance the checks, leaving questions about whether the connection is more rhetorical than budgetary.

What the Checks Actually Cost

According to a senior administration official, the one-time payments will cost about $2.6 billion. The checks will function as a housing-related supplement for eligible service members, including roughly 1.28 million active-duty troops and 174,000 reservists.

Congress, through the One Big Beautiful Bill, appropriated roughly $2.9 billion to the Department of Defense for supplements tied to basic housing allowances; suggesting the funding may be less about tariffs and more about standard appropriations.

Trump’s Broader Push to Calm Economic Anxiety

The announcement comes as Trump faces slipping approval ratings on the economy and growing voter concern about affordability. While blaming lingering economic pain on the Biden administration, Trump has simultaneously claimed the economy is “better than ever.”

Alongside the military checks, he pointed to falling mortgage rates and promised housing reforms as evidence that relief is coming; even as inflation tied to tariffs remains a persistent concern.

Tariff Revenue: Big Claims, Smaller Reality

The “warrior dividend” is the latest in a series of relief efforts Trump has linked to tariffs, following farmer aid packages and talk of $2,000 rebate checks for households. He has even floated tariffs as a tool to chip away at the $38 trillion national debt.

Yet actual tariff revenue has fallen well short of White House projections.

Economists Cut Tariff Revenue Estimates

After the administration rolled back tariffs on grocery staples like bananas, coffee, and beef, economists revised their expectations downward. Macroeconomists now estimates annual tariff revenue at roughly $400 billion; about $100 billion less than the $500 billion forecast Treasury Secretary Scott Bessent offered in August.

The pullback highlights how affordability pressures have already forced policy adjustments that reduce expected income from levies.

China’s Pullback Hits Customs Receipts

A major reason for the shortfall is collapsing Chinese imports. Shipments from China fell 7.5% year-over-year in October and 7.8% in November, as U.S. companies shifted sourcing to countries like Vietnam, where tariff rates are lower.

Earlier stockpiling temporarily boosted imports and customs revenue, but that surge has faded, leaving a weaker and less reliable revenue stream.

Signs Tariff Revenue May Have Peaked

Treasury data suggest tariff income may already be topping out. Customs duties collected in November totaled $30.75 billion, down from $31.35 billion in October. From April through October, revenues rose month over month; but the trend is no longer clear.

For critics, the data undercut the idea that tariffs can sustainably fund large-scale cash distributions.

Even Trump’s Cabinet Is Hedging

Treasury Secretary Scott Bessent has publicly walked back certainty around tariff-funded payouts. Asked in November about rebate checks, he said, “we will see,” and later suggested any dividends might instead come through tax deductions already written into law.

That ambiguity reinforces the central tension of the “warrior dividend”: a popular and politically potent check, backed by a funding narrative that looks increasingly fragile as tariff revenue underperforms.

A Symbolic Win, With Lingering Fiscal Questions

For military families, the $1,776 checks will provide welcome holiday relief. Politically, the move allows Trump to showcase direct action on affordability while celebrating the armed forces.

But the gap between tariff rhetoric and tariff reality remains. As the administration leans harder on import taxes to justify cash payouts, economists; and even Trump’s own officials; are signaling that the math may not be as solid as the message.

Like Financial Freedom Countdown content? Be sure to follow us!

New Social Security CBO Proposal Would Cut Benefits for Top 50% of Retirees

The Congressional Budget Office (CBO) has released a controversial new budget option that aims to shore up the federal government’s finances by targeting the retirement checks of high-income Americans. With the federal deficit hitting a staggering $1.8 trillion in Fiscal Year 2025 and the Social Security insolvency clock ticking down to 2033, this proposal offers a stark look at one potential “fix”: changing the math to pay the wealthy less.

New Social Security CBO Proposal Would Cut Benefits for Top 50% of Retirees

Car Loan Delinquencies Hit 15-Year High as Student-Loan Payments Return

More Americans are falling behind on their car loans than at any point in the last 15 years, a troubling milestone that underscores how fragile household finances have become in 2025. Economists say the long-delayed return of student-loan payments is a key; and often overlooked driver behind the surge in auto delinquencies now rippling through the economy.

Car Loan Delinquencies Hit 15-Year High as Student-Loan Payments Return

Social Security Crisis: New Plan Could Tax High Earners to Prevent 21% Benefit Cut

The United States is facing a fiscal double-whammy: a ballooning federal budget deficit and a Social Security trust fund racing toward depletion. With the Congressional Budget Office (CBO) releasing new numbers on potential fixes, one option is gaining significant attention: uncapping the Social Security payroll tax.

Social Security Crisis: New Plan Could Tax High Earners to Prevent 21% Benefit Cut

Trump Signals Interest in Australia’s ‘Super’ Retirement System; A Mandatory 12% Employer Contribution Could Upend U.S. Savings

President Donald Trump sparked a national debate after saying the Australian retirement system is a “good plan” that has “worked out very well,” adding that the administration is “looking at it very seriously.” His comments raised the question: Could the U.S. pivot away from its aging retirement model and adopt components of Australia’s mandatory “superannuation” program?

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.