Retirement Wealth Soars as 401(k) and IRA Millionaires Cash In While Others Struggle

Fidelity’s analysis of 24 million 401(k) accounts across 26,000 employer-sponsored plans revealed that the number of 401(k) “millionaires” reached 497,000 last quarter, marking a 2.5 percent increase from 485,000 in the first quarter.

The number of IRA millionaires increased by 6%, rising from 376,275 to 398,594.

Yet, this financial triumph contrasts sharply with the grim reality for the average American, whose retirement balances tells a very different story.

Who Are the Retirement Millionaires?

Although the Fidelity study does not provide a breakdown of the professions of retirement millionaires, it is safe to assume that high-income earners have a more significant potential to save money in their retirement accounts.

High-income skills often pave the way for lucrative professions that enable individuals to allot a hefty portion of their income towards retirement savings after comfortably meeting their living expenses. These skills, which may range from advanced technical abilities to specialized knowledge in fields such as medicine, law, or financial management, command a premium in the market. Professionals with these skills typically garner 7 figure salaries, providing the financial leeway to prioritize long-term savings.

Industry List of Retirement Millionaires

The Fidelity study listed few industries and the average 401(k) balances

1. Legal Services: $309,800

2. Petrochemical: $255,500

3. Energy Production/Distribution: $215,300

4. Pharmaceuticals: $214,600

5. Computer & Electronic Manufacturing: $201,700

6. Technology: $200,500

Amar Shah, CFA, CFP, works with many clients that have 7 figure retirement balances. He says, “Most of our clients in their mid to late 60s are transitioning into the next chapter in life and stepping away from their original professional careers. Clients who have accumulated these large balances typically have been professional business owners like doctors, lawyers, or engineering consultants.”

Retirement Millionaires Can Be Found in Other Industries Too

However, it’s essential to note that high incomes are not the sole pathway to substantial retirement savings. Individuals can also accumulate a sizeable retirement nest egg by adhering to a disciplined saving and investment strategy.

Angela Dorsey, CFP, says, “What is interesting is that you don’t need an unusually high income to reach one million in retirement assets.”

Some of her retirement millionaire clients include a Senior Human Resources Specialist with a $95,000 annual salary and a Marketing Manager with a $101,000 income.

Furthermore, many employers offer matching contributions to 401(k) accounts, which can significantly accelerate savings growth. Therefore, even individuals with modest incomes can aspire to achieve the status of retirement millionaire by focusing on sustained saving over time and leveraging employer contributions. The commitment to financial discipline truly matters, not merely the size of the paycheck.

Stock Market Gains Increased 401(k) Balances

Due to robust gains in stocks and bonds throughout 2023 and first half of 2024, alongside consistent contributions from savers and employer match programs, 401(k) investors concluded the year on a high note.

By the end of the second quarter, the average 401(k) balance had climbed to $127,100, marking a 39% increase over the last decade.

Generational Divide in Balances

1. Boomers have an average 401(k) balance of $242,200, indicating that they have accumulated the most savings for retirement compared to other generations.

2. Gen X have notably lower average balances compared to Boomers of $182,100, suggesting that they may need to focus more on retirement savings to catch up.

The good news for Gen Xers is that those who have been contributing to a 401(k) for at least 15 years saw their average balance increase to $554,000, up from $543,000 in the previous quarter.

The bad news is that the median balance of Gen Xers, which is the midpoint where half of 401(k) balances are lower, is only $55,500. As the oldest members set to reach full retirement age (67) within the next decade, they need to start saving soon.

3. Millennials have the average balances of $62,000 with a total savings rate of 13.3%,

4. Gen Z has the lowest average balance of $12,000, highlighting the need for early retirement planning and savings habits among this generation.

5. This quarter, more than 17% of both Millennial and Gen Z workers contributed to a Roth 401(k), indicating a preference for post-tax contributions and potential tax-free withdrawals in retirement.

What Did These Participants Do Differently?

However, market performance isn’t the sole contributor to increased account balances. Fidelity noted that improved savings habits also had a significant impact.

In the second quarter, the combined average savings rate for 401(k) accounts hit a new high of 14.2%, fueled by contributions from both employees and employers.

Average Retirement Balances Look Bleak

Although retirement accounts with over a million dollars capture the imagination, the average American has much lower savings balances.

By the end of the second quarter, the average balance of 401(k) millionaires had risen to $1,595,200, up from $1,581,000 at the end of March.

However, the average 401(k) balance of all accounts (not just the millionaires) was only $127,100.

The substantial disparity between the average balance of 401(k) millionaires and the other accounts arises from a limited number of sizable accounts that considerably elevate the average.

The U.S. Census Bureau paints a similarly bleak picture of median IRA and 401(k) account balances at $30,000.

Similarly, the average IRA balance of all accounts was only $129,200

Survey Reveals Americans Now Need $1.46 Million for Retirement

According to a Northwestern Mutual survey of 4,588 adults, the new ideal retirement savings goal is $1.46 million, up from last year’s $1.27 million—a 15% increase. This figure marks a significant 53% rise from the $951,000 Americans estimated they would need in 2020.

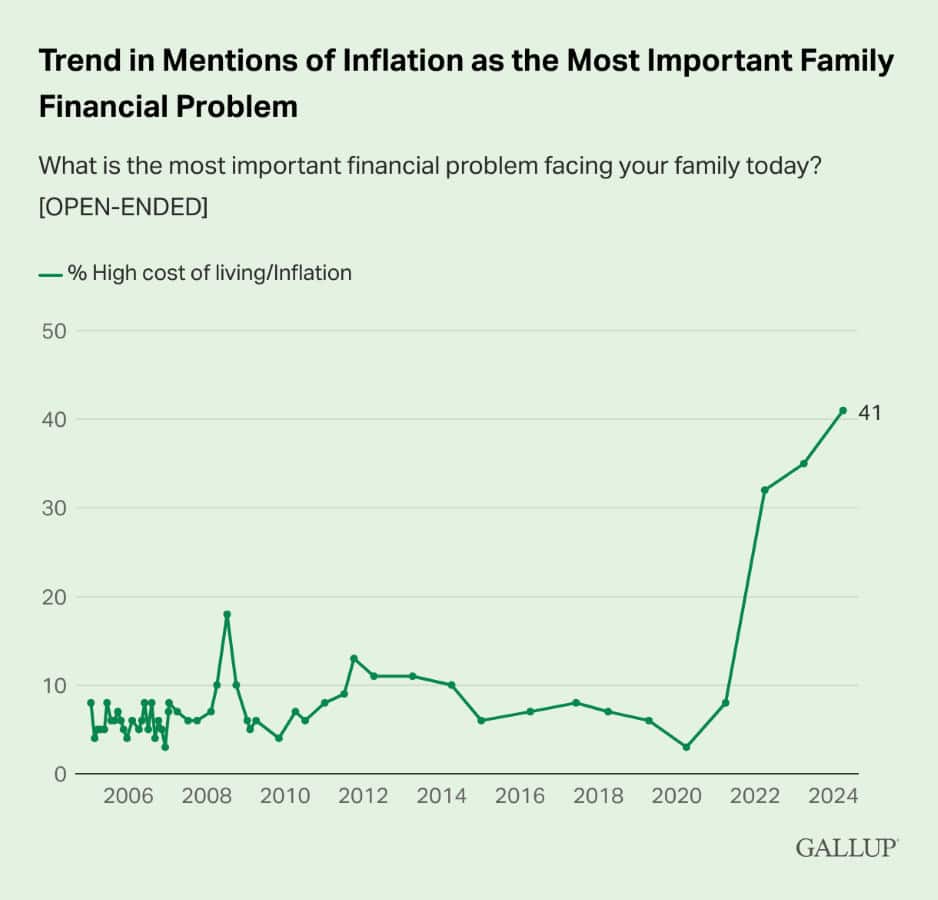

Inflation a Cause For 53% Increase in Retirement Savings Expectations

The worst inflation in 40 years is a key reason why average Americans anticipate needing 53% more in their retirement savings compared to four years ago.

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak as per the latest Gallup’s annual Economy and Personal Finance poll.

Anxiety About The Economy

Despite a robust U.S. job market, Fidelity found widespread economic concerns among its customers, with 75% stressed about rising prices and the escalating cost of living.

Furthermore, recent Fidelity research revealed that 70% of workers worldwide feel “restless” at work, characterized by low job satisfaction, a negative perception of their work environment, and an increased likelihood of leaving their current employer.

Borrowing From 401(k) Accounts

Despite a strong overall savings rate, Fidelity reported that the percentage of workers with an outstanding loan rose to 18.3%, up from Q1.

Nearly 1 in 4 Gen X workers (24.7%) currently has a loan outstanding.

Getting Retirement Savings Back on Track

Numerous factors have posed challenges for individuals looking to save for retirement. However, if your retirement savings fall below your desired level, there is still an opportunity to rectify the situation. Here are 4 steps to follow

1. Check your asset allocation

2. Increase your contribution rate

3. Stay the course

4. Consider smart tax planning strategies

#1 Consider Holistic Asset Allocation

When considering asset allocation for optimizing retirement savings, looking beyond just your 401(k) account is crucial. Many investors must consider other income-producing assets besides their retirement accounts, which comprise their total net worth.

Define an approach to retirement savings, encompassing all your assets, including 401(k), Individual Retirement Accounts (IRAs), brokerage accounts, and real estate, to provide a more balanced and diversified portfolio. This can help minimize risk while maximizing potential returns, aiding in achieving your retirement goals.

# 2 Increase Contribution Rate

Another vital strategy to optimize your retirement savings involves increasing your savings rate as your income grows. Your salary may be relatively low when starting your career, making it challenging to set aside a substantial portion for retirement. However, starting with whatever you can comfortably afford is essential, even if it’s a small percentage of your income.

As your income increases over time, progressively raise your savings rate proportionately. This strategy, often called “incremental saving,” allows you to grow your retirement nest egg gradually and sustainably without placing undue financial strain on your current lifestyle.

For 2024, the annual contribution limit for 401(k) is $23,000. However, individuals above the age of 50 have the opportunity to make supplemental catch-up contributions of up to $7,500 per year.

# 3 Stay the Course

Kevin M. Arquette, CFP, noticed that staying the course no matter the volatility helped his clients accumulate a seven-figure retirement portfolio. He says, “A noteworthy trait among many of these clients was their relatively passive approach to managing their accounts; they refrained from impulsive reactions during stock market downturns. By allowing the forces of time and compound interest to work in their favor, they have now positioned themselves to retire on their terms and establish a lasting legacy for their families.

Naturally, these millionaires didn’t become wealthy overnight. Instead, Fidelity notes that these account holders have typically contributed for long periods.

# 4 Do Smart Tax Planning

Having retirement accounts over a million is an accomplishment. However, tax-deferred accounts can result in significant tax hits without proper planning.

Angela Dorsey, CFP, recommends strategic Roth IRA Conversions. Amounts converted from a pre-tax retirement account to a Roth IRA are taxed as ordinary income. However, these conversions can be done in a tax-efficient way to take advantage of lower-income years, such as the years between retirement and when required minimum distributions (RMDs) begin. Without doing Roth IRA Conversions, RMDs can push a retiree unnecessarily into a higher tax bracket.

Individuals pursuing early retirement have a longer window to perform these conversions in a systematic manner known as the Roth conversion ladder.

Like Financial Freedom Countdown content? Be sure to follow us!

Top 6 High-Paying Jobs That Thrive Even in Recession Times

We all want a job that pays well, gives our life meaning and lets us do something useful. However, job security is also vital to long-term growth and increasing our average net worth, which means working in a recession-proof field. If the past few years have taught us anything, some jobs are built to last and can withstand any economic downturn. It can unquestionably influence the field of work that we choose to go into. So, what are recession-proof jobs, and what aren’t? Here’s a look at some of the top recession-proof jobs.

Top 6 High-Paying Jobs That Thrive Even in Recession Times

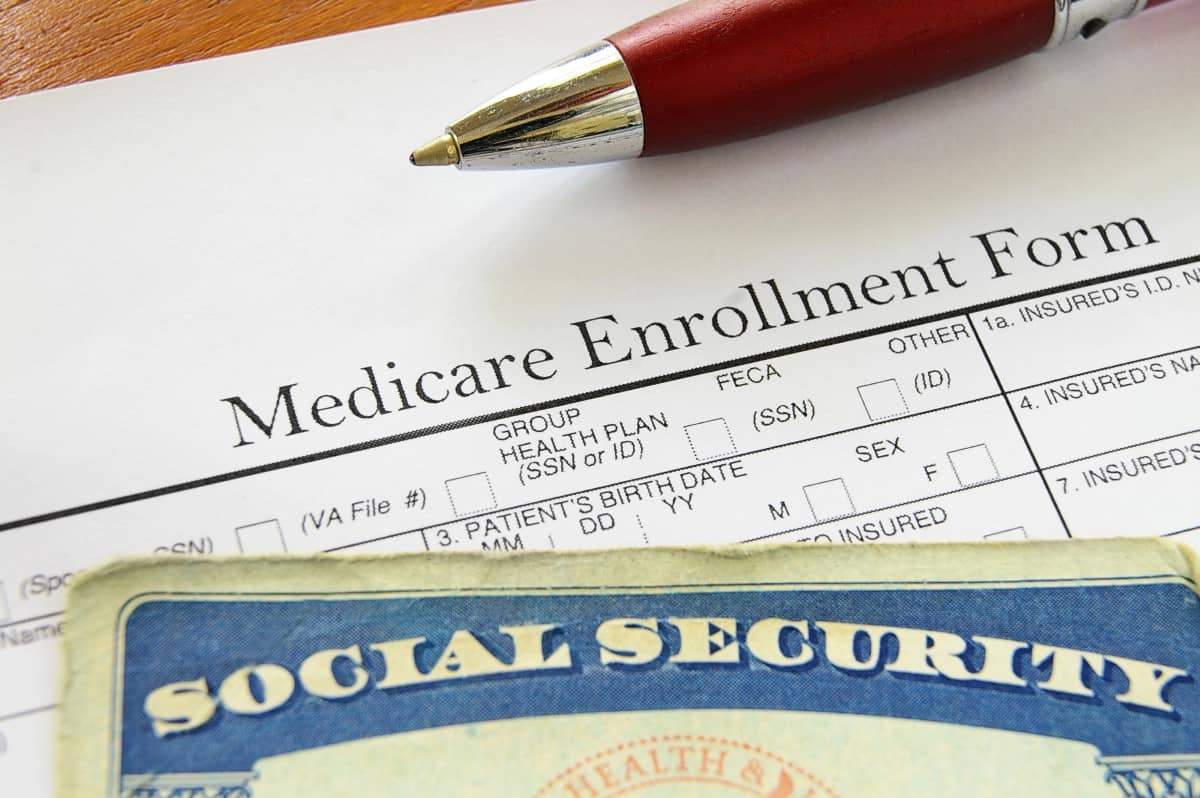

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

As Americans approach retirement, their anxiety about the future intensifies. Economic challenges, rising healthcare costs, and high living expenses are creating a cloud of uncertainty over the choice of retirement destinations. A recent study, however, reveals the Mountain State region as a prime spot for those seeking affordable retirement options.

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

Maximize Your Social Security Benefits with These 14 Smart Strategies

Social Security serves as a critical lifeline for countless seniors, providing essential income support in their retirement years. In the current economic environment, Social Security’s inflation-adjusted benefits offer a safeguard against the worst inflation seen in four decades. Rising interest rates have disrupted many retirement portfolios, causing bond fund values to plummet. Social Security can act as a ballast for a typical stock-bond retirement portfolio. By implementing specific strategies, retirees can maximize their Social Security benefits and secure a stable financial future.

Maximize Your Social Security Benefits with These 14 Smart Strategies

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.