California’s Vetoed Exit Tax: Could it Still Shape Future Tax Policies Nationwide?

2023 saw booming demand for U-Haul equipment from California as citizens chose to flee the West Coast. On the U-Haul Growth Index, which shows net losses of one-way trucks in various states that year, California marked its third consecutive year at the bottom positions.

As more individuals leave California for states like Texas, Nevada, and Florida which have no income tax, proposals for an exit tax have emerged.

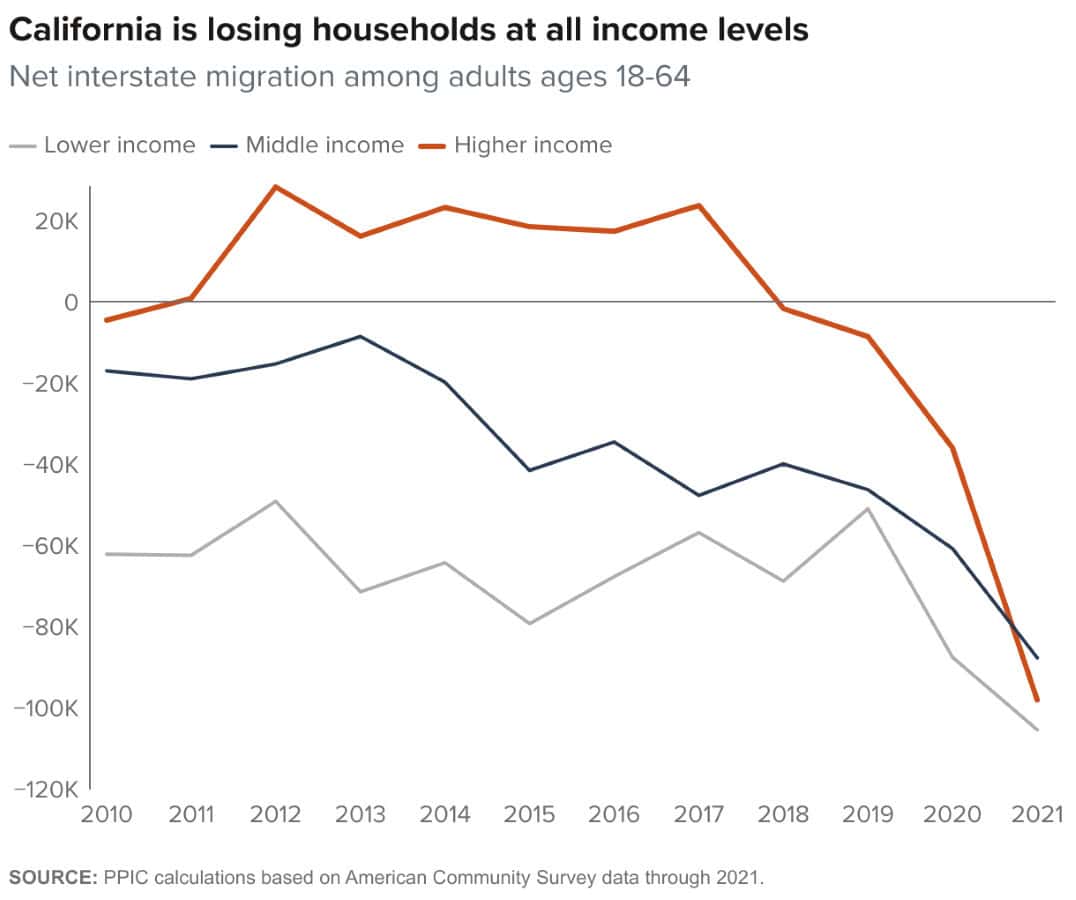

High Income Earners Leaving Is Bad News for CA

Although California has been losing households at all income levels, the number of high income households leaving the Golden State since 2017 is astronomical.

The chart by Public Policy Institute of California indicates a grim trend.

Examination of the roughly 750,000 individuals who have departed California in the past three years indicates that a considerable number of high-income, highly educated professionals have left the state compared to those who have relocated to it.

The ultra-wealthy in California, constituting the top 1%, typically contribute approximately 40-50% of the state’s personal income tax revenue.

The State’s top 5% of earners pay 70% of California’s personal income tax.

Why Are High Income Earners Leaving

While it’s uncertain exactly how many people leave California solely due to taxes, recent developments have made the prospect more attractive, particularly for those with high incomes:

– In 2018, Congress imposed a $10,000 cap on the federal tax deduction for state and local taxes. Before this change, there was no cap and the state taxes could be written off against the Federal Taxes. The limits on the state and local taxes as part of the Tax Cuts and Jobs Act has hurt higher tax payers more.

– The shift toward working remotely has made it easier to relocate to states with lower taxes while retaining the same job.

– Starting 2024, California’s state disability insurance (SDI) tax, which supports paid disability and family leave, now applies to an unlimited amount of annual wages. Previously, the SDI tax of 1.1% for this year was only levied on wages up to $153,164, effectively increasing California’s top tax rate on wages to 14.4% from 13.3%.

Wealth Tax Bill Proposed

Last winter, Democrats introduced a bill amid efforts to address a projected $68 billion budget deficit, opting for a wealth tax as an alternative to expenditure cuts.

As per the proposed California Assembly Bill 259, beginning on or after January 1, 2024, and before January 1, 2026, this bill would impose an excise tax of 1.5% on the worldwide net worth of every resident in California exceeding:

– $500 million for married taxpayers filing separately,

– $1 billion for all other taxpayers.

From January 1, 2026, onward, the bill would enforce a 1% excise tax on the worldwide net worth of every resident in California exceeding:

– $25 million for married taxpayers filing separately,

– $50 million for all other taxpayers.

Additionally, beginning on January 1, 2026, an additional .5% surtax would be applied (total combined tax rate of 1.5%) on the worldwide net worth of every resident exceeding:

– $500 million for married taxpayers filing separately,

– $1 billion for all other taxpayers.

Part-time residents would be subject to a proportional tax based on their annual presence in California.

Moreover, nonresidents who recently departed the state would still be liable for this tax.

The scope of the wealth tax encompasses a wide array of assets, including partnership shares, private-equity holdings, artwork, and offshore financial assets. California’s Franchise Tax Board would assess the value of non-publicly traded assets, potentially leading to scrutiny of out-of-state private businesses by the board’s auditors and appraisers.

The wealth tax is projected to generate approximately $21.6 billion in annual revenue, provided there is no mass departure of wealth from the state. However, this falls significantly short of California’s current fiscal year budget deficit of $45 billion.

Additionally, it doesn’t address the $27 billion rise in Medicaid expenditure over the past four years.

With the state extending eligibility to all undocumented migrants, Medicaid spending is expected to increase even further this year.

Legality of Exit Tax Questioned

The issue at hand isn’t whether individuals from other states can be taxed when they have a “nexus” to California, such as earning income within the state or owning property there. Instead, the concern arises when individuals sever all ties with California.

Taxing the wealth of such individuals would likely be considered a violation of the U.S. Constitution’s Commerce Clause.

Exit Tax Vetoed for Now

California currently does not impose an “exit tax.” However, a recent bill aimed to introduce a wealth tax targeting the state’s wealthiest residents and would have included provisions affecting those moving away, gradually decreasing over four years post-departure. Governor Gavin Newsom opposed this bill, and it failed to pass in January.

The notion of Wealth Tax proposals isn’t novel in California, given the Democrats’ two-thirds majority, granting them the ability to enact taxes sans Republican backing. California presently operates with a tax structure heavily reliant on revenue from affluent residents, contributing to its considerable volatility.

Avoid Retaining Ties to the State

Although the “exit tax” was vetoed, if you relocate from California but maintain significant connections with the state, you may still be considered a resident by the Franchise Tax Board (FTB), subjecting your global income to California taxes.

Even as a nonresident, the FTB can tax any income you earn from California sources, such as earnings from rental properties or home sales within the state, wages for work performed there, and other similar cases.

Moreover, if you move to or from California mid-year, you’ll be classified as a part-year resident. In this case, you’ll owe taxes on all income earned while residing in California, as well as on any income from California sources during the period you were not a resident.

California Aggressive About Pursuing Taxes

While other states have comparable regulations, “California and New York are typically the most assertive” in their enforcement. For instance, California led the introduction of the “jock tax,” a levy now adopted by most states, targeting nonresident athletes for income earned during games and other “duty days” within their jurisdiction.

What Determines Residency

California’s residency rules are more intricate than those of some states that simply count the days a person spends within their borders each year.

California defines a resident as someone who is in the state for reasons beyond just a temporary or transitory visit, or someone who is domiciled in California but outside the state temporarily (for more details, see FTB Publication 1031).

The state considers your domicile to be the place where you voluntarily establish yourself and your family with the intent to make it your permanent home and main establishment. This is the place you plan to return to whenever you are away. While a person can have residences in multiple states, they can only have one domicile.

According to the FTB, your residence is determined by where you have your “closest connections.” This includes an examination of over a dozen factors, such as where your primary residence is located, voter registration, driver’s license, vehicle registration, bank accounts, health care providers, and memberships in churches and clubs.

The FTB emphasizes that it is the strength of these ties, rather than the sheer number, that ultimately determines your residency.

What is “California Sourced” Income

If the FTB classifies you as a nonresident, you may still be liable for taxes on income derived from California sources, provided your total income or California-source income meets the threshold for filing requirements for nonresidents and part-year residents.

Sources of California income typically include:

– Income from properties rented out within California, or from business operations generating sales in the state.

– Taxable capital gains from selling real estate in California, including homes.

– Wages earned by nonresident workers while physically present and working in California. Many employers in California withhold taxes on these wages, and some may also withhold SDI tax, even if it’s not mandatory for the employee, as explained by Zobayan. The rules for SDI are set by the Employment Development Department.

– Distributions from private deferred compensation plans accrued in California. This becomes pertinent if the plans aren’t structured as qualified retirement plans. A notable example is baseball player Shohei Ohtani, who deferred most of his $700 million, 10-year contract until 2034, which will then be distributed over the following decade.

– Freelance income from clients in California. The FTB notes that if an independent contractor earns income by providing services that benefit a California-based company, this can count as California-source income, “even if the nonresident never physically worked or lived in California during the tax year.”

– Certain types of stock compensation. With nonqualified stock options and restricted stock units, income is recognized and taxed upon exercise or vesting, respectively. If you were a nonresident when these events occurred, but a resident when the options or units were granted, you might owe taxes on a portion of the income based on the duration of your employment in California.

How To Reduce Audit Risk When Documenting Leaving California

To officially establish residency outside of California, follow these steps:

– Update your address with the U.S. Postal Service and across all your financial and insurance accounts.

– Inform your employer of your relocation.

– Consider relinquishing all properties and ties in California. If retaining any property, ensure you’re not claiming the homeowner’s exemption for a primary residence in California.

– Obtain voter registration, a driver’s license, and register your vehicle in your new state. (Those relocating out of state must inform the California Department of Motor Vehicles of their address change within 10 days and subsequently register their vehicle in their new state. Note that the DMV does not offer prorated refunds of vehicle registration fees to individuals moving out of state.)

– Maintain thorough documentation to support your out-of-state residency.

– Minimize your time spent in California.

Since the implications are significant, consider consulting a tax professional for guidance.

California Group Pushing for Voter Approval for Any New Taxes

Statistics indicate that a majority of Californians are troubled by the state’s fiscal challenges. California boasts some of the highest gas prices nationwide, along with notable sales and income tax rates. Additionally, housing affordability and the availability of affordable housing remain pressing issues in the Golden State.

The upcoming November ballot in California may bring significant changes to the state’s tax landscape, courtesy of an initiative supported by business groups. The aim is to shield Californians from what proponents deem an unsustainable tax system.

If passed, the Taxpayer Protection and Government Accountability Act could have profound effects. It seeks to restrict future tax hikes at both state and local levels, aiming to curb what proponents view as excessive taxation lacking adequate oversight.

As outlined on its promotional website, the measure’s core argument is that “California cannot sustainably endure continually rising taxes and fees without proper accountability or transparency.”

However, opponents, including California Governor Gavin Newsom, express concerns. They fear that the initiative’s requirement for voter approval of tax increases might adversely impact essential public services, infrastructure funding, and potentially diminish the state legislature’s authority to levy and allocate taxes.

This week, the California Supreme Court is set to hear arguments regarding whether the initiative can remain on the November ballot.

California is not alone in imposing these taxes. Several states have already gone ahead or are planning to impose similar taxes.

Washington Imposes Additional Taxes

Democrats in Washington state have led several efforts to introduce what is popularly known as a billionaire tax. As per the proposed tax, individuals who reside in Washington would be subject to a wealth tax equal to 1% of their taxable worldwide wealth over $250 million.

The proposal to impose a new 1% wealth tax on billionaires failed to pass, but Democrats have vowed to continue trying to garner support for the bill.

In Washington, where Bezos was previously based, the Washington State Supreme Court upheld a 7% tax on capital gains above $250,000 earlier this year.

Passed by the 2021 Washington State Legislature, the Douglas County Superior Court ruled in March 2022 that the capital gains excise tax was unconstitutional and invalid. Washington State appealed the ruling, and with all legal challenges now settled, a 7% tax on any long-term capital gain in excess of $250,000 in a calendar year will be imposed.

Massachusetts Imposing “Millionaire Tax”

Due to a change in the state constitution approved by voters, Massachusetts has a “millionaire tax.” Residents of the state with taxable incomes exceeding one million dollars must pay an additional 4% income tax to the Commonwealth.

Hawaii Considering Wealth Asset Tax

Hawaii’s proposed Wealth Asset Tax would apply to taxpayers with over $20 million in assets in the state. The proposed tax would be 1% of net worth per year.

Should Non-California Residents Care About The Wealth and Exit Tax

Although California laws don’t impact individuals if they don’t reside in California or have investments there, it’s worth noting that nine other states are considering similar proposals, and a federal exit tax has already been enacted into law.

History has shown that trends originating in California often extend nationwide. Take, for instance, the “Gig Worker Bill,” California Assembly Bill 5, which not only reshaped employment dynamics within the state but also served as a model for similar legislation in other states and at the federal level.

Wealth Tax Proposal at Federal Level

Joe Biden aims to implement a minimum 25% tax on all Americans possessing assets exceeding $100 million.

Biden’s plans lack specific details, but experts suggest that reaching a minimum 25% tax rate would likely involve taxing unrealized gains—profits from asset value increases that haven’t been realized through asset sales. Currently, unrealized gains remain untaxed until the asset is sold at a profit.

Dubbed the “billionaire tax,” this proposal would affect the wealthiest 10,700 Americans and potentially generate an estimated $400 billion in revenue over a decade.

However, this revenue would barely make a dent in the national debt, which is increasing by $1 trillion every 100 days.

Like Financial Freedom Countdown content? Be sure to follow us!

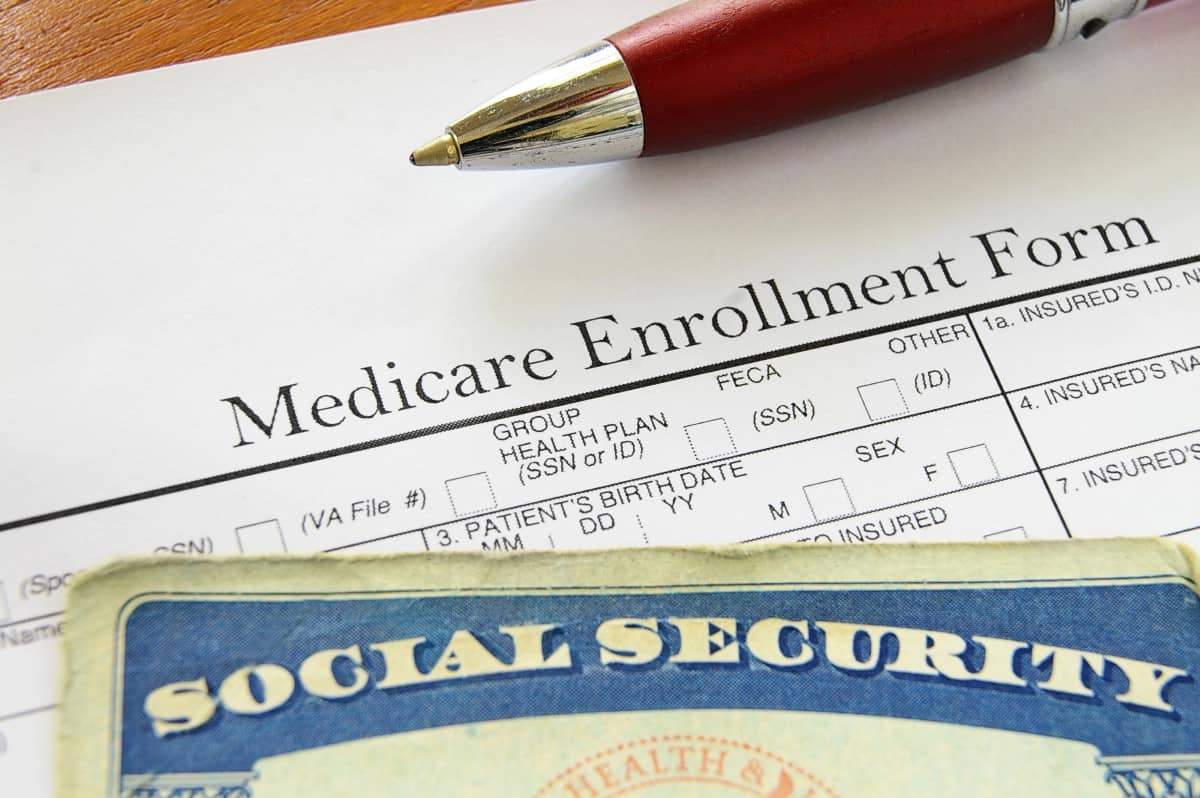

Social Security Solvency Extended to 2035, Medicare Gains 5 More Years to 2036: What It Means for You

The projected depletion dates for Medicare and Social Security have been extended as reported in the annual trustees report for Social Security and Medicare released on Monday. However, officials caution that without significant policy changes, these programs may still be at risk of failing to deliver full benefits to retiring Americans.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

Three years after the landmark SECURE Act reshaped America’s retirement scene, the follow-up SECURE Act 2.0 expands access to retirement plans and perks. Key updates include mandatory enrollment in certain workplace retirement plans, higher catch-up contributions for older workers, and broader savings options for part-timers. Additionally, it enhances the ability to save for emergencies, providing quicker access when needed. This significant step forward promises to strengthen financial security for many. Here’s what you need to know about the new provisions.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

Treasury Sets I Bond Rate at 4.28%. Are I Bonds Still Worth Your Investment?

Inflation is a silent killer. With the rapid rise in inflation over the last two years, I bonds became an attractive, safe investment. With the government reporting lower CPI numbers lately, the composite rate of I bonds at 4.28% is less attractive than when investors purchased them at an annual rate of 9.62% in May 2022. Given the lower rates, investors are now considering whether they should continue buying or selling existing Series I bonds.

Treasury Sets I Bond Rate at 4.28%. Are I Bonds Still Worth Your Investment?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.