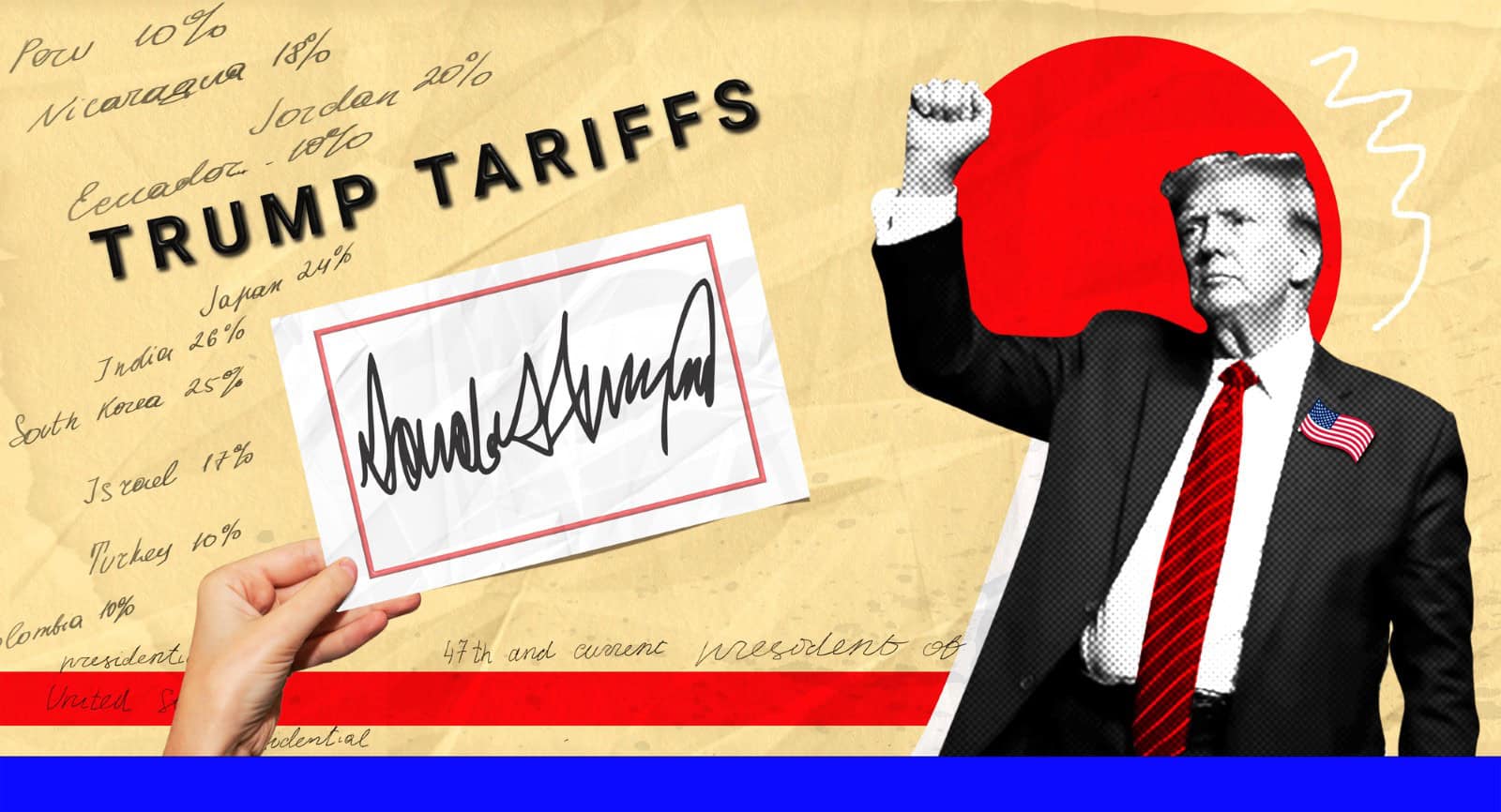

Could Americans Get $2,000 Rebate Checks? Trump Says Tariff Money Is Piling Up

President Donald Trump says his administration may be able to issue $2,000 “dividend” rebate checks to Americans without congressional approval, reviving a proposal that has drawn strong public interest; and significant legal and economic questions.

Speaking at a press conference Tuesday, Trump suggested the payments could be funded by tariff revenue and might not require lawmakers’ sign-off, even as his own economic advisers have previously said Congress would need to approve the spending.

What Trump Is Proposing With the $2,000 “Dividend”

Trump has floated the idea of issuing $2,000 payments to lower- and middle-income Americans, describing them as a “dividend” funded by tariff revenue generated under his administration.

He has argued that tariffs are bringing in so much money that the government could both send checks to Americans and still pay down national debt; an assertion that economists and budget analysts have questioned.

Trump Says Congressional Approval May Not Be Needed

At Tuesday’s press conference, Trump said he does not believe his administration would have to go to Congress to issue the payments, though he acknowledged the legal question is still unsettled.

“I don’t think we would have to go to Congress now, but, you know, we’ll find out,” Trump said when pressed on whether lawmakers would need to approve the plan.

The White House’s Mixed Messaging on Legal Authority

Trump’s comments contrast with earlier statements from his top economic adviser, Kevin Hassett, director of the National Economic Council.

In December, Hassett said any checks would likely require congressional approval and formal appropriations, underscoring Congress’ constitutional power over federal spending.

How Tariff Revenue Factors Into the Plan

The president has repeatedly emphasized that tariffs are the primary funding source for the proposed checks.

According to Treasury Department data, the U.S. collected about $195 billion in customs duties in the fiscal year that ended September 30, with roughly $90 billion more collected so far this year.

Trump argues this inflow makes a $2,000 dividend feasible, at least for Americans below a certain income threshold.

Why Budget Experts Say the Math Doesn’t Add Up

Nonpartisan and conservative-leaning analysts alike have raised doubts about whether tariff revenue is sufficient.

The Committee for a Responsible Federal Budget estimates the proposal could cost around $600 billion, while the Tax Foundation has said it would likely cost $300 billion or more; even after excluding higher-income Americans.

Those figures far exceed current annual tariff collections.

Inflation Concerns Are a Major Red Flag

Economists warn that sending out large checks could reignite inflation at a time when price pressures remain elevated.

Tax experts have said the policy could undermine efforts to stabilize prices, especially if paired with pressure on the Federal Reserve to cut interest rates.

Critics argue that combining higher spending with looser monetary policy could push inflation back up.

Public Support for the Checks Is Surprisingly Strong

Despite the economic concerns, the idea appears popular with voters.

A December survey of registered voters found that 52 percent support a tariff-funded rebate, including nearly half of Democrats, while only 20 percent oppose the idea.

The broad appeal may explain why the White House continues to promote the proposal despite unresolved questions.

Income Limits Are Still Undecided

Trump has said there would be an income cutoff “where it made sense,” but has offered no details on eligibility.

It remains unclear whether the checks would mirror past stimulus programs, target only working households, or exclude retirees and higher earners entirely.

The Supreme Court Could Decide Everything

A looming Supreme Court ruling on the legality of Trump’s sweeping tariffs may determine whether the plan can proceed at all.

If the Court finds the tariffs unlawful, the government could be required to refund tariff revenue; potentially eliminating the funding source for any dividend payments.

When Americans Might See the Money; If It Happens

Trump has said he expects the payments could arrive “toward the end of the year,” but no formal timeline has been announced.

With unanswered legal questions, uncertain funding, and potential court rulings ahead, the $2,000 rebate checks remain a proposal rather than a promise.

For now, whether Americans receive a tariff-funded dividend may depend less on political will and more on constitutional law and economic reality.

Like Financial Freedom Countdown content? Be sure to follow us!

Democrats Push $8 Credit Card Late Fee Cap After Court Blocks CFPB Rule

Senate Democrats are reviving a consumer protection fight that pits Washington against Wall Street, unveiling legislation to sharply cap credit card late fees as households continue to feel squeezed by high prices and borrowing costs.

Democrats Push $8 Credit Card Late Fee Cap After Court Blocks CFPB Rule

2026 State Tax Shake-Up: See How Your Income, Property, and Sales Taxes Will Change

As the calendar flips to 2026, taxpayers across the country will feel the impact of sweeping state tax changes. From income tax cuts and flat-tax expansions to corporate reforms, sales tax overhauls, and property tax relief, 43 states are implementing notable tax changes, most taking effect January 1, 2026. Together, they reveal a clear trend: states are competing harder than ever to attract workers, families, retirees, and businesses. Below are some of the significant changes.

2026 State Tax Shake-Up: See How Your Income, Property, and Sales Taxes Will Change

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.