Americans Face Financial Struggles Despite ‘Cooling’ Inflation As 65% Say Their Finances Worsened in 2023

Despite claims that inflation is cooling, American households are feeling the financial squeeze harder than ever. Soaring costs for essentials like food, rent, and childcare are straining budgets, with many struggling to keep up.

As financial stress intensifies and optimism fades, the latest Federal Reserve report reveals a grim economic reality that millions of Americans are facing today.

Struggles with Day-to-Day Expenses

American households struggled to cover some day-to-day expenses in 2023 and many remained glum about inflation even as price increases slowed. This paints a troubling picture of financial instability for many.

Fed Policies Tackling Inflation

The Fed has increased interest rates to 5.3 percent from near-zero levels as recently as 2022 to cool the economy and curb rapid price increases.

While this move has made home-buying less affordable and credit card debt more costly for many households, Fed officials that the policy is necessary to get inflation lower.

The policy has worked but inflation is still visible in parts of the economy.

Inflation’s Lingering Impact

Inflation cooled notably over the course of 2023, yet 65 percent of adults said that price changes had made their financial situation worse. This lingering impact is particularly severe among low-income individuals.

Many economists believe the ongoing concern stems from households focusing on price levels — which remain significantly higher than they were in 2020 — rather than on price changes, the metric statisticians use to measure inflation.

For instance, people may fixate on their groceries costing $50 instead of $30, rather than on the fact that prices are no longer rising as quickly as they did last year.

Rising Rent Challenges

Renters reported increasing challenges in keeping up with their bills. The report showed that 19 percent of renters were behind on their rent at some point in the year, up two percentage points from 2022, indicating worsening housing insecurity.

A recent Redfin survey found that half of homeowners and renters are having difficulty covering their housing payments. Around 20% of those struggling have skipped meals or worked additional hours to make ends meet, while approximately 17% have put off medical care. A notable number of millennials, who are generally not retired, have tapped into retirement savings to manage housing expenses.

Renting has squeezed budgets, as rents in most major US metropolitan areas have surged 1.5 times faster than wages over the last four years.

Nationwide, rents climbed 30.4% while incomes expanded just 20.2% from 2019 to 2023, data from StreetEasy, a Zillow subsidiary, show.

Homes Are Unaffordable

Homeownership has become increasingly out of reach for many Americans, with a Zillow report revealing a troubling 80% increase in the income needed to afford a home comfortably in just the past four years.

While median income has only risen by 23% since January 2020, prospective buyers now face the challenging requirement of earning over $106,000 to realize their dream of homeownership.

Economic Discontent Amidst Booming Job Market

Consumer confidence remains depressed even though the job market is booming and inflation is cooling notably. This paradox highlights a deep-rooted economic discontent among the population.

Wage Growth vs. Inflation

Although government statistics show that paychecks are now rising faster than inflation, many Americans don’t believe that is the case.

Only 33% of adults said they received a raise in 2023, highlighting the disconnect between statistical improvements and personal perceptions.

Although incomes grew healthily in 2023, so did spending, with more than half of adults not having money left over after paying their expenses.

This trend exacerbates the financial strain on many households.

Financial Strain on Parents

Parents living with children under the age of 18 saw a significant decline in financial well-being. Child care expenses were considerable, with some parents spending up to 70% of their monthly housing payment on child care.

Emergency Expense Preparedness

The share of adults able to cover a $400 emergency expense with cash on hand remained unchanged from 2022 at 63%, but this is down from a high of 68% in 2021.

This indicates a decrease in financial resilience.

Disparities Among Lower-Income Adults

Lower-income adults reported higher instances of not having enough to eat, not being able to cover bills in full, and skipping medical care. These disparities underscore the economic challenges faced by vulnerable populations.

96% of people making less than $25,000 reported their financial situation has worsened.

Impact of High Inflation

High inflation has created severe financial pressures for most U.S. households, forcing them to pay more for everyday necessities like food and rent. This has disproportionately affected lower-income Americans.

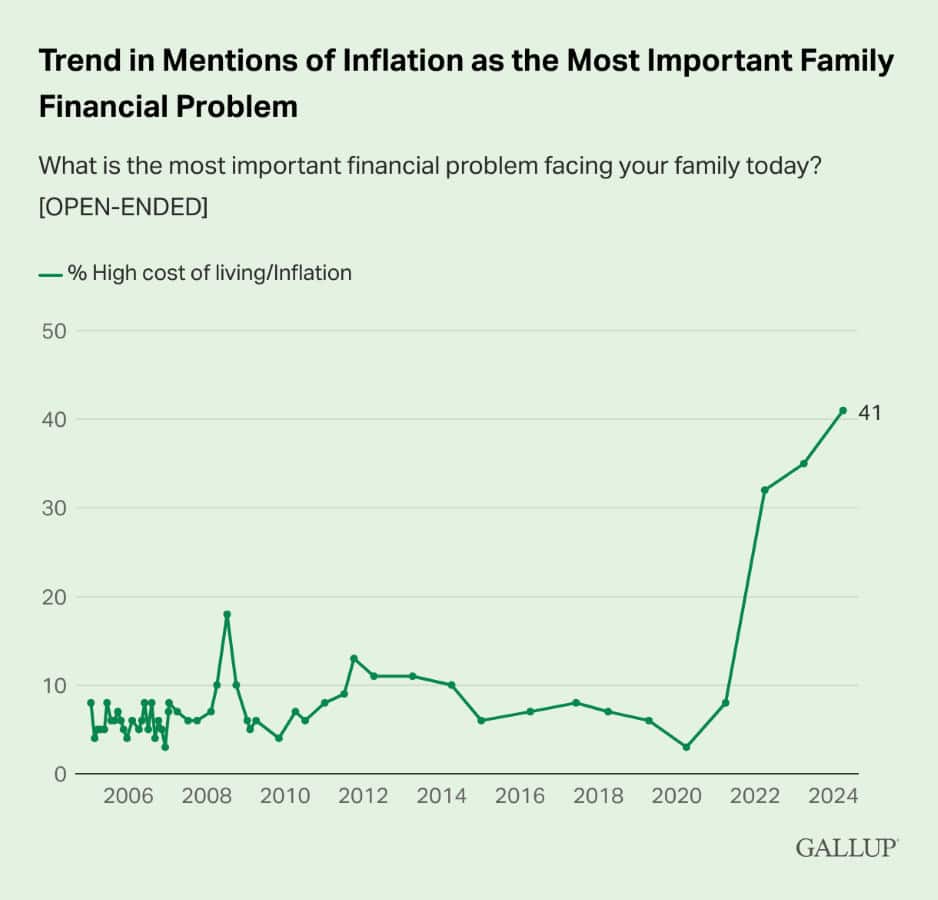

Gallup’s annual Economy and Personal Finance poll, asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

This year, the cost of owning or renting a home follows inflation as the second most pressing issue at 14%, a new high for this category.

Decline in Financial Well-Being

About 72% of adults said they were doing “OK” financially as of October 2023, down from 78% in 2021 and the lowest rate since 2016. This decline indicates a broad-based deterioration in financial well-being.

Political Ramifications

Polls show that Americans take a dim view of the economy under the Biden-Harris administration. This dissatisfaction is impacting the political landscape.

Perception of Local and National Economies

The report showed improvement in people’s feelings about their local economy, with 42% saying it was “good” or “excellent.”

However, this share remains significantly lower than 2019 levels, reflecting ongoing economic anxiety.

The Stark Reality Behind the Numbers

The Federal Reserve’s latest findings reveal a stark reality: despite official claims of cooling inflation, the financial strain on American households persists. As rising costs continue to outpace income gains, many are left grappling with the challenge of covering basic expenses.

This economic squeeze underscores the disconnect between optimistic reports and the lived experiences of millions. As we move forward, it’s clear that addressing these financial pressures is crucial for the well-being of American families.

Like Financial Freedom Countdown content? Be sure to follow us!

20% of Retirees Are Returning to Work. What Are the Reasons Behind the “Unretirement” Wave?

In recent years, the concept of retirement has begun to evolve beyond traditional expectations of leisure and relaxation. A surprising trend has emerged, with 1 in 5 retirees returning to work. What’s drawing so many retirees back into the workforce?

20% of Retirees Are Returning to Work. What Are the Reasons Behind the “Unretirement” Wave?

11 Reasons You Should Claim Social Security Early

Deciding when to claim Social Security is often about maximizing your benefit. Financial planners usually advise delaying your claim for as long as possible to secure the highest monthly payment. Your benefit is based on your lifetime earnings, with a full payout available at your full retirement age (FRA), which is currently between 66 and 67 depending on your birth year. Claiming before FRA results in a permanent reduction in your monthly benefit, while waiting beyond FRA leads to a permanent increase. However, the decision isn’t solely about maximizing the monthly check. Personal factors such as health, family circumstances, and financial needs can play a significant role in determining the right time to claim.

11 Reasons You Should Claim Social Security Early

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

Retirement age fluctuates across nations, influenced by diverse factors such as labor market dynamics, job types, economic policies, gender roles, and pension systems. For instance, Saudi Arabia stands out as the sole country offering full retirement benefits to individuals under 50, whereas in 2023, France faced uproar after raising its retirement age by two years, sparking widespread strikes. The Organization for Economic Co-operation and Development (OECD) collects and analyzes retirement data using distinct metrics: – The Current Retirement Age signifies the age at which individuals can retire with full pension benefits after a career starting at age 22, without facing any deductions. – The Effective Retirement Age represents the average age at which workers aged 40 or older exit the workforce, influenced by personal decisions or job availability.

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.