Stock Rich and Home Poor: The Startling Wealth Gap Threatening Young Americans’ Financial Stability

Research from the New York Fed explores changes in wealth distribution among different age groups over the past four years.

In 2019, individuals under 40, who represented 37% of the adult population, controlled just 4.9% of the nation’s wealth. In contrast, those over 54, with a comparable population share, held a substantial 71.6% of the total wealth. Recent findings indicate a slight narrowing of these wealth disparities, possibly due to increased financial asset ownership among younger Americans.

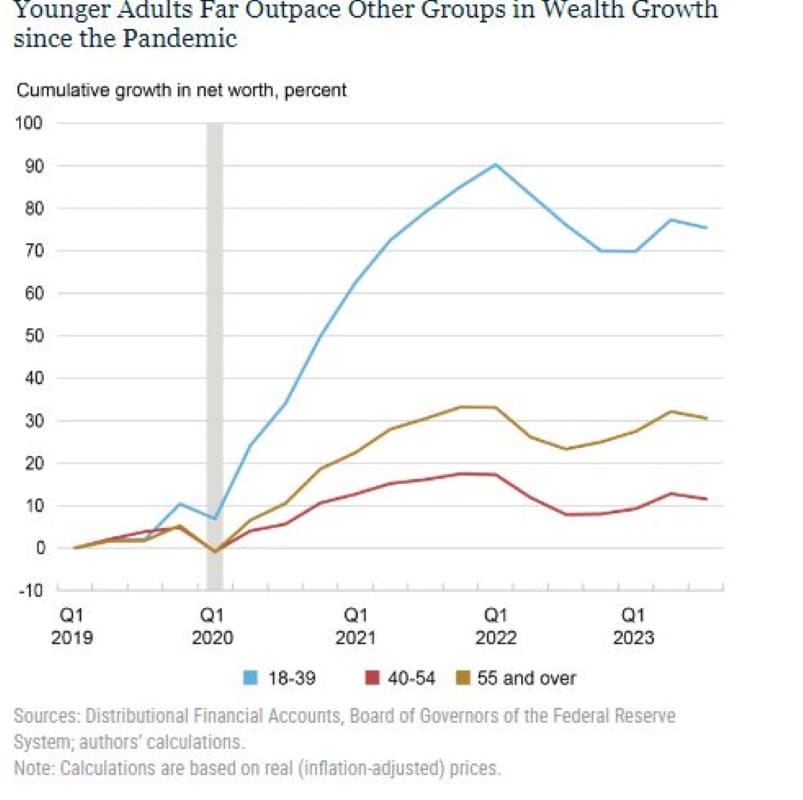

Changes in Wealth Based on Age Groups

Real wealth has seen an increase across all age groups since 2019, with the most significant surge observed among younger adults, as illustrated in the chart below. Individuals aged 39 and below experienced an 80% growth in wealth, in contrast to a 10% increase for those aged 40-54 and a 30% rise for those 55 and above.

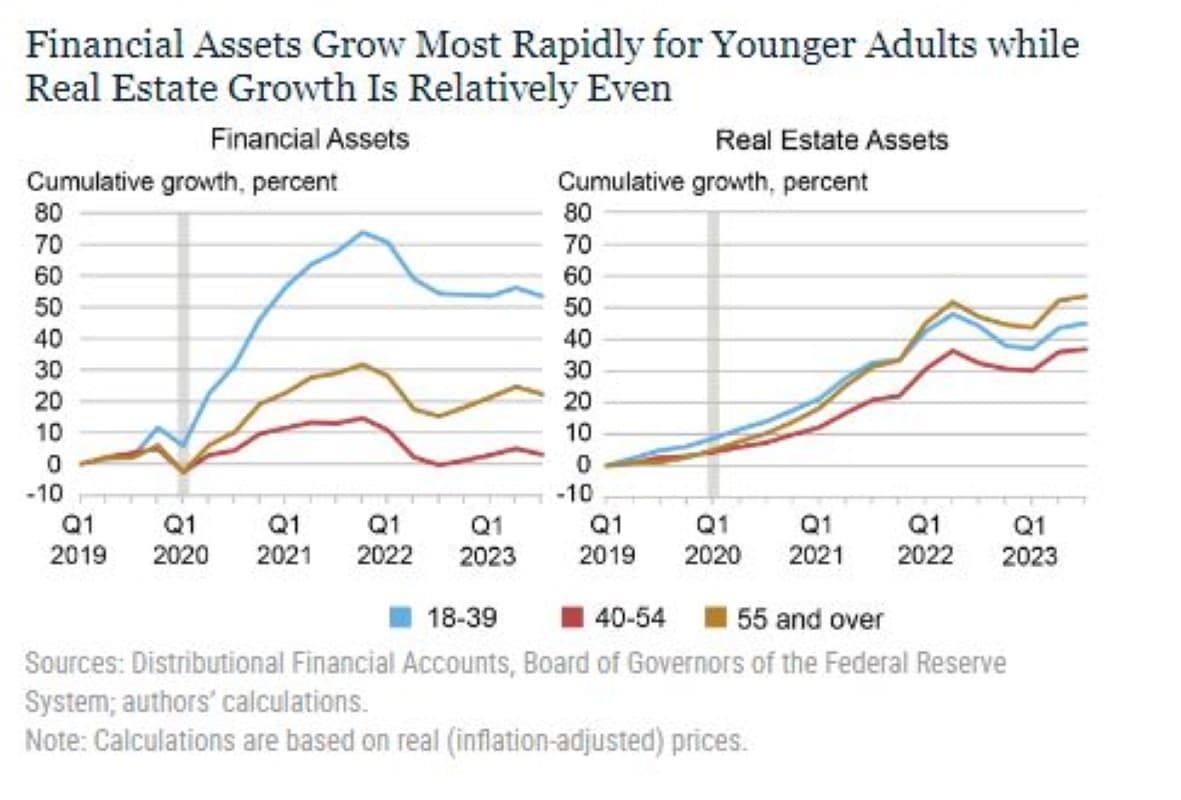

Differences in Asset Classes

The variation in wealth growth can be attributed to the substantial rise in financial assets, particularly evident in the under-40 age group, where the real value of financial assets soared by over 50% between 2019 and 2023. This shift towards equities, the fastest-growing financial asset class during the period, played a pivotal role in the younger demographic’s overall wealth growth, reflecting their ability to take on higher-risk investments due to their distance from retirement.

Analyzing wealth distribution shifts since 2019, the study reveals that the accelerated wealth growth among younger adults has marginally reduced age-based wealth disparities, primarily driven by changes in financial asset holdings across the three age groups, particularly the under-40 group’s increased exposure to equities amidst rising prices.

Home Equity Is a Silver Lining For Older Homeowners

A vast majority of homeowners over 60 have not just formed deep attachments to their homes; they see these spaces as more than just bricks and mortar. For many, their home equity represents a critical financial safety net, underpinning their confidence in a secure retirement based on a research study conducted by Fannie Mae.

72% believe they’ll have sufficient income throughout their golden years. This confidence tends to increase with age. However, homeowners facing economic challenges show less optimism, with only 55% feeling confident about their financial readiness for retirement.

56% intend to never sell; 27% consider selling in the future; and merely 17% have sold or plan to sell their residences. Those retirees who have sold cite various motivations, such as relocating to a more suitable home, financial benefits like lower taxes or housing costs, the desire to be nearer to family and friends, or the pursuit of a warmer climate.

Home as a Buffer Against Unexpected Expenses

Additionally, nearly half acknowledged that their home’s equity serves as a financial safeguard for unforeseen expenses, encompassing potential emergencies like significant healthcare costs, assisted living, or substantial home repairs, although the survey didn’t explicitly define these situations.

With Social Security projected to be insolvent in 10 years, and Medicare Funds expected to run out sooner, seniors are rightfully cautious about the future.

Older homeowners have voiced heightened apprehension about inflation and the financial and health challenges linked to aging. The escalating expenses of assisted living, compounded by inflation, could be influencing their inclination to age in place. Staying put allows them to exert more control over costs, leveraging their familiarity with the community and their home. With a robust grasp of current expenses, these homeowners are well-positioned to manage and potentially curtail costs as needed.

Leave a Legacy for Their Children

A significant 62% expressed their aspiration to pass down their homes to heirs, suggesting that many consider their residences a crucial part of their legacy—an emotional and financial motivation to remain in their homes.

Homeownership Crisis for Younger Americans

Although the average net worth of younger Americans has increased rapidly due to the stock investments, aspiring homeowners face a daunting financial reality: earning over $106,000 is now a prerequisite for affording a home comfortably—an 80% increase from January 2020.

Median income has risen only 23% in the same time frame putting the dream of homeownership out of reach for many Americans as per the latest report from Zillow. The generational wealth transfer of homes from Older Americans to the younger generation might stave off the homeownership crisis.

Do Rising Stock Values Compensate for Lack of Homeownership?

Younger investors would be better served investing in stocks due to their longer time horizon for retirement. Older individuals should continue with their asset allocation based on their risk tolerance.

Different asset classes are required to build a diversified portfolio and returns of a particular asset are only one of the several factors to be considered. Risk, volatility, liquidity and availability are the other factors based on which assets should be selected.

However, for the vast majority of young Americans who do not own a home, the rising stock portfolio does little to assuage their feelings of being cheated out of the American dream.

Like Financial Freedom Countdown content? Be sure to follow us!

Unraveling Online Romance Scams: Here Are the 8 Warning Signs to Protect Your Heart and Wallet

According to the Federal Trade Commission (FTC), romance scams led to over $1.14 billion in losses in 2023. The rise in online dating has fueled this deceit, affecting over 64,003 Americans of all ages throughout the year.

Unraveling Online Romance Scams: Here Are the 8 Warning Signs to Protect Your Heart and Wallet

Guard Your Retirement: Essential Tips to Safeguard Your Savings Amid Financial Uncertainty

In times of rising financial risks, investors typically take comfort in the safety of bonds. However, with rising inflation, many individuals are finding their retirement plans faltering as bond funds suffered unprecedented losses last year and are continuing to trend lower this year.

Guard Your Retirement: Essential Tips to Safeguard Your Savings Amid Financial Uncertainty

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

As spring blooms and road trip season kicks into high gear, drivers face the challenge of balancing wanderlust with the rising cost of fuel. The average regular gas price as of March 2024 is $3.45 per gallon and at the highest level since November. But fear not! We’ve compiled 12 invaluable tips to help you navigate the highways and byways while keeping your gas budget in check. From clever tricks to tried-and-tested techniques, discover how you can maximize your mileage and minimize your spending, ensuring that your spring road adventures are not just memorable but also affordable. Whether you’re planning a cross-country expedition or a weekend getaway, these tips will empower you to make the most of every gallon, so you can hit the road with confidence and ease.

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

Dreaming of a consistent passive income every month from your investments? It’s not just a dream for the wealthy; it’s achievable for anyone willing to explore the possibilities. We will uncover various investments that promise monthly returns, from the well-known to the hidden gems. Whether you’re new to investing or looking to diversify your portfolio, discover how to create a dependable monthly income stream and take a step towards financial stability.

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.