Skipping Meals, Delaying Medical Care: How America’s Housing Crisis is Forcing Impossible Choices

A recent Redfin survey highlights the harsh financial toll of the housing crisis, with half of homeowners and renters struggling to keep up with payments. Nearly 20% report skipping meals or taking on extra work to stay afloat, while 17% have delayed essential medical care. Even millennials, years away from retirement, are tapping into their retirement savings just to cover soaring housing costs..

Sacrifices Made to Afford Housing

Based on the survey responses, Americans had to make the following sacrifices

35% took no vacation

22% skipped meals

21% had to work additional hours or sell their belongings

18% borrowed money from friends and family or withdrew from retirement accounts

16% delayed or skipped medical treatments

Homeownership Crisis Has Escalated In Past Four Years

Homeownership has become increasingly out of reach for many Americans, with a Zillow report revealing a troubling 80% increase in the income needed to afford a home comfortably in just the past four years.

While median income has only risen by 23% since January 2020, prospective buyers now face the challenging requirement of earning over $106,000 to realize their dream of homeownership.

Rampant Inflation Caused Asset Prices to Increase

Inflation exerts a significant impact on the value of hard goods, particularly real estate. As the general price level of goods and services rises, the purchasing power of currency diminishes. Investors often turn to hard assets like real estate as an inflation hedge, seeking to preserve and potentially increase their wealth.

Real estate values tend to rise during inflationary periods, driven by increased construction costs, higher demand for housing, and the perceived stability of tangible assets. Additionally, landlords may raise rents to compensate for the eroding value of money, contributing to the overall appreciation of real estate in times of inflation.

Home values have surged by 42.4%, with the average home now valued at approximately $343,000.

Fed Raised Rates to Tackle Inflation

The landscape of housing affordability has dramatically transformed in the past four years, with the monthly mortgage payment for a typical U.S. home almost doubling to $2,188, marking a 96.4% increase.

Mortgage rates started at a manageable 3.5% in January 2020 and have since climbed to over 8% and currently at 7.6%, further complicating the dream of homeownership.

A significant portion of the monthly mortgage payment is now interest cost.

Wage Growth Not Keeping Pace With Rising Prices

The wage growth has failed to keep pace with these rising costs.

In 2020, a household earning $59,000 could afford a home without spending more than 30% of its income on mortgage payments.

Today, a household would need to earn around $106,500 to afford the same.

The typical U.S. household income is around $81,000.

“Housing has become so financially burdensome in America that some families can no longer afford other essentials, including food and medical care, and have been forced to make major sacrifices, work overtime and ask others for money so they can cover their monthly costs,” said Redfin Economics Research Lead Chen Zhao. “Fortunately, the country’s leaders are starting to pay attention.”

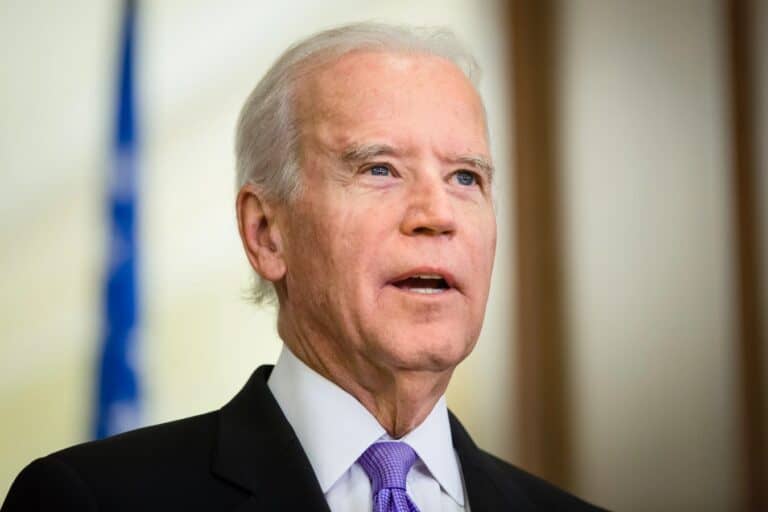

Biden-Harris Administration Proposed Starter Home Credit

In his State of the Union address, Biden proposed a $10,000 tax credit for first time home buyers and people who sell their starter homes. Critics mentioned the $10,000 tax credit will not move the needle on affordability since most of the country is now unaffordable to the average American.

As part of her campaign, Kamala Harris proposed a $25,000 down payment support.

Americans Grappling With Sacrifices as Housing Crisis Deepens

As the American housing market continues to be an uphill battle for many, the Redfin survey underscores the dire choices people are making just to keep a roof over their heads.

The shift in homeownership from attainable dream to distant reality reflects broader economic pressures, including stagnant wage growth against a backdrop of soaring property values and rising interest rates.

Such conditions not only highlight the growing disparity in housing affordability but also call for urgent policy interventions to address these disparities.

As various campaign promises illustrate, there is recognition of the problem at the highest levels of government. However, the effectiveness of such measures remains to be seen, especially in a landscape where even a $25,000 assistance seems like a drop in the bucket against the enormity of the affordability crisis.

Pittsburgh, St. Louis and Detroit are the only major metro areas currently within reach for those earning the average income.

Like Financial Freedom Countdown content? Be sure to follow us!

20% of Retirees Are Returning to Work. What Are the Reasons Behind the “Unretirement” Wave?

In recent years, the concept of retirement has begun to evolve beyond traditional expectations of leisure and relaxation. A surprising trend has emerged, with 1 in 5 retirees returning to work. What’s drawing so many retirees back into the workforce?

20% of Retirees Are Returning to Work. What Are the Reasons Behind the “Unretirement” Wave?

11 Reasons You Should Claim Social Security Early

Deciding when to claim Social Security is often about maximizing your benefit. Financial planners usually advise delaying your claim for as long as possible to secure the highest monthly payment. Your benefit is based on your lifetime earnings, with a full payout available at your full retirement age (FRA), which is currently between 66 and 67 depending on your birth year. Claiming before FRA results in a permanent reduction in your monthly benefit, while waiting beyond FRA leads to a permanent increase. However, the decision isn’t solely about maximizing the monthly check. Personal factors such as health, family circumstances, and financial needs can play a significant role in determining the right time to claim.

11 Reasons You Should Claim Social Security Early

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

Retirement age fluctuates across nations, influenced by diverse factors such as labor market dynamics, job types, economic policies, gender roles, and pension systems. For instance, Saudi Arabia stands out as the sole country offering full retirement benefits to individuals under 50, whereas in 2023, France faced uproar after raising its retirement age by two years, sparking widespread strikes. The Organization for Economic Co-operation and Development (OECD) collects and analyzes retirement data using distinct metrics: – The Current Retirement Age signifies the age at which individuals can retire with full pension benefits after a career starting at age 22, without facing any deductions. – The Effective Retirement Age represents the average age at which workers aged 40 or older exit the workforce, influenced by personal decisions or job availability.

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

While many bask in the belief that their golden years will be tax-friendly, residents in ten specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

2025 Social Security COLA Almost Wiped Out by Medicare Hikes, Leaving Retirees Struggling

Retirees hoping for relief from rising costs with the 2025 Social Security cost-of-living adjustment (COLA) are facing a harsh reality: most of the 2.5% increase will be swallowed by higher Medicare premiums and deductibles. Next year’s COLA falls far short of the 8.7% adjustment for 2023, which was the largest increase in over 40 years and meant to help seniors and people with disabilities keep up with soaring prices. The official Social Security cost-of-living adjustment (COLA) numbers released on 10th October are a disappointing 2.5%, a sharp drop from the 3.2% increase retirees received in 2024. This meager adjustment raises concerns about how seniors will cope with persistent inflation

2025 Social Security COLA Almost Wiped Out by Medicare Hikes, Leaving Retirees Struggling

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.