Major Student Loan Changes Coming in 2026; From Parent PLUS Caps to the End of SAVE

Federal student loans are about to change in some of the biggest ways in decades. Beginning in 2026, new laws will reshape how much students and parents can borrow, eliminate long-standing loan programs, and overhaul repayment for future borrowers.

For families planning for college, graduate students weighing advanced degrees, and borrowers already navigating repayment, these shifts could significantly alter education and financial decisions.

Graduate PLUS Loans Are Ending for New Borrowers

For years, Graduate PLUS loans allowed graduate and professional students to borrow up to the full cost of attendance, covering everything from tuition to living expenses once other aid was applied.

That option disappears in 2026.

Starting July 1, 2026, Graduate PLUS loans will no longer be available to students taking out their first federal loan for graduate school.

Students already enrolled in programs and using Grad PLUS loans may be able to continue borrowing under current rules for up to three years, but new entrants will be shut out entirely.

Why Congress Is Eliminating Grad PLUS Loans

The change comes from the One Big Beautiful Bill Act, which lawmakers say targets unlimited borrowing. While graduate borrowers represent a smaller share of total loan holders, they carry some of the highest average balances in the system.

By ending Grad PLUS loans, policymakers are placing firm caps on graduate borrowing for the first time; a move designed to limit long-term debt growth but one that shifts more financial responsibility onto students and families.

High-Cost Graduate Programs Will Feel the Biggest Impact

Students entering law school, medical school, MBA programs, and other high-tuition graduate tracks may no longer be able to cover total costs using federal loans alone.

That gap may need to be filled through scholarships, fellowships, employer tuition benefits, personal savings, or private student loans; which typically offer fewer protections than federal loans.

For some degrees, the math may no longer work, forcing applicants to reconsider where or whether to enroll.

Parent PLUS Loans Will Face Strict New Caps

Parent PLUS loans have long served as a safety net, allowing parents to borrow whatever remained after financial aid was applied. That era is ending.

For Parent PLUS loans issued after July 1, 2026, borrowing will be capped at:

$20,000 per year per student

$65,000 lifetime per student

Previously, there was effectively no limit beyond the cost of attendance.

Why Parent Borrowing Is Being Reined In

Lawmakers have raised concerns about parents taking on large student loan balances close to retirement, often with limited income growth left to support repayment.

The new caps aim to reduce that risk; but they also mean many families will face funding gaps when considering private colleges, out-of-state public schools, or higher-cost degree programs.

New Borrowing Limits for Graduate and Professional Students

With Grad PLUS gone, graduate and professional students will rely on capped Federal Direct Unsubsidized Loans instead.

Under the new rules:

Graduate programs: $20,500 per year, $100,000 lifetime

Professional programs: $50,000 per year, $200,000 lifetime

This marks the first time federal borrowing limits explicitly distinguish between graduate and professional programs.

ROI Will Matter More Than Ever for Advanced Degrees

Lower-cost graduate programs may see little impact, but expensive degrees with modest earning potential could become much harder to justify.

Students will need to weigh total debt against realistic post-graduation income. Private lenders may not step in to replace lost federal funding for certain degrees, making some paths financially inaccessible for many students.

A New Repayment Assistance Plan (RAP) Is Launching

Borrowing rules aren’t the only thing changing. Repayment is undergoing a major overhaul as well.

For loans disbursed on or after July 1, 2026, most existing income-driven repayment plans will be replaced by a new Repayment Assistance Plan (RAP). Borrowers will generally choose between a standard fixed plan and RAP.

Notably, parents with new Parent PLUS loans after July 1, 2026 will only have access to the standard repayment plan.

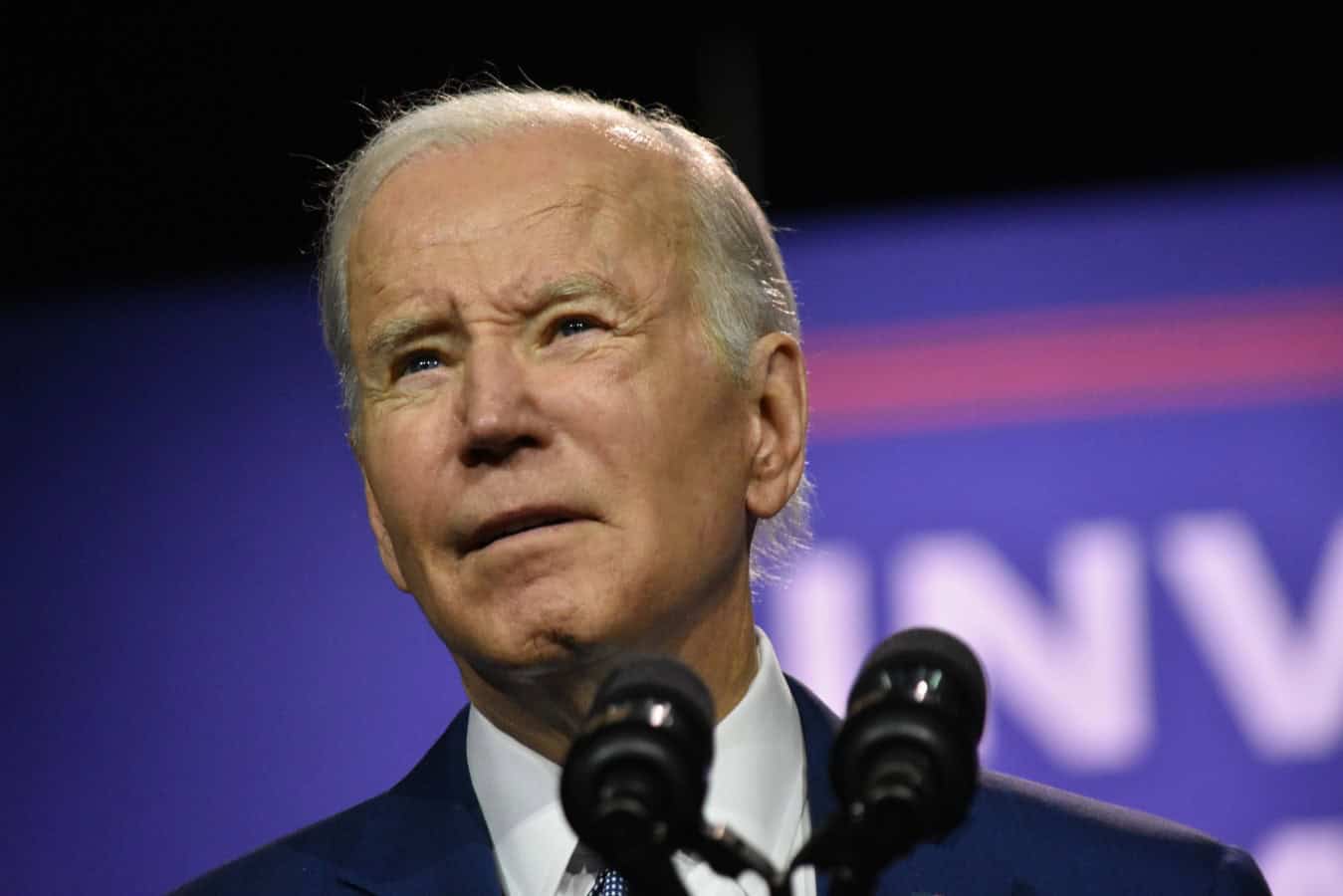

The SAVE Plan Is Ending; And Borrowers Are in Limbo

The SAVE plan, a Biden-era initiative, is officially closed to new borrowers and has been eliminated by both courts and legislation. Millions of borrowers currently enrolled must now decide whether to switch to Income-Based Repayment (IBR) or wait for RAP to launch.

Waiting carries risks. The Department of Education could transition borrowers on its own timeline, potentially moving them into less favorable plans.

Borrowers pursuing Public Service Loan Forgiveness may want to act sooner to avoid losing progress.

What Borrowers and Families Should Do Now

The most important takeaway is timing. The rules that apply to your loans depend heavily on when you borrow and which loans you use.

Families and borrowers should:

Review college and graduate school timelines carefully

Compare total program costs against new loan caps

Increase savings and pursue scholarships earlier

Ask financial aid offices how funding packages may change

Run repayment scenarios under IBR, RAP, and standard plans

The federal student loan system in 2026 will be more limited, more structured, and less forgiving for future borrowers. Those who plan early and understand the new rules will be far better positioned to avoid costly surprises; and to make education decisions that support long-term financial stability.

Like Financial Freedom Countdown content? Be sure to follow us!

Gen Z Would Cut Current Retirees’ Social Security Before Raising Taxes; A Generational Reckoning Is Here

Social Security supports the majority of American workers, retirees, and families. Yet as the program barrels toward a funding shortfall, a stark generational divide is emerging. Younger Americans; especially Gen Z, are increasingly unwilling to pay higher taxes to preserve benefits they’re not confident they’ll ever receive.

Forgotten IRS Retirement Rule Is Costing Americans $1.7 Billion a Year and It’s Still Catching Retirees Off Guard

Missing a required minimum distribution (RMD) might sound like a minor paperwork error. But new research from Vanguard shows it’s anything but small: investors who failed to take required withdrawals in 2024 triggered an estimated $1.7 billion in IRS penalties, with the biggest mistakes concentrated among people with the smallest retirement accounts. Here’s what the data reveals; and what retirees can do to avoid an expensive oversight.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.