10 Surprising Reasons You Might Want to Rethink Retirement

Imagine looking forward to the golden years of retirement, only to find the dream a bit out of reach. What happens if an unexpected event drains your savings, or you realize you haven’t stashed away enough to step back from work life comfortably? The stark reality for many is postponing retirement, tethered to their job out of necessity or fear of financial insecurity.

But it’s not just the monetary aspect that can make retirement less than idyllic. The post-work phase can bring its own set of challenges, including feelings of isolation or a lack of purpose that once structured your days.

Let’s dive into the reasons retirement might not be how it is often cracked up to be and explore how you can lay the groundwork for a fulfilling and worry-free retirement by actively chasing your dreams today!

Sacrificing Living Today for an Uncertain Tomorrow

Some people obsessed with retirement live their lives around a future day, putting off living in the present till then. We don’t know what the future holds for our health, economy, or relationships.

There are several real-life examples of estranged couples due to the relentless focus on retirement savings.

As with everything in life, moderation is the key. If there are activities which you or your family enjoy, then go for them! Also, have a conversation with your family and develop your budget jointly. Financial Freedom is a marathon, not a sprint. And it is better to make sure we bring along others on this journey.

There Is No Guarantee You’ll Have Enough Saved Up

Retirement doesn’t come around every year; it’s something we look forward to once we’ve reached a certain age and retired from our full-time jobs. However, many people underestimate the amount of money they will need during this time in their lives. It can be hard to save up for retirement when you don’t know how much money you’ll need or the costs.

Yes, there are several retirement accounts like 401(k), Roth IRA, Traditional IRA, HSA, Self-directed IRA, etc. But unless you can save every month, the tax benefits don’t matter. Often we need to improve our human capital so that your income is much larger than your expenses, and you can invest the difference. However, despite our best efforts, things might not go as per plans. Luck plays a huge factor in many areas of our lives, including picking the best assets to buy.

Many retirees spend more money than working after paying for their medical care and health insurance costs—and keeping up with hobbies that cost money like golfing and boating.

It is perfectly fine if you cannot afford to retire. Don’t wait until retirement to pursue your goals and dreams – start living them now! Your future self will thank you for not allowing an opportunity to slip past while waiting for something that may never happen.

You Might Not Be As Healthy as You Think

It’s easy to assume that we’ll stay young and healthy forever – but unfortunately, this isn’t always the case. Even if your retirement is decades away, it could still come sooner than expected if something tragic happens to your health. It is even more critical for people who plan on retiring later in life to pursue their goals now, especially if they’re working in a career that can be dangerous or harmful to their health.

Make the most of every day and don’t take for granted what you have – because, at any time, something unexpected could happen which will change everything. Don’t wait until retirement is right around the corner to make the most of your life. Get out there and experience what this world has to offer before it’s too late!

You Never Know When an Emergency Will Happen

Emergencies can happen at any time, making it nearly impossible to predict when they’ll arise. There’s no way of knowing how much money you’ll need in an emergency until one happens (and by then, it might be too late).

Start saving up for an emergency fund now! It will help give your future self-peace of mind. Keep your emergency funds safe in risk-free I-Bonds or high-interest rate online banks which are FDIC insured.

You Are Afraid of Health Complications Due to Not Working

While working can often be stressful and cause health complications, one must also be mindful of the effects of retirement. On two levels, a regular retirement might be harmful: physically and emotionally.

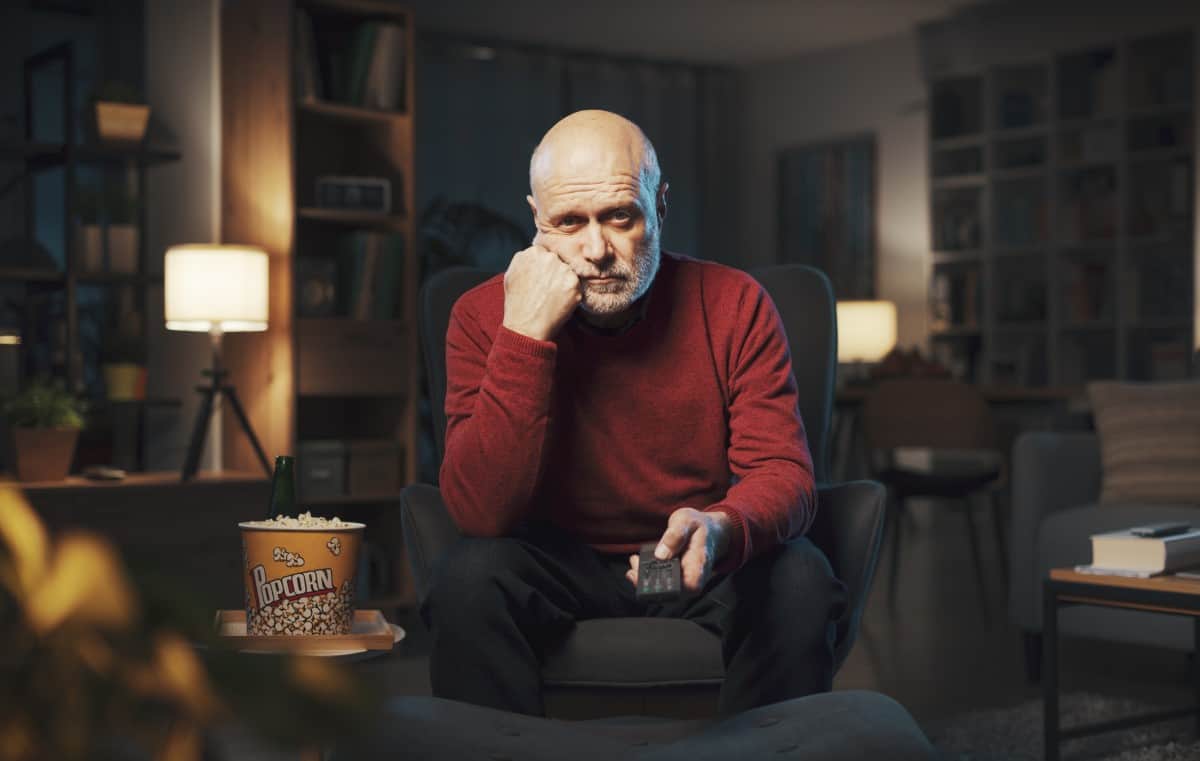

Retirement frequently entails a loss of activity on a physical level. You no longer have a compelling reason to get out of bed or engage in physical activity. Even the simple act of running from one conference to the next or walking couple of blocks at work for lunch could prove beneficial compared to sitting on a couch all day in retirement.

Retirement, on an emotional level, frequently results in withdrawal and isolation. The danger of becoming lonely and depressed may be a problem for many people, especially if no relatives are nearby or do not have a robust social support system.

Find a sport that you can engage with your friends, go for walks in your neighborhood, or join a fitness center to keep you active. Start getting involved in your local neighborhood associations. Pursue hobbies that keep your mind sharp. If there was a skill you wanted to learn, go ahead and pursue it. Online courses are available on a variety of subjects at Udemy or LinkedIn Learning. Volunteering or working allows us to stay active, keep our minds occupied, make new friends, and feel a part of society.

Being in an Office Helps You Maintain Friendships

If most of your friends are from work, then retirement can seem scary. People who work in an office environment often find themselves surrounded by friends and co-workers every day. It makes it easier to maintain friendships, as you’ll see these people more than those outside of your working life (who may live further away).

There could be several non-profits and charitable organizations that could benefit from your skills. Large charitable organizations are often run like corporations. So they would have a role for everyone, no matter how niche your professional skills are.

You Are a Type-A Personality

Most people who are Type-A personalities are unhappy in retirement. It’s boring, isolating, and depressing. They love being in charge and have a sense of purpose at work. Work becomes their identity. People who retire early often end up back at work within a few years of quitting because they get sick of being bored all day, or they miss the social aspect of working with other people each day.

You can either try and change your personality or find a way to embrace retirement life. The first option is difficult, but not impossible. If you cannot overcome this obstacle, you might accept that you will always be unhappy in retirement until your personality changes.

You Want To Build a Legacy

Early retirement often means we stop working when we have our maximum income-generation potential. If you are working at a job based on your experience, you earn the most in your 50s and 60s. Deciding on retirement entails now living off your nest egg and depleting it during retirement. Instead, you can extend your working years by delaying retirement.

If you have several dependents and want to build generational wealth, it might be better to continue working. Due to the power of compounding, your investment will keep growing, and your legacy wealth can support the next generation. Your tax planning strategies can ensure that your investments grow tax-free.

You Can Work Part-Time

People who retire early from their careers often find themselves struggling to fill the gap in their days left by retiring sooner than expected. Even if you don’t want full-time employment, there are plenty of ways to stay active and involved with your community without working long hours at a job that could be harmful or dangerous to your health.

Don’t let retirement scare you into thinking that the only options available are full-time careers! You can still stay active and involved with others without working long days – there are plenty of ways to be just as happy in retirement by pursuing part-time jobs or hobbies on a more casual basis.

In fact, as per the Back to Work: Expectations and Realizations of Work after Retirement paper nearly 50 percent of retirees follow a nontraditional retirement path that involves partial retirement or unretirement, and at least 26 percent of retirees later unretire.

Doing Nothing All Day Gets Old Fast

Retirement can be challenging because it leaves us with a lot of time on our hands. While the initial thought is that we’ll have so much free time to do whatever we want, this isn’t always how things turn out in reality – and doing nothing all day gets boring fast. You don’t need to be retired to realize that you’ll eventually get bored after a certain amount of time, and therefore it’s essential to pursue your dreams even if retirement isn’t right around the corner.

Make a plan for how you want to spend your time in retirement before you actually retire. Ideally, the decision to retire should be based on the activities you want to run towards as opposed to running away from work.

What Is The Healthiest Age To Retire?

Retirement is an important and personal decision. Retirement may be seen as a significant burden for many individuals. But for others, it’s the perfect time to slow down and enjoy their lives without having to work long hours at jobs that they don’t love or find fulfilling in any way. There isn’t one age that everyone should consider retiring at – it’s all up to you and your life. Don’t worry about other people pressuring you into quitting early or at a certain age – focus on finding happiness in the way that works for YOU! The average retirement age is 60 years old and full retirement age as per Social Security Administration is 67.

How Much Does The Average Person Need To Retire?

The amount of money that you’ll need to retire can vary widely depending on your living expenses, income needs, location, and so much more. The general rule is that you should have enough savings for about 25 times the amount of your annual expenses, also known as the 4% retirement rule – but this isn’t always possible or realistic. Don’t worry too much if retirement seems like a distant dream right now – start saving what you can, and don’t feel guilty if it takes a bit longer than expected. As long as you’re doing your best to save money for the future, there’s no need to stress!

Does Retirement Shorten Your Life?

Retirement doesn’t necessarily shorten your life – but it can impact how long you live depending on your retirement lifestyle. Retirement could lead to more stress, leading to a shorter lifespan or poorer health in general if you do not take engage in regular mental and physical activities post-retirement. While this is certainly not something anyone wants for their lives, the good news is that retirees who can stay busy and active live longer than if working.

What Is The Average Income Of A Retired Person?

The average income of a retired person in the United States is $30,479 per year – and this number can vary depending on where you live. Even if your salary isn’t above average when working full-time, there are plenty of ways to increase it through retirement! You don’t need to work long hours at jobs that leave you feeling drained and exhausted when retirement is just around the corner. The median retirement income by age in the U.S. is is $22,000 for ages 55-64.

While you might not have saved enough money to support all your annual living expenses, most retirees can cover at least half of their expenses while living off Social Security.

Examine your current spending. I use Personal Capital, a free tool, which automatically creates a budget for me based on my everyday spending. The free tool also has a retirement planner which estimates how much you can spend in retirement. You can read my Personal Capital review for ideas on how to use it.

Should You Retire?

Retirement is a big decision – but there are some signs that you might be ready to retire. If retiring would allow you the opportunity to pursue hobbies and interests without getting permission from your boss, then it’s probably time for early retirement! Not retiring is also a sign that you might not be ready to retire yet – so don’t worry too much if it seems like the perfect time.

If you’re worried about retirement, don’t be! There are steps you can take to make sure that you have money set aside for retirement, and there’s no need to feel guilty if it takes a little longer than expected. Retirement is an important personal decision – focus on finding happiness in the best way for YOU!

Is Retirement Overrated?

Retirement should be viewed as a good thing, something to look forward to, instead of being wary about it. With financial freedom comes options and choices. While you’re working your way up the corporate ladder, take time out to plan for what will come after that.

Everyone’s situation is different, and financial well-being is just as important. Retirement is not overrated if you’re part of the group of people that knows what you plan to do after retirement and have made plans to be financially secure.

On the other hand, if you are a type-A personality who enjoys working, has a dream job, wants to build legacy wealth, or appreciates the company of co-workers, then maybe don’t stress about retirement. Whether or not you agree with the perspective on retirement, hopefully, it inspires you to take steps. If you want to live a fulfilling life, there’s no time like the present to start living your dream.

Like Financial Freedom Countdown content? Be sure to follow us!

20 Ways To Invest In Real Estate With Little Or No Money

Reviewing the list of income-producing assets backed by collateral, real estate typically features high. In fact, real estate is one of the best ways to build generational wealth. However, investing in real estate usually requires money. Typically, you need at least a 25% down payment for buying a rental property. Often individuals wonder how to invest in real estate with little or no money. Your lack of funds will have to be made up by sweat equity or adjustments in your lifestyle. After all, there is no free lunch. Let’s get started!

20 Ways To Invest In Real Estate With Little Or No Money

Surging Household Debt Sparks Concern As Delinquency Rates Soar

Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023, according to the Federal Reserve Bank of New York. Credit card balances, mortgage loans, and auto loans are at record-high levels as delinquency rates for most debt types continue to climb, causing concern about the U.S. consumer-driven economy among economists and financial analysts.

Surging Household Debt Sparks Concern As Delinquency Rates Soar

Nearly a Million People Risk Losing Over $1 Billion in Unclaimed 2020 Tax Refunds If They Don’t Act by May 17

Tick tock, the clock is counting down for nearly a million Americans who stand on the brink of losing out on a staggering sum of over $1 billion in unclaimed tax refunds from 2020. With the May 17 deadline looming, it’s a race against time to secure what’s rightfully yours.

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.