What Is Generational Wealth And How To Build And Pass It Down

Have you ever wondered what you would do if you inherited a large sum of money?

I frequently ask my readers to chime in with topics they would be interested in reading. One of my readers was curious about building generational wealth and how to pass it on to future generations. After all, the most significant intergenerational wealth transfer in history will pass down over $30 trillion in inheritance from baby boomers to millennials. Planning for generational wealth is not just for the 1%. Let us explore what’s generational wealth and how does generational wealth work to provide economic security.

What Is Generational Wealth?

Generational wealth, also known as legacy wealth or family wealth, is defined as monetary assets passed down from one generation of a family to the next. Leaving behind a substantial inheritance to your heirs in the form of assets such as real estate, stocks, bonds, a business, precious metals, jewelry, art, currency, or anything that contains a financial value is generational wealth transfer.

If you can leave something behind for your children or grandchildren, you contribute to increasing generational wealth in your family. Financial legacy is the link between the past, the present, and to the future.

While the focus is often on financial assets that you leave behind, you should also consider other things such as excellent education, values, good memories, and healthy habits behind for your future generations as part of building generational wealth.

Why Is Generational Wealth Important?

Generational wealth is essential so your heirs can pursue work they find fulfilling, and that will positively impact the world without worrying about how they will pay the bills.

Wealth gives you more options in life!

Building generational wealth and passing it down to your heirs could have a tremendous impact on their financial future and provide a high level of economic security. Boosting the financial wellness of children and their children sounds very satisfying.

Inheriting generational wealth provides a meaningful economic benefit compared to those who are not privileged enough. You could avoid debt such as student loans or mortgages. Or invest your inheritance into income-producing assets.

What Amount Is Considered Generational Wealth?

Definition of generational wealth is when you have accumulated enough investments to pay for your heirs’ living expenses in perpetuity without touching the principal.

Since living expenses, investment returns, tax laws, and spending of future generations are varied, it is hard to put a number on what is considered generational wealth.

You might build a nest egg of $100 million, but if you have ten kids and each of them spends over a million annually, then your generational wealth planning would have failed.

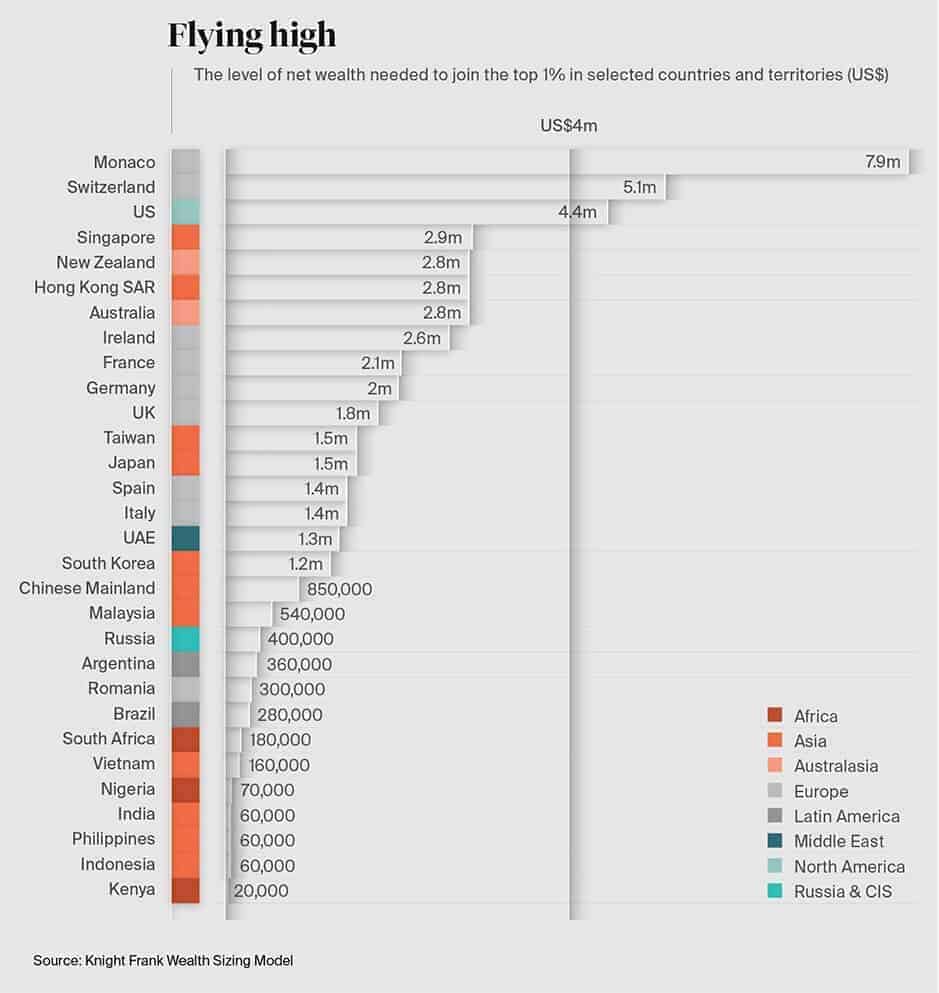

Also, generational wealth differs a lot by geography. The average American net worth would be a princely sum in a lower cost of living country. Many individuals run their retirement projections using various free retirement calculators and decide to geo arbitrage.

So, where does that leave us in trying to define what does generational wealth mean?

The amount I would consider generational wealth would be at least ten times the top 1% average net worth by age in your location.

I use Personal Capital to track my net worth for free.

For example, you need to have a net worth of $4.5 million in the U.S. to be in the top 1%, and the number jumps to $8 million if you live in Monaco.

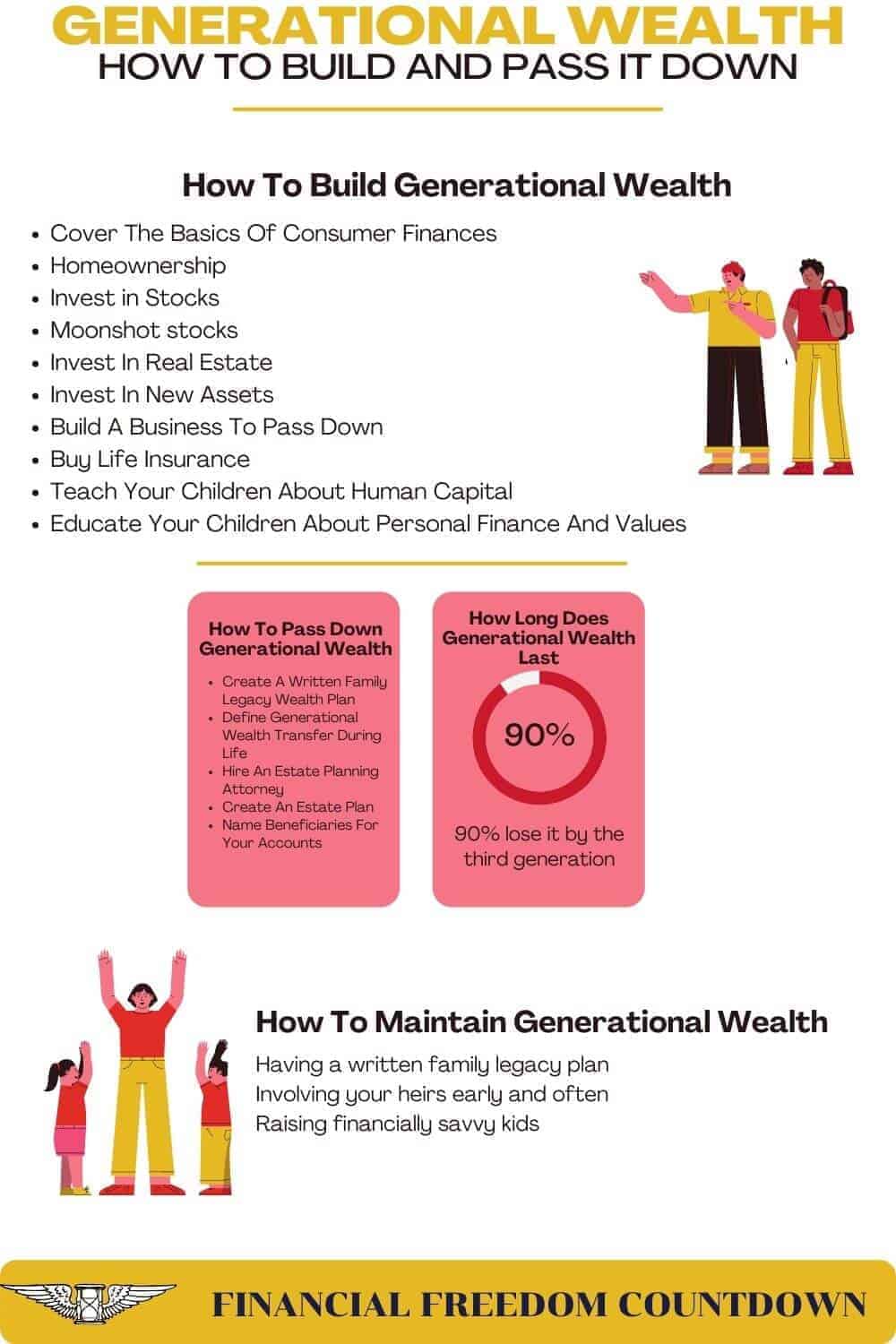

How To Build Generational Wealth

By now, I am sure you are wondering how generational wealth is built? Before you consider generational wealth creation, it is critically important to ensure your own retirement savings plan and other financial goals are secured.

After you have taken care of all your financial needs, then start planning for generational wealth. Accumulating income-generating assets as part of your legacy wealth plan could take time unless you had wealth passed down. However, generational wealth building is achievable if you follow the steps outlined.

Cover The Basics Of Consumer Finances

Put on your oxygen mask first before assisting others.

Make sure you have a decent-sized emergency fund earning high-interest rates. Maintain an excellent credit score so you can qualify for the most competitive loans with the lowest interest rates. Credit scores drive everything in the U.S. A difference of 100 points in credit score would mean you pay thousands more in interest on a car or hundreds of thousands more on a home. Sometimes identity theft can result in your score tanking without your knowledge.

Sign up for free tools like Credit Karma to monitor your scores and receive free alerts. Once a year, you can also get the entire credit report from the three bureaus via AnnualCreditReport.com.

Have sufficient funds in your retirement accounts.

Homeownership

No matter which country you live in, homeownership is the primary way to build and pass generational wealth. The value of a house in expensive cities worldwide – New York, San Francisco, Melbourne, Mumbai has appreciated a lot. If your children inherit the house without any mortgage, they can use the money saved on housing expenses for other investments.

Homeowners get tax breaks on mortgages and owner-occupied property tax exemptions.

Also, owning a home gives you equity. So your downpayment returns more due to leverage. Assume you buy a $1M home with a 5% down payment. When the home price increases to $1.2M, you have access to equity much more significant than your initial $50,000 downpayment.

You can use home equity investment products, which give you access to the equity you’ve built up in your home without interest or monthly payments. However, homeowners shouldn’t treat their home as a nest egg. If you have a primary home with a fixed-rate 30-year mortgage, your home is paid off by the time you retire. And after you die, you can pass it on to your children.

The biggest challenge is keeping your home without incurring debt or selling it so you can pass it down to your kids. Often, many individuals who are unprepared for healthcare costs would use the equity in the home. Don’t do that!

Plan in advance for healthcare expenses by saving money in triple tax advanatged accounts such as the HSA

If your employer-sponsored account has additional fees or charges extra to invest, you can roll over your prior year’s funds to Lively or Fidelity. Or if you have a High Deductible Health Plan, consider Lively to save taxes on your HSA.

Lively HSA is free and has no hidden fees. Also, Lively won’t charge you any fees to roll over or transfer your HSA to them. You can move your full or partial balance directly to Lively from your existing provider. Lively will contact your previous provider and handle the transfer on your behalf.

.

Invest in Stocks

The stock market is an excellent option to build wealth over the long term because it can continue growing for decades. Stocks make money through capital appreciation and dividends.

If you have never invested in stock markets, watching the volatility or the talking heads on TV can be scary. The best approach is to follow a simple dollar cost average approach with periodic rebalancing. Pick low-cost index funds and let compounding magic work in creating generational wealth.

M1 Finance provides a simple DIY approach. You can read my complete M1 Finance review, including why I believe it is the better option than Vanguard, Schwab, Fidelity, etc.

In a traditional portfolio, as you get older, you might take less risk with your retirement nest egg by moving into bonds or fixed income as appropriate. Capital preservation strategy is excellent for your retirement portfolio but not conducive to creating family wealth.

However, in a generational wealth-building portfolio, your focus should continue to be on growing your family wealth. It might be better to continue the aggressive asset allocation so your investments increase in value. Remember, you do not need the money, and it is for your heirs.

Generational Wealth Benefit Of Stocks

Stocks in taxable accounts benefit from a stepped-up basis. Assume you bought 1,000 shares of VTI at $50. When you die, VTI is at $400.

Instead of selling your stock, you pass down your VTI shares to your daughter. At the moment she inherits these shares, the IRS resets their original cost basis to $400. Your daughter sells these shares immediately for $400,000. She owes ZERO taxes on this sale because she did not profit as per the current IRS rules.

As a result of the IRS stepped-up basis rule, you can pass down stocks in a taxable account without triggering a taxable event. Those stocks can be further passed down to your children, grandchildren, and even your great-grandchildren. Imagine never selling the stocks and just living on the considerable dividend stream.

Wouldn’t that be the ideal generational wealth planning scenario?

Of course, Congress might change the rules in the future just like they did with the Stretch IRAs. As part of the SECURE Act, except in cases of a spouse, minor beneficiaries, or beneficiaries with special needs, the balance of inherited IRAs must be disbursed within ten years of the second spouse’s death.

Before the SECURE Act passage, anyone who inherited an IRA could draw down the account over a lifetime.

Moonshot stocks

In 2011, Marc Andreessen penned the “Why Software is eating the world” article in WSJ.

Based on the recurring pattern of innovation, part of my portfolio is dedicated to Moonshot investing. When I started creating my moonshot portfolio, it was heavily weighted towards technology firms. I now believe firms treating aging as a disease offer great potential and have added a few longevity-focused companies to my portfolio accordingly.

To create generational wealth, you have to observe the trends and predict the outperforming sectors. The technology sector has handily outperformed the broader market without needing to pick the individual winners and losers. What is in your moonshot portfolio?

Generational Wealth Benefit Of Moonshot investing

Since Moonshot investing is an asymmetric bet on a particular stock or sector, they have the same stepped-up basis for inherited assets when passed down to the next generation. The tax benefit is magnified since I hope your moonshots increase at least 10,000 times.

Invest In Real Estate

Real estate and precious physical metals are one of the oldest forms of generational wealth transfer. Real estate can be a great foundation to build your generational wealth plan, whether in an ancestral home or a rental property.

Do not let the lack of funds hold you back. You can invest in real estate with little or no money as long as you are ready to put in some sweat equity.

Rental income has several tax advantages.

The Tax and Jobs Cut Act introduced QBI deductions for rental properties. You can claim depreciation as a tax deduction to reduce your rental property taxable income on paper. You can also use accelerated depreciation if you follow cost segregation principles. You do have to pay back the depreciation when you sell. IRS has rules for Depreciation Recapture to be taxed as ordinary income. You can defer taxes as per the IRS with section 1031 exchanges.

However, buying property and managing it yourself isn’t the only way to build generational wealth from real estate. You could invest in a Real Estate Investment Trust (REIT). REITs are companies that own income-producing real estate and are one the best passive real estate options.

Based on IRS laws, a REIT needs to pay 90% of its taxable income as dividends. Similar to dividend-paying stocks, a portfolio of REITs can provide passive cash flow.

Another option is real estate crowdfunding.

To get started in crowdfunded real estate, check out Streitwise available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Real Estate Syndication is an excellent option if you do not have the skills or time to manage your real estate investments. As per SEC regulations, a few of these investment options are restricted to individuals who meet the accredited investor qualifications.

The advantage of Real estate syndications is the ability to do the 1031 exchange for the syndicated property.

| Investment Platform | Open to | Type of Investment | Minimum |

|---|---|---|---|

| PeerStreet | Accredited Investors | Residential | $1,000 |

| EquityMultiple | Accredited Investors | Commercial | $5,000 |

| CrowdStreet | Accredited Investors | Commercial | $25,000 |

| AcreTrader | Accredited Investors | Farmland | $10,000 |

| Farm Together | Accredited Investors | Farmland | $15,000 |

| Fundrise | Accredited and non-Accredited Investors | Residential | $1,000 |

Generational Wealth Benefit Of Real Estate

The 1031 exchange allows you to swap one like-kind property for another, thus deferring capital gains. As a result, more capital is available for investment in the replacement property instead of paying taxes.

Similar to stocks, when you inherit real estate, the IRS resets the market value of the real estate to the price on the date of the original owner’s death. Then, when the heir sells the real estate, capital gains taxes are applied based on this reset value.

The 1031 exchange combined with a stepped-up basis forms a powerful legacy wealth-building combination. One way to eliminate the requirement to pay taxes on your deferred gains is to continue to 1031 until your death and pass on the final property to your heirs. In this manner, you can pass on your original property and all of your capital gains to your children tax-free!

Invest In New Assets

New assets are outside the traditional asset classes. Cryptocurrency is an excellent example of a new asset class worth over $2T in a decade, starting from zero.

Many people did not invest when Bitcoin came on the scene since individuals relied on central bank definitions of money.

Individuals who studied history knew that tribes used everything from shells to rai stones as currency. Look around you and figure out what new assets you are missing? Asymmetric bets need only a small amount to be bet. Since they have a 10000x return, you do not need to invest a significant amount.

Build A Business To Pass Down

Looking at the generational wealth data, 99% of it involves a family member starting a business. No matter how much you value you provide at your job, there is no way you can accumulate the money needed to build wealth.

Yes, there are scattered stories of early employees of Facebook or Microsoft using pre-IPO shares to build wealth. However, being an early employee is akin to being a business owner. You take tremendous risks in your career and are as vested as the founder in the company’s success.

Only C-level executives get paid a lot. For the rest of us, the best way to build wealth involves starting a business. And it has never been easier to create one.

Given that everything is moving online, you should seriously consider starting an online business. Economies of scale, low startup costs, the entire world as your potential audience, ability to work on it from anywhere provide a tremendous advantage over a physical business.

Start with just writing and sharing about your high income skills developed at work or hobbies. Check if your ideas resonate with anyone. You can figure out monetization after you have built an audience.

One of the biggest challenges with business as a legacy wealth-building tool is that the subsequent generations may either be not interested in managing it or lack the skills to run it successfully.

To ensure your family business is successfully passed on to your children, you should include them from an early age.

It will help them learn the nuts and bolts of the business and successfully execute. More importantly, it will develop a work ethic in them. Your children realize the effort it takes to run a successful business.

Generational Wealth Benefit Of A Business

Including your children in your business also provides a tremendous tax advantage. For example, you start a website on simple keto recipes for working moms looking to lose weight. If your kids help you cook or film the cooking video, you can pay them a fair wage, deduct the wages as a business expense and invest your kid’s earnings into a Roth IRA to grow tax-free. Refer to the IRS guidelines and stay compliant.

Besides paying your children, the business tax code has lots of additional deductions you could claim. Social media users always get upset, claiming a different tax code for the rich v/s the poor. Incorrect! There is a tax code for business owners and another tax code for employees.

Even better if the business is in tax-sheltered accounts just like Peter Thiel and the infamous Paypal Roth IRA

Buy Life Insurance

Life insurance pays your beneficiaries after your death. Although none of us want to die, planning for our demise is always a prudent strategy. Having a good life insurance policy in place will ensure that your family is constantly protected in the event of your untimely death.

Life insurance premiums increase with age since your risk of dying and finding health complications increases. It is always advisable to get a policy as soon as possible.

Compare quotes from your current insurance provider as well as Fintech providers like Fabric or Insurify.

Generational Wealth Benefit Of Life Insurance

Depending on how many assets you leave your heirs, they may not need the life insurance death benefit to fund their lifestyle. The tax treatment of life insurance proceeds is quite favorable. As per the IRS, any death benefits you receive due to the insured person’s death aren’t includable in gross income.

Although life insurance proceeds are income-tax-free, they could be included in your taxable estate for estate tax purposes. The TCJA raised the exemption amount above $11M. For estates that still owe taxes, explore the usage of ownership transfer or life insurance trusts to avoid taxation.

Teach Your Children About Human Capital

Human Capital is not merely beneficial in your 9 to 5 job but also helpful in everyday life.

Soft skills of influencing, persuasion, negotiating, influencing are valuable skills. The human capital skills developed by your kids will be vastly superior to any college degrees they may earn.

Let us take Paris Hilton as an example. She could merely live off the generational wealth of the Hilton family and not work a day in her life. However, she had figured out ways to keep earning money.

After noticing her picture in the “best-dressed section” of the New York Post, she signed up as a model for various designer brands. She then starred in a TV show which made her a household name.

She worked as a highly paid DJ leveraging her fame.

She founded the Paris Hilton Entertainment company in 2006 to manage her brand licenses and launched a slew of products from apparel, cosmetics, handbags, shoes, perfume, sunglasses.

I was playing a character on The Simple Life, so I don’t blame people for thinking I was ditzy. People assumed that’s who I really was

Paris Hilton

Does anyone remember the episode in A Simple Life where she feigned ignorance of Walmart?

Generational wealth requires your children to have the skills to keep earning more money, albeit in fun ways to add to the family legacy.

Educate Your Children About Personal Finance And Values

Many parents want their children to grow up as charitable, compassionate, empathic human beings.

If your children do not know the basics of personal finance, i.e., spend less than you earn and invest the difference, they would lose the generational wealth.

Teach them about financial freedom and living a life without regrets.

In summary, there is no single best way to create generational wealth. We covered several strategies to build wealth. The idea is to start contributing early and let compound interest do the work. Also, you are better off diversifying and following all the listed methods simultaneously.

How To Pass Down Generational Wealth

If you are wondering how to pass on generational wealth, follow these steps.

Create A Written Family Legacy Wealth Plan

After building your assets, create a written family legacy plan to pass generational wealth to your children.

The family legacy plan is in addition to the legal documents. The legal documents are required to hold, disburse and grow the investments, but a written generational plan highlights your thought process and keeps the money together.

It is your responsibility to offer guidance and leadership to the family to know what to do when you pass away.

A family legacy wealth plan is an opportunity for you to bring your family together, cast a vision for your wealth, and outline your dream of a family legacy.

A great leader seeks the opinion of others to obtain their buy-in. You should discuss what your family values represent, outline the shared vision and what wealth strategies will help create legacy wealth.

A written generational wealth plan has the potential to pave the way for each family member to understand their role and responsibility to perpetuate the legacy.

Each family member is responsible for growing and contributing to the estate, so it is better for the next generation.

Define Generational Wealth Transfer During Life

Although it is preferable to transfer family wealth after your death, here are two reasons to opt for some wealth transfer when you are alive.

- Involving your children in the family legacy wealth plan will give you an idea of their immediate needs. If your daughter has plans to expand her drop-shipping business to a private label business, the money can help her now at age 30 versus waiting till you pass away and she is 60 years old.

- The federal government taxes inheritances above a certain amount. And some states have an additional estate tax or an inheritance tax. Typically, the estate pays an estate tax, while the individual heirs bear an inheritance tax. By transferring money when you are living, you can reduce the size of your generational wealth transfer after death, avoiding the various estate taxes.

What are the typical ways to transfer family wealth when alive?

- Custodial accounts. Setting up custodial accounts for your children is a simple way to pass down wealth. Custodial accounts are investment accounts for your kids that you can control until they are no longer minors. You can fund these accounts for your children’s future financial goals. The adult managing the account can spend this wealth, as long as it’s for your beneficiaries’ benefit.

- Gifts. The federal gift tax limits change frequently based on the political winds. But as of today, you can transfer $15,000 annually per person without incurring federal gift taxes. For a married couple, that means you can give $30,000 per child. And you can do similar amounts (depending on the limits) for every year.

- Educational Expenses. Instead of burdening your children with student loans, paying for their education is another avenue to transfer wealth while you are living.

Hire An Estate Planning Attorney

Involve an estate planning attorney well versed in taxes to create an estate plan. Laws are complex and keep changing, especially when the size of the estate grows above $10M. For example, the federal government currently only charges estate taxes and no inheritance taxes. However, Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania charge an inheritance tax. Maryland imposes both an estate and an inheritance tax.

Create An Estate Plan

What do Aretha Franklin, Bob Marley, Sonny Bono, Prince have in common besides being fantastic performers? They all died without an estate plan!

The estate plan is not just for passing down generational wealth. You can also define what happens when you can no longer care for your estate or yourself. Who will look after your children when incapacitated. And a host of other scenarios.

Depending on your country, state, and the size of your estate, do not rely on a simple will. Create an estate plan.

Dying without an estate plan could lead to lots of legal fights between your survivors. They might spend a lot of money and, more importantly, destroy relationships with each other.

Also, depending on your state, wills might not be sufficient. California is a probate state. Although you do not have many assets, consult an attorney to get a revocable living trust done.

If you die without an estate plan in states like California, the state will take money from your estate to settle. An estate plan is crucial for passing down your generational assets.

Trust & Will provides state-specific trusts for the protection and transfer of your most important financial assets. You can also nominate legal guardians for your children to make sure they are looked after by someone you know and trust, in case something happens to you.

You can set milestones for when your heirs receive the money. I’ve even seen some estate plans contingent on the kids graduating from Stanford with honors to receive the inheritance. You can make the estate plan as straightforward or as complex as you want it.

The estate plan should include your specific wishes for the disbursement of your assets within the legal boundaries. In some instances, it might be more beneficial to have an irrevocable trust compared to a revocable trust depending on the creditor protection laws.

Name Beneficiaries For Your Accounts

After creating your estate plan, you should ideally name your trust as a beneficiary except on life insurance policies and retirement accounts. The advantage of naming the trust as a beneficiary is that you only need to update the individuals named as beneficiaries in your trust if you change your mind.

The most significant disadvantage of naming a trust as beneficiary is that the retirement plan’s assets will be subjected to required minimum distribution (RMD) payouts, calculated based on the oldest beneficiary’s life expectancy. If there are beneficiaries of different ages, this could be a challenge. However, eliminating the stretch IRA as part of the SECURE Act means that non-spousal beneficiaries must take distribution within ten years.

To pass down your family wealth to the next generation is a multi-step and complicated process. Make sure you talk to the required professionals when you are ready to set up your generational wealth plan.

Standard disclaimer that I’m not a CPA or an estate planning attorney, or a licensed professional.

How Long Does Generational Wealth Last

However, maintaining generational wealth across several generations is challenging. A groundbreaking 20-year study conducted by wealth consultancy, The Williams Group involved over 3,200 families and found that 70% lose their fortune by the second generation, while 90% lose it by the third generation. The odds for building sustainable wealth over several generations are not great.

The first generation works hard to build wealth, and they pass on their assets to their children.

The second generation has watched their parents struggle to build wealth. They usually have a good understanding of the hardship involved and might be more fiscally conservative.

The third generation is so far removed from the wealth creation, having never witnessed the sacrifices of the previous generations. They become lazy and entitled with no clue on how to make or manage money.

Just transferring intergenerational wealth is not sufficient. You need to raise financially savvy kids. By reading this article, you are already way ahead of others. Make sure you share it with your family and kids.

How To Maintain Generational Wealth

Based on the generational wealth stats, it is not easy to maintain generational wealth beyond three generations.

The biggest challenge in generational wealth management is that the next generation starts living the lifestyle of the Rich and Famous and spending down the wealth. If the spending is higher than the generational wealth growth, the family wealth will decline over time.

The best way to maintain generational wealth is to coach the next generation to be financially savvy. The next generation invests the generational wealth amount into income-generating assets or begins to earn more money themselves, adding to the intergenerational wealth.

Teaching your children to value money and manage it to continue building wealth should be your highest priority in generational wealth management.

Roy Williams and Vic Preisser published the book “Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values” They were able to identify three leading causes after studying thousands of family businesses over 20 years.

- 60% of failure to maintain generational wealth was caused due to breakdown in trust and communication within the family.

- 25% of losses were due to “inadequately prepared heirs.”

- The final 15% were attributed to the operational details such as legal issues, poor tax strategy, etc.

In summary, having a written family legacy plan, involving your heirs early and often, and raising financially savvy kids will provide you the greatest success at maintaining generational wealth.

Why Generational Wealth Is Bad

Contrary to popular belief, generational wealth is not a recent phenomenon.

The most common generational wealth bible verse is from Proverbs 13:22 – “A good person leaves an inheritance for their children’s children” I have no idea if inheritance in this context is limited to money or it also includes qualities like integrity and trustworthiness. Given this verse about generational wealth in the bible, it is safe to assume that generational wealth-building was considered a moral duty.

Since the great financial crisis, generational wealth has acquired a bad rap. Discussions about the racial wealth gap or wealth inequality inevitably lead to generational wealth and its use in building more wealth. Developing generational wealth results in an increasing concentration of wealth. The stories of wealth disparities and systemic barriers are heart-breaking. Questions are often raised “How has generational wealth contributed to the racial wealth gap”?

To some extent, the criticism is valid since we are all aware of the compounding nature of assets. After some time, exponential growth is used to build wealth and further increase the generational wealth gap between the “haves” and “have nots.”

The impact of generational wealth on the wealth gap is highlighted in the Wealth Inequality paper by the Federal Bank of St. Louis. As per the paper, the top 10% hold 76% of the country’s wealth, while the bottom 50% have just 1%.

Studies have shown a massive gap between black household wealth and white household wealth. To some extent, the Federal Reserve paper on Disparities in Wealth by Race highlighted the impact of generational wealth and the racial wealth gap between black households and white households.

Also, the concentration of wealth in the hands of a few individuals who can influence politics in a democratic society makes everyone nervous.

Can Generational Wealth Be Good

After listing all the negative aspects of generational wealth, why did I publish an article on generational wealth management?

- Because I see the world “as is” and not how it “should be.” The best way to end generational wealth inequality is by becoming financially savvy to build your wealth.

- Once you build wealth, you can decide the causes to support and how your wealth will be used.

- Wealth is not a zero-sum game; just because your neighbor is wealthier than you does not reduce your wealth—all arguments against generational wealth center on wealth inequality. But from a global perspective, the average American has greater net worth than many other countries.

- Human society has progressed due to individuals trying to provide value. I am perfectly fine if they charge for the value created and, in turn, become wealthy. The compounding effect of value creation creates generational wealth. In his book The Wealth of Nations, Adam Smith wrote, “It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love.”

- As per the generational wealth report from BLS paper “Inheritances and the Distribution of Wealth Or Whatever Happened to the Great Inheritance Boom“, the addition of wealth transfers had a sizeable effect on reducing wealth inequality. Also, wealth transfers are likely to raise the degree of wealth mobility across the generations.

As with any nuanced topic, there are great arguments on both sides. Focus on your circle of influence.

Since I mentioned Paris Hilton, let us take a look at the generational wealth plan of Conrad Hilton. He was the hotel magnate behind the iconic 100-year-old Hilton empire who left just $500,000 to each of the surviving sons. The remainder of his wealth went to the Conrad N. Hilton Foundation charity.

His son Barron left just 3% of his wealth to his family – eight children, 15 grandchildren, and four great-grandchildren, including Paris and Nicky Hilton. 97% of his wealth went to charity.

Final Thoughts On Building Generational Wealth

Building generational wealth and intergenerational transfers can provide tremendous advantages to your heirs.

There are several strategies to build generational wealth. To tackle this Big Hairy Audacious Goal, I would begin working on each one of these. The idea is to start contributing early and let compound interest do the work. Also, you are better off diversifying and following all the listed methods simultaneously.

Seek professional tax advice from individuals who specialize in generational wealth management after you have accumulated a sizeable amount so you can pass the family wealth to your heirs.

Maintaining generational wealth beyond three generations can be a complicated task.

Even if you do not want to create and pass down generation wealth in monetary terms, ensure your children understand the basics of personal finance and money management. You can get started with financial education at an early age.

The best way to combat wealth disparities is by being armed with basic personal finance knowledge.

Readers, what are your thoughts on generational wealth, and is it part of your financial plan?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.