Senator Mike Lee Sparks Backlash with Viral Critique of Social Security as “Deceptive Sales Techniques”

Senator Mike Lee of Utah posted a viral thread on X (formerly known as Twitter) stating “Of all the deceptive sales techniques the U.S. government has used on the American people, one of them—the Social Security Act—gets far too little attention”.

Constitutionality of the Social Security Act

Here is what he said, “In 1935, the American people were sold a bill of goods. They were told, “Pay into this system, and it’ll be YOUR money for retirement.” Sounds great, right? But here’s where it gets juicy, in a really ugly way. Two years later, when the Supreme Court was considering the constitutionality of the Social Security Act, the government did a complete 180. The government—through Assistant Attorney General Robert Jackson—argued in essence, “Oh no, this isn’t YOUR money at all. This is a TAX, and we can do whatever we want with it.” Classic bait and switch.”

Supreme Court Upheld the Social Security Act

He further added, “Let’s not forget the ruling in Helvering v. Davis, where the Supreme Court upheld the Social Security Act by embracing the government’s argument / admission that what people pay into Social Security is tax revenue—available to be used as Congress may direct—and not at all money belonging to those who paid it. So, to summarize: the proponents of the Social Security Act told American workers that what they paid into the system would remain *their* money, not the government’s—to get Congress to pass it—and then told the courts the exact opposite when defending the Act’s constitutionality. The Supreme Court accepted the government’s argument, to the great detriment of the American people.”

Management of Social Security Funds

Senator Lee stated, “Now, let’s talk about what happens to “your money” once it’s in the government’s hands. Spoiler alert: it’s not managed like your IRA or 401(k). First of all, this money doesn’t sit in a nice, individual account with your name on it. No, it goes into a huge account called the “Social Security Trust Fund.”

Usage of Funds

Senator Lee further added, “But here’s the kicker—the government routinely raids this fund. Yes, you heard that right. They take “your money” and use it for whatever the current Congress deems “necessary.”

Every few years, there’s talk in Congress about “saving Social Security.” I’ve introduced and cosponsored a number of measures over the years that would fix it. But most in Congress show little desire to fix it, and are instead constantly looking for ways to “borrow” from it—with no plan to put it back.”

Returns on Social Security Investments

Senator Lee mentioned, “And the returns? Forget about compound interest or stock market gains. Your “investment” in Social Security can give you a return lower than inflation. If you had put the same amount into literally ANYTHING else—a mutual fund, real estate, even a savings account—you’d be better off by the time you reached retirement age, even if the government kept some of it!

Do the math: with Social Security, you’re looking at a return that’s pathetic compared to market averages. It’s not even an investment; it’s a tax.”

Demographic Challenges

Senator Lee highlighted the challenges by stating, “And let’s talk about how this system is set up to fail. The demographic shift? More retirees, fewer workers. It’s almost fair to compare it to a Ponzi scheme that’s running out of new investors. Every dollar you pay into Social Security, only to see it gobbled up by the government itself, is a dollar you can’t invest in your own future. It’s government dependency at its worst.

Remember, this isn’t just about retirement. It’s about independence, about controlling your own destiny. With Social Security, you control nothing.

The government promises you security but gives you dependency. It promises ownership but gives you a tax receipt.”

Social Security Administration Efficiency

Senator Lee further stated, “And don’t get me started on the management. The Social Security Administration is a bureaucratic behemoth, not exactly known for its efficiency or innovation. If you think your money is safe there, you’re in for a rude awakening. The mismanagement, the waste, the deception—it’s all on display.

So, what’s the solution? We need real, genuine reform. Within the Social Security system, Americans should be able to invest in their own future, and not be shackled by the worst parts of this outdated, mismanaged system.

It’s time we acknowledge the truth: Social Security as it now exists isn’t a retirement plan; it’s a tax plan with retirement benefits as an afterthought.

We were sold a dream, but received a nightmare. It’s time for a wake-up call. We need real reform.

It’s time for Americans to know the true history of the Social Security Act. The more people learn the truth, the more they’ll start demanding answers, options, and real reform from Congress. Please help spread the word.

The history of the Social Security Act—which sadly must include the deceptive manner in which it was sold to the American people—is yet another reason why America’s century-long era of progressive government must be brought to a close.”

The entire thread can be viewed on X (formerly known as Twitter). Within 4 hours of posting, Senator Lee’s post already garnered over 7 million views and 14,000 likes.

Solvency of Social Security

While no official comment has been made on any of the details mentioned by Senator Lee, the latest report from the Social Security Trustees indicates that Social Security will be solvent till 2033 and after that only 79% of scheduled benefits are expected to be paid out.

Medicare is expected to face funding challenges starting in 2036 after which the program income can only pay 89% of expected benefits.

Like Financial Freedom Countdown content? Be sure to follow us!

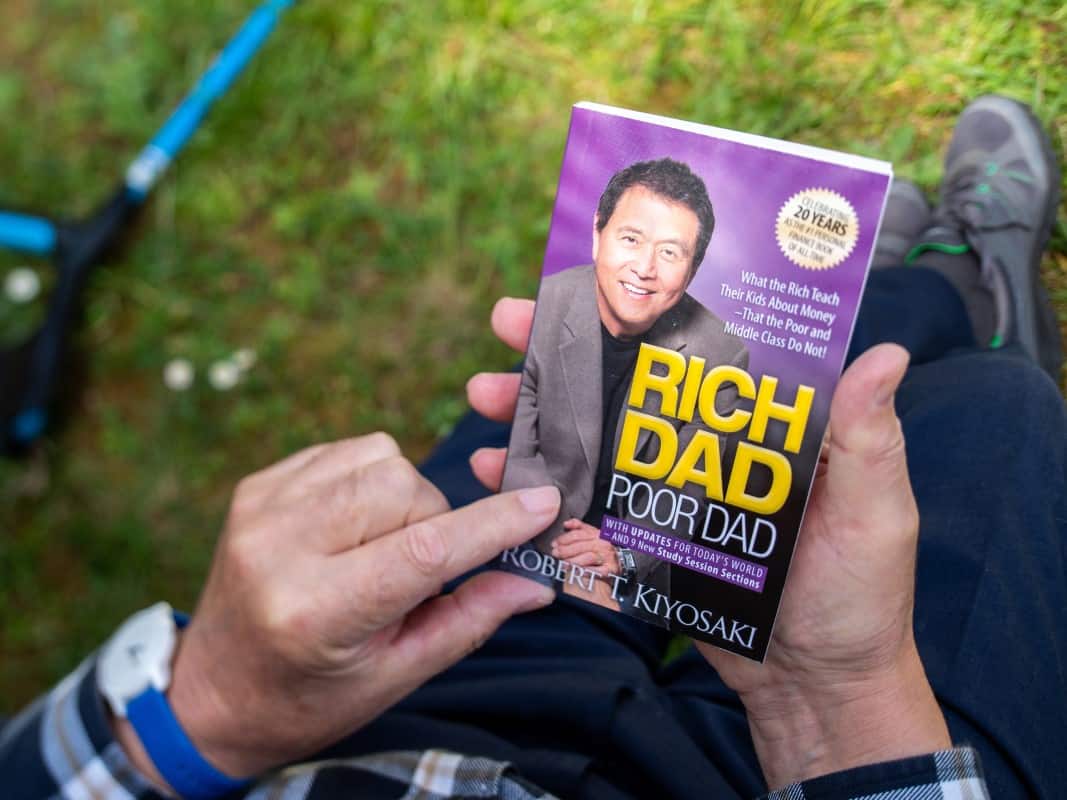

Transform Your Finances by Shifting From an Employee to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

The “Buy, Borrow, Die” strategy is a favorite among the affluent, who work with financial planners to sustain their lavish lifestyles while slashing their tax bills. Though it seems like a modern trend, Professor Ed McCaffery coined the term in the mid-1990s to explain how the wealthy legally avoid paying taxes.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

Are You Living in One of the 10 States That Still Tax Social Security Benefits? Also 2 States That Finally Stopped in 2024

While many envision tax-friendly golden years, residents in ten states face a harsh reality as their Social Security benefits are taxed. In contrast, two states are offering relief by ending their practice of taxing these benefits. And one state has a phased implementation to end taxation of Social Security benefits. This shift highlights the complexities of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you living in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Treasury I Bond Rates Drop from 4.28% to 3.11% — But with a 1.2% Fixed Rate Locked for 30 Years, Is It Still a Smart Investment?

Inflation has become a significant concern. During the past three years of surging inflation, I bonds offered a safe and attractive investment option. However, with recent lower CPI numbers, the current composite rate for I bonds has dropped to 3.11%, a sharp decline from the enticing 9.62% annual rate available in May 2022 or even the 4.28% available for bonds purchased before October 31st. As rates decrease, investors are now considering whether it’s still worth buying Series I bonds.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.