The Cashflow Quadrant: How To Shift From Employee to Investor

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom.

One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income.

As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

How Does the Cashflow Quadrant Work?

The book’s official title is Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom. The book is by Robert Kiyosaki, who has published the entire Rich Dad series. The books aim to ensure that people can complete their journey to financial freedom. Robert Kiyosaki is a businessman, entrepreneur, and investor who has made his fortune helping others learn more about how they can achieve financial independence.

The Rich Dad, Poor Dad book often tops the list of best beginner books on real estate investing.

Rich Dad’s Cashflow Quadrant deals explicitly with helping people optimize their income. In it, Robert Kiyosaki argues that most people can increase their bottom line by moving away from just working for someone else. Instead, people can make more money – and journey towards financial freedom – by controlling their destinies.

Much of the book is about changing how people think money works and optimizing your life across various quadrants. Kiyosaki persuasively argues that people are programmed to think about money a certain way as a direct result of how the education systems are created in America and throughout much of the world.

People tend to think of income matters in more traditional ways: Get a job, save toward retirement, and be happy.

Kiyosaki argues that people need to evaluate how they think of money. Instead of thinking about being part of the financial system, people need to figure out how to stake their claim over it. You can do it by moving away from the E quadrant (employee) and moving towards becoming an investor. Doing so can enable someone to create various types of income streams, own more income-generating assets, increase their wealth, and ultimately improve their lives.

Let us talk through the various quadrants.

E (Employee) Quadrant

The E Quadrant is where most people live their lives and generate income. E stands for employee and refers to a person with a job. There is nothing wrong with having a job and working for someone else, and as Kiyosaki makes clear, this can allow someone to have a happy life – mainly if this is where they want to live from a financial perspective.

A person who is an employee has a job with someone else. They have job responsibilities and can go home at the end of the day, usually without thinking about their job.

However, from a financial independence perspective, there are real cash flow problems with this cash flow quadrant. Employees usually depend upon someone else – or a massive, faceless corporation – for their financial and job security.

An employee produces money and income for their boss or corporation but doesn’t get to share in the fruits of their labor fully.

One of the most critical components to understanding this particular cash flow quadrant is that you never really own the fruits of your labor. Yes, an employee will make a salary. It may even be a relatively high 7 figure salary with extensive financial benefits.

But if something happens to that business or the relationship between employee and employer is severed, the income stops flowing. That makes this cash flow quadrant one of the most dangerous since you are never quite in control of your destiny.

While Kioyaski has positive things to say about working for someone, he notes that it is difficult to achieve freedom if you are only someone else’s employee.

You will never be your boss and can’t make your money work for you. As such, Kioyaski argues that people should work on developing the skills needed to enhance their ability to make money in other quadrants.

Your only option to earn more money in the Employee quadrant is to improve your human capital and continuously seek higher-paying jobs.

S (Self-Employed) Quadrant

S refers to self-employed. Self-employed people work for themselves. As such, they have much more control over their financial destiny. However, it is still difficult for someone in the S quadrant to ultimately move toward financial freedom.

An S quadrant means that a person owns and runs their own business. In a sense, they control their job. It can include certain small business owners who work for their companies, like service-shop owners or medical professionals.

There are unquestionable benefits to owning your job. Doing so allows a person ultimate control over their financial destiny.

It means there is no boss, more flexibility, and the chance to move a business in your chosen direction. Self-employed people can use their high-income skills in a manner and location that they see fit.

Robert Kiyosaki talks about his experience when he quit his pilot job and learned to sell. Selling involves a lot of empathetic listening, proposing solutions, influencing, and negotiating. It is listed as one of the easy jobs that pay well because there are no barriers to entry in the form of expensive degrees and certifications.

There is also greater flexibility. Someone self-employed is also a business owner, giving them much greater control over their cash flow, personal development, and how they use their skills.

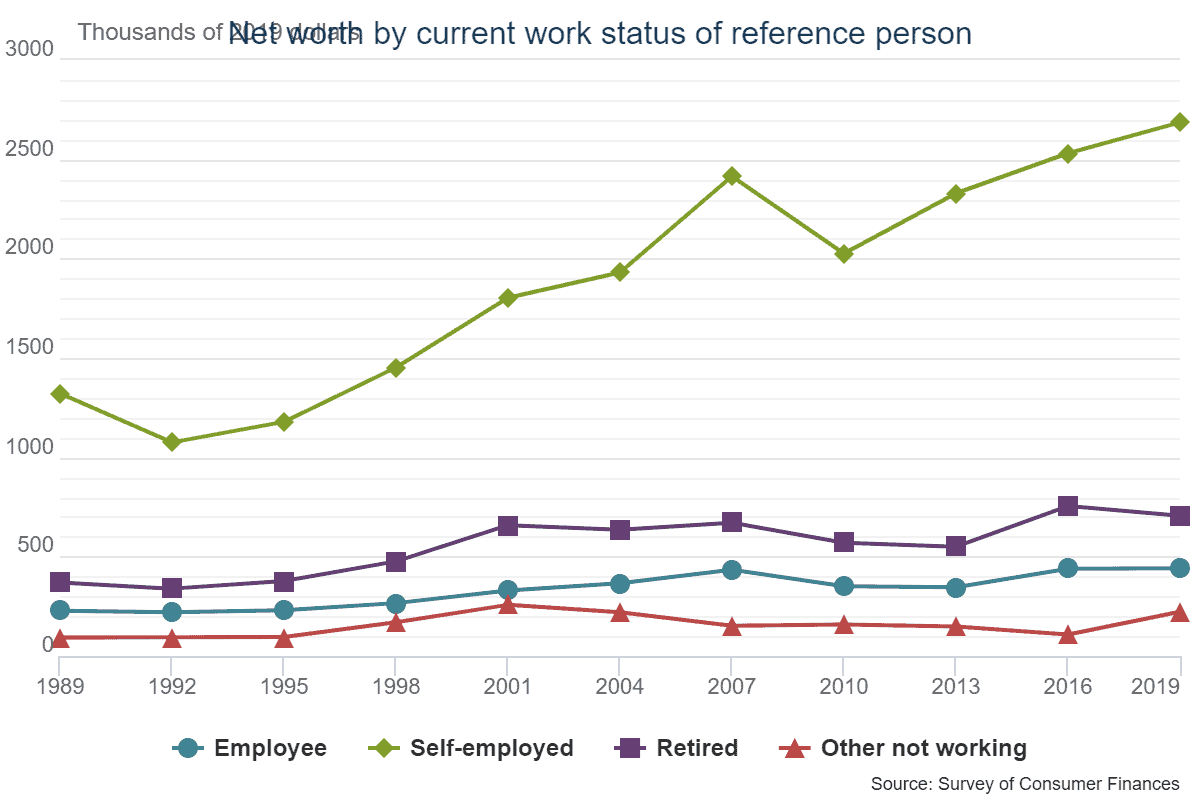

Date from the last Survey of Consumer Finance shows that the best way to increase your average net worth is to be self-employed compared to working as an employee.

However, this isn’t to say that everything is perfect in this particular cash flow quadrant, and to some extent, the idea of financial freedom here is an illusion. Self-employed people have no one but themselves to report to, which means they have no one but themselves to lean on if something goes wrong.

Indeed, this is one quadrant where a person must continue to work despite theoretically having control over their destiny since their business will fall apart without their constant involvement.

If someone who took this path were to stop working, their business would almost certainly collapse.

The only way to improve income in the self-employed quadrant is by working more hours or increasing your billing rate.

It can be highly stressful, leading many to find another way to make money.

The left side of the quadrant, either an employee or self-employed, involves trading time for money. Your Money or Your Life, one of the best early retirement books, focuses on a similar concept.

Concentrating on the activities in this book can help you become a self-employed person and reach financial freedom.

B (Business Owner) Quadrant

The B quadrant of Rich Dad’s guide is where people can fully understand how to control their financial destiny and make their money work for them. People make their money work for them in this particular cash flow quadrant.

B quadrant means owning a business or a system that makes money. To be clear, it is about much more than just owning a job or a place where you work.

In the B quadrant, owners ensure that the business makes money for them, even without their involvement.

To be sure, a person may still actively work for their business. However, the company is bigger than them, and if they were to stop working for the business – but continue to own it – that business could still operate.

There are multiple forms of making money in this quadrant. Like individuals in the S quadrant, someone in the B quadrant could make money by owning a service or medical business.

However, this is where someone could also invest their money and own a business that made money for them. They could be actively involved in managing that business or leave that management to another highly-skilled individual. Think about someone who owns a small business or a franchise.

You may easily invest in small firms around the country by using a platform like Mainvest. It’s free to join, and there are no fees. Simply choose the businesses you’d like to invest in. You can begin investing with as little as $100, making it a fantastic investment for both novice and expert investors.

Like the S quadrant, jobs in the B quadrant require extensive work and set-up. This cash flow quadrant has difficulties and extensive barriers to entry. You’ll need real business education and significant financial resources to get your business up and running.

Being a business owner also means investing the time and energy necessary to start your business and create a system that can survive without your constant attention.

Of course, this investment of time and energy is usually well worth it by the time the effort is completed. When your business grows, you will be a business owner, unlike jobs in the E cashflow quadrant. This will ultimately give you the freedom and flexibility to make your money work for you – not the other way around.

While stealth wealth is great, more and more individuals are searching for how to become a billionaire. And most wealthy or rich people have created generational wealth by starting their businesses.

I (Investor) Quadrant

I quadrant refers to investing. Investing means taking your hard-earned money and putting it into a financial instrument, like a stock, bond, or collectible. In theory, that investment will then rise, allowing you to reap the rewards later.

Of course, investing money is not without its risk. You can lose some (or even all) of your money if the investment goes bad. That’s why it is critically important that you select an investment vehicle that can diversify and minimize your risk.

It would help if you were comfortable with where you are investing your money. As such, you’ll have to do your homework and learn how to invest.

Several stock investment research websites have simplified the learning process for how to invest in stocks.

Depending on your asset allocation, you could pick moonshot companies, value stocks, dividend aristocrats, or even ESG stocks. Alternatively, investing in the S&P 500 can be the easiest way to start.

You can buy all the ETFs using M1 Finance which has zero fees, low minimums, fractional shares, and automated investment options. You can read my M1 Finance review, including the comparison with other platforms such as Vanguard, Schwab, Fidelity, Wealthfront, and Betterment to find the perfect investment platform.

Investing in real estate is another familiar option for most individuals.

Don’t let the high cost of real estate be a mental barrier. Depending on your investment budget, you have several options. You can invest in real estate with little to no money down.

Fundrise is one of the top real estate crowdfunding platforms. Sign up for free and look at passive real estate investment opportunities with a low minimum (only $100).

Or, if you already have the funds, learn how to evaluate a rental property, do a live-in flip using the BRRRR method, or get started with apartment investing.

Commercial real estate investing or real estate syndication are additional options once you have substantial amounts to invest.

In fact, with the boom in self-storage investing, you can add a storage unit to your existing property.

Sign up for Neighbor and get paid to store things. You can earn $100-$400 per month as passive income with unused space. You get to pick WHO, WHAT, and WHEN items are stored. And the platform comes with $1,000,000 host liability protection.

You list your space for free, review the renter’s request (including what and when they want to store), and approve as per your criteria. You can list a garage, RV pad, closet, empty lot, shed, and basement as available rental space.

Kiyosaki is a favorite of real estate investors because he often talks about generating passive income from real estate.

Besides stocks and real estate, one can also consider investing in cryptocurrency.

You may also want to consider speaking with a financial professional who can guide you as necessary to help you reduce risk and maximize returns.

It is almost impossible to imagine someone truly wealthy that does not have significant alternative investments. Virtually all their wealth is tied up in several assets, and they rely on the buy, borrow, die strategy to avoid taxes.

However, unless you inherit your money (in which case, you probably aren’t reading the Rich Dad Poor Dad series!), you will need to earn the money you make to invest. You will have to spend some time in the other three quadrants to make your financial fortune.

Furthermore, investor quadrant investments should be able to generate monthly income. This means that your money will need to provide you with an annuity or dividend that you can live off of and pay expenses, whether pursuing Lean FIRE or Fat FIRE.

Tax Implications of Cash Flow Quadrants

Finally, it is worth considering that taxes favor investors. A variety of changes to the United States tax code – including lower tax rates on investment returns and capital gains – tend to skew toward investments in the Investor quadrant.

It means you can potentially make more money – and pay fewer taxes – if you start investing. Taxes are not the be-all, end-all consideration, of course. However, they are important to keep in mind.

Business owners also have several exemptions favoring them over W2 employees. Real estate has several tax advantages, including QBI deductions for rental properties, 1031 exchanges, accelerated depreciation, etc.

The Book On Tax Strategies For The Savvy Real Estate Investor and Advanced Tax Strategies For Real Estate By Amanda Han and Matthew MacFarland cover real estate tax strategies extensively.

It is also worth considering that employees and self-employed have access to some tax-saving strategies. For example, if you invest your money in certain retirement funds, you will ultimately pay reduced rates of taxes. It means you can save extensively and pay lower tax rates when you withdraw the money in early retirement. It is one of the many reasons it is better to invest in a 401(k) vs. a Roth 401(K).

You can also save money by investing in a college account for your children’s school, again providing an opportunity to invest money towards a worthy goal while reducing your tax burden. Opting for ESPP at work provides stocks at an attractive discount.

Similarly, you can also select Health Savings Accounts which are triple tax-advantageous.

After all, the number one expense paid by every American is taxes. Taxes must be at the forefront of your mind when considering how to make and spend your money – including where to invest.

Why Is the Cashflow Quadrant Important?

Kiyosaki created the cashflow quadrant to organize how to make income and describe the pros and cons of specific income methods.

However, as Kiyosaki noted, making money is about much more than knowing how to earn: You also have to understand how to save money. Kiyosaki discussed the importance of saving money for later and using that money wisely.

Kiyosaki also noted that people have to learn to think independently to be independent. This means that they need to find ways of making money that is unique and align with their skill set.

As such, conventional wisdom may only sometimes be worth listening to. Individuals should be prepared to chart their paths and take risks. Advice from family and friends may be well-meaning, but everyone is locked into their own financial experiences.

People who are not in your shoes may be unable to give you the advice you need to be financially successful.

The crux of the book is that you need to make your money work for you – not the other way around. It means setting up financial systems on the right side of the quadrant, the Business and Investor sides.

These sectors require the most work and the most capital to invest, so you will unquestionably spend some time on the left side of the financial quadrants to earn money necessary to make appropriate investments. However, with time and discipline, these investments will pay off.

Various other methods unquestionably exist to help people generate income and achieve financial independence, but Rich Dad, Poor Dad series is easier to comprehend with real-life examples.

How To Move From Left to Right Side of the Cash Flow Quadrant?

Kiyosaki noted that education is essential for making money, but it was far from the be-all and end-all to it. He said emotional intelligence was the most critical aspect of achieving financial success. People tend to earn and immediately spend money, which is ultimately not how anyone can become financially successful.

Instead, Kiyosaki argued that people have to learn how not just to make money but save it and not spend it immediately. This requires financial discipline and learning to be fiscally responsible. It also means learning how to stop spending money.

Actionable steps to move towards business and investor quadrants are

- Spend time learning. Often books are the best way to learn a subject, so read the best personal finance books.

- Automate all the steps in saving and investing money. If you do not have a budget template, consider signing up for Personal Capital, a free tool to track your liquid net worth with a budget tracker included.

- Share your financial goals with an accountability partner.

- Understand how compound interest works and be patient since the progress may take time.

There is no question that the Rich Dad, Poor Dad series offers a fascinating financial education, perspective, and method by which an individual can potentially improve their financial lives. It has helped many open their businesses, improve job security, build passive income, and become self-employed.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

![30 High-Income Skills Worth Learning [Without College Education] 7 High-Income Skills](https://financialfreedomcountdown.com/wp-content/uploads/2022/07/High-Income-Skills-768x432.jpg)

Absolutely love Kiyosaki’s Cashflow Quadrant and the framework it provides. ESBI really helped get me going on thinking about how I’m earning money and paying taxes.

Another way I’ve heard it referenced is “balancing the teeter totter” over time. Gradually earning more (for us) passive income from the I quadrant in proportion to our W2 and 1099 salaries.

Along those lines, do you have any recommended books for tax strategies?

Great point Kurt. The 2 real estate tax strategy books I’ve listed are my favorite so far. Business taxes depending on how and where it is incorporated gets more complex; especially when considering intellectual property in tax favorable jurisdictions. I’ll keep you posted if I find some good ones on non-real estate businesses.