Record 401(k) Savings in 2023 Overshadowed by Alarming Spike in Hardship Withdrawals

In 2023, American workers participating in 401(k) plans continued to save at unprecedented rates, according to Vanguard’s annual report, “How America Saves.

While the overall trends in savings and investment were positive, there were signs of financial strain among some participants. The report notes a 12 percent increase in loan usage from 2022. More concerning was the rise in hardship withdrawals. Nearly four percent of non-retirees took money out in 2023 for emergencies.

Despite strong savings habits, some workers face financial challenges that necessitate tapping into their retirement funds prematurely.

Record High Account Balances

In 2023, average 401(k) account balances rose 19%, mainly due to market performance. By the end of the year, the average participant account balance was $134,128. The median account balance reached $35,286 — 29% more than the end of 2022.

The stock markets saw gains of 25%, while bond markets rose 5% on the back of strong economic growth, resulting in high 401(k) balances.

Additionally, the average participant deferral rate matched the historic high of 7.4%. With employer contributions factored in, the total savings rate maintained its 11.7% all-time high from the previous year.

The increase in automatic enrollment drives these savings behaviors. In 2023, a record 59% of 401(k) plans included automatic enrollment, up from 35% a decade ago. Among these plans, 60% defaulted employees at a deferral rate of 4% or higher, another all-time high.

The shift in plan design led more participants to increase savings rates; 43% of participants raised their deferral rates in 2023, Vanguard’s highest reported level.

Long-Term Investment Behaviors

Despite economic uncertainties and market volatility in 2023, American workers largely remained committed to long-term retirement goals. The use of target-date funds, often many plans’ default investment option, continued to rise.

These funds accounted for 64% of all contributions, growing in popularity. Only 1% of investors who exclusively invest in a single target-date fund made trades in 2023, highlighting strong adherence to long-term investment strategies.

Account advice availability also reached new heights. More than three-quarters of participants access professional financial advice. A record number of participants took advantage of this service in 2023, reflecting increased reliance on professional guidance to navigate complex financial landscapes.

Growing Concerns on Hardship Withdrawals and Loan Usage

Despite optimistic retirement savings behavior, the broader economic environment presented challenges, including the highest mortgage rates in more than two decades and record-high household debt.

Participants using hardship withdrawal jumped to a record high of 3.6%. Of consumers’ hardship withdrawals last year, 39% were to prevent home foreclosure or eviction — 31% more than just two years earlier. Medical expenses were a close second, accounting for one-third of hardship withdrawals, consistent with 2022 levels.

Data from Fidelity notes similar hardship withdrawal trends. In Q3 2023, 2.8% of participants took out 401(k) loans due to inflation and rising living costs.

Decoding Reasons Behind 401(k) Hardship Withdrawal Surge

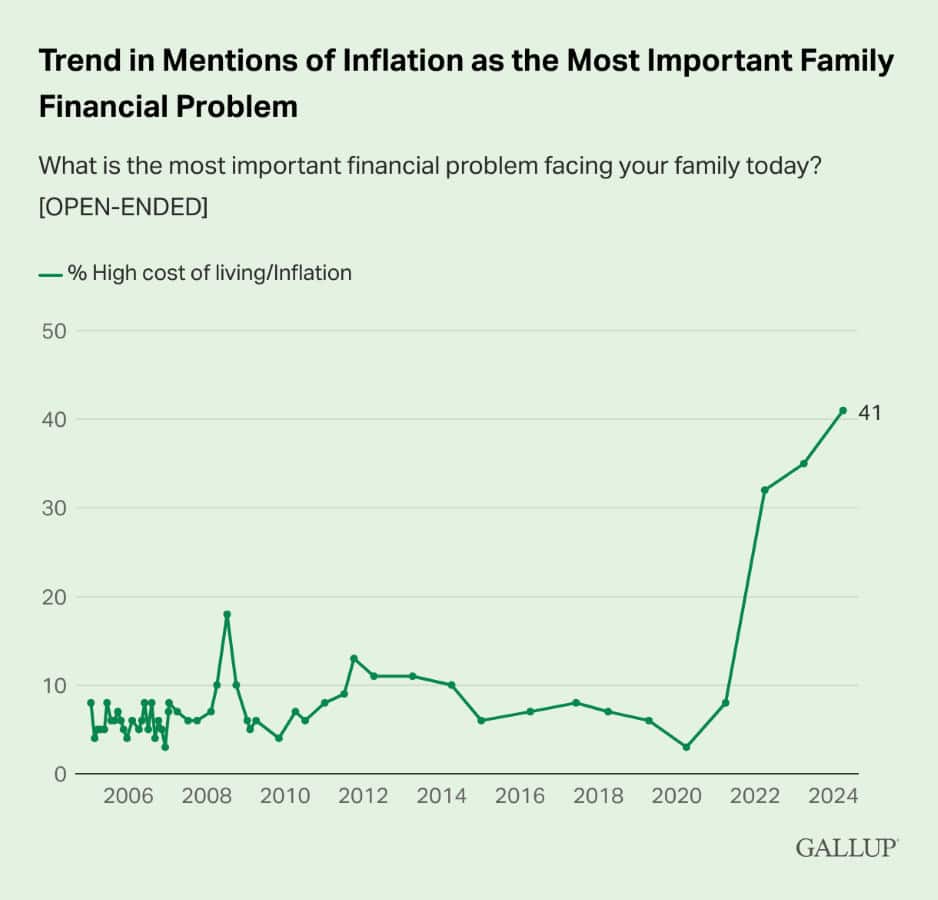

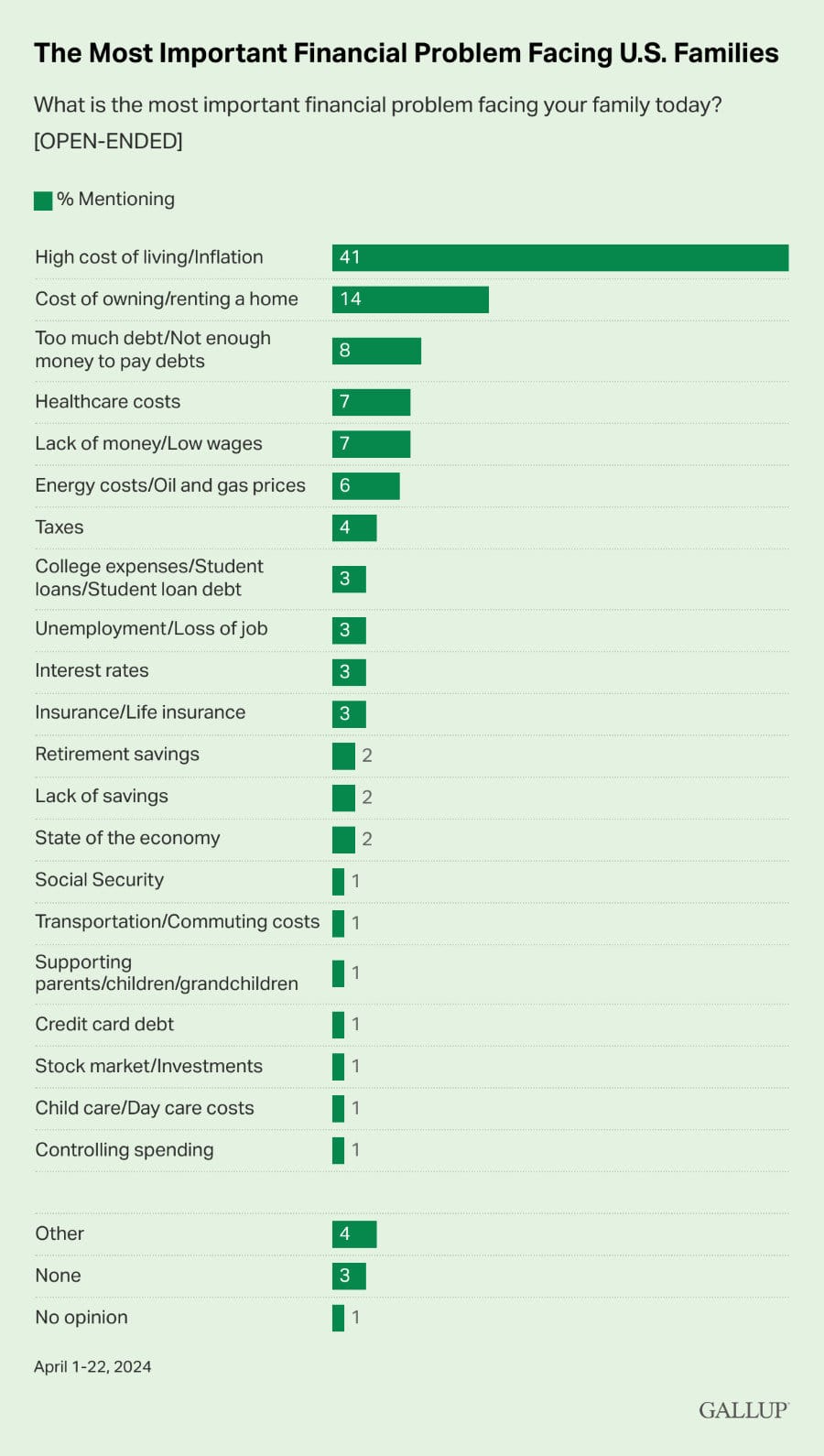

Americans who identify inflation or high living costs as their family’s top financial problem peaked for the third consecutive year — this year, 41% cite the issue, an increase from 35% last year.

Gallup’s annual Economy and Personal Finance poll, conducted in April, reports the latest findings. Gallup has asked Americans to name their top financial concern annually since 2005. Inflation has been the leading worry for the past three years.

Cost of Shelter Increasing

This year, the cost of owning or renting a home follows inflation as the second-most pressing issue at 14%, a new high for this category.

Americans’ other major concerns include excessive debt (8%), healthcare expenses (7%), low wages or lack of funds (7%), and energy costs or gas prices (6%).

High homeownership and rental costs continue to crush average Americans. Zillow’s recent research report sheds light on the reality homebuyers face and significant market shifts since 2020. To afford a home in the current market, individuals need to earn $47,000 more than they did just a few years ago, pushing the required annual income to over $106,000.

Redfin’s recent research, which delved into housing and income statistics, mirrors these findings, highlighting the widening gap between home affordability and average earnings. Their analysis reveals that the average household’s income falls short by about $30,000 of what is necessary to purchase a median-priced home in the U.S.

To afford such a home today, a buyer must earn $114,000 annually — 35% more than the typical household earns.

Pick Hardship Withdrawals Only as a Final Choice

Many financial advisors discourage tapping into 401(k) investments as it involves additional taxes and penalties. You also lose out on the potential growth from compound interest.

Riley Adams, CPA and founder of Young and the Invested, says, “A 401(k) hardship withdrawal is a tough decision, not one that should be made lightly. Considering the future lost returns and the immediate tax implications you’ll likely face from withdrawing your money, it behooves you to consider other options before pushing ahead. Regarding the hit you can expect to take from a tax perspective, you’ll need to pay income taxes on any previously untaxed earnings you’ve placed into the account and an additional 10% penalty unless you’re 59.5 or older. Further, you’re not eligible to contribute to your 401(k) again for six months after you receive the distribution.”

IRS Guidance on Hardship Withdrawals

As per the IRS, hardship withdrawals allow workers to tap their 401(k) for an “immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need.” However, the penalty can be waived if workers provide adequate evidence that the money is being used for a qualified hardship, such as an unreimbursed medical expense totaling more than 10% of the individual’s adjusted gross income.

Considering the restrictions on contributing for the next six months, opting for a 401(k) loan might be more advantageous in certain situations. Under federal regulations, employees can borrow up to 50% of their account balance or a maximum of $50,000, whichever is lower, without facing penalties, provided the loan is repaid within five years.

401(k) Loan or Hardship Withdrawal?

An advantage of opting for a 401(k) loan over a hardship withdrawal is that when you borrow from a 401(k), you pay back the loan with interest, and that extra interest goes back into your own account. This helps compensate for the lost investment gains when you borrowed the money from your retirement account.

401(k) loans do not report to the credit bureaus and do not impact credit scores.

The challenge of a 401(k) loan is that in the event of a job loss or securing new employment, many employers may demand prompt repayment of the remaining balance within a shorter period. Also, repaying the loan using after-tax dollars means you will get double-taxed when eventually receiving retirement age-appropriate distributions.

Other Options for Emergencies

Currently, very few options exist to tide over emergencies. Selling vested restricted stock units (RSUs) or shares from employee stock purchase plans and liquidating brokerage assets are alternative methods to acquire immediate funds when an emergency fund isn’t available.

Accessing a home equity line of credit (HELOC) or cash-out refinancing is risky if you cannot repay the money.

SECURE Act 2.0 Offers Some Relief

Congress included the SECURE Act 2.0 provisions to provide easier access to emergency savings within retirement accounts. Beginning in 2024, individuals under 59.5 can withdraw up to $1,000 from their retirement account for emergency expenses without the customary 10% tax penalty on early withdrawals. Nonetheless, penalties may apply if you do not replenish these funds within three years and require another withdrawal due to a similar circumstance.

Companies may allow their employees to set up emergency savings accounts through automatic payroll deductions, with an upper limit of $2,500 per annum and the first four withdrawals in a year free from taxes and penalties.

Positive Outlook Amidst Financial Struggles

Despite the uptick in hardship withdrawals, the general outlook for retirement savings remained positive. Fidelity Investments reported retirement savers ended the year on a high note, with improved market conditions and steady contributions boosting average account balances to their highest level in nearly two years.

Additionally, more than one-third (37%) of workers increased retirement savings contributions in 2023, indicating a commitment to preparing for the future.

While American workers achieve record savings rates and show resilience in their retirement planning, increasing hardship withdrawals and loan usage highlight some participants’ ongoing financial challenges. The continued evolution of retirement plan designs and growing financial advice accessibility are crucial in helping Americans achieve long-term financial security.

Like Financial Freedom Countdown content? Be sure to follow us!

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

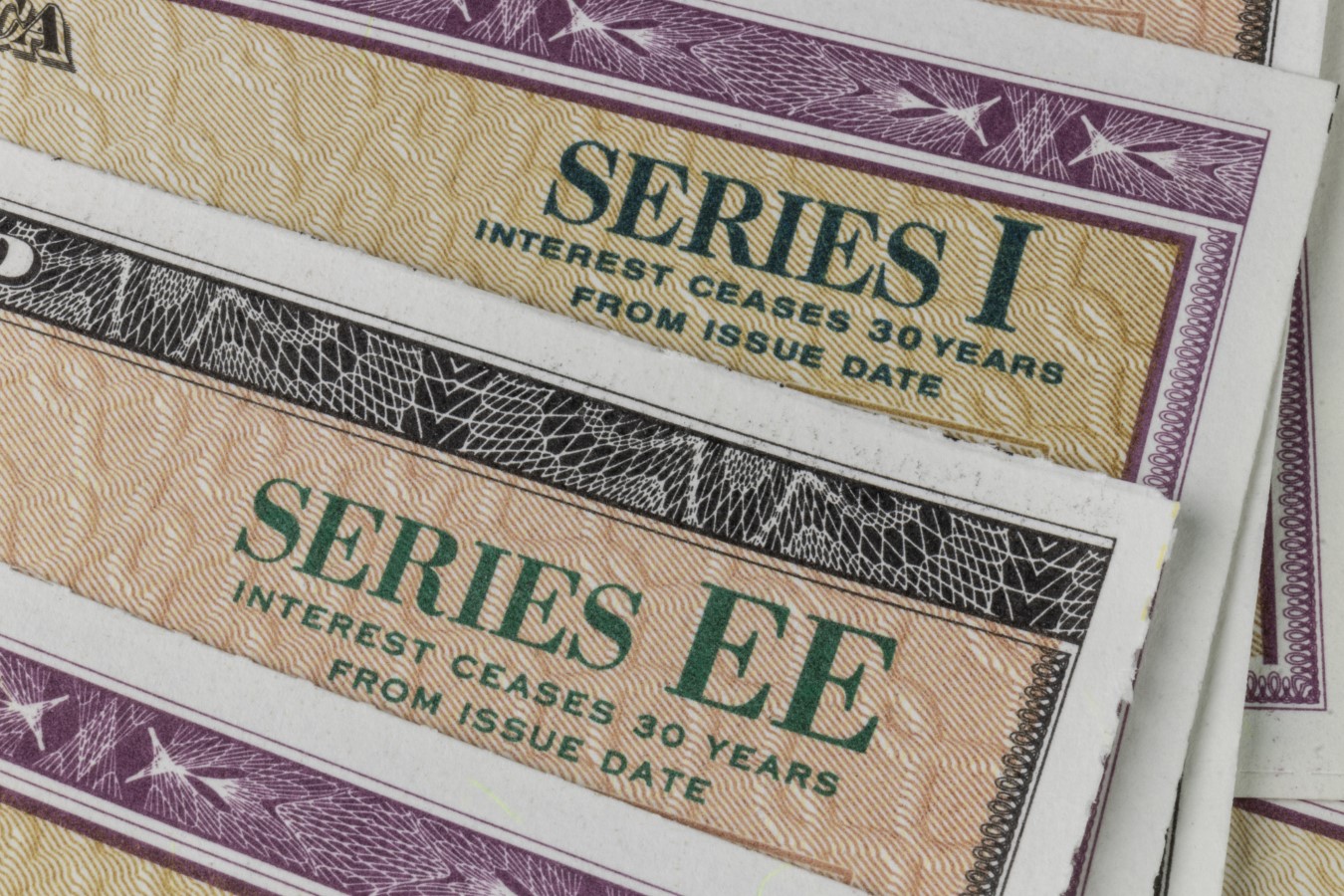

Treasury Sets I Bond Rate at 4.28%. Are I Bonds Still Worth Your Investment?

Inflation is a silent killer. With the rapid rise in inflation over the last two years, I bonds became an attractive, safe investment. With the government reporting lower CPI numbers lately, the composite rate of I bonds at 4.28% is less attractive than when investors purchased them at an annual rate of 9.62% in May 2022. Given the lower rates, investors are now considering whether they should continue buying or selling existing Series I bonds.

Treasury Sets I Bond Rate at 4.28%. Are I Bonds Still Worth Your Investment?

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.