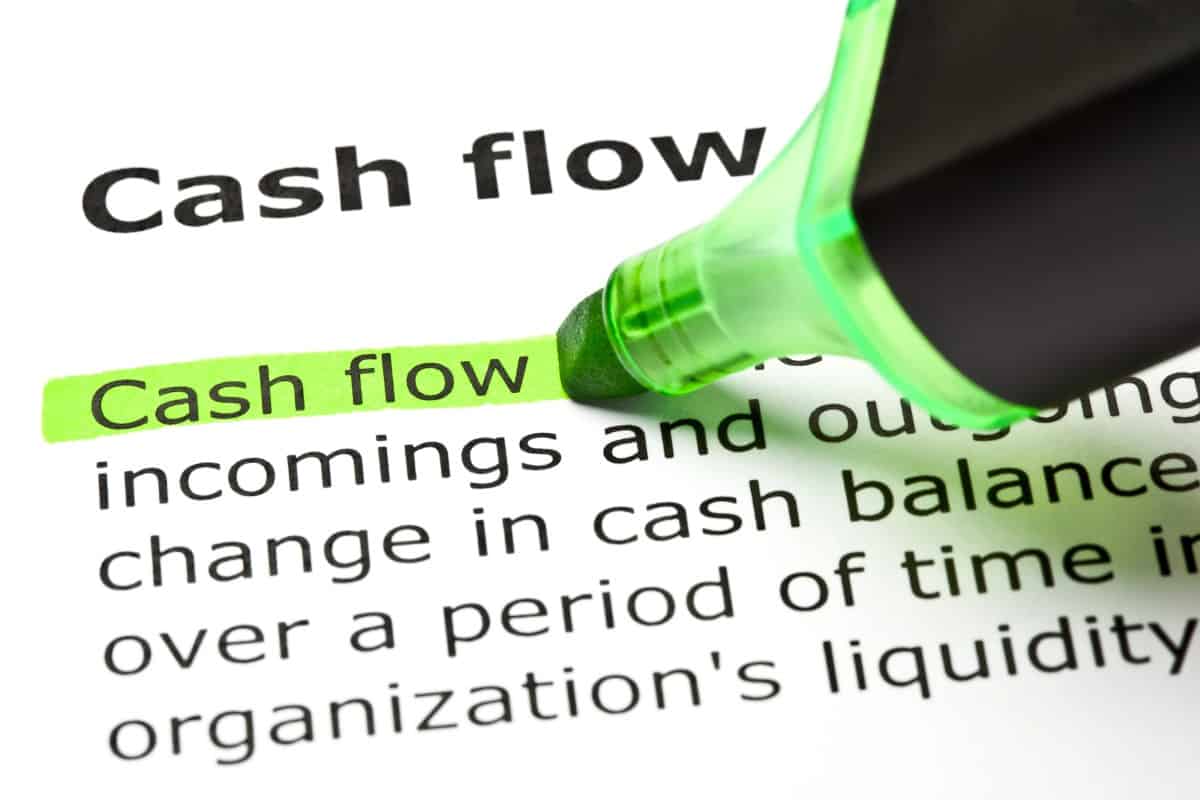

Transform Your Finances by Shifting From an Employee to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom.

One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

What is the Cashflow Quadrant?

The book’s official title is Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom. The book is by Robert Kiyosaki, who has published the entire Rich Dad series. Robert Kiyosaki is a businessman, entrepreneur, and investor who has made his fortune helping others learn more about how they can achieve financial independence.

The Rich Dad, Poor Dad book often tops the list of best beginner books on real estate investing.

Rich Dad’s Cashflow Quadrant deals explicitly with helping people optimize their income. In it, Robert Kiyosaki argues that most people can increase their bottom line by moving away from just working for someone else. Instead, people can make more money – and journey towards financial freedom – by controlling their destinies.

Much of the book is about changing how people think money works and optimizing your life across various quadrants. Kiyosaki persuasively argues that people are programmed to think about money a certain way as a direct result of how the education systems are created in America and throughout much of the world.

How Does the Cashflow Quadrant Work?

People tend to think of income matters in more traditional ways: Get a job, save toward retirement, and be happy.

Kiyosaki argues that people need to evaluate how they think of money. Instead of thinking about being part of the financial system, people need to figure out how to stake their claim over it. You can do it by moving away from the E quadrant (employee) and moving towards becoming an investor. Doing so can enable someone to create various income streams, own more assets, increase their wealth, and ultimately improve their lives.

Let us talk through the various quadrants.

E (Employee) Quadrant

The E Quadrant is where most people live their lives and generate income. E stands for employee and refers to a person with a job. There is nothing wrong with having a job and working for someone else, and as Kiyosaki makes clear, this can allow someone to have a happy life – mainly if this is where they want to live from a financial perspective.

A person who is an employee has a job with someone else. They have job responsibilities and can go home at the end of the day, usually without thinking about their job.

However, from a financial independence perspective, there are real cash flow problems with this cash flow quadrant. Employees usually depend upon someone else – or a massive, faceless corporation – for their financial and job security.

An employee produces money and income for their boss or corporation but doesn’t get to share in the fruits of their labor fully.

One of the most critical components to understanding this particular cash flow quadrant is that you never really own the fruits of your labor. Yes, an employee will make a salary. It may even be a relatively high 7 figure salary with extensive financial benefits.

But if something happens to that business or the relationship between employee and employer is severed, the income stops flowing. That makes this cash flow quadrant one of the most dangerous since you are never quite in control of your destiny.

While Kioyaski has positive things to say about working for someone, he notes that it is difficult to achieve freedom if you are only someone else’s employee.

You will never be your boss and can’t make your money work for you. As such, Kioyaski argues that people should work on developing the skills needed to enhance their ability to make money in other quadrants.

Your only option to earn more money in the Employee quadrant is to improve your human capital and continuously seek higher-paying jobs.

S (Self-Employed) Quadrant

S refers to self-employed. Self-employed people work for themselves. As such, they have much more control over their financial destiny. However, it is still difficult for someone in the S quadrant to ultimately move toward financial freedom.

An S quadrant means that a person owns and runs their own business. In a sense, they control their job. It can include certain small business owners who work for their companies, like service-shop owners or medical professionals.

There are unquestionable benefits to owning your job. Doing so allows a person ultimate control over their financial destiny.

It means there is no boss, more flexibility, and the chance to move a business in your chosen direction. Self-employed people can use their high-income skills in a manner and location that they see fit.

Robert Kiyosaki talks about his experience when he quit his pilot job and learned to sell. Selling involves a lot of empathetic listening, proposing solutions, influencing, and negotiating. It is listed as one of the easy jobs that pay well because there are no barriers to entry in the form of expensive degrees and certifications.

There is also greater flexibility. Someone self-employed is also a business owner, giving them much greater control over their cash flow, personal development, and how they use their skills.

Date from the last Survey of Consumer Finance shows that the best way to increase your average net worth is to be self-employed compared to working as an employee.

However, this isn’t to say that everything is perfect in this particular cash flow quadrant, and to some extent, the idea of financial freedom here is an illusion. Self-employed people have no one but themselves to report to, which means they have no one but themselves to lean on if something goes wrong.

Indeed, this is one quadrant where a person must continue to work despite theoretically having control over their destiny since their business will fall apart without their constant involvement.

If someone who took this path were to stop working, their business would almost certainly collapse.

The only way to improve income in the self-employed quadrant is by working more hours or increasing your billing rate.

It can be highly stressful, leading many to find another way to make money.

B (Business Owner) Quadrant

The B quadrant of Rich Dad’s guide is where people can fully understand how to control their financial destiny and make their money work for them. People make their money work for them in this particular cash flow quadrant.

B quadrant means owning a business or a system that makes money. To be clear, it is about much more than just owning a job or a place where you work.

In the B quadrant, owners ensure that the business makes money for them, even without their involvement.

To be sure, a person may still actively work for their business. However, the company is bigger than them, and if they were to stop working for the business – but continue to own it – that business could still operate.

There are multiple forms of making money in this quadrant. Like individuals in the S quadrant, someone in the B quadrant could make money by owning a service or medical business.

However, this is where someone could also invest their money and own a business that made money for them. They could be actively involved in managing that business or leave that management to another highly-skilled individual. Think about someone who owns a small business or a franchise.

Like the S quadrant, jobs in the B quadrant require extensive work and set-up. This cash flow quadrant has difficulties and extensive barriers to entry. You’ll need real business education and significant financial resources to get your business up and running.

Being a business owner also means investing the time and energy necessary to start your business and create a system that can survive without your constant attention.

Of course, this investment of time and energy is usually well worth it by the time the effort is completed. When your business grows, you will be a business owner, unlike jobs in the E cashflow quadrant. This will ultimately give you the freedom and flexibility to make your money work for you – not the other way around.

I (Investor) Quadrant

I quadrant refers to investing. Investing means taking your hard-earned money and putting it into a financial instrument, like a stock, bond, or collectible. In theory, that investment will then rise, allowing you to reap the rewards later.

Of course, investing money is not without its risk. You can lose some (or even all) of your money if the investment goes bad. That’s why it is critically important that you select an investment vehicle that can diversify and minimize your risk.

It would help if you were comfortable with where you are investing your money. As such, you’ll have to do your homework and learn how to invest.

Several stock investment research websites have simplified the learning process for how to invest in stocks. Alternatively, investing in the S&P 500 can be the easiest way to start.

You can buy all the ETFs using M1 Finance which has zero fees, low minimums, fractional shares, and automated investment options. You can read my M1 Finance review, including the comparison with other platforms such as Vanguard, Schwab, Fidelity, Wealthfront, and Betterment to find the perfect investment platform.

Investing in real estate is another familiar option for most individuals.

Don’t let the high cost of real estate be a mental barrier. Depending on your investment budget, you have several options. You can invest in real estate with little to no money down.

Kiyosaki is a favorite of real estate investors because he often talks about generating passive income from real estate.

You may also want to consider speaking with a financial professional who can guide you as necessary to help you reduce risk and maximize returns.

However, unless you inherit your money (in which case, you probably aren’t reading the Rich Dad Poor Dad series!), you will need to earn the money you make to invest. You will have to spend some time in the other three quadrants first to make your financial fortune.

Furthermore, in the investor quadrant, your investments should be able to generate monthly income. This means that your money will need to provide you with an annuity or dividend that you can live off of and pay expenses.

Tax Implications of Cash Flow Quadrants

Finally, it is worth considering that taxes favor investors. A variety of changes to the United States tax code – including lower tax rates on investment returns and capital gains – tend to skew toward investments in the Investor quadrant.

It means you can potentially make more money – and pay fewer taxes – if you start investing. Taxes are not the be-all, end-all consideration, of course. However, they are important to keep in mind.

Why Is the Cashflow Quadrant Important?

Kiyosaki created the cashflow quadrant to organize how to make income and describe the pros and cons of specific income methods.

However, as Kiyosaki noted, making money is about much more than knowing how to earn: You also have to understand how to save money. Kiyosaki discussed the importance of saving money for later and using that money wisely.

Kiyosaki also noted that people have to learn to think independently to be independent. This means that they need to find ways of making money that is unique and align with their skill set.

Conventional wisdom may only sometimes be worth listening to. Individuals should be prepared to chart their paths and take risks. Advice from family and friends may be well-meaning, but everyone is locked into their own financial experiences.

People who are not in your shoes may be unable to give you the advice you need to be financially successful.

The crux of the book is that you need to make your money work for you – not the other way around. It means setting up financial systems on the right side of the quadrant, the Business and Investor sides.

These sectors require the most work and the most capital to invest, so you will unquestionably spend some time on the left side of the financial quadrants to earn money necessary to make appropriate investments. However, with time and discipline, these investments will pay off.

How To Move From Left to Right Side of the Cash Flow Quadrant?

Kiyosaki noted that education is essential for making money, but it was far from the be-all and end-all to it. He said emotional intelligence was the most critical aspect of achieving financial success. People tend to earn and immediately spend money, which is ultimately not how anyone can become financially successful.

Instead, Kiyosaki argued that people have to learn how not just to make money but save it and not spend it immediately. This requires financial discipline and learning to be fiscally responsible. It also means learning how to stop spending money.

Actionable steps to move towards business and investor quadrants are

1. Spend time learning. Often books are the best way to learn a subject, so read the best personal finance books.

2. Automate all the steps in saving and investing money. If you do not have a budget template, consider signing up for Personal Capital, a free tool to track your liquid net worth with a budget tracker included.

3. Share your financial goals with an accountability partner.

4. Understand how compound interest works and be patient since the progress may take time.

There is no question that the Rich Dad, Poor Dad series offers a fascinating financial education, perspective, and method by which an individual can potentially improve their financial lives. It has helped many open their businesses, improve job security, build passive income, and become self-employed.

Like Financial Freedom Countdown content? Be sure to follow us!

Continuing Exodus Sees Californians Flocking to Florida and Texas

2023 saw booming demand for U-Haul equipment from California, Massachusetts, Illinois, and New Jersey as citizens chose to flee the West Coast and Northeast. On the U-Haul Growth Index, which shows net losses of one-way trucks in various states that year, California, Massachusetts and Illinois ranked 50th, 49th and 48th, respectively – marking their third consecutive year at the bottom positions. But what could be causing such a mass exodus from states like California, New York, and Illinois?

Continuing Exodus Sees Californians Flocking to Florida and Texas

Worry Mounts as Household Debt Surges and Delinquency Rates Soar

Total household debt surged by $212 billion, reaching $17.5 trillion in the fourth quarter of 2023, as reported by the Federal Reserve Bank of New York. This includes credit card balances, mortgage loans, and auto loans, all hitting record-high levels. Concurrently, delinquency rates for most debt types continue to climb, stirring concerns among economists and financial analysts about the stability of the U.S. consumer-driven economy.

Worry Mounts as Household Debt Surges and Delinquency Rates Soar

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

Top 10 Housing Markets Where Soaring Prices Leave Locals Priced Out, Defying Historical Norms

Real estate economists at Florida Atlantic University analyzed average expected home values based on historical data against current list prices across the nation’s 100 largest metro areas. The study used publicly available data from online real estate portal Zillow or other providers from January 1996 through the end of last month, for single-family homes, townhomes, condominiums and co-ops. The research aims to pinpoint cities with significant price disparities, shedding light on the challenges faced by long-time residents priced out of their neighborhoods amidst soaring real estate costs. Besides home owners, the findings are also important for real estate investing to identify pockets of exuberance and analyze if the higher priced metros deserve the price jump compared to historical trends. Here are the top 10 cities where current prices are much higher compared to their historical prices.

Top 10 Housing Markets Where Soaring Prices Leave Locals Priced Out, Defying Historical Norms

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

The “Buy, Borrow, Die” strategy is a favorite among the affluent, who work with financial planners to sustain their lavish lifestyles while slashing their tax bills. Though it seems like a modern trend, Professor Ed McCaffery coined the term in the mid-1990s to explain how the wealthy legally avoid paying taxes.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

Check if Your State Taxes Social Security in 2024 as 10 States Continue and 2 Finally Stop

As the 2023 tax filing season ends, retirees across the nation are revising their financial plans for 2024, but a crucial detail could drastically alter their retirement landscape: the taxing of Social Security benefits. While many believe their golden years will be tax-friendly, residents in ten states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, two states are bringing relief by ending their practice of taxing these benefits. This shift highlights the complexity of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you residing in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Check if Your State Taxes Social Security in 2024 as 10 States Continue and 2 Finally Stop

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.