Trump Warns Supreme Court: Blocking Tariffs Would Be a ‘Terrible Blow’ to U.S. National Security

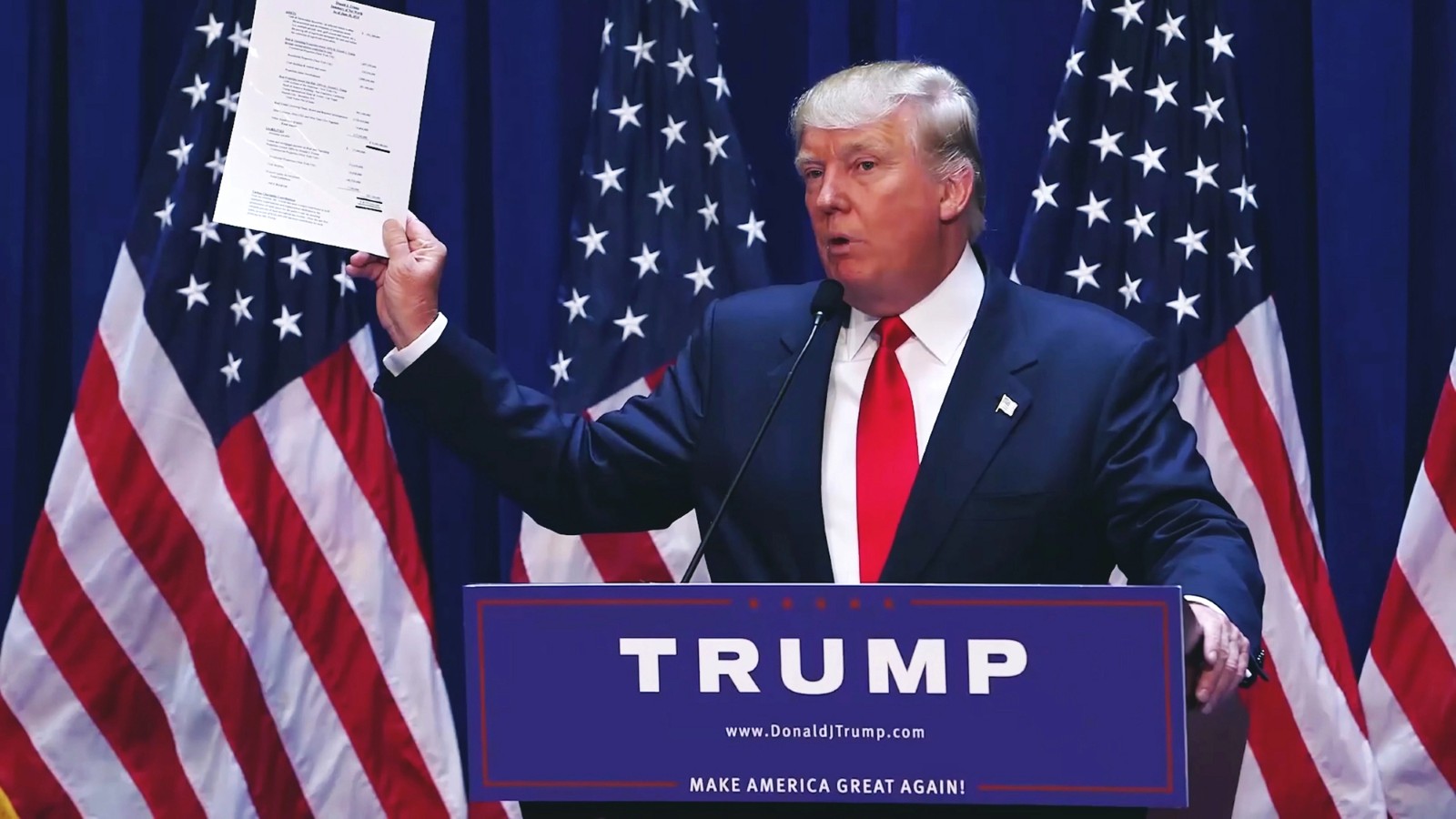

President Donald Trump is forcefully defending his sweeping tariff agenda as the Supreme Court weighs whether he has the legal authority to impose import taxes without explicit congressional approval. The outcome could reshape U.S. trade policy, presidential power, and the prices Americans pay at the checkout line.

Trump Doubles Down as Supreme Court Reviews Tariff Authority

With the justices considering the legality of his actions, Trump made clear he sees tariffs as central to his economic and national security strategy. Writing on Truth Social, the president argued that tariffs have delivered unprecedented prosperity and protection for the United States; and warned that losing this power would seriously weaken the country.

“Tariffs are an overwhelming benefit to our Nation, as they have been incredible for our National Security and Prosperity (like nobody has ever seen before!),” the president wrote on Truth Social. “Losing our ability to Tariff other countries who treat us unfairly would be a terrible blow to the United States of America.”

‘An Overwhelming Benefit’: Trump Frames Tariffs as National Security Tools

Trump insists tariffs are not merely economic instruments but strategic defenses. He has repeatedly argued that import taxes protect domestic industries, strengthen supply chains, and reduce reliance on foreign rivals, framing the policy as essential to U.S. national security.

The Legal Fight Centers on Emergency Powers

At the heart of the case is the International Emergency Economic Powers Act (IEEPA), a law that allows presidents to regulate economic transactions during declared national emergencies. Trump has relied on this statute to justify imposing tariffs without new legislation from Congress.

Justices Signal Skepticism During Oral Arguments

During arguments in November, several justices; including Chief Justice John Roberts and Justices Amy Coney Barrett and Neil Gorsuch; raised concerns about the scope of presidential authority. Their questions suggested unease with allowing major economic policy decisions to rest solely with the executive branch.

The ‘Major Questions’ Doctrine Looms Large

Roberts and Justice Sonia Sotomayor pointed to the “major questions” doctrine, which holds that the executive branch cannot unilaterally enact policies of vast economic or political significance without clear authorization from Congress. The doctrine could prove decisive in limiting Trump’s tariff powers.

‘Liberation Day’ Tariffs and the Emergency Argument

The White House argued earlier this year that America’s persistent trade deficit; along with immigration pressures and trafficking from Canada and Mexico; constituted national emergencies. Those claims underpinned Trump’s so-called “Liberation Day” tariffs announced in April.

Reshoring Manufacturing Remains Trump’s Core Pitch

Trump has consistently said tariffs will encourage companies to bring manufacturing back to the United States, boosting jobs and long-term economic growth. Supporters see the policy as a corrective to decades of offshoring and trade imbalances.

Consumers Are Feeling the Cost

While firms have absorbed some of the tariff burden, economists say a significant share has been passed on to consumers. Higher import costs have translated into higher prices for everyday goods, complicating Trump’s economic messaging.

Tariff Rates Hit Levels Not Seen Since the 1930s

According to the Yale Budget Lab, American consumers faced an average effective tariff rate of 16.8 percent as of mid-November; the highest level since 1935. That marks a dramatic increase from early January, underscoring how sharply trade policy has shifted.

Inflation Debate: Trump vs. the Data

Trump has claimed his tariffs produced “no inflation,” but official figures tell a more nuanced story. Year-over-year inflation stood at 2.7 percent in November, down from 3 percent in January; lower, but not nonexistent.

Powell Calls Tariff Impact a Possible ‘One-Time Shift’

Federal Reserve Chair Jerome Powell has suggested the inflationary effects of the tariffs could be temporary, assuming Trump does not escalate them further. Still, the Fed continues to monitor trade policy closely as it weighs future rate decisions.

A Ruling That Could Redefine Presidential Power

The Supreme Court is expected to issue its decision by the end of its term this summer. The ruling could either cement broad presidential authority over trade; or significantly curtail it; setting a precedent with lasting implications for U.S. economic and constitutional governance.

Like Financial Freedom Countdown content? Be sure to follow us!

Gen Z Would Cut Current Retirees’ Social Security Before Raising Taxes; A Generational Reckoning Is Here

Social Security supports the majority of American workers, retirees, and families. Yet as the program barrels toward a funding shortfall, a stark generational divide is emerging. Younger Americans; especially Gen Z, are increasingly unwilling to pay higher taxes to preserve benefits they’re not confident they’ll ever receive.

Forgotten IRS Retirement Rule Is Costing Americans $1.7 Billion a Year and It’s Still Catching Retirees Off Guard

Missing a required minimum distribution (RMD) might sound like a minor paperwork error. But new research from Vanguard shows it’s anything but small: investors who failed to take required withdrawals in 2024 triggered an estimated $1.7 billion in IRS penalties, with the biggest mistakes concentrated among people with the smallest retirement accounts. Here’s what the data reveals; and what retirees can do to avoid an expensive oversight.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.