Trump’s Social Security Overhaul Sparks Big Changes but Leaves Millions Wondering Who Wins

The Social Security Administration (SSA) has rolled out a sweeping set of reforms in the first 100 days of the Trump administration. While agency leaders say these efforts aim to enhance customer service and eliminate waste, critics question whether the changes go far enough—or serve the most vulnerable.

Social Security Fairness Act Brings Relief to Millions

More than 2.2 million people have received retroactive payments totaling $14.8 billion under the Social Security Fairness Act.

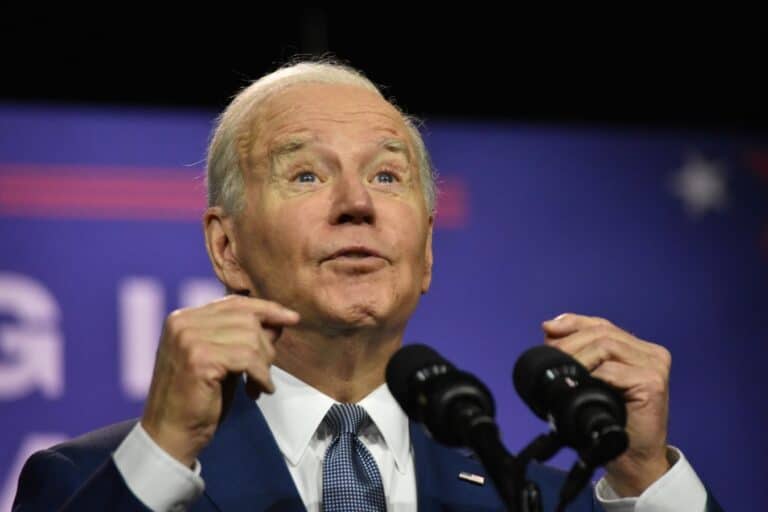

The Fairness Act was signed into law by President Biden and had enjoyed bipartisan support in Congress.

Although the initial timelines for retroactive payment distributions were over 12 months, the SSA has been able to condense the timelines due to automation.

While this is a major win for affected individuals, SSA notes that complex cases may still take a year or longer to process fully—an area advocates say deserves continued oversight.

Cost-Saving Push Projects Over $1 Billion in Efficiencies

The SSA has identified over $1 billion in projected savings for fiscal 2025 by reducing unnecessary spending in IT, payroll, and travel.

These efficiencies are designed to protect public funds while maintaining service levels, though some worry about how lean operations may affect long-term staffing and support.

Workforce Restructuring Streamlines Operations

SSA has launched a major internal reorganization aimed at reducing duplication and improving frontline services.

Voluntary separation programs and reassignment options are helping reshape the workforce, but employee advocates emphasize the need to support staff through these transitions to avoid morale issues.

Local Offices Remain Open Despite Rumors

Contrary to public speculation, the SSA confirms that no local field offices have been permanently closed in 2025.

Temporary closures due to weather or maintenance continue as needed, and the agency reaffirms its commitment to keeping local services accessible to the public.

New Call System Enhances Access and Automation

SSA is expanding its modern call platform to all field offices by summer 2025. Early results show better call response times and increased use of automated services—making it easier for users to get answers without long waits, though the experience can vary by region.

Telephone Fraud Detection Tools Improve Program Security

A new fraud detection system for phone-based claims is helping SSA catch anomalies and ensure proper identity verification.

While this adds a layer of protection, some users without digital or in-person access may face new hurdles.

Death Record Accuracy Gets a Boost

SSA is now proactively reviewing and updating records for individuals who are statistically unlikely to be alive, strengthening anti-fraud measures.

Safeguards are in place to ensure that no one is mistakenly removed from the system, and so far, no false reports have occurred.

Overpayment Collection Resumes With Higher Withholding

The SSA has increased the default overpayment withholding rate to 50% and resumed collections through the Treasury Offset Program.

The agency says this will restore program integrity, though some beneficiaries may experience financial strain as a result.

Wage Data Integration Expected to Reduce Payment Errors

The rollout of the Payroll Information Exchange (PIE) marks a big step forward in real-time wage data sharing. It promises to reduce improper payments and administrative burden—though as with any large system change, there may be technical hiccups in early phases.

Disability Claims May Be Processed Faster With Health IT

SSA is expanding its Health IT partnerships to speed up disability decisions by streamlining access to medical records. This move could greatly reduce delays for applicants, while also saving the agency hundreds of millions in processing costs annually.

Social Security Number Verification to Get Cheaper and Smarter

Enhancements to the Electronic Consent Based Social Security Number Verification (eCBSV) service include cutting costs by 40% and lowering user fees. The plan also offers more clarity in mismatch results, benefiting both financial institutions and the general public.

AI-Powered Hearing Transcription Tool Launches Nationwide

The new Hearing Recording and Transcription (HeaRT) system is replacing older tech to provide more accurate hearing records. SSA expects to save $5 million annually while improving due process—but it will need to ensure that the human element remains strong.

Public Awareness Campaigns Aim to Thwart Scams

SSA and its Office of the Inspector General continue to warn about imposter scams, hosting “Slam the Scam” events and expanding outreach efforts. These educational campaigns are essential in protecting vulnerable populations, though scams remain a persistent threat.

SSA Highlights Early Wins, But Public Response Is Mixed

In its first 100 days under the Trump administration, the Social Security Administration (SSA) has unveiled a broad set of reforms aimed at improving service delivery, modernizing operations, and protecting taxpayer dollars as listed on their website.

While many changes are being welcomed, some observers caution that the rapid rollout may bring growing pains for the agency and its beneficiaries.

Like Financial Freedom Countdown content? Be sure to follow us!

Trump’s Second Term Could Shake Up Your Taxes in Surprising Ways – Here’s What to Expect

With former President Donald Trump reclaiming the White House after defeating Vice President Kamala Harris, taxpayers may soon feel the effects of his ambitious tax agenda. Trump introduced the Tax Cuts and Jobs Act (TCJA) in 2017, which lowered tax brackets, increased the standard deduction, and boosted the child tax credit. During his campaign, he teased even more aggressive tax cuts, including eliminating taxes on Social Security benefits and tips, and slashing corporate taxes further. One of the most likely tax proposals to become reality would be the extension of key provisions from Trump’s Tax Cuts and Jobs Act set to expire in 2025. Here are some of the TCJA provisions slated to expire next year if not extended.

Trump’s Second Term Could Shake Up Your Taxes in Surprising Ways – Here’s What to Expect

Discover 15 Smart Investments That Provide Monthly Passive Income

Are you dreaming of a steady passive income every month from your investments? It’s not just a fantasy for the wealthy—it’s attainable for anyone ready to explore their options. Whether you’re just starting out or seeking to diversify, learn how to establish a reliable monthly income stream from familiar choices to hidden opportunities.

Discover 15 Smart Investments That Provide Monthly Passive Income

Seniors Brace for Another Social Security Letdown as 2026 COLA Prediction Signals Trouble Ahead

Millions of retirees counting on Social Security to keep up with rising costs may face yet another financial squeeze in 2026. The Senior Citizens League (TSCL) has forecasted a mere 2.3% cost-of-living adjustment (COLA) for next year—falling short of inflation and marking a continued trend of inadequate benefit increases. This prediction lags behind the 3.0% yearly rise in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). If accurate, this would mean yet another year where Social Security adjustments fail to keep pace with real-world expenses, leaving many retirees struggling to cover essentials like housing, healthcare, and groceries.

Seniors Brace for Another Social Security Letdown as 2026 COLA Prediction Signals Trouble Ahead

Trump Administration Walks Back Punishing 100% Social Security Overpayments Clawback Plan

The Social Security Administration is pulling back from a plan that would have allowed the government to withhold 100% of certain beneficiaries’ monthly checks in an effort to recover alleged overpayments. Starting March 27, 2025, the SSA was supposed to begin withholding 100% of overpayments from Social Security recipients’ benefits, reversing the previous policy that allowed for just 10% withholding. This change was expected to recover approximately $7 billion over the next decade but had raised serious concerns about the financial well-being of vulnerable Americans. Announced in March under the Trump administration, the aggressive policy faced immediate criticism for putting vulnerable Americans at risk of losing their only reliable income. In a reversal dated April 25, the agency now says it will default to withholding 50% of monthly benefits instead of the full amount.

Trump Administration Walks Back Punishing 100% Social Security Overpayments Clawback Plan

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.