U.S. National Debt Reaches New Heights with $1 Trillion Added Every 100 Days

The U.S. National Debt is skyrocketing, ballooning from $34 trillion at the year’s start to $34.47 trillion by the end of February—an alarming $470 billion surge in just two months. At this pace, the debt could expand by $1 trillion every 100 days, putting it on track to increase by $2.8 trillion this year. What does this relentless rise mean for Americans and the future of the U.S. economy?

U.S. Debt at All-Time High

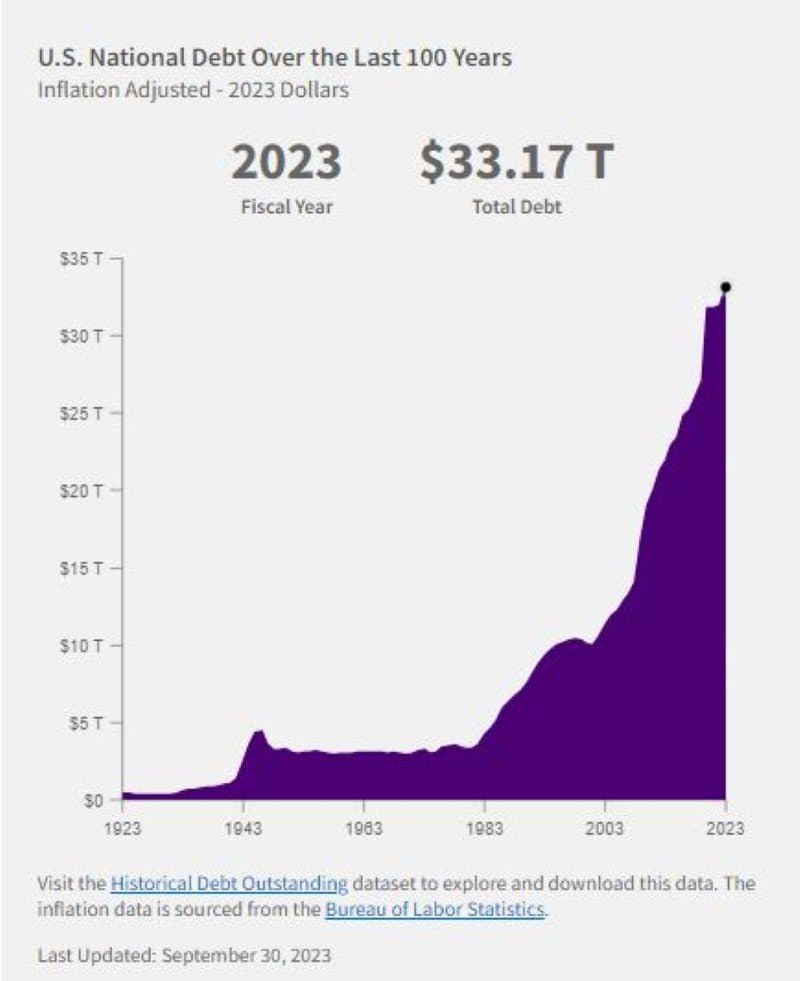

The U.S. national debt officially surpassed $34 trillion on January 4, as reported by the U.S. Department of the Treasury. Notably, it had reached $33 trillion on September 15, 2023, and $32 trillion on June 15, 2023, indicating an accelerated increase. Prior to this, the ascent from $31 trillion to $32 trillion took approximately eight months.

In the last century, the U.S. federal debt has surged ominously from $403 billion in 1923 to a staggering $33.17 trillion in 2023. Fed Chairman Jerome Powell has said it is past time to have an “adult conversation about fiscal responsibility.”

The US National Debt has now increased by $3 trillion since the debt ceiling was suspended last June (9 months ago).

National Deficit Increasing

A deficit arises when the federal government’s expenditures surpass its revenues. In fiscal year (FY) 2024, the national deficit emerged as the federal government spent $532 billion more than it collected. The deficit is expected to swell to $2.6 trillion by 2034 as per the projections of the Congressional Budget Office (CBO).

To finance government programs amidst a budget shortfall, the federal government accrues debt through the issuance of U.S. Treasury, bills, and securities. This national debt represents the total of borrowed funds plus the interest due to the investors who have bought these financial instruments.

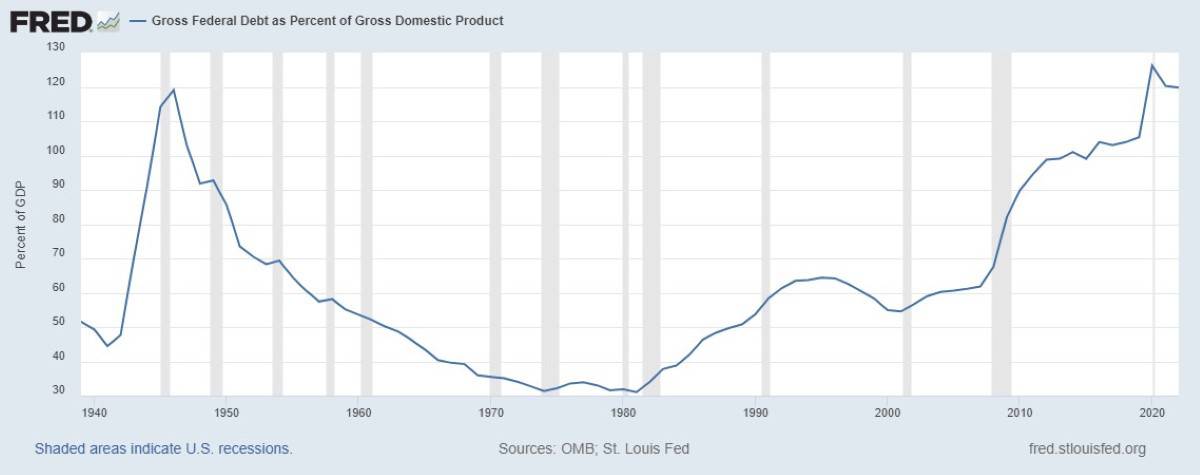

Unsustainable Federal Debt Levels As Percentage of GDP

Assessing a nation’s debt in relation to its gross domestic product (GDP) provides insight into its capacity to settle the debt. This ratio is deemed a more informative gauge of a country’s fiscal health compared to the raw national debt figure, as it reflects the debt burden relative to the country’s overall economic output, indicating its repayment capability. The U.S. witnessed its debt-to-GDP ratio exceed 100% in 2013, with both debt and GDP hovering around 16.7 trillion.

The debt-to-GDP ratio is currently around 123%, and politicians are not showing any sign of slowing spending.

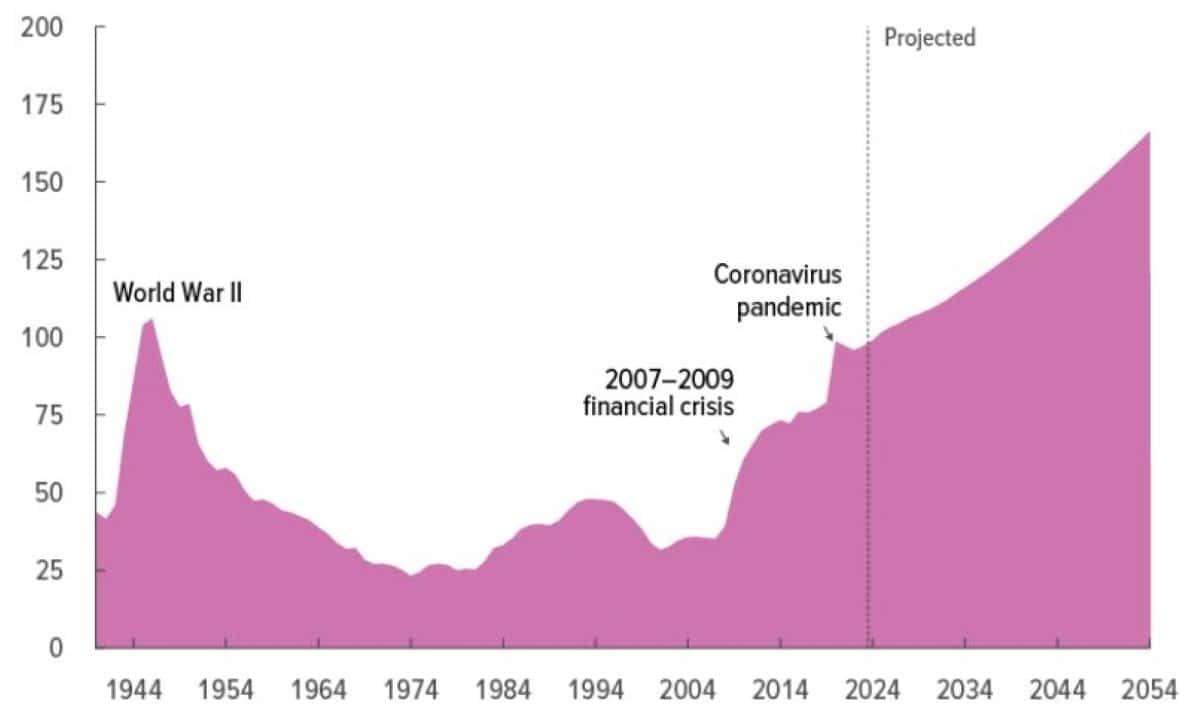

Federal Debt Held By The Public

Rising deficits lead to an increase in the already substantial federal debt held by the public, causing it to grow significantly over the next 30 years.

By 2054, the debt is projected to reach 166% of GDP, with expectations of continued growth beyond that.

Interest On Debt Unsustainable

Year-to-date, interest on Treasury debt exceeds $357 billion, showing a 37% increase from the same time previous year. It surpasses military spending and rivals only Social Security Administration or the Department of Health and Human Services. By year-end, the interest on the debt is projected to reach $1.1 trillion.

The interest payments on US Federal Government Debt have surpassed a $1 trillion annual rate, increasing 98% over the past 3 years.

More Taxes Or Print Money

Higher debt must be financed with higher taxes or more money creation. Raising taxes might prove difficult, but the alternative of printing more money could result in rampant inflation. Americans have suffered in the past two years as inflation has made everyday necessities more expensive. Although the pace of price increases has slowed, food and gas prices are still higher than in the past. The January and February inflation data came in higher than anticipated confirming the pain Americans are facing everyday.

Spending By Borrowing

So far, government spending has been financed by selling U.S. debt to foreign nations. America’s ability to pay its debt is a concern for nations worldwide, which own around $7.6 trillion of our debt. Japan and China are the top two countries holding U.S. debt. Both countries have been reducing their holdings of U.S. Treasuries. The last quarter data shows that Japan has slipped into a recession.

If the U.S. government can no longer find buyers for its $1.7 trillion annual debt, significant cuts must be imposed on social programs.

The CBO Report Unveils A Dire Path Ahead

The latest report released by the non-partisan Congressional Budget Office (CBO) for March 2024, offered dire projections for the country’s fiscal and economic landscape over the upcoming decade.

Critical trust funds face looming insolvency. The Highway Trust Fund is anticipated to exhaust its reserves by 2028, the Social Security retirement trust fund by 2033, and the Medicare Hospital Insurance trust fund is on track to deplete its funds by the mid-2030s.

Cuts to Social Programs

The insolvency of the trust funds would trigger automatic, across-the-board reductions in their payouts.

The CBO projects that the Social Security Old-Age and Survivors Insurance (OASI) trust fund will run out of funds by 2033, coinciding with the moment when individuals currently aged 58 reach the official retirement age and the youngest of today’s retirees hit 71. Consequently, all recipients will experience an automatic 25 percent reduction in benefits, irrespective of their age or financial situation.

Urgent Need to Tackle National Debt

The U.S. National Debt is on track for a $2.8 trillion increase this year. This unprecedented growth, reaching historic highs, poses significant challenges, including a rising national deficit, an unsustainable debt-to-GDP ratio, and unmanageable interest costs. The reliance on foreign nations for debt financing and the looming risks of a recession add urgency to address the dire projections. Critical trust funds, such as Social Security and Medicare, are facing insolvency, emphasizing the need for immediate and comprehensive fiscal strategies to navigate the complex economic landscape ahead.

Like Financial Freedom Countdown content? Be sure to follow us!

Retirement Is Overrated: 10 Reasons Not To Retire

You might be thinking that retirement sounds excellent – but what if you can’t afford it? What if an unforeseen catastrophe occurs and you need money? The reality is that so many people are retiring later in life because they don’t have enough saved up or can’t afford to take the risk of quitting their job before they know how much money they’ll need each month. Retirees also face many challenges, from loneliness to boredom, but there are ways to combat these problems with the right lifestyle changes. We will discuss why retirement isn’t always as glamorous as it seems and how to avoid these pitfalls by pursuing your goals now!

Retirement Is Overrated: 10 Reasons Not To Retire

Discover the Top 10 U.S. Cities Where Renters’ Income Goes the Furthest

With housing affordability at an all-time low, many Americans are forced to rent. While certain cities offer a higher income potential, they also have higher living cost. For renters, the optimal solution often lies in finding a middle ground — achieving the perfect balance between income and expenses. Luckily, individuals in search of apartments can now make informed decisions by exploring the latest report on RentCafe.com, which identifies cities where they can maximize the value of their budget. Here are the top 10 cities where renters can stretch their dollars.

Discover the Top 10 U.S. Cities Where Renters’ Income Goes the Furthest

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

Retirement age fluctuates across nations, influenced by diverse factors such as labor market dynamics, job types, economic policies, gender roles, and pension systems. For instance, Saudi Arabia stands out as the sole country offering full retirement benefits to individuals under 50, whereas in 2023, France faced uproar after raising its retirement age by two years, sparking widespread strikes. The Organization for Economic Co-operation and Development (OECD) collects and analyzes retirement data using distinct metrics: – The Current Retirement Age signifies the age at which individuals can retire with full pension benefits after a career starting at age 22, without facing any deductions. – The Effective Retirement Age represents the average age at which workers aged 40 or older exit the workforce, influenced by personal decisions or job availability.

Comparing Retirement Ages: How Does the US Stack Up Against Other Countries?

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

Nearly a Million People Risk Losing Over $1 Billion in Unclaimed 2020 Tax Refunds If They Don’t Act by May 17

Tick tock, the clock is counting down for nearly a million Americans who stand on the brink of losing out on a staggering sum of over $1 billion in unclaimed tax refunds from 2020. With the May 17 deadline looming, it’s a race against time to secure what’s rightfully yours.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.