How To Prepare For An Upcoming Recession

It is hard to fathom a recession when all asset classes are increasing in value. But this is exactly the right time to make a plan to prepare for an upcoming recession. The time to dig a well is before you are thirsty.

I’ve linked all my accounts to Personal Capital to utilize their free tools. If you don’t have an account; create a free account here. Personal Capital provides a free tool enabling you to track your net worth, cash flow, budget, emergency fund, asset allocation, performance against benchmarks, any hidden fees and retirement planning. Here is my review on the pros and cons of Personal Capital.

Cut All Expenses Mercilessly

After linking all my accounts, Personal Capital tracks all my spending and cash flow in an automated manner. I receive a weekly summary email.

As you can see, I have spent significantly less this month than the last month. The solid line in the graph is the current month (March) compared to the dotted line last month. Also my cash flow is higher!

I hate frugality more than anyone else. In fact I wrote an entire post on How to be really Rich like Suze Orman; but extreme times call for extreme measures. And these are extreme times.

Start with examining your grocery bills. Americans on average waste a lost of food. Can you reduce food wastage?

Action Step: Go over your last month’s expense line by line. Personal Capital does the hard work by aggregating all your spending from every linked account. Challenge yourself to reduce your expenses by at least 30%. Use the reduced expense to add to your emergency fund.

Beef Up Your Emergency Fund

Don’t leave your money earning no interest. This is all the more relevant since now your Emergency Fund would now be much larger compared to the bull markets.

Instead of relying on the Fed, you can use the Ultimate guide to Emergency Fund including how to get 8%+ risk free returns

Action Step: Look for bank bonuses from the major banks like Chase, Wells Fargo, Citibank. One website I use to check bank bonuses monthly is Doctor of Credit. Also check your local regional banks since they would have mailed you flyers. Follow the steps and get the bonus.

Leverage Your Human Capital

Unemployment claims across the county have spiked up. Unless you work for a government entity or in the medical profession; it is only a matter of time before your job will be on the line.

Human Capital is the biggest asset which you should now leverage. The free time you save by not traveling and staying at home can be used to add value at work.

Have regular conversations with your manager asking for more responsibility. This will ensure you are at the bottom of the “let us lay-off these people” list.

In parallel work on sharpening your high-income skills, network with recruiters and your former coworkers. Start applying to companies which continue to operate successfully in this challenging environment.

Action Step: Have a 1:1 with your manager and ask them what you could help with. Online education is easier then ever so use that free time to pick up some skills which would help you in the next job. Consider skills you need if you switch industries.

Start Building Additional Income Streams

Ideally, you should already have built additional income streams. But if you have not; then now is as good time as any to get started.

It could be dealing with physical items such as retail arbitrage. Or you can go totally digital. Build a brand for yourself by producing content. There is a lot of money being made by everyone moving online. Even fitness coaching to doctor visits can be done online. After this pandemic ends and we are able to resume our normal activities; the online behaviors developed will continue. At a minimum, learn to create a website.

There are lots of free lance gigs to help local businesses transition online. Once you develop your own website; you can use that as a showcase to sell your website development services to others.

If you are still struggling, here are some creative passive income ideas.

Action Step: Determine what are your skills which can be leveraged to generate additional income streams. Develop your online presence.

Do Tax Loss Harvesting

Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability. You can harvest losses to offset gains as well as up to $3,000 in non-investment income.

Be careful though to steer clear of the Wash-Sale rule. According to the wash-sale rule, when you harvest losses, you cannot repurchase substantially identical investments for 30 days across all accounts.

The definition of substantially identical is quite ambiguous. So consult with your tax professional. Personally I would sell SPY and purchase VTI and still consider both ETFs to be substantially different.

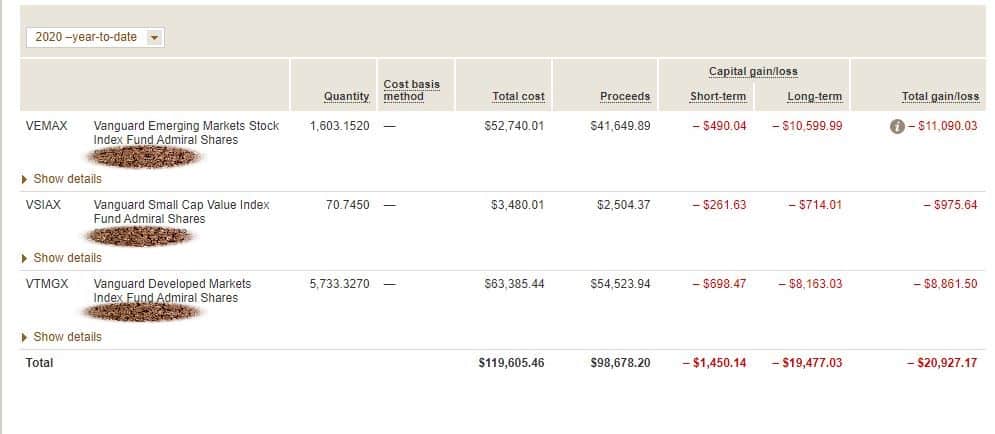

Here you can see that I have around $21,000 of tax losses harvested. I can use these to offset any gains or upto $3,000 of my W2 income. Any excess losses can be carry forwarded to future years indefinitely. This is a powerful tool to reduce your taxes!

Action Step: Look at your taxable accounts and decide what positions you want to use for tax loss harvesting. Reach out to your CPA if you have any questions.

Determine Your Asset Allocation

Consider your asset allocation. This drop has been fast and furious. There is no guarantee it would get worse. It’s hard to make plans with so much emotions riding on it. However, now is as good time as any to look at your asset allocation.

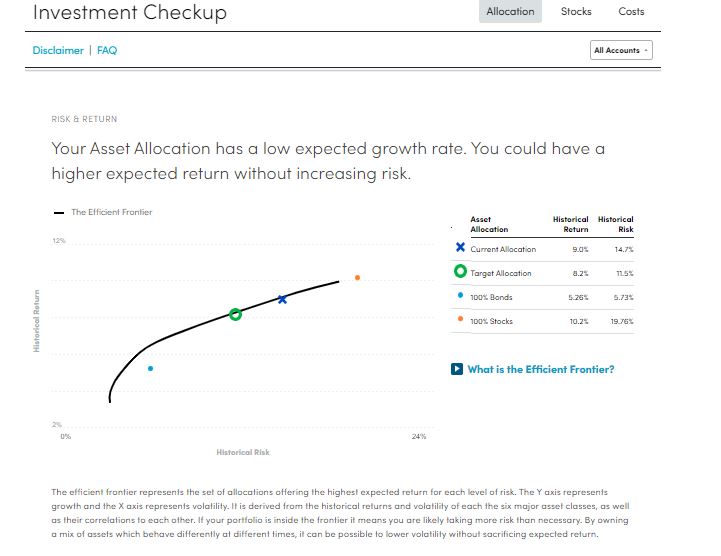

Log into your Personal Capital account which aggregates all your investment accounts. Look at your asset allocation and decide what is your risk allocation. Based on the efficient frontier, you can decide your stock/bond mix

Although we have dropped from peak; we might still have some more downside. You need to ask yourself if you can still sleep at night when we drop another 20%.

Action Step: Perform the Investment Checkup in your Personal Capital account. Review the recommendations. It is fine to not act on them. But have an honest conversation with yourself.

Avoid Picking Individual Stocks

Every time there is a drop you wonder; what if this is the bottom and we have a monster rally?

What is the next Amazon I should buy?

Is Carnival cheap now and can I make a killing if they receive a bailout?

Remember, you have no edge and have the same information as a million others. Although I do pick individual stocks as part of my Moonshot portfolio; it is less than 20% of my overall Net worth. I also documented my worst investment mistakes to highlight the challenges we all face.

Not only do you have to be right with picking the right stocks; but also nail the timing. During the Great Financial Crisis, there were a number of stimulus bills for various industries from auto makers to banks to insurance firms. If you picked the wrong stocks (Eg: Lehman v/s Citi) or were early in the game; you would have lost money.

If you are dying to pick individual stocks; at least dollar cost average instead of going all in and the market moves sharply against you. This will ensure you don’t blow yourself up and if the stock drops further after buying you still have funds ready to deploy.

Action Step: Avoid trying to pick winner and loser since we might still be early in the game.

Plan Your Next Major Purchase

As the markets dips lower and you have put the above steps in place; you should be in a great position to pick up distressed income-producing assets cheaper.

Distressed assets could be an investment property or a small business. It could even be a substantial position in your favorite stock.

Start the research accordingly and run your numbers.

My friend bought a Subway franchise right after the great financial crisis. Unfortunately his numbers were only the bullish projections and the traffic to that location never returned even after the economy mended.

Action Step: Look at your investment plan and decide what changes you would like to make. If there is an asset class you would like to add; start studying it and run your numbers. Network with others who have already gone down this path and also who sold this asset class. This way you get both the pros and cons.

Summary

Although the blog is titled “how to prepare for the upcoming recession”; let us assume the worst case scenario of a depression and plan accordingly.

Readers, are there any other steps you are taking to brace for impact? What worked well for you in the last recession and what lessons did you learn?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Can you share your asset allocation before the Coronavirus and what it is now and what you plan to do?

I forget if you are retired or still working?

I’ve given up on work.

Thx

Based on your philosophy Sam, I asked to be laid off but was instead offered WFH and less workload (only supervisory). Practically getting paid for minimal work so hard to say no. Maybe this year with the recession I might be let go. Time will tell.

Asset allocation

Dec 2019 40/40/20 Real Estate/equities/Debt instruments (including alternatives)

Jan 2020 40/20/40 Real Estate/equities/Debt instruments (including alternatives)