US Rents Skyrocket 1.5 Times Faster Than Wages Over Last Four Years in Major Cities

Soaring home prices and mortgage rates make buying a home increasingly unaffordable, forcing many Americans to turn to renting instead. However, even renting has squeezed budgets, as rents in most major US metropolitan areas have surged 1.5 times faster than wages over the last four years. Nationwide, rents climbed 30.4% while incomes expanded just 20.2% from 2019 to 2023, data from StreetEasy, a Zillow subsidiary, show.

NYC Tops The Chart With Rent Increases In The Last Year

In New York City, the contrast is striking: while wages increased by just 1.2% from 2022 to 2023, rents surged more than seven times faster.

In many major metropolitan areas across the country, wages actually fell over the past year while rents kept climbing. Meanwhile, the drop in wages in metro areas like Memphis, Boston, and Chicago has exacerbated the impact of even modest rent hikes.

The widest disparities between wage growth and rent increases in the last year were seen in New York City, Boston, Cincinnati, Buffalo, and Chicago.

Florida Bears The Brunt as Migration Pushes Housing Beyond Reach for Locals

Florida markets take three of the top five spots for the largest gap between rent growth and wage growth in the last four years.

The state has become a popular destination since 2020, attracting newcomers with its year-round outdoor living and relatively affordable housing compared to many coastal areas. This influx has caused rents to skyrocket, while wages have lagged.

Even in Miami, where wage growth has slightly outpaced the national average, a more than 50% increase in rents — the highest of any US market — has created a significant disparity between residents’ income and the income needed to afford living in the area.

Homes Are Also Unaffordable

Zillow’s recent research report sheds light on the reality facing today’s homebuyers, indicating a significant shift in the financial landscape since 2020. To afford a home in the current market, individuals need to earn $47,000 more than they did four years ago, pushing the required annual income to over $106,000.

Redfin’s recent research, which delved into housing and income statistics, mirrors these findings, highlighting the widening gap between home affordability and average earnings. Their analysis reveals that the average household’s income falls short by about $30,000 of what is necessary to purchase a median-priced home in the U.S.

To afford such a home today, a buyer must earn $114,000 annually—35% more than what the typical household earns.

Spiraling Inflation Worsened the Situation

With the highest inflation in 40 years, prices of hard assets like homes increased. The Fed raised rates to tame the inflation resulting in mortgages becoming unaffordable.

Consequently, buyers who would previously buy a home continue to rent increasing the demand for rentals raising rents.

Gallup’s annual Economy and Personal Finance poll, asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

This year, the cost of owning or renting a home follows inflation as the second most pressing issue at 14%, a new high for this category.

Plans To Increase Affordability

“With house prices having gone up and now with much higher interest and mortgage rates, it’s almost impossible for first-time buyers,” U.S. Treasury Secretary Janet Yellen said during her testimony before the House Ways and Means Committee

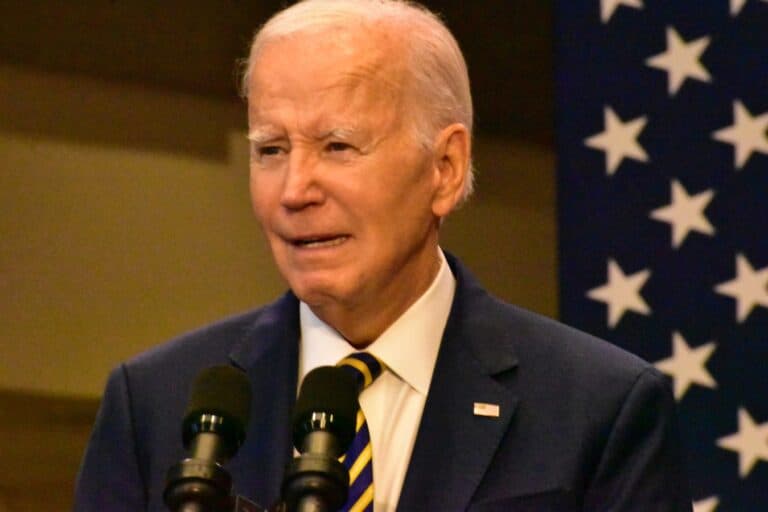

President Joe Biden has proposed a pair of tax credits to help solve the housing crisis.

The first proposed tax credit would provide $10,000 to first-time homebuyers. A separate $10,000 tax credit is proposed for homeowners who sell their “starter home” to move into a bigger house.

Americans Skipping Meals Or Medical Care To Afford Housing

A recent Redfin survey found that half of homeowners and renters are having difficulty covering their housing payments.

Around 20% of those struggling have skipped meals or worked additional hours to make ends meet, while approximately 17% have put off medical care.

A notable number of millennials, who are generally not retired, have tapped into retirement savings to manage housing expenses.

Americans Caught Between Scylla and Charybdis as Home and Rent Costs Outstrip Wages

As rents climb faster than wages, renters find themselves with little choice but to continue leasing even as their budgets tighten. Buying a home is even more out of reach due to elevated home prices and high interest rates. This situation traps many Americans in a cycle where they must pay higher rents because homeownership is simply not a feasible option. The lack of affordable alternatives creates added financial strain and uncertainty for renters.

Like Financial Freedom Countdown content? Be sure to follow us!

Exodus From California and Massachusetts to Florida and Texas Continues

2023 saw booming demand for U-Haul equipment from California, Massachusetts, Illinois, and New Jersey as citizens chose to flee the West Coast and Northeast. On the U-Haul Growth Index, which shows net losses of one-way trucks in various states that year, California, Massachusetts and Illinois ranked 50th, 49th and 48th, respectively – marking their third consecutive year at the bottom positions. But what could be causing such a mass exodus from states like California, New York, and Illinois?

Exodus From California and Massachusetts to Florida and Texas Continues

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Recent reports from prominent financial institutions like Fidelity Investments, Bank of America, and Vanguard reveal a concerning trend: an uptick in the share of retirement plan participants resorting to hardship withdrawals from their 401(k) accounts. More individuals face immediate and significant financial strains, leading them to tap into their retirement savings as a solution. This rising trend signals a worrisome pattern, shedding light on the challenges many Americans are encountering.

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Social Security Solvency Extended to 2035, Medicare Gains 5 More Years to 2036: What It Means for You

The projected depletion dates for Medicare and Social Security have been extended as reported in the annual trustees report for Social Security and Medicare released on Monday. However, officials caution that without significant policy changes, these programs may still be at risk of failing to deliver full benefits to retiring Americans.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

Three years after the landmark SECURE Act reshaped America’s retirement scene, the follow-up SECURE Act 2.0 expands access to retirement plans and perks. Key updates include mandatory enrollment in certain workplace retirement plans, higher catch-up contributions for older workers, and broader savings options for part-timers. Additionally, it enhances the ability to save for emergencies, providing quicker access when needed. This significant step forward promises to strengthen financial security for many. Here’s what you need to know about the new provisions.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.