Is Bidenomics Working? 66% Say “No” in the Latest CNN Poll

According to the most recent CNN poll released April 28, Biden’s approval ratings for the economy (34%) and inflation (29%) remain notably low.

Voters say economic issues are now more critical in selecting a candidate than in previous presidential elections. In the latest poll, 65% of registered voters deemed the economy extremely important to their presidential vote, up from 40% in early 2020.

It Is the Economy

As per the survey conducted for CNN, a large majority of Americans, 70%, perceive economic conditions in the US as poor.

Americans’ views on their personal finances remain divided, with 53% expressing dissatisfaction and 47% satisfaction.

Discontent is especially pronounced among lower-income households (67% dissatisfied), people of color (64% dissatisfied), and younger adults under 45 (61% dissatisfied).

A number of economic indicators might be responsible for the negative feelings over the economy.

Surging Household Debt

According to the Federal Reserve Bank of New York, total household debt rose by $212 billion to $17.5 trillion in the fourth quarter of 2023.

The outstanding credit card balances, currently at $1.13 trillion, increased by $50 billion, marking a 4.6% rise over the prior quarter.

Auto loan balances continued their upward trend, experiencing a $12 billion increase, and currently stand at $1.61 trillion, maintaining the trajectory observed since the second quarter of 2020.

Mortgage balances increased by $112 billion from the previous quarter, reaching $12.25 trillion at the end of 2023. Americans under financial stress have resorted to using their home equity lines of credit (HELOC), which saw an increase of $11 billion, marking the seventh consecutive quarterly rise since 2022. The aggregate outstanding HELOC balances now amount to $360 billion.

Consumer Delinquencies Rising

Credit card balances, mortgage loans, and auto loans are at record-high levels as delinquency rates for most debt types continue to climb.

On an annualized basis, about 8.5% of credit card balances and 7.7% of auto loans became delinquent. Serious credit card delinquencies increased across all age groups, particularly among younger borrowers, surpassing pre-pandemic levels.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

Since consumer spending is a critical component of the U.S. Gross Domestic Product, an uptick in delinquency rates as individuals attempt to manage debt payments with fewer financial resources could prove disastrous.

Low Personal Savings Rate

The personal saving rate, often termed as the percentage of personal saving to disposable personal income (DPI), is derived by calculating the ratio between personal saving and DPI. Personal saving represents the portion of personal income available after deducting living expenses and taxes.

As of March 2024, the Personal Savings Rate stands at 3.2%, one of the lowest savings rates on record and 2% lower than a year ago.

The January and February 2024 inflation data came in higher than expected adding further pressure to household budgets.

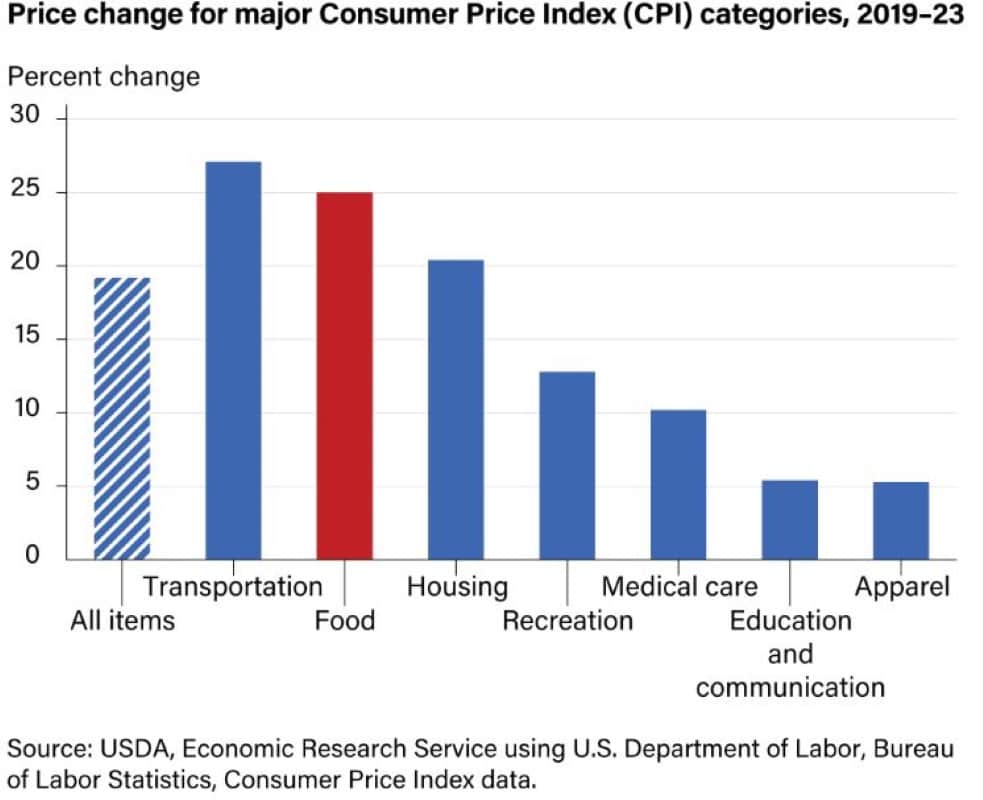

Surging Transportation, Food and Housing Costs Crushing Americans

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period as per USDA data.

While food prices saw a rise lower than the 27.1 percent increase in transportation costs, they outpaced the upticks in housing, medical care, and all other primary categories.

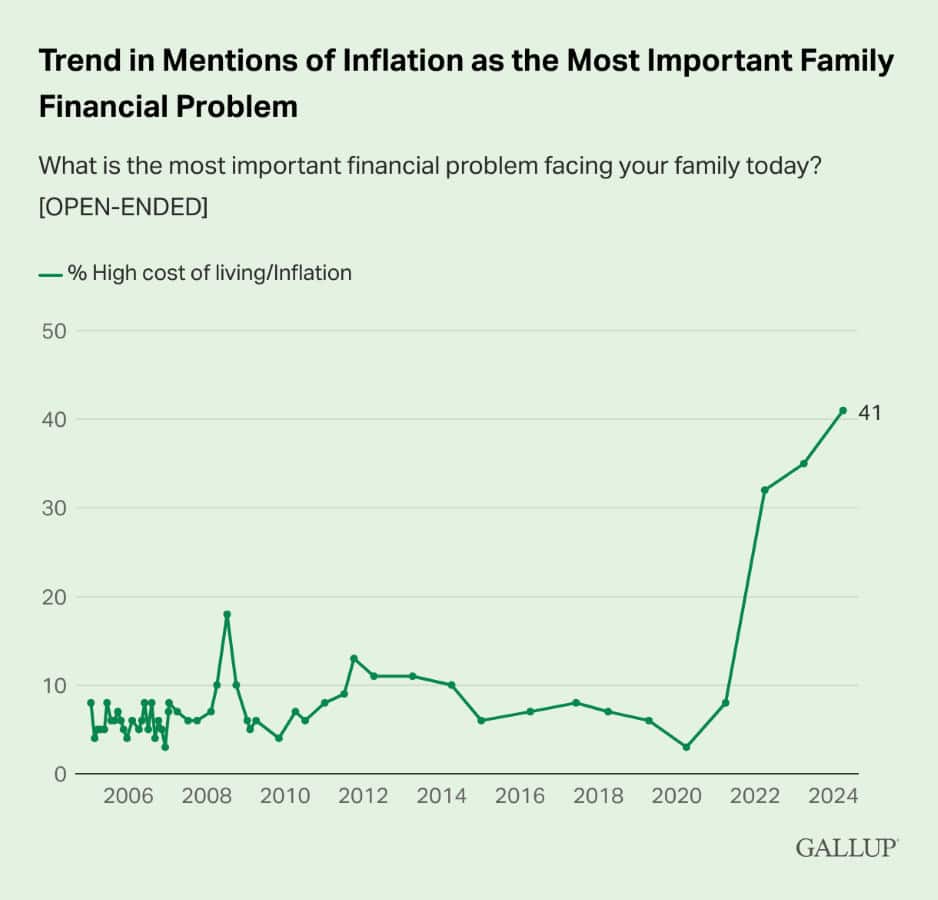

Inflation Top Concern As Per Gallup Poll

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak. This year, 41% cite the issue, a slight increase from 35% last year.

The latest findings come from Gallup’s annual Economy and Personal Finance poll, conducted between April 1 and 22, 2024. Since 2005, Gallup has asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

Federal Reserve Needs More Data That Inflation Has Been Tamed

After experiencing a steady decline in the latter half of the previous year, inflation has not shown significant improvement in the first quarter of this year.

The committee said in its latest policy statement that “in recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

On Tuesday, Neel Kashkari, president of the Minneapolis Federal Reserve, said “I think it’s much more likely we would just sit here for longer than we expect or the public expects right now until we see what effect our monetary policy is having,”

Speaking at the Milken Institute conference in Los Angeles Kashkari stated that interest rates are likely to remain at their current levels for a “extended period.” He also mentioned that an increase could be possible if inflation hovers around 3%.

“That’s not my most likely scenario, but I also can’t rule it out,” he said, adding, “I think the bar for us raising is quite high but it’s not infinite. There is a limit when we say, ‘OK, we need to do more.'”

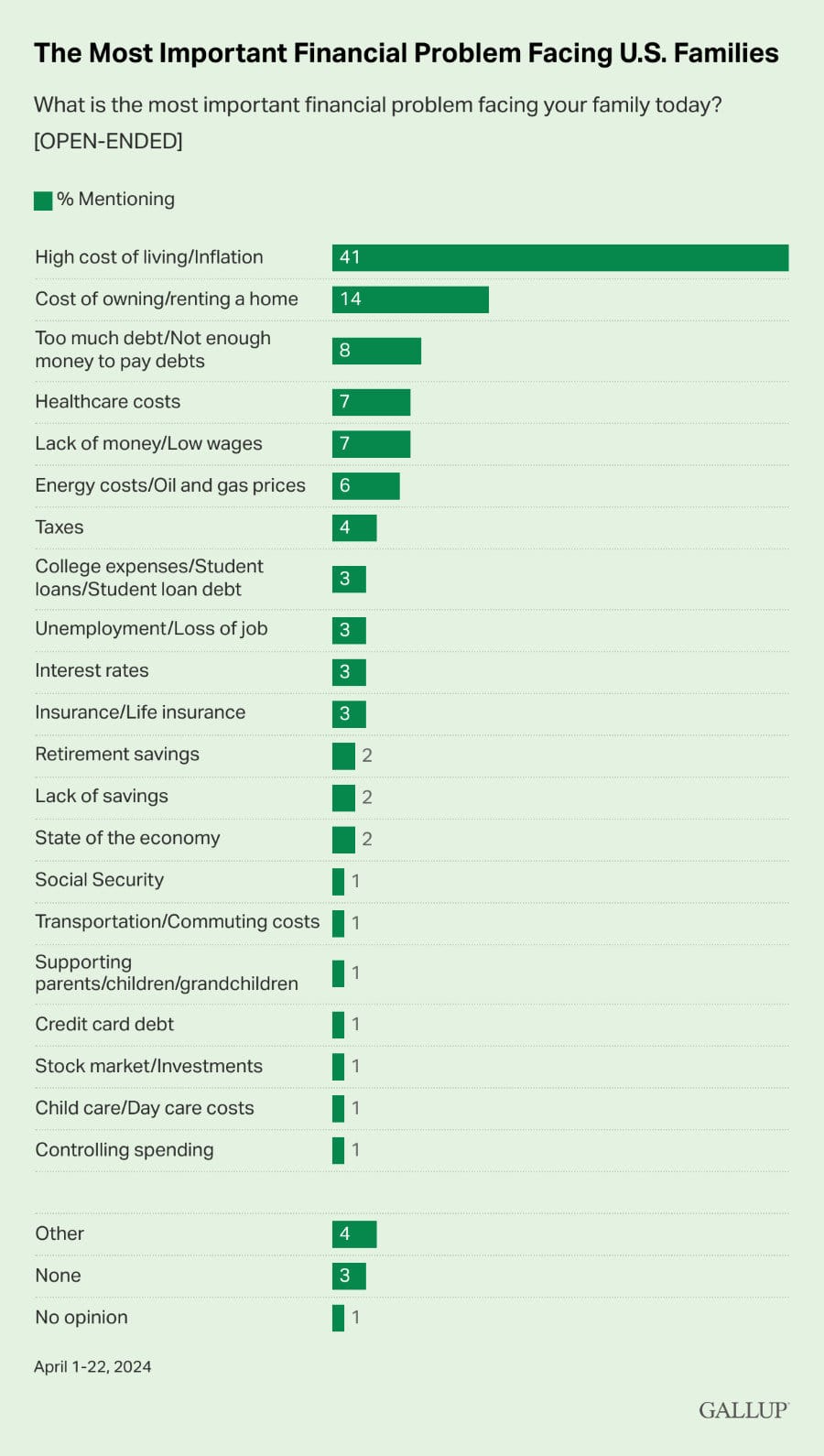

Other Financial Problems Mentioned

This year, the cost of owning or renting a home follows inflation as the second most pressing issue at 14%, a new high for this category.

Other major concerns Americans mention include excessive debt (8%), healthcare expenses (7%), low wages or lack of funds (7%), and energy costs or gas prices (6%).

The increase in cost of owing and renting homes has crushed average Americans.

Zillow’s recent research report sheds light on the reality facing today’s homebuyers, indicating a significant shift in the financial landscape since 2020. To afford a home in the current market, individuals need to earn $47,000 more than they did four years ago, pushing the required annual income to over $106,000.

Redfin’s recent research, which delved into housing and income statistics, mirrors these findings, highlighting the widening gap between home affordability and average earnings. Their analysis reveals that the average household’s income falls short by about $30,000 of what is necessary to purchase a median-priced home in the U.S.

To afford such a home today, a buyer must earn $114,000 annually—35% more than what the typical household earns.

A recent Redfin survey found that half of homeowners and renters are having difficulty covering their housing payments. Around 20% of those struggling have skipped meals or worked additional hours to make ends meet, while approximately 17% have put off medical care. A notable number of millennials, who are generally not retired, have tapped into retirement savings to manage housing expenses.

Treasury Secretary Janet Yellen Says It’s ‘Almost Impossible’ For First-Time Homebuyers

“With house prices having gone up and now with much higher interest and mortgage rates, it’s almost impossible for first-time buyers,” U.S. Treasury Secretary Janet Yellen said during her testimony before the House Ways and Means Committee

President Joe Biden has proposed a pair of tax credits to help solve the housing crisis. The first proposed tax credit would provide $10,000 to first-time homebuyers. A separate $10,000 tax credit is proposed for homeowners who sell their “starter home” to move into a bigger house.

Stagflations Concerns Rise

JPMorgan Chase CEO Jamie Dimon expresses hope that the Federal Reserve can lower inflation without triggering a recession, but he doesn’t dismiss the potential for more serious outcomes like stagflation.

Stagflation is an economic condition characterized by a simultaneous occurrence of stagnant economic growth, high unemployment, and high inflation.

The latest numbers show GDP growth fell from 3.4% to 1.6% and Personal Consumption Expenditure (PCE) inflation jumped for the last 2 months which indicate slowing growth and inflation ticking higher.

Fed Chairman Jerome Powell was forced to confront the topic of stagflation at his recent press conference. Powell rebuked stagflation fears at the Federal Open Market Committee (FOMC) press conference on Wednesday, saying that he doesn’t see the “stag” or the “-flation” in economic data that investors are worried about.

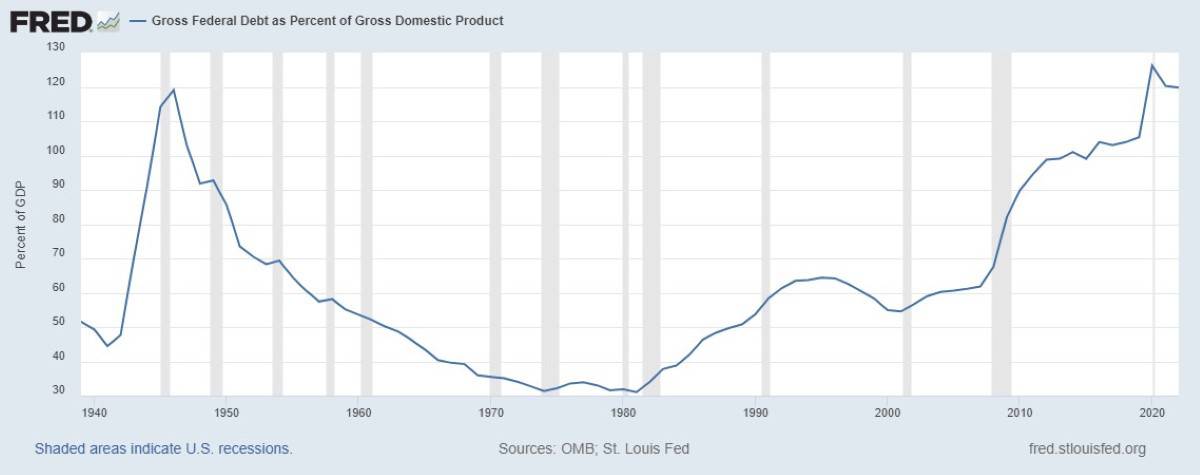

Unsustainable Federal Debt Levels

The Gross Federal Debt Levels are at an all-time high as per the FRED Economic Data.

The Penn Wharton Budget Model projects that financial markets may struggle under the accumulated deficits forecasted under the existing U.S. fiscal policy. Financial markets anticipate that forthcoming fiscal policies will implement significant corrective measures in advance. However, if financial markets were to lose confidence in this scenario, the debt dynamics could quickly become unsustainable and potentially unravel sooner than expected.

Fed Chairman Jerome Powell has said it is past time to have an “adult conversation about fiscal responsibility.”

The debt-to-GDP ratio is currently around 121.6%, and politicians are not showing any sign of slowing spending.

Interest On Debt Unsustainable

Year-to-date, interest on Treasury debt exceeds $357 billion, showing a 37% increase from the same time previous year. It surpasses military spending and rivals only Social Security Administration or the Department of Health and Human Services. By year-end, the interest on the debt is projected to reach $1.1 trillion.

The US National Debt began the year at $34 trillion and surged to $34.47 trillion by the end of February, piling on $470 billion in merely two months.

With the debt continually compounding, it’s on a trajectory to swell by $1 trillion every roughly 100 days.

At this rate of borrowing, the National Debt is projected to balloon by $2.8 trillion over the course of this year.

More Taxes Or Print Money

Higher debt must be financed with higher taxes or more money creation. Raising taxes might prove difficult, but the alternative of printing more money could result in rampant inflation. Americans have suffered in the past two years as inflation has made everyday necessities more expensive. Although the pace of price increases has slowed, food and gas prices are still higher than in the past.

Americans Bracing for Higher Taxes

Warren Buffet says taxes could rise to offset the widening US deficit.

At Berkshire Hathaway’s 2024 annual shareholder meeting in Omaha he said, “I think higher taxes are likely. They may decide that some day they don’t want the fiscal deficit to be this large because that has some important consequences. So they may not want to decrease spending and they may decide they’ll take a larger percentage of what we own, and we’ll pay it”.

As the clock ticks towards 2025, pivotal components of the Tax Cuts and Jobs Act (TCJA) initiated by President Trump are poised to expire.

Previously, there were seven tax brackets with respective rates of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Under the TCJA, these were adjusted to rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%, resulting in a reduction of taxes for the majority of taxpayers.

The TCJA revised the tax structure by reducing tax rates across various income brackets and modifying the income ranges associated with each tax bracket.

With no extension in sight, tax rates are expected to go reset higher.

Cuts to Social Programs

If taxes won’t be raised the other option is cuts to existing social programs.

So far, government spending has been financed by selling U.S. debt to foreign nations. America’s ability to pay its debt is a concern for nations worldwide, which own around $7.6 trillion of our debt. Japan and China are the top two countries holding U.S. debt. Both countries have been reducing their holdings of U.S. Treasuries.

If the U.S. government can no longer find buyers for its $1.7 trillion annual debt, significant cuts must be imposed on social programs.

Based on the latest Social Security Trustees’ Report, Social Security will be insolvent by 2035 and Medicare by 2036.

Is the Gloomy Outlook Accurate?

The economic indicators paint a challenging narrative for the current financial landscape.

From the ominous signs of an inverted yield curve, historically a herald of impending recession, to the mounting household debt, surging delinquency rates, and concerning federal debt levels, the economic stage appears set for potential turbulence. As we navigate these indicators, it becomes apparent that the need for prudent fiscal measures is more crucial than ever.

The looming questions about addressing these economic challenges, whether through tax hikes or increased money creation, cast a shadow over the future. As policymakers grapple with these dilemmas, the potential repercussions, including cuts to social programs, hang in the balance, emphasizing the urgency of a thoughtful and strategic approach to navigating the uncertain economic terrain ahead.

The CNN poll conducted by SSRS from April 18-23 among a random national sample shows Americans are unhappy with the economy.

Besides the CNN poll, the latest Gallup poll does not bode well for Biden.

During the thirteenth quarter of his presidency, Biden’s average approval rating dropped to 38.7%, marking a historic new low and surpassing George H.W. Bush’s previous record low of 41.8%. Biden’s rating also fell below the averages of his two predecessors: Donald Trump, who averaged 46.8%, and Barack Obama, who averaged 45.9% during the same period of their first terms.

Biden is the least popular president in 70 years — below even Nixon and Carter.

Over 67% of respondents in the Gallup Economic Confidence Survey said the economic outlook is getting worse.

The decline in economic confidence was across all political groups, with Republicans and independents experiencing a more pronounced drop than Democrats.

Democrats have consistently been the most optimistic about the economy among the three party groups since Biden took office. However, their current Economic Confidence Index (ECI) score fell from 35 in March to 31 in April.

Republicans have largely held a negative perception of the economy during Biden’s term, and their April assessment worsened from -62 in March to -71, though this is an improvement from their -77 score in November.

Independents’ ECI score of -38 marks a 10-point drop since last month.

Axios reported that House Democrats are ditching the “Bidenomics” messaging. One of the reasons cited was that voters were far more likely to say they trust former President Trump over Biden on the economy in a NYT/Siena poll in battleground states.

Like Financial Freedom Countdown content? Be sure to follow us!

Exodus From California and Massachusetts to Florida and Texas Continues

2023 saw booming demand for U-Haul equipment from California, Massachusetts, Illinois, and New Jersey as citizens chose to flee the West Coast and Northeast. On the U-Haul Growth Index, which shows net losses of one-way trucks in various states that year, California, Massachusetts and Illinois ranked 50th, 49th and 48th, respectively – marking their third consecutive year at the bottom positions. But what could be causing such a mass exodus from states like California, New York, and Illinois?

Exodus From California and Massachusetts to Florida and Texas Continues

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Recent reports from prominent financial institutions like Fidelity Investments, Bank of America, and Vanguard reveal a concerning trend: an uptick in the share of retirement plan participants resorting to hardship withdrawals from their 401(k) accounts. More individuals face immediate and significant financial strains, leading them to tap into their retirement savings as a solution. This rising trend signals a worrisome pattern, shedding light on the challenges many Americans are encountering.

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Social Security Solvency Extended to 2035, Medicare Gains 5 More Years to 2036: What It Means for You

The projected depletion dates for Medicare and Social Security have been extended as reported in the annual trustees report for Social Security and Medicare released on Monday. However, officials caution that without significant policy changes, these programs may still be at risk of failing to deliver full benefits to retiring Americans.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

Three years after the landmark SECURE Act reshaped America’s retirement scene, the follow-up SECURE Act 2.0 expands access to retirement plans and perks. Key updates include mandatory enrollment in certain workplace retirement plans, higher catch-up contributions for older workers, and broader savings options for part-timers. Additionally, it enhances the ability to save for emergencies, providing quicker access when needed. This significant step forward promises to strengthen financial security for many. Here’s what you need to know about the new provisions.

Understanding How SECURE Act 2.0 Affects Your Retirement Plan

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.