Find Out Which U.S. Cities Offer Renters the Most Bang for Their Buck

In an era where the dream of homeownership seems more elusive than ever, a growing number of Americans are navigating the rental market in search of affordability without sacrificing quality of life. Amidst this landscape, the quest for cities that promise not only higher earnings but also manageable living costs has become paramount. Fortunately, there’s a silver lining. A new report from RentCafe.com breaks down where your rental dollar goes further. Dive into our list of the top 10 cities that offer renters the most value for their money.

1. Sunnyvale, CA

Sunnyvale, CA, emerged as the premier location for renters to find an ideal equilibrium between their earnings and outgoings (encompassing monthly rent and essential living costs). Situated at the core of Silicon Valley, this city offered the highest salaries in the nation, three times the median U.S. income. Once known for its orchards, Sunnyvale, CA, now stands as a pivotal Silicon Valley city, where renters with an average yearly income of around $146,000 receive exceptional value for their money. The median salary here was threefold the U.S. median, and although the monthly rent of $3,000 was 76% above the national average, the cost of basic needs was only 28% higher than the country’s average, making it the optimal spot for renters seeking value.

2. Surprise, AZ

Surprise, AZ, part of the Phoenix metropolitan area, secured the second spot on the list. Here, renters benefit from the seventh highest median yearly income nationwide, with average rental costs aligning with the national standard. Specifically, renters in Surprise earn around $86,000 annually and face an average monthly rent of $1,781. Furthermore, the cost for basic utilities, essential groceries, medical consultations, and other vital products and services is approximately $1,004 per month, falling below the national average.

3. Arlington, VA

Arlington, VA, positioned just across the Potomac River from Washington D.C., ranked third on the list of U.S. cities where renters can maximize their earnings. In Arlington, the annual income of $102,710 enables residents to comfortably afford the average monthly rent, which is nearly $2,500, along with additional monthly costs for essential needs totaling $1,152 — an amount that aligns closely with the national average.

4. Bethesda, MD

Bethesda, MD, a suburb of Washington, D.C., claimed the fourth position. In this city, an annual income of $99,315 — ranking fourth highest across the 189 U.S. cities analyzed in the report — supports renters in covering an average monthly rent of $2,684 and essential living costs of $1,093, aligning with the national average. Notably, utilities, including energy and phone bills, accounted for almost half of the total expenses for basic needs in Bethesda, amounting to $404.

5. Alexandria, VA

Alexandria, VA, another suburb of Washington, D.C., was close behind, ranking fifth. Sharing an economic profile with other cities around the nation’s capital — characterized by federal agencies, corporate headquarters, and tourism — Alexandria stood out as one of the top cities for renters to find a balance between their earnings and spending. The city boasts the sixth-highest annual income in the study, at $89,845, sufficient to manage the monthly rent of $2,068 and the overall cost of essential needs, which amounts to $1,174.

6. Westminster, CO

Westminster, CO, a suburb of Denver, secured the sixth spot on the list for cities where renters can stretch their salaries the furthest. Here, the median annual income stands at $75,841, allowing renters to comfortably afford the slightly below-average monthly rent of $1,864 and essential living costs that remain under the $1,000 mark. With basic necessities priced at $941 per month, Westminster offers one of the lowest costs for essential items and services nationwide. The main advantages of renting in Westminster include affordability and convenient access across the Denver metropolitan area.

7. Scottsdale, AZ

Returning to the Phoenix metropolitan area, Scottsdale, AZ, claimed the seventh position in the top 30 rankings. In Scottsdale, renters have the advantage of a median annual income of $82,865 — ranking as the eighth highest in the U.S. — with the cost of essential items and services averaging $1,087 monthly, aligning with the national average. This setup allows a smaller portion of income to be dedicated to expenses, facilitating a higher quality of living for renters. Additionally, the monthly rent in Scottsdale was slightly over the $2,000 mark, at $2,084.

8. Round Rock, TX

In Round Rock, TX, renters benefit from convenient access to Austin, a leading tech hub in the nation, along with an average monthly rent that falls below the national average, at $1,574. The annual income in Round Rock is approximately $68,517, which is 39% above the standard, while the cost for essential needs—including utilities, groceries, healthcare, transportation, and various goods and services—is modestly below the average, at $1,058.

9. Plano, TX

In another Texan locale, Plano secured the ninth spot by achieving a positive equilibrium between renters’ income and the cost of essential needs. The monthly rent closely approached the national average, standing at $1,786, while basic living expenses slightly exceeded the average, totaling $1,204. Despite this, the annual income in Plano reached $76,824, ranking as the 11th highest in the country, thereby facilitating renters in maintaining their financial well-being.

10. Broken Arrow, OK

When it comes to affordability, Broken Arrow, OK, stands out as a fantastic location where renters can make their dollars go a long way. This Tulsa suburb secured the tenth position on the list, as the median income here is sufficient to cover four monthly rents. In fact, among the 189 cities scrutinized, only Conway, AR, and Lawton, OK, outperformed Broken Arrow in terms of financial metrics. With an annual income of $54,594, Broken Arrow easily covers the below-average monthly rent and the cost of basic living expenses, providing renters with enhanced financial comfort.

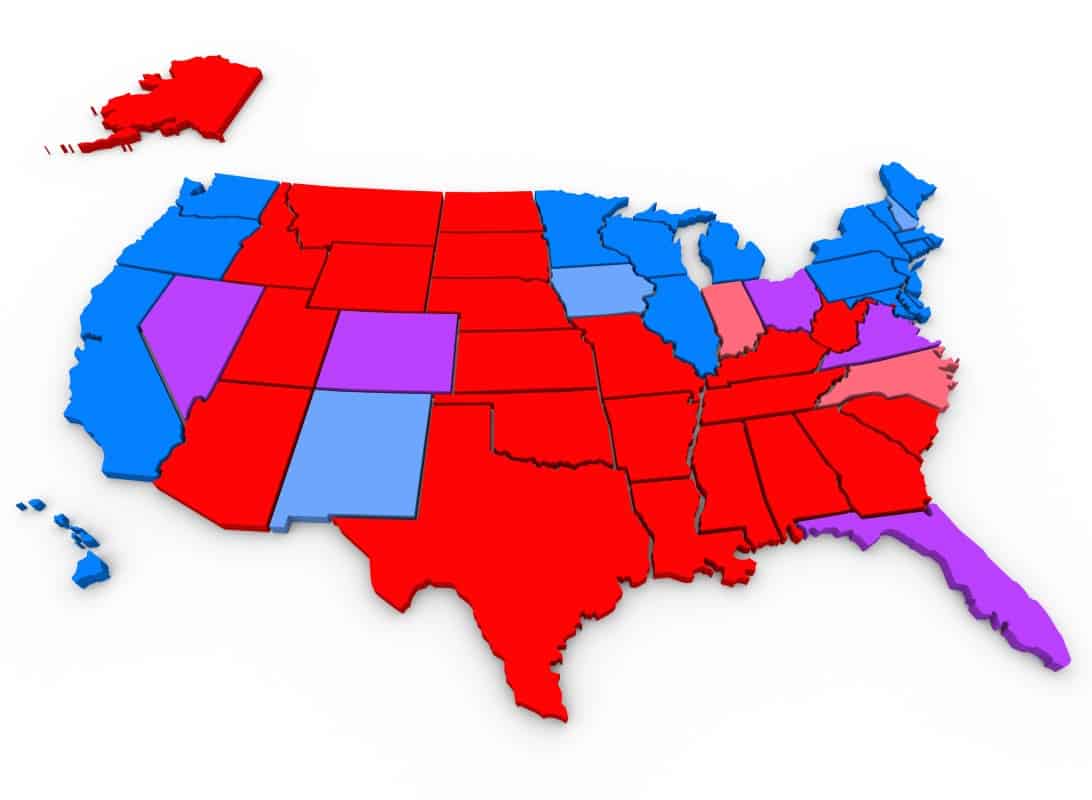

Southwestern Renters Get the Ultimate Bang for Their Buck

In the Southwest suburbs, renters enjoy a financial advantage by allocating a smaller share of their income towards rent, basic necessities, and groceries. Specifically, salaries surpass the norm, while rental costs remain close to or below the national benchmark. With the region boasting the highest average total score of 40.9 points, it signifies that achieving financial stability is more attainable for renters in these suburban locations.

Contrastingly, the Northeast presents a different picture, featuring the lowest average score just under 20 points. This suggests that renters in these cities are likely to allocate a larger proportion of their earnings towards expenses.

Leading the pack in the Southwest are cities like Round Rock (#8), Plano (#9), and Broken Arrow (#10), offering renters enhanced financial comfort. Followed closely are Cedar Park, TX (#12); Lawton, OK (#15); Austin (#16); Allen, TX (#19); and Tulsa, OK (#25), all providing optimal conditions for renters to make the most out of their income.

Mountain Region Ranks Second for Renters

The Mountain region was the second best for renters trying to balance between salary and living expenses.

Alongside Surprise (#2), Westminster (#6), and Scottsdale (#7) in the top 10 cities where renters maximize value, explore other Mountain gems like Denver (#29), Phoenix (#34), Colorado Springs, CO (#41), Las Vegas (#67), and Reno, NV (#76), where rent and basic necessities won’t weigh heavily on your wallet!

Denver secured the 29th position on the list, attributed to an annual income nearing $65,000, a monthly rent just under the $2,000 mark, and prices for utilities, essential groceries, and services lower than the national average. On the other hand, Phoenix, ranking slightly lower with an annual income of $54,852, had renters benefiting from a monthly rent below the national benchmark, along with even more affordable basic utilities and services compared to Denver.

Technology Salaries Dominate the West Coast

Sunnyvale (#1), San Francisco (#13), and San Jose (#17) emerged as the top three cities in the Pacific region, where renters could maximize the value of their income. Unsurprisingly, Sunnyvale and San Francisco boasted the highest median incomes among all 189 cities analyzed for this report. Meanwhile, San Jose was not to be outdone, securing a spot at the top with the fifth-highest annual income, reaching $92,952.

Regional Variations Across the Country

Texas leads in terms of number of cities where income and rent match, with Round Rock ranking highest at #8. Since Texas has been the consistent beneficiary of states losing population, it should not be a surprise.

Suburban areas in the Southwest has renters allocating a smaller share of their income to rent and basic necessities. The Southeast dominates with the most cities in the top 30. In the Northeast, Pittsburgh emerges as the leading city, where renters can make their dollars go the furthest.

Considering the stocks market investments are at an all-time-high on account of large technology companies, the higher than average net worth of renters in Silicon Valley can compensate for the astronomical rent.

Although every region might not be affordable, there are cities in every area where renters can have the best balance in terms of income and living expenses.

Like Financial Freedom Countdown content? Be sure to follow us!

Retirement Millionaires? How Much Money Americans Have in Their 401(k)

The latest Fidelity retirement study shows that the number of retirement millionaires jumped in the second quarter of 2023. There was a 10% increase in individuals holding 401(k) accounts, with over a million compared to the previous quarter. However, the average American has a significantly smaller 401(k) account balance.

Retirement Millionaires? How Much Money Americans Have in Their 401(k)

Escape the Rat Race: Focusing on the Two Key Numbers for Financial Independence

You want to retire, but it seems too far away. Most people can’t quit until they hit a specific number in their bank account. But every financial calculator spits out generic numbers. Discovering the road to financial independence starts with understanding just two crucial numbers. Let us delve into the key metrics of retirement expenses and safe withdrawal rate, and how you can calculate it for your lifestyle.

Escape the Rat Race: Focusing on the Two Key Numbers for Financial Independence

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.