Average Net Worth By Age: How Does It Compare With Others?

Worried about your financial future? You’re not alone. We’ve compiled data from the latest Federal Reserve Survey and broken it down into easy-to-read graphs and charts.

You may be surprised that most people don’t reach their peak net worth until they hit their late 60s! But don’t worry – there are plenty of things you can do to increase your net worth today.

Check to see how you stack up against the average net worth by age and for tips on how to grow your wealth.

Average vs. Median With Examples

First, it’s essential to understand that the answer to your net worth by age may vary dramatically, depending on whether you are trying to answer this question using the average or median.

From a mathematical perspective, the term “average net worth” refers to the total sum of every individual net worth divided by the total number of individuals. Average is also defined as mean or arithmetic mean

The overall median net worth grabs the middle observation. In other words, if 100 people were surveyed, the median would be the value of the 50th number.

To better understand average net worth vs. median net worth, let us consider five individuals with a net worth of $100K, $100K, $200K, $300K, and $900K.

The average net worth = ((100K+100K+200K+300K+900K)/5) = $320K

However, median net worth is the middle value after all numbers are arranged in ascending order. So, in this case, the median net worth is $200K

Why does this matter? Average net worth is more likely to be skewed by extremely high or low numbers, while median observation may provide a more accurate representation of the true “middle.”

The average net worth is more likely to skew when there are extreme values in a sample.

How Is Your Net Worth Calculated?

It may seem complicated, but it’s not. Your net worth is the summary of all your assets minus your liabilities.

Total assets include things like:

- Value in your bank accounts, savings accounts, and emergency fund, including interest-bearing accounts like I-Bonds.

- The total value of brokerage accounts used for investing in stocks.

- Any retirement accounts through work, including 401 (k) and deferred compensation plan. Retirement accounts outside of work include IRAs, Roth IRAs, and even your Crypto IRAs.

- Life insurance policies, including the overall policy coverage and how much you may have saved within a life insurance account

- Collectibles such as art investments, vintage cars, watches, stamps, coins, gold, and luxury goods.

- Accounts used for investing in cryptocurrency, including NFTs and DeFi.

- Value of any real estate investments such as real estate crowdfunding, REITs, mortgage notes, and home equity

- Valuation of your business ventures, including online business or equity in the crowdfunded company.

All your liabilities include:

- Long-term debt, such as a mortgage, auto loan, medical debt, or student loan debt.

- Liens against your property.

- Short-term debt, like credit card debt, vehicle loans, installment loans for consumer purchases, or other loans.

You can always find a net worth calculator to help you make sense of this calculation. I use Personal Capital to link all my accounts which provides a great tracker of my liquid net worth changes over a period. You can read my Personal Capital review and why I use this free software for everything from budget templates to retirement calculators.

Why Is Net Worth Important?

Determining the overall monetary value of your total assets and liabilities can be very useful for figuring out your financial position. As you can imagine, the value of your net worth is constantly changing from one day to the next. You will never have a complete, comprehensive idea of exactly how much money you have.

However, your net worth can help you determine your overall financial health and is the cornerstone of personal finance. Figuring out your net worth – and comparing it to your age group’s average net worth or median worth – can help you benchmark your total financial performance against similarly situated people in your age bracket.

Of course, how your net worth is calculated does not tell the whole story. Someone with many assets and liabilities may be worse financially than someone without them, mainly if those liabilities grow and assets shrink. Furthermore, net worth may not be the most accurate money indicator in a bad financial environment.

However, it can help track your cash, investment success, etc. It is not a guarantee of future net worth, of course. As the old saying goes, past performance is not indicative of future success. However, it can be a good snapshot in time that can help you understand how much money you have and how you are doing in terms of meeting overall financial goals.

The Federal Reserve released in September 2020 its last Survey of Consumer Finance results. As such, it can be a valuable metric.

Average Net Worth by Age

Based on the survey, here’s a look at net worth by age.

| Age | Median net worth | Average net worth |

|---|---|---|

| Less than 35 | $13,900 | $76,300 |

| 35 – 44 | $91,300 | $436,200 |

| 45 – 54 | $168,600 | $833,200 |

| 55 – 64 | $212,500 | $1,175,900 |

| 65 – 74 | $266,400 | $1,217,700 |

| 75 or more | $254,800 | $977,600 |

Net Worth in Your 20s

According to an annual survey conducted by the Federal Reserve Board, your average net worth in your 20s is likely to be low – and maybe even negative net worth, thanks to loans and other forms of debt. Until you are 35, the median net worth is $13,900. The average net worth is $76,300.

These relatively low numbers make sense, of course. Many people in their 20s are just starting with living independently, opening savings accounts, finding the financial products that suit their needs, and taking the basic steps necessary to increase their net worth and pay down their debt.

Fortunately, if you want to increase your net worth, there are many things you can do when you first start your financial career. It includes:

- Start an emergency fund. It should be 3-6 months of necessary expenses that will allow you to pay a sudden and unexpected cost or live for some time if you become unemployed and lose all of your income. An emergency fund should be relatively liquid and kept in a form that you can easily convert to cash, such as a savings account or a money market account.

- You may not be able to afford to purchase any significant assets until you are older, which is both healthy and normal. Instead, concentrate on building an emergency expense and savings for these important asset purchases, like a car or a house.

- Begin the process of paying down your debt, particularly your student loans. The average American graduates with tens of thousands of dollars in student debt, and there is no question that this can be a massive drag on your overall net worth. Do what you can to repay this debt, including exploring income-sensitive repayment options and creating a debt-repayment method that works for your financial situation. If you have Student Loan debt, check Credible to refinance federal, private, and ParentPLUS loans. Compare prequalified rates from multiple vetted lenders in 2 minutes. Checking rates won’t affect your credit score.

- Ensure that you have enough money to cover all of your living expenses.

- Concentrate on improving your income by having a steady job that can help you build your net worth. Improving human capital is the best asset in your 20s.

- Learn about real estate investing. There are several ways to invest in real estate with little or no money. You might not have sufficient funds to buy rentals, but you can use your sweat equity for house flipping or wholesaling houses.

- Since you do not have the capital to buy rental properties, one option could be crowdfunding platforms like Fundrise, which provide passive real estate income opportunities with low minimums of only $10.

- Keep your credit card debt to a minimum.

- Plan to improve your credit score to get lower rates as you are ready to move to the next stage of your life. The FTC enables you to order one annual free credit report from each credit bureau – Equifax, Experian, and TransUnion.

- Credit Karma partners with Equifax and TransUnion and offers free credit reports and free credit scores updated weekly. It also provides alerts when it detects unusual activity on your credit files.

- You can also sign up with Transunion for additional monitoring and peace of mind.

Net Worth in Your 30s

When it comes to your net worth by age, your 30s is when the amount of money you have begins to increase. According to the survey cited earlier, the median net worth of someone between 35 and 44 is $91,300, while the average net worth is $436,200. As you can tell, both of these average net worths represent significant growth over where the numbers were in the last net worth by age bracket.

When it comes to your 30s, this can be when you begin to increase your net worth. You know you are on the right track if you can pay down your debt, save for retirement, have a healthy emergency account, and concentrate on accumulating wealth.

Increasing your net worth means saving for the future and planning for what happens when you retire. As such, you should:

- If you own a home, pay your mortgage payments on time, allowing you to build as much home equity as possible. You can use your home equity to increase your net worth and potential for personal capital. In case of an emergency, you can always do a cash-out refinancing.

- Speak with a financial professional, and begin to invest in the stock market. The stock market can be a great way to grow your savings accounts and ensure that you are raising your personal capital. Besides value investing, also look at growth stocks. Consider adding some high-risk plays with moonshot companies.

- Create a diversified portfolio. Based on your risk profile, add other assets not related to stocks. Learn about investing in art or investing in cryptocurrency.

- If you are bullish on crypto, dip your toes into DeFi and Metaverse crypto. Or you could invest in a crypto IRA with tried and tested large-cap coins.

- As your income increases, taxes will take a significant chunk of your net worth, so you should employ appropriate tax planning strategies. Besides focusing on asset allocation and diversification, also consider asset location.

- Continue to expand your overall savings and emergency fund by finding more ways to make your money work for you by identifying a high yield savings account. It will allow the power of compound interest to grow your personal capital.

- Use the real estate knowledge gained in your 20s to buy rental properties. Learn how to evaluate rental properties. You can also use the BRRR method for an extra boost to increase your average net worth.

- Minimize your personal loans and total liabilities to increase your saving rate. You can have all the assets in the world, but if your liabilities continue to rise, you will be cash poor and unable to get ahead of your financial situation. The Federal Reserve has lowered interest rates across the board. Make sure you take advantage of it.

- If you have been paying higher interest on credit cards, car financing, etc., check out personal loan rates from up to 10 vetted lenders in 2 minutes on Credible to refinance for lower rates.

Net Worth in Your 40s

Your net worth by age will begin to increase during this period. According to survey data, the median net worth of someone between 45 and 54 is $168,600, while the average net worth is $833,200.

This rapid increase makes sense as you consider how average net worth improves. The best way to allow someone’s average net worth to increase is simply money and time. When one considers mathematical properties like the impacts of investment growth and compounding interest, it makes sense that average net worth will increase as someone gets older. That is what is happening here.

- Retirement will become a more and more pressing concern during this time, and you could be looking at leaving the workforce within the next 20-30 years. You want to make sure that you are maxing out investments into your retirement accounts, such as your 401k. It is possible to retire early with 401(k).

- If all is going well, you will be making a higher income than at any previous point in your career. It may enable you to accumulate more valuable assets. You will want to ensure that you can keep your total liability to a minimum.

- It would be best to meet the accredited investor qualifications with higher income and net worth. Additional investment opportunities such as crowdfunded real estate or farmland investing should now be available.

- If you are not located in one of the best states for real estate investors, consider long-distance real estate investing.

- It would help if you also met regularly with a financial professional to discuss financial goals and retirement plans. These meetings can ensure that your financial decisions align with what you seek to accomplish as you get older, regardless of whether you come from poor or affluent households.

Net Worth in Your 50s

Your net worth in your 50s will hopefully continue to accelerate as you place more and more money into savings and various investment accounts. At the same time, your finances will have hopefully stabilized to the point that building wealth will be more of a priority than managing your living expenses. Hopefully, you will have minimal debt and may have even paid off your mortgage and auto loans.

According to survey data, the median net worth between 55 and 64 is $212,500. The average net worth is much higher, breaking $1,175,000.

These are very high numbers, and they should put you on the path to ensure that you are getting ready for retirement. You are certainly wondering “when can I retire” and reading every article on “how to retire early.” However, you aren’t there yet!

You want to execute the appropriate strategies and tactics that will provide you with a sound retirement.

- First and foremost, you should be working to maximize your savings options. It includes making sure you have a healthy emergency fund and savings account, maximum contribution to your 401k limits, and any other retirement accounts that you can fund.

- You want to minimize your debt and liabilities. However, saving may take precedence at this point in your life. As such, be careful about what debts you pay down. Make sure that any obligations you pay down will not come at the expense of contributions to your retirement accounts. Furthermore, plot out your debt. Make sure that your total liabilities will be manageable, even as you approach retirement.

- Consider passive income ideas. You can establish a steady stream of income by investing some effort initially.

- Finally, consider your overall investment goals and strategies. Younger individuals are encouraged to take more risks with their investments. Even if something goes wrong, their longer timeframe ensures that they will have the chance to make up for any potential investment losses. However, if you’re in your 50s, time is no longer a luxury that you can afford for your retirement savings. Make sure you are investing with an eye on the future. It means balancing risk with rewards and leaning more heavily towards conservative investments than you had done in the past.

- Leverage your real estate knowledge to get started with real estate syndication.

Net Worth in Your 60s

If things are going your way, you should be in the best financial shape of your life. Between 65 and 74, the median net worth is $266,400. The average net worth is $1,217,000.

Your 60s is when you may begin to draw upon your retirement accounts to survive. It may occur as you retire from your job or need to use your savings for medical expenses. Your net worth strategy will no longer focus on growth but income preservation. It means that, as you get older, the average net worth of a person will shrink. It makes sense, of course, as someone is drawing down on their retirement savings, thus decreasing their net worth by age.

When it comes to your 60s, you may no longer be interested in increasing your net worth instead of becoming more focused on making your money last as long as you can. It means that you should take the following steps:

- Shift your investment portfolio to a complete income preservation orientation, ensuring that you minimize risk and focus on saving money, not risking investment losses.

- Your retirement account should be at the highest level.

- You should be close to paying down your home mortgage.

- Slow down or stop contributions to your investment accounts, and instead concentrate on minimizing your expenses and tax burden.

- At this stage, you should ideally not have any personal loans.

Net Worth in Your 70s

It is time to enjoy your retired lifestyle.

Indeed, in terms of net worth by age, the number begins to decline when someone hits their 70s. According to the recent data collected from the Federal Reserve survey, net worth decreases when a person hits 75 or older: Median net worth becomes $254,800, and average net worth by age becomes $977,600. Both represent a drop in net worth from when someone is in their 60s.

There is no reason to be alarmed by the decline in your investment portfolio. It would help draw down your nest egg and enjoy your money. Social Security payments would make up for the shortfall in assets.

- Ensure you watch for Required Minimum Distributions (RMDs) from your retirement savings. With the passage of the SECURE Act, Congress has dealt a blow to the Stretch IRA. Congress is planning to get more aggressive with SECURE ACT 2.0.

- Draft a revocable living trust.

- Decide on the distribution of your generational wealth.

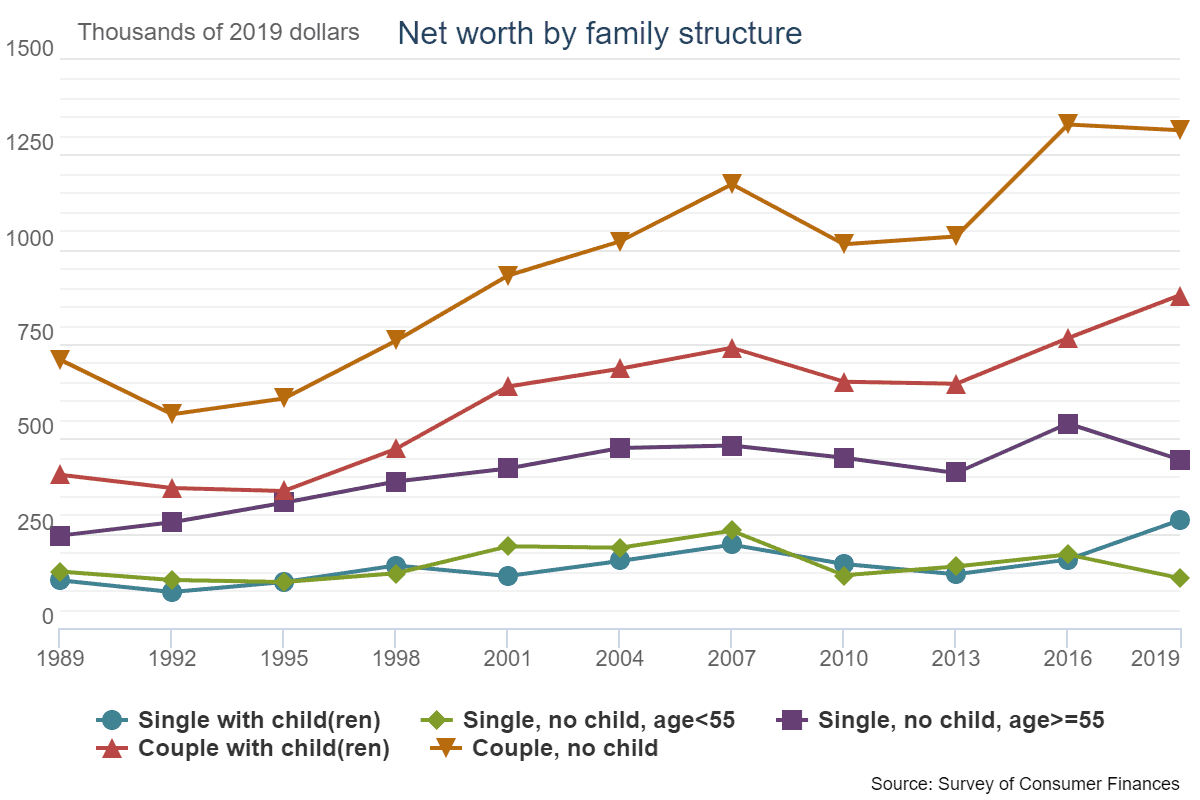

Average Net Worth by Family Structure

The family structure statistics for net worth show a positive effect for couples, likely due to their ability to share some expenses. Even couples who have to provide for dependents have a higher average net worth than single people with no children.

| Family Structure | Median net worth | Average net worth |

|---|---|---|

| Single (less than 55 years old), no child | $15,700 | $131,760 |

| Single with child(ren) | $36,710 | $284,620 |

| Single (55 years or older), no child | $119,500 | $444,900 |

| Couple with child(ren) | $166,300 | $879,210 |

| Couple, no child | $251,700 | $1,314,550 |

Housing is the most significant expense besides taxes in everyone’s budget. Naturally, couples are at a distinct advantage compared to singles. One route singles could use to level the playing field is house hacking.

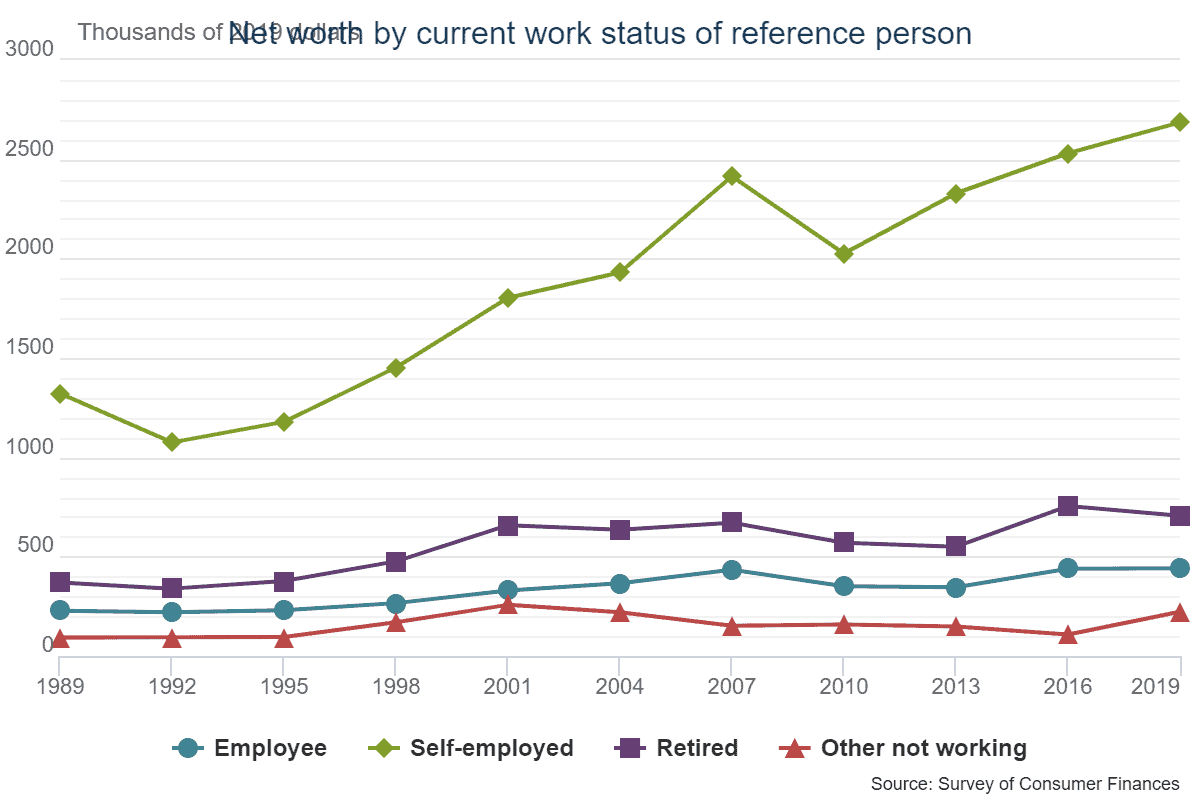

Average Net Worth by Current Work Status

The net worth chart by work status confirms one of my long-held beliefs that the USA is the land for entrepreneurs.

The best way to increase your net worth is to start a business.

| Work Status | Median net worth | Average net worth |

|---|---|---|

| Employee | $90,200 | $441,490 |

| Self-employed | $379,800 | $2,685,680 |

| Retired | $174,960 | $705,620 |

| Other not working | $10,500 | $222,870 |

When we evaluate the various types of businesses, online business is the best due to the risk/reward ratio.

- The low cost to start an online business coupled with the opportunity for passive income makes it an ideal diversified income source.

- Besides, you can avail of several tax exemptions and live in a low-cost country/state to make it even more profitable.

- Given the digital economy, more and more of our world will be moving online. Automated tools make it easy to start a website in 10 minutes with zero computer programing skills.

Unlike physical business, it is effortless and cheap to create a website. You can start a website for a low monthly fee of $3.95/month.

Setting up a website or blog is considered active in the initial phase because you need to produce content. But, the internet provides infinite leverage in terms of audience. The content created once can be sold repeatedly, with no extra cost.

Contrast online with a physical business where you have ongoing manufacturing costs to generate extra sales. Also, the one-time effort to create content pays off in the long run. You no longer need to create new content. Marketing the already created content will result in a passive income stream for the future.

And you do not need to be an expert. Everyone loves to learn from their peers.

The topic does not need to be complex either. Make money from your hobby.

My friend started a kitchen herb garden and now sells e-books on herb gardening from her website. Another friend is offering keto recipes on his website. With costs so low to start an online business, there is no reason not to start. Check out my guide on how to create a website in 10 minutes.

The decade-long chart shows that the net worth trend favors self-employed individuals by a wide margin compared to employees.

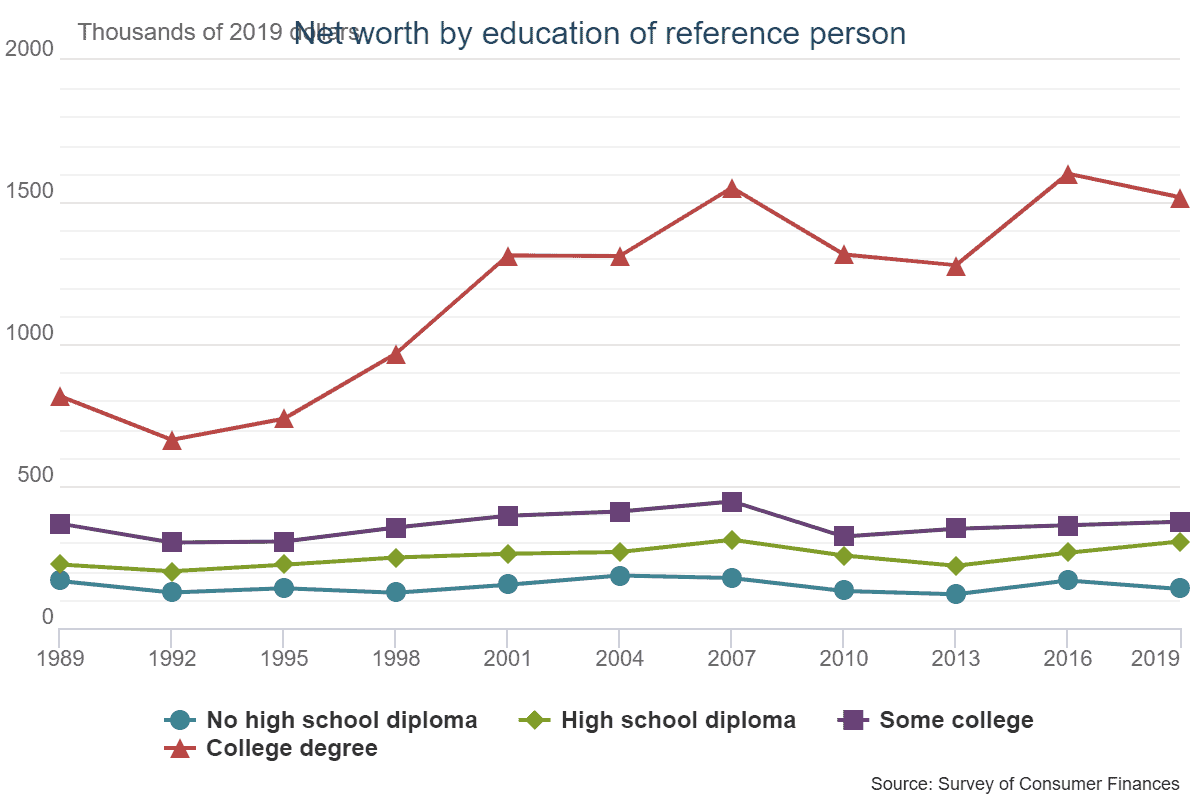

Average Net Worth by Education

Although we compared average net worth by age, it is also instructive to compare the net worth by education.

| Education | Median net worth | Average net worth |

|---|---|---|

| No high school diploma | $20,780 | $137,580 |

| High school diploma | $73,890 | $304,590 |

| Some college | $89,280 | $374,010 |

| College degree | $308,800 | $1,516,910 |

Having a college degree compared to a high school diploma does lead to a higher overall net worth. But the data could be skewed based on the degree. Technology and medicine jobs require a graduate degree and result in a higher earning potential. It is easier to build a net worth with a science, technology, engineering, or mathematics degree.

The disparity in net worth based on education also shows in the intergenerational transmission of wealth via inheritances. Children of parents with a college degree expect an inheritance with a median value of almost double compared to children whose parents don’t have a college degree.

However, I am not convinced that pursuing a liberal arts degree with student debt is beneficial.

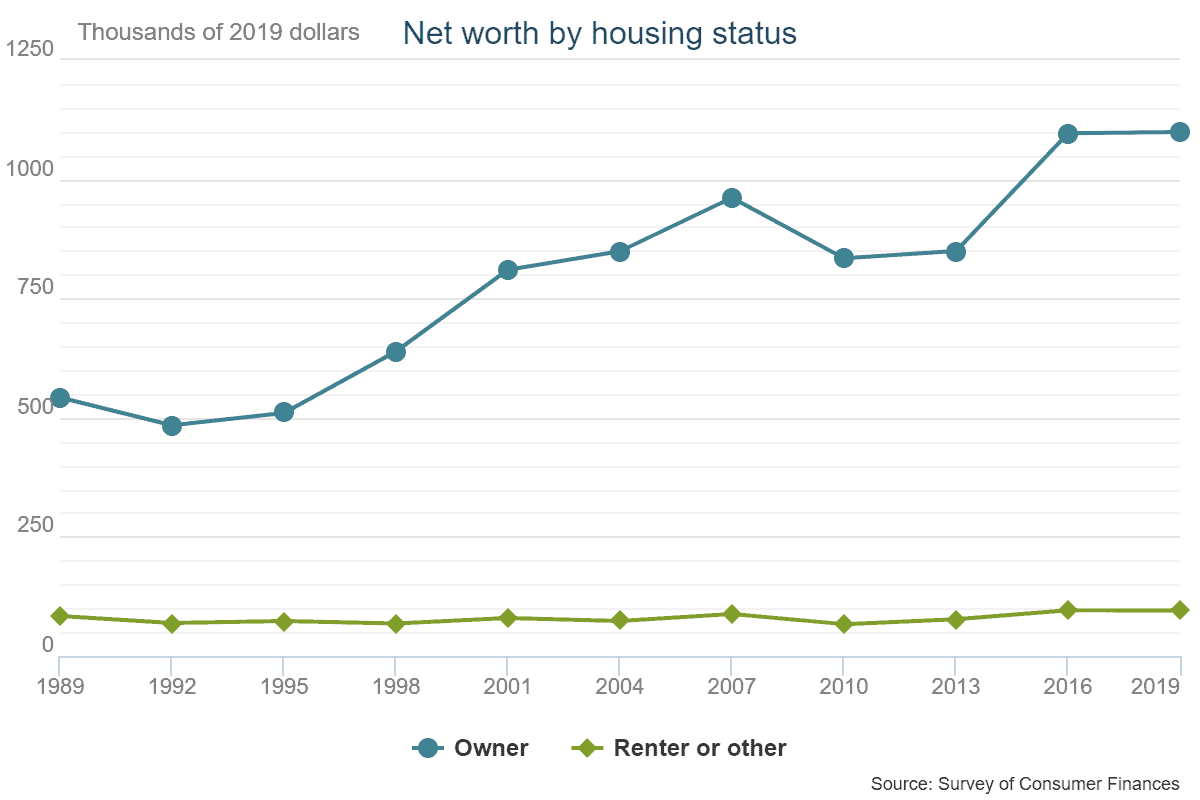

Average Net Worth by Housing Status

The average net worth data breakdown by housing status to denote primary homeownership compared to renters is interesting.

The results should not surprise anyone who knows the power of home equity and leverage in real estate. Leverage of real estate tilted the returns in favor of real estate when comparing stocks vs. real estate. Of course, the real estate vs. 401(k) decision is slightly more nuanced due to the massive tax benefits of tax-deferred accounts.

| Housing Status | Median net worth | Average net worth |

|---|---|---|

| Renter | $6,270 | $95,560 |

| Homeowner | $254,900 | $1,099,070 |

It is impressive that over a decade, and possibly longer, we see homeowners have a higher net worth than renters.

Final Thoughts on Net Worth by Age

One of the great questions in America these days are about finances. Americans are constantly checking out their finances and comparing them to others, seeking to ensure that they are making enough money to lead a happy and financially sound life.

Of course, there are fundamental differences in terms of what that means, and everyone must understand what their net worth should be and at what age. Although the comparison is not healthy, it is human to compare our net worth to our peers.

But do not be discouraged!

No matter your net worth by age, you can always build net worth by following various strategies highlighted in the article.

Is net worth important? Yes! But it is also essential to live a meaningful life. The journey should not be only focused on assets minus liabilities but also on life experiences. Memories with loved ones are always greater than all your assets.

FAQs on Average Net Worth

Is my net worth good for my age?

There is no universal answer since everyone’s circumstances are different. However, the Federal Reserve’s Survey of Consumer Finances provides valuable data points on median and average net worth by age. However, race, education, and location where you live also play a huge role in determining your net worth.

What factors influence average net worth?

Age, race, education, location, housing, and marital status are key factors that influence the average net worth.

What is the net worth to be considered wealthy?

There is no definitive answer to this question since wealth is relative. However, based on our understanding of rich vs. wealthy, we know that the rich have a lot of money, but the affluent are not concerned about money. Wealth is measured by free time and having the ability to be financially free.

How can I increase my net worth?

There are several ways to increase your net worth. Some include investing in real estate, stocks, and other assets. You can also decrease your liabilities by paying off debt. Finally, you can also increase your income, directly impacting your net worth.

What are the best net worth calculators?

You can calculate net worth easily by adding all your assets minus liabilities. However, it can be hard to track manually for individuals who have diversified portfolios.

Mint and Personal Capital offer one of the best free net worth calculators.

Besides tracking net worth, Mint also provides free credit monitoring of your Equifax credit report, and Personal Capital has an excellent retirement calculator.

Since both tools are free and update your net worth automatically, I signed up for both.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.