Another Disappointing Jobs Report Hits, Continuing Trend of Revisions, Spelling Trouble for Kamala Harris

The labor market seems to be losing momentum, heightening concerns that businesses are hesitant to hire as rising interest rates dampen investment and uncertainty lingers over consumer demand.

In August, employers added 142,000 jobs on a seasonally adjusted basis, the Bureau of Labor Statistics reported on Friday. This marks a weaker-than-expected result for the second month in a row.

Additionally, job totals for June and July were revised downward by a combined 86,000 positions, dragging the three-month average to just 116,000 jobs—a significant signal that hiring is slowing. This downward revision comes on the heels of another massive revision a few weeks ago.

Massive Jobs Data Revision, Largest Since the Great Financial Crisis

Each year, the BLS revises the data from its monthly payroll survey of businesses and benchmarks the March employment level against figures from the Quarterly Census of Employment and Wages (QCEW) data.

This year’s preliminary data reveals the largest downward revision since 2009, indicating that the labor market wasn’t as robust as initially portrayed.

818,000 Fewer Jobs

The U.S. economy created 818,000 fewer jobs than originally reported in the 12 months leading up to March 2024, the Labor Department revealed on August 21st.

In its preliminary annual benchmark revisions to the nonfarm payroll numbers, the Bureau of Labor Statistics indicated that actual job growth was nearly 30% lower than the initially reported 2.9 million jobs from April 2023 to March 2024.

Professional and Business Services Faced the Largest Downward Revision

At the sector level, the largest downward revision was in professional and business services, with job growth reduced by 358,000. Other sectors with significant downward revisions included leisure and hospitality (-150,000), manufacturing (-115,000), and trade, transportation, and utilities (-104,000).

Within the trade sector, retail trade figures were specifically cut by 129,000 jobs.

The only sector where the jobs numbers had minor revisions were Government jobs.

Economy in Recession?

Nonfarm payroll jobs reached 158.7 million through July, marking a 1.6% increase from the same month in 2023. However, concerns are growing that the labor market may be weakening. The unemployment rate has risen to 4.3%, an increase of 0.8 percentage points from its 12-month low, triggering the “Sahm Rule,” a historically reliable indicator of an economy entering a recession.

A weak August jobs report shifted attention to the slowing labor market. The report revealed a weaker-than-expected showing for the second consecutive month. The unemployment rate dropped to 4.2% after rising to the highest level of 4.3%, in nearly three years.

Focus Shifts to the Federal Reserve

As of Friday morning, markets had dropped significantly and were fully expecting an interest rate cut by the end of the Fed’s September meeting, with a roughly 50-50 chance of a 25 or 50-basis-point cut being priced in.

John Williams, the New York Fed president, said that today’s jobs report is “consistent with what we’ve been seeing: a slowing economy, a cooling off in the labor market” and that the Fed wants the data broadly to “be in balance, and stay in balance.”

Biden-Harris Administration’s Economic Performance

The new data comes at a critical political moment as Vice President Kamala Harris seeks to build momentum as the Democrats’ new presidential nominee and reshape voters’ perceptions of the Biden administration’s economic performance.

The White House, along with Harris, has struggled to persuade Americans that, despite widespread public unease about the U.S. economy, things are actually going well and that inflation has been controlled without severely harming the labor market.

Biden’s Job Creation Claim No Longer True

At the Democratic National Convention, Joe Biden proudly claimed to have created 16 million new jobs as president, rounding up from 15.8 million.

However, after the downward revision by BLS, that claim is no longer accurate.

Americans Worried About the Economy

In Gallup polling from July, fewer than 25% of Americans rated the U.S. economy as good or excellent for most of the past year.

Any negative economic news in the coming months could provide an advantage to Trump in the upcoming election.

The Gallup Economic Confidence Index measured in April, reflecting American sentiment on current economic conditions marked the first decline in economic confidence in the past seven months.

Over Two-Thirds Say Economic Outlook Is Declining

When queried on the direction of the economy, 29% of Americans believe conditions are improving, while 67% feel they are deteriorating.

Gallup’s Economic Confidence Index offers a measure of American sentiment toward current economic conditions—ranging from excellent to poor—and their expectations for its trajectory, improving or worsening.

Political Views: All Groups Reported Declines

As often observed, there is a significant divergence in economic evaluations between supporters of the president’s party and the opposition, with the former typically more positive.

This past month, all political groups reported a decline in economic confidence, with Republicans and independents experiencing a more pronounced drop than Democrats.

Democrats have consistently been the most optimistic about the economy among the three party groups since Biden took office. However, their current Economic Confidence Index (ECI) score fell from 35 in March to 31 in April.

Republicans have largely held a negative perception of the economy during Biden’s term, and their April assessment worsened from -62 in March to -71, though this is an improvement from their -77 score in November.

Independents‘ ECI score of -38 marks a 10-point drop since last month.

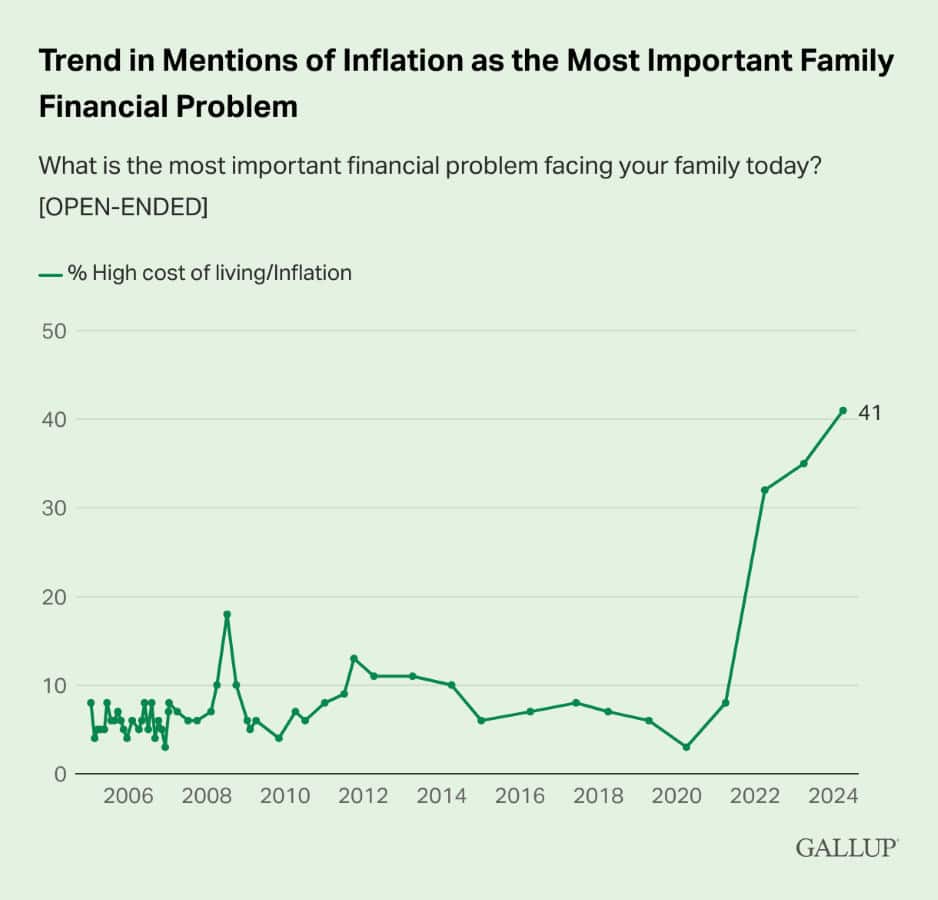

Inflation Top Concern

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak. This year, 41% cite the issue, a slight increase from 35% last year.

The latest findings come from Gallup’s annual Economy and Personal Finance poll, conducted between April 1 and 22, 2024. Since 2005, Gallup has asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

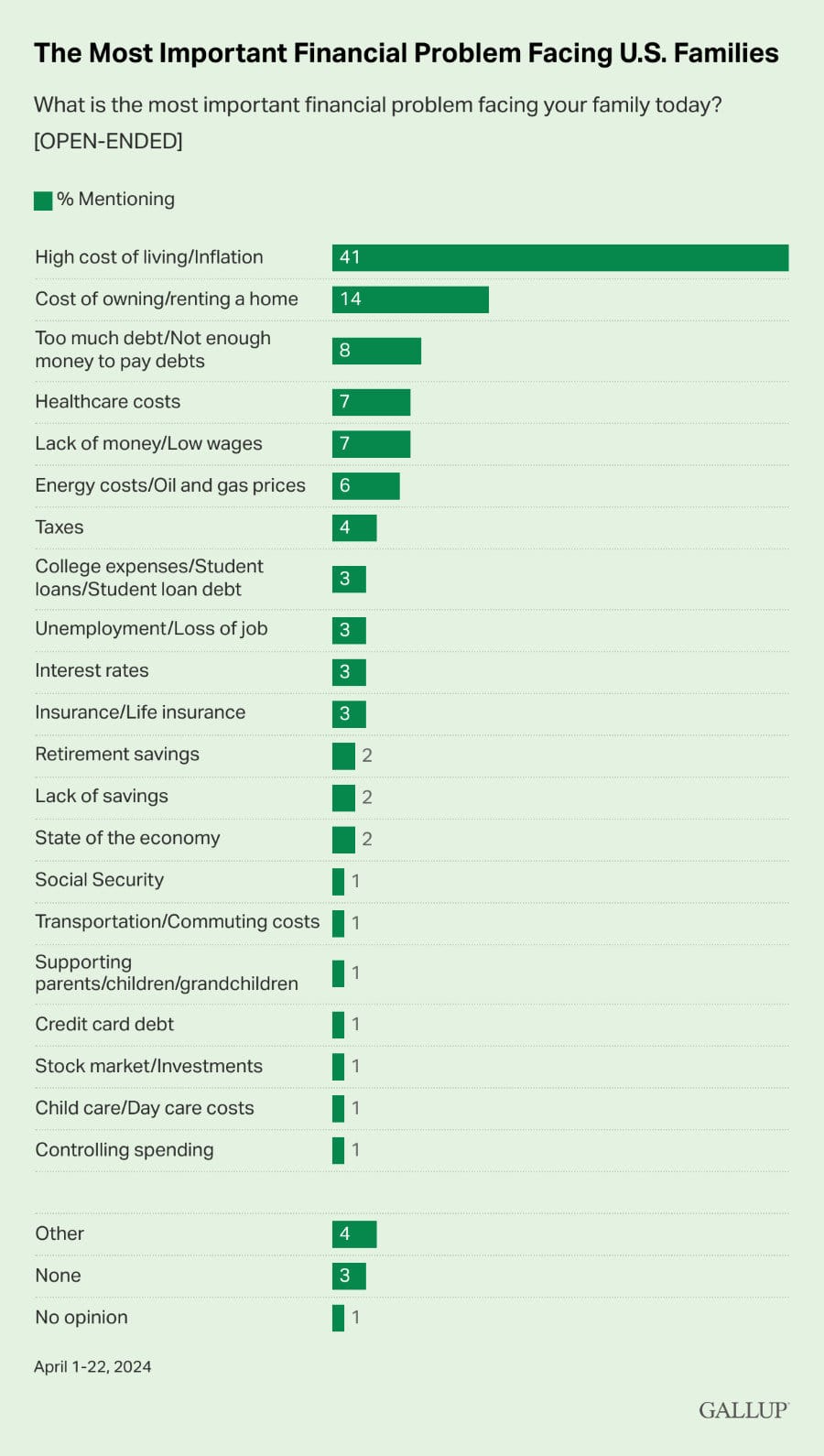

Other Financial Problems

This year, the cost of owning or renting a home follows inflation as the second most pressing issue at 14%, a new high for this category.

Other major concerns Americans mention include excessive debt (8%), healthcare expenses (7%), low wages or lack of funds (7%), and energy costs or gas prices (6%).

The increase in cost of owing and renting homes has crushed average Americans.

Zillow’s recent research report sheds light on the reality facing today’s homebuyers, indicating a significant shift in the financial landscape since 2020. To afford a home in the current market, individuals need to earn $47,000 more than they did just a few years ago, pushing the required annual income to over $106,000.

Redfin’s recent research, which delved into housing and income statistics, mirrors these findings, highlighting the widening gap between home affordability and average earnings. Their analysis reveals that the average household’s income falls short by about $30,000 of what is necessary to purchase a median-priced home in the U.S.

To afford such a home today, a buyer must earn $114,000 annually—35% more than what the typical household earns.

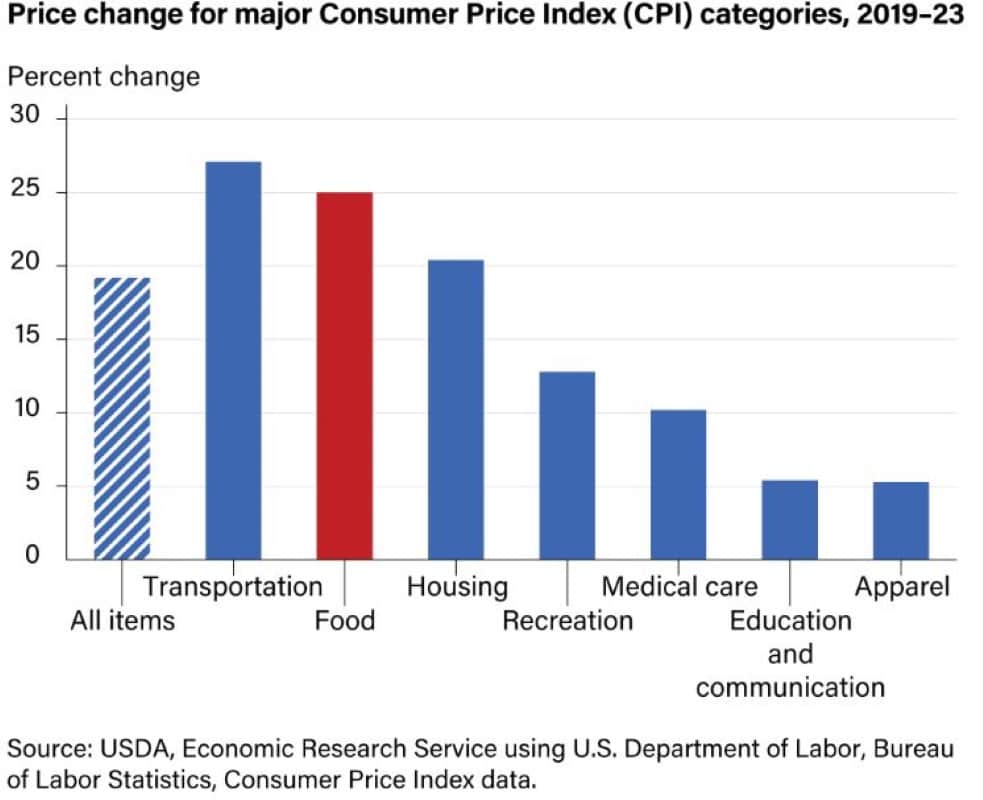

Surging Transportation and Food Costs Crushing Americans

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period.

While food prices saw a rise lower than the 27.1 percent increase in transportation costs, they outpaced the upticks in housing, medical care, and all other primary categories.

Demographic Breakdown of Inflation Concerns

Inflation is the top financial concern across all major societal groups, though certain age, income, and political segments express higher levels of concern.

Among older Americans (50+), 46% cite inflation as their primary worry, compared to 36% of younger Americans (under 50).

Middle-income earners (46%) and upper-income earners (41% of those making $100,000 or more annually) are more concerned about inflation than lower-income individuals (31% of those with incomes under $40,000).

The issue is most pressing for Republicans, with 56% naming it their top financial problem, followed by 39% of independents and 26% of Democrats.

Concerns About Maintaining Standard of Living

Retirement and medical emergencies are additional sources of concern. A separate survey question asks Americans to rate their level of worry about eight specific personal financial issues, not including inflation.

However, inflation’s impact is seen in the increased percentage of those anxious about maintaining their standard of living.

Fifty-five percent express significant or moderate worry about sustaining their lifestyle, marking the third consecutive year where a majority has held this concern.

Social Security and Medicare Insolvency

Concerns about maintaining one’s standard of living rank among the top three economic worries for Americans, alongside fears of insufficient retirement savings and the inability to cover medical expenses in case of a serious illness or accident.

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Perceptions of Personal Finances Stay Low

Forty-six percent of Americans view their personal finances as excellent or good, consistent with the past two years’ figures but worse than the assessments recorded from 2017 to 2021.

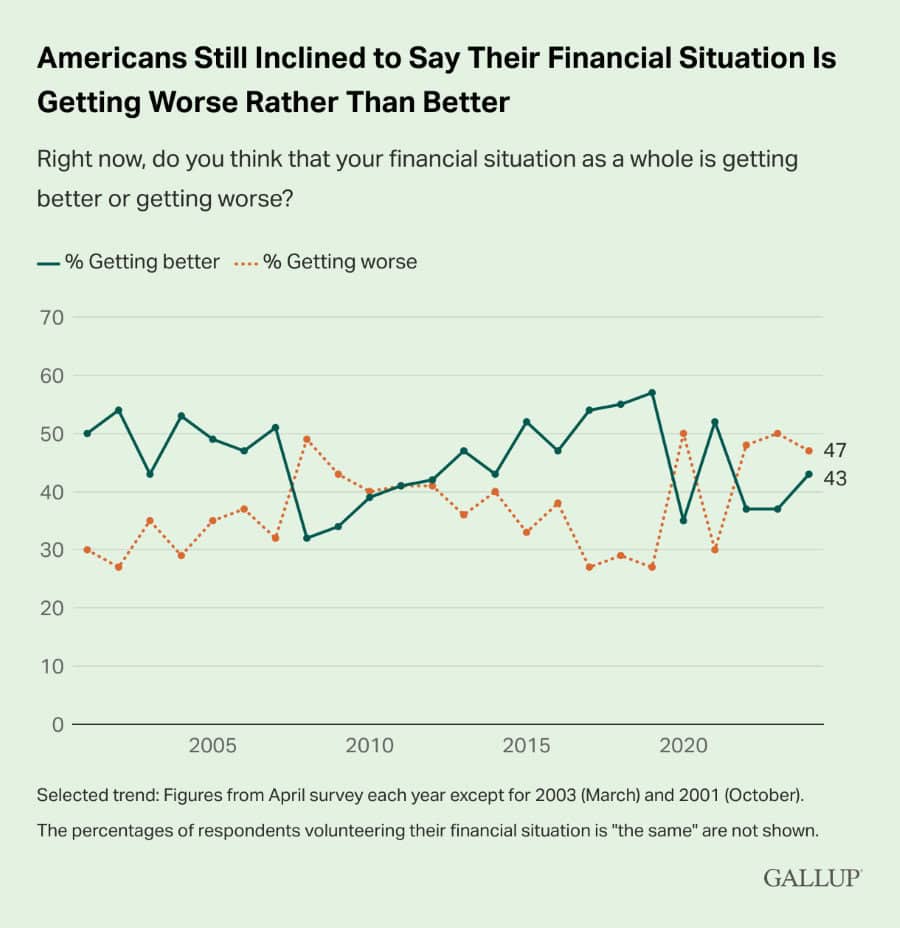

Americans Say Their Finances Are Deteriorating

47% now believe their financial situation is worsening, marking a 17-point increase since 2021.

Inflation remains a significant concern for Americans and may explain why fewer than half feel optimistic about their financial situation. It’s not only seen as the most pressing financial problem for families, but it also ranks high among the domestic issues Americans worry about most.

Inflation is only surpassed by concerns over immigration, government, and the economy as a whole when Americans are asked about the nation’s most critical problems.

Although the U.S. inflation rate has decreased notably from its 2022 peak, this improvement hasn’t changed Americans’ views on their finances.

The lingering effect of higher prices over recent years, coupled with inflation staying above the lower rates seen between 2012 and 2020, could be influencing these perceptions. Recent government reports suggest inflation might be on the rise again, which has led the Federal Reserve to postpone expected interest rate cuts this year.

Election Implications

The declining economic confidence index coupled with the revised lower job numbers highlights Americans’ mounting concerns over inflation, financial stability, and the broader economy. As pressures on household finances persist, political leaders and policymakers must address these issues to restore confidence. The sustained worries could play a significant role in shaping the outcome of the upcoming elections and future economic policies.

Like Financial Freedom Countdown content? Be sure to follow us!

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

As Americans approach retirement, their anxiety about the future intensifies. Economic challenges, rising healthcare costs, and high living expenses are creating a cloud of uncertainty over the choice of retirement destinations. A recent study, however, reveals the Mountain State region as a prime spot for those seeking affordable retirement options.

Planning to Retire? Check Out The Most Affordable States – Surprisingly, Florida Isn’t One of Them

Maximize Your Social Security Benefits with These 14 Smart Strategies

Social Security serves as a critical lifeline for countless seniors, providing essential income support in their retirement years. In the current economic environment, Social Security’s inflation-adjusted benefits offer a safeguard against the worst inflation seen in four decades. Rising interest rates have disrupted many retirement portfolios, causing bond fund values to plummet. Social Security can act as a ballast for a typical stock-bond retirement portfolio. By implementing specific strategies, retirees can maximize their Social Security benefits and secure a stable financial future.

Maximize Your Social Security Benefits with These 14 Smart Strategies

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.