Personal Finance Basics: Learn How To Start Managing Your Money

Have you wondered, “what is personal finance all about?”

Personal finance is a complicated topic. There are so many things to consider when you’re trying to create and stick with a plan that works for your goals and lifestyle.

I’ve been there too, when I came to this country as an immigrant by myself and didn’t know anything about personal finance.

The good news is that you can get better at it. I’ve created this guide to personal finance basics as a starting point for learning how to manage your money so you can live the life you want.

What Is Personal Finance?

Personal Finance is simply the art of managing our money.

Personal finance includes savings, money management, and investment. Basics of personal finance skills help you plan for retirement, budget your finances, get insurance, mortgages, make investments, etc. Personal finance often references the whole industry that caters to households and individuals financially and enlightens them on investment opportunities and financial matters.

Personal finance basics are essential for everyone, the young and adults alike. This article is for us, who want to learn how to understand personal finance basics, whether we are just starting or we want to be financially prepared.

Personal finance can seem daunting at first glance. But it doesn’t have to be that way. These tips are for anyone looking for personal finance basics for beginners. It will help us understand our finances and set up a solid financial foundation to build our money management skills.

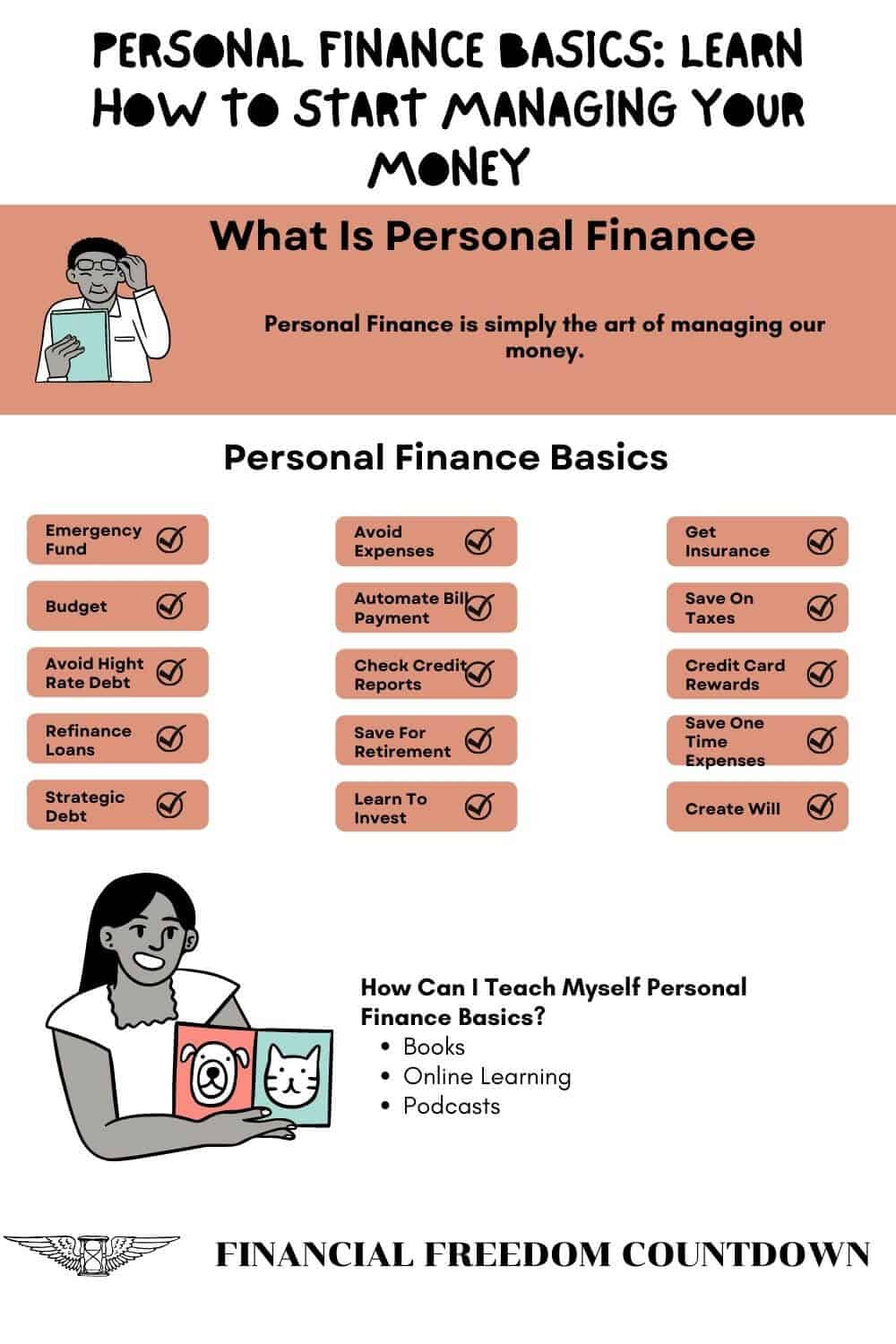

Personal Finance Basics

The earlier you begin planning for your finances, the better. However, it is never too late to set these objectives. Planning your finances provides financial security for yourself and those you love, i.e. friends and family. What are the basics of personal finance? To answer this question, here are the basics of personal finance.

Create An Emergency Fund

Personal finance 101 is creating an emergency fund. Indeed, emergencies always happen when we least expect them, but they don’t need to ruin our budgets if we’re ready with an emergency fund. A good rule of thumb is three months’ worth of income saved up if something unexpected happens, like job loss or a medical emergency. That way, we won’t be forced to put our expenses on credit cards or loans.

An emergency fund should be used only to cover extreme scenarios like job loss. Vehicle repairs or replacing a heater should all be part of your regular budget; else, you will be lurching from one emergency to another every few months.

In the past, you could save your emergency fund in a high yield savings account with low fees. However, with the Fed lowering interest rates, keeping your fully funded emergency fund with the bank offering bonuses to earn a higher rate on our money is more prudent. I-Bonds also now provide over 7% interest rate and are backed by the US Treasury.

Experts usually recommend saving 20% of each paycheck every month to ensure you have your emergency fund. After you’ve fully funded your emergency fund, continue putting that money toward additional financial objectives such as investing.

Understand Your Budget

Budgeting is one of the most important things we can do for our finances. A budget is crucial for living efficiently and saving money to achieve your set achievements. Personal finance basics worksheets can help you plan your budget efficiently.

When we create a budget, we’re essentially creating a plan for how we’ll spend our money each month. It is a great way to stay in control of our spending and make sure that we’re not overspending on unnecessary items. There are many different ways to create a budget. Some people prefer to use a paper and pen budget, while others use online tools or apps.

No matter how we choose to budget, the most important thing is to be consistent. Make sure that we review our monthly budget and make changes as needed. It will help ensure that our budget works for us and helps to avoid unnecessary purchases.

Budgeting will help ensure that our money goes towards the things we value instead of spending all of it on random, unimportant items. The budget must be realistic. If not, we won’t stay motivated with it for long. So make sure that our expenses match our income, and we are not overcommitting ourselves.

You can maintain control of your finances while having a social life. Learn how to carve up your paycheck to ensure you’re putting money towards the right things.

The 50/30/20 budget strategy is a fantastic starting point. It’s broken down into essentials, luxuries, and retirement savings.

- Living essentials, such as rent or mortgage, utilities, groceries, and transportation (public transportation or cost of car and gas) take up 50% of your take-home pay.

- Discretionary spending, such as eating out, buying fancy clothes, travel, gifts, receives a budget of 30%. You can add Charity donations in this category.

- Invest the remaining 20% for retirement savings.

With the growing popularity of personal budgeting software, there are more options than ever to help you track your spending and stick to your budget.

- YNAB is an online budgeting program that helps you keep track of your spending and make adjustments when necessary. It enables you to maintain control over every dollar you spend by tracking and adjusting your expenditures. The app has a monthly charge for using it, and I found it cumbersome.

- Mint combines your cash flow, budgets, credit cards, bills, and investment tracking in one place and makes it easy to manage. It automatically updates and classifies your financial data to know where you’re at financially. The program will even give customized suggestions and advice.

- Personal Capital is also a free software similar to Mint, but it has several more features I use to monitor my financial health.

Unlike other budgeting apps, Personal Capital doesn’t need you to do the tedious task of setting up a budget. After you link all your accounts together, it looks at your current spending and creates a budget for your lifestyle. You can then modify it as needed. Personal Capital also has features to analyze your retirement accounts and eliminate fees, track your net worth and cash flow. You can read my Personal Capital Review and how I use the various components to set up your free account.

Avoid High-Interest Debt

The first personal finance 101 for young adults is avoiding high-interest debt. Credit card debt is usually the highest interest debt, and it is best to avoid it. Although credit cards can be helpful tools if used correctly to accumulate travel rewards and cashback, they can also get us into a lot of trouble if we’re not careful. Credit cards often have high-interest rates, so it’s essential to pay off our balance in full each month. If we can’t afford to pay off our entire amount due, it’s best to avoid using our credit cards altogether.

Another thing to keep in mind is that the minimum payment on a credit card is often tiny. It can take years to pay off a big balance if we only make the minimum payment, so avoid carrying a large balance from month to month.

If we have trouble staying within our budget, it’s best to put our credit cards away and use cash for purchases instead. It will help us avoid getting into debt while teaching us to follow a budget. Utilizing a debit card that withdraws money directly from your bank account is another way to ensure that you don’t pay interest for small purchases over an extended period.

Most importantly, you should avoid using your credit cards to their limits and permanently settle your accounts before deadlines. One way to quickly ruin your credit score is by not paying your bills on time or not paying the bills at all.

Refinance Expensive Loans

Besides credit card debt, you may also have student loans. Look at options like Credible for Student Loan Refinancing. Why pay higher interest rates when you could lower your payments by refinancing federal, private, and ParentPLUS loans? Checking rates won’t affect your credit score.

Credible also provides personal loans. If you have been paying higher interest on credit cards, car financing, etc., check out individual loan rates from up to 10 vetted lenders in 2 minutes on Credible.

Use the Personal Loan only to lower your higher interest rates and not take on additional debt.

Be Strategic With Debt

Having little to no obligation to your name is one of the best personal finance basics. Don’t spend more than you earn, and keep your debts to a bare minimum. These are some crucial practices you should adopt to manage your finances. Of course, most people need to take out loans from time to time, and at times there can be a benefit in going into debt, such as when it leads to the acquisition of a cash-flowing investment.

Acquiring a mortgage to purchase a home could be such a case. Or you are buying a rental property. However, there are ways to invest in real estate with little and no money down, so debt should not be the first option.

Debts may sometimes be more economical than buying outright but be strategic and think of all possible scenarios to avoid debt as much as possible.

Avoid Unnecessary Expenses

To achieve financial freedom, avoiding unnecessary expenses is a personal financial basic that everyone should follow. It can be hard to avoid spending money on unnecessary monthly costs, especially if struggling financially. However, we must do our best to limit these expenditures as much as possible. We may not live without any luxuries, but there are ways to cut back on our spending.

One way to start is by looking at our monthly expenses and seeing where we could cut. Do we need cable TV? Can we get by with a less expensive cell phone plan? These are the types of questions we should be asking ourselves. It’s also a good idea to avoid using our credit cards as much as possible as that will only get us into more trouble.

To improve our finances, we must stay away from lifestyle inflation and make an effort to live within our means.

Most companies drain our money by asking us to sign up for subscription services. We often pay for several subscription services and don’t even use them. Trim is an excellent service that looks at all your current subscription saves money by eliminating unnecessary money leeches. Also, instead of paying full price, sign up and see if Trim can do the work negotiating your cable, phone, and internet bills lower.

Automate Bill Payment

Paying our bills on time is one of the most important things we can do for our finances. It is the best personal finance basics that everyone ought to know from the start. Not only does it help us stay in good standing with our creditors, but it also helps to avoid late fees and penalties. Late payments can quickly add up, so it’s best to avoid them if at all possible.

If we’re having trouble paying the bills on time, it’s essential to address the root cause of the problem. Knowing the personal financial management basics helps us understand that unexpected expenses sometimes take a significant toll on our budgets and put us into debt. As long as you stick to your budget and have an emergency fund in place, you should be able to pay your bills regularly.

Additionally, it’s crucial to have a sound system to ensure we pay our bills on time. We can either use a paper calendar or an online tool to keep track of the bills. When we know when the bills are due, we can plan and ensure that we have the money to cover them. I am a massive fan of automating my bill payments.

Check Credit Reports Regularly

When we research what are the basics of personal finance, checking credit reports is at the top of the list. It’s a good idea to regularly check our credit reports, as this can help identify any errors or fraudulent activity.

By checking our credit reports regularly, we can ensure that our credit score is accurate and up-to-date. It is one of the best ways to ensure that we don’t have any surprises on our credit reports that could affect our credit history or interest rates. An error on your credit reports could mean thousands of dollars in extra interest on your home loan for no fault of your own.

Identity fraud is a huge issue, and every month you might have read about some data breach or the other – sometimes it is retailers, and other times it is even the federal agencies like the IRS. I checked my email address in the https://haveibeenpwned.com/ and realized that my email has already been identified in several breaches.

The FTC enables you to order one annual free credit report from each credit bureau – Equifax, Experian, and TransUnion.

Credit Karma partners with Equifax and TransUnion and offers free credit reports and free credit scores updated weekly. It also provides alerts when it detects unusual activity on your credit files.

You can also sign up with Transunion for additional monitoring and peace of mind.

Save For Retirement

One personal financial planning basics is saving for the future. If we do nothing else with our money, we need to ensure that we’re putting aside some of it for retirement. If we don’t start investing in our 401(k) early on, then we’ll miss out on the magic of compound interest. One can retire early with a 401(k).

An early start can make a significant difference in retirement savings. Employer match programs might be used to your advantage while maximizing your contributions. Unfortunately, it is hard to retire on only social security.

We may think we don’t have enough to save right now, but this is the best time to start retirement planning. If we start investing early on, then we can reap the benefits of compound interest for decades to come. It means that the money we save today will end up being worth a lot more over time. Even if it’s just a tiny amount that we can set aside each month, it will make a huge difference once we’re retired.

Saving for retirement is one of the most innovative personal finance management basics that teaches us how to plan personal finance today to benefit us in the future. So we need to ensure that we’re saving for retirement. It’s one of the most brilliant things we can do with our money.

Many people make the mistake of not saving for retirement, but it’s one of the most important things we can do.

Retirement may seem like a long way off, but the sooner we start saving, the more money we’ll have in the end. We should try to contribute as much to our 401k account every month. It will help ensure that we can save enough money for retirement, and it’s easy to do with automatic deduction. Given a choice between Roth 401k vs. Traditional 401k, I prefer traditional 401(k).

Besides the 401(k) offered by your employer, you also have options to save for retirement using other accounts such as IRAs, HSAs, 529s, 503(b)s, self-directed IRA, Solo 401(k), etc.

Learn To Invest

In addition to an emergency fund, it’s also essential that we include investing for our future selves when talking about personal finance. Learning how to invest is one of the topmost personal finance fundamentals that everyone should know. Investing can be a great way to build generational wealth and improve our financial future.

After fully funding our 401(k), look at investing in your brokerage account. If we’re ready to start investing, then we must take the time to learn how it works and what strategies we can use. Learn to invest in real estate or stocks which tend to be the most popular options.

If we choose to invest in stocks, we must research and make wise investments. We can even purchase stock in companies we already know and love, like Disney, Apple, or Amazon. The key to investing in stocks is to auto-invest regularly and periodically rebalance. M1 Finance is the platform I use to invest my moonshot stocks, and you can learn more in my M1 Finance Review.

If you have sufficient funds and enjoy being a landlord, learn how to evaluate a rental property. Make sure you buy in one of the best states for real estate investors.

If you prefer a more passive income approach to real estate, look into crowdfunding real estate. Some of the crowdfunded platforms require you to meet accredited investor qualifications.

Fundrise and Diversify are available to all investors, including non-accredited investors, and offer low minimums of $10 and $500 respectively to get you started investing in real estate.

Both stocks and real estate can be risky, so it’s essential to understand the risks involved before investing our hard-earned money. No matter what we choose to do with our money, it’s important to remember that patience is vital. Investments can take time to grow, so be prepared to wait a while before you see any significant returns.

Get Insurance

When we have a family, it’s essential to consider the financial implications of a tragic accident or significant illness. If something were to happen to one of us, then there would be a lot of expenses that we wouldn’t be able to cover on our own. Getting insured is one of the many basics of personal finance. It is best to be prepared by getting insured for these events.

There are a variety of insurance policies out there, so it’s essential to do research and find the one that’s best for us. Some of the most common types of insurance include health insurance, life insurance, and car insurance. We have to ensure that we have all of these types of coverage, as they can be beneficial in an emergency. Being insured is one of the basics of personal financial management that will save us from economic pain if the worst were to happen.

Use Insurify to compare car, life, and home insurance quotes for free from several national providers in one place so you can select the best policy for your needs.

Fabric provides term life insurance to protect your family so they are taken care of if anything unfortunate should happen to you.

Save On Taxes

Personal financial statement basics are knowing all your assets and liabilities. Taxes are one of the most significant expenses we have to deal with regularly, and it’s a liability.

It is essential to properly adjust our payroll withholding not to overpay or underpay our taxes. Paying our taxes will also help us avoid legal troubles down the road.

However, it’s crucial to learn the various tax strategies that enable us to lower our tax bill legally. There is no reason to pay high taxes when the IRS has provided us various tax exemptions, deductions, and tax credits to reduce our taxes.

If we’re struggling financially, the money saved by tax breaks may be best to put toward debt or even investing.

Take Advantage Of Credit Card Rewards

We already talked about avoiding credit card debt and staying within our budget. If you have those personal finance basics down, you could look into credit card rewards.

Banks offer credit card rewards to entice us to spend more than we should and push us into debt. But if we know the basics of personal financial management, we can beat banks at their own game by using credit cards for our everyday spending and paying the balance in full each month collecting rewards.

We can get rewards from our credit card company by using our credit card responsibly. Many credit card companies offer cash back, airline miles, and other types of bonuses.

Make sure that we’re taking advantage of these rewards by using our credit cards for all of our purchases. By earning credit card rewards, we can give our wallets a little extra boost by using the money that we already have.

The bonus of using credit cards judiciously and staying on top of bills improves our credit score.

Having an excellent credit score is the backbone of how to plan personal finance. A good credit score will earn us various rewards, such as low-interest rates and better car insurance premiums.

However, credit card rewards are not an excuse to spend more than you usually spend without a credit card. If you do that, the credit card companies win! Only spend what you would typically spend, and before spending, make sure that you can pay your monthly bill in full without impacting your budget.

Save For Large One-Time Expenses

What is personal finance all about? It’s about taking control of our finances and being smart about our financial decisions. It’s best to save up rather than pay with debt because we’ll usually end up paying more in interest and fees when it comes to one-time expenses, such as a wedding or vacation or even down payment for buying a home.

If we have a savings account that offers a high yield, we can quickly save our money. Make sure to set a budget for ourselves and stick to it to avoid overspending on these expenses. By reserving for significant one-time expenditures, we can ensure that we don’t have any unexpected expenses in the future.

Create A Will Or A Living Trust

Wills and living trusts are not only for the rich and famous but also you and me.

It is imperative that you make a will and, if necessary, establish one or more foundations to protect your property and consider your wishes in the event of death.

California is a probate state. If you do not have a living trust, the court will appoint some bureaucrat to dictate how your property should be divided among your family, and the government will take money from your estate to make that decision!

Other important documents, such as healthcare directives, come in handy for your relatives if you are ill or unable to make decisions.

Trust & Will provides state-specific trusts for the protection and transfer of your most important financial assets. You can also nominate legal guardians for your children to make sure they are looked after by someone you know and trust, in case something happens to you.

Personal Finance Principles

The three basic principles of personal finance are

1) earn more than you spend

2) invest the difference

3) insure yourself against catastrophic failure

Of course, the devil is in the detail.

You can earn more by aggressively improving your human capital. There is no limit on your income generation potential, whether at a job or a side hustle starting an online business.

Investing entails deciding on the best assets to buy and having an asset allocation and diversification plan in place, taking into your risk tolerance.

Insurance protects us from losing all our hard-earned assets due to misfortune.

How Can I Teach Myself Personal Finance Basics

If you want to learn more about personal finance basics, there are several avenues.

Books

Books are one of the best ways to learn any topic you are interested in and increase your financial literacy. They can be a great supplemental read full of information. You can also read books that go into more detail about personal finance, such as those from the library or those you purchase from a bookstore.

Here are the best real estate books for beginners for those drawn to real estate.

The ten best early retirement books highlight the mindset around financial freedom and stories of how individuals achieved early retirement.

Online Learning

If you prefer a more structured manner of learning, several online tools are available to learn in a classroom setting without enrolling in a full-time college course.

LinkedIn Learning has courses on personal finance 101 for young adults

Khan Academy also provides in-depth videos on several topics, including personal finance basics and fundamentals.

Podcasts

If you prefer to learn by listening, podcasts are a great source of learning while driving or working out at the gym.

Bigger Pockets covers real estate extensively.

ChooseFI has inspirational stories on individuals achieving financial freedom and covers personal financial planning basics.

Radical Personal Finance by Joshua Sheats has a unique perspective on several topics, including the basics of personal financial management.

Millionaires Unveiled by Clark Sheffield and Jace Mattinson interview millionaires to find out how they got to where they are. Besides the personal finance management basics, you also learn how to turbocharge your nest egg.

The Dreamers Podcast by Anne-Lyse covers wealth building with purpose along with the basics of personal finance by interviewing guests on their money wins and losses.

Final Thoughts On Personal Finance Basics

The basics of personal finance are about taking control of our finances and being smart with how we spend money.

It is all about achieving set financial goals, primarily personal ones, whether they include planning your retirement, meeting short-term financial needs, or putting funds aside for your child’s education and future.

All these are dependent on the amount of salary you are making, your living needs, expenses, and your personal goals and desires. It is crucial to educate yourself in financial matters when deciding between good and bad financial advice.

We covered several areas on how to understand personal finance basics. We see the importance of personal financial planning basics, personal financial management basics, how to plan personal finance, how to understand personal finance, what personal finance is all about, and how to personal finance management. With this information, people can adequately plan for their futures and the futures of their loved ones.

Although it can seem like a lot, don’t be overwhelmed!

Start with one step and return to the article for more steps when ready.

Now go forth and take charge of your personal finances. It’s easy when you get a grip on how it all works!

Readers, did we miss any personal finance 101 steps? What has been the most difficult for you to tackle?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.