Japan and UK Just Fell Into a Recession. Is the US Next?

Two of the largest global economies have officially entered a recession as per the data released last week. Japan experienced an unexpected decline in GDP, attributed to its weakened currency and aging population. Simultaneously, the UK witnessed a contraction in growth for the second consecutive quarter, occurring just months before a crucial election. Economic data released in the U.S. showed rising unemployment. Although the Federal Reserve could cut rates, inflation came in higher than expected effectively causing concern among economist.

How Do You Define a Recession?

A recession is generally defined as a significant decline in economic activity that persists for an extended period, typically marked by a contraction in gross domestic product (GDP), rising unemployment rates, reduced consumer spending, and declining business investment. While there isn’t a strict rule for the duration or magnitude of these economic downturns, they are commonly characterized by negative GDP growth for two consecutive quarters or more. Recessions are a natural part of the economic cycle and can be influenced by various factors such as financial crises, external shocks, or imbalances in the economy. Policymakers often implement measures to stimulate economic recovery during recessions.

Weaker Yen and Sluggish Consumption Tips Japan Into a Recession

Cabinet Office data revealed that the economy contracted at an annual rate of 0.4% in the October to December period, despite a 1.9% growth for the entirety of 2023. This followed a more significant contraction of 2.9% in July-September. The consecutive quarters of contraction signal a technical recession. Japan declined to the fourth position in the global economic order due to a weaker Japanese yen, as nominal GDP comparisons are in dollar terms. Economists also attribute Japan’s relative weakness to a declining population, as well as lagging productivity and competitiveness.

The Bank of Japan (BOJ) has been preparing to conclude negative interest rates and revamp other aspects of its extremely accommodative monetary framework by April. However, any subsequent policy tightening is expected to proceed cautiously due to persisting risks.

High Rates and Stagnant Growth Result in Recession for UK

According to the Office for National Statistics, the UK gross domestic product contracted by 0.3% in the final quarter of the year, marking the second consecutive quarterly decline. All three primary sectors—services, industrial production, and construction—experienced decreases. This trend reflects the impact of elevated interest rates, implemented to curb inflation. The Bank of England aggressively raised its main interest rate to 5.25%, the highest in 16 years, aiming to reduce inflation from over 11% to 4%. While interest rates seem to have peaked, the central bank remains cautious about premature rate cuts, fearing that lower borrowing costs could stimulate spending and reignite inflationary pressures.

Economists Are Concerned About the State of the US Economy

Contrary to Wall Street’s pessimistic predictions, the US economy successfully defied expectations of a prolonged downturn last year. However, according to Citi, there are indications that the US economy is poised to enter a recession in the middle of 2024.

Citi’s chief US economist, Andrew Hollenhorst said, “There’s this very powerful and seductive narrative around a soft landing, and we’re just not seeing it in the data”

Last week’s data showed the core US consumer prices climbed by most in eight months. January retail sales report showed a larger drop than forecast indicating the the U.S. consumer might be under pressure.

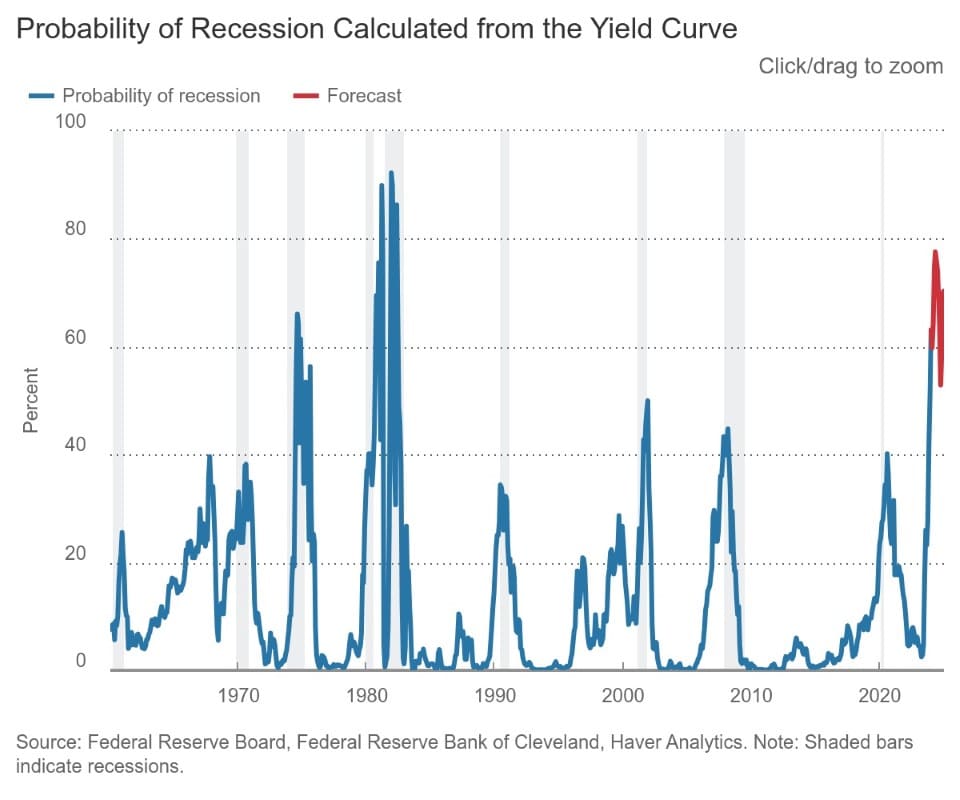

Inverted Yield Curve

The Cleveland Fed considers the yield curve a predictor of economic growth. According to conventional wisdom, when the yield curve inverts (short-term rates surpass long-term rates), it forewarns an impending recession roughly a year later. Notably, yield curve inversions have heralded each of the last eight recessions, as defined by the NBER (National Bureau of Economic Research). A compelling case in point is the most recent recession: The yield curve inverted in May 2019, almost a year before the onset of the March 2020 downturn.

The U.S. Yield Curve (10-year minus 3-month) has been inverted for 473 consecutive days.

Surging Household Debt

According to the Federal Reserve Bank of New York, total household debt rose by $212 billion to $17.5 trillion in the fourth quarter of 2023.

The outstanding credit card balances, currently at $1.13 trillion, increased by $50 billion, marking a 4.6% rise over the prior quarter.

Auto loan balances continued their upward trend, experiencing a $12 billion increase, and currently stand at $1.61 trillion, maintaining the trajectory observed since the second quarter of 2020.

Mortgage balances increased by $112 billion from the previous quarter, reaching $12.25 trillion at the end of 2023. Americans under financial stress have resorted to using their home equity lines of credit (HELOC), which saw an increase of $11 billion, marking the seventh consecutive quarterly rise since 2022. The aggregate outstanding HELOC balances now amount to $360 billion.

Consumer Delinquencies Rising

Credit card balances, mortgage loans, and auto loans are at record-high levels as delinquency rates for most debt types continue to climb.

On an annualized basis, about 8.5% of credit card balances and 7.7% of auto loans became delinquent. Serious credit card delinquencies increased across all age groups, particularly among younger borrowers, surpassing pre-pandemic levels.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

Since consumer spending is a critical component of the U.S. Gross Domestic Product, an uptick in delinquency rates as individuals attempt to manage debt payments with fewer financial resources could prove disastrous.

Low Personal Savings Rate

The personal saving rate, often termed as the percentage of personal saving to disposable personal income (DPI), is derived by calculating the ratio between personal saving and DPI. Personal saving represents the portion of personal income available after deducting living expenses and taxes.

As of Dec 2023, the Personal Savings Rate stands at 3.7%, one of the lowest savings rates on record. The January 2024 inflation data came in higher than expected adding further pressure to household budgets.

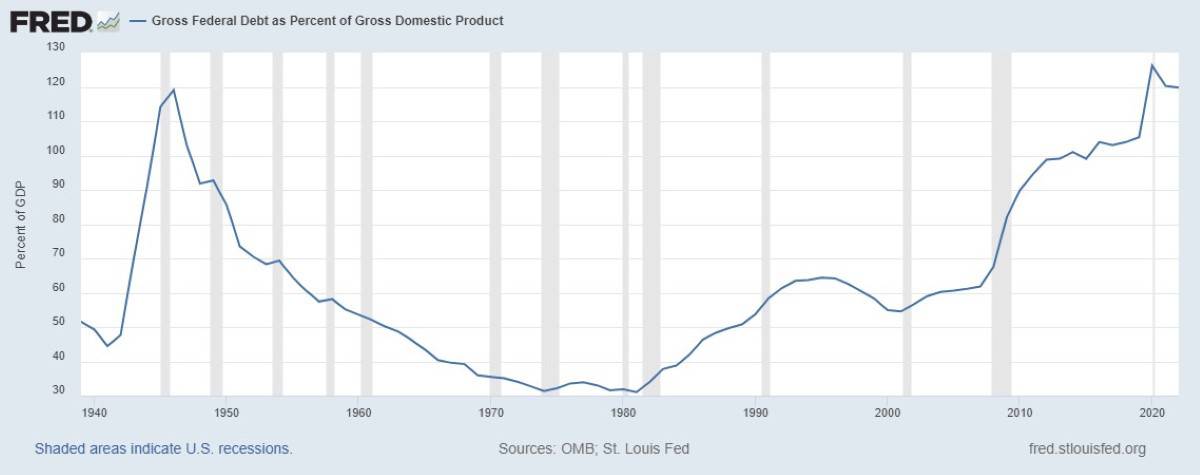

Unsustainable Federal Debt Levels

The Gross Federal Debt Levels are at an all-time high.

The Penn Wharton Budget Model projects that financial markets may struggle under the accumulated deficits forecasted under the existing U.S. fiscal policy. Financial markets anticipate that forthcoming fiscal policies will implement significant corrective measures in advance. However, if financial markets were to lose confidence in this scenario, the debt dynamics could quickly become unsustainable and potentially unravel sooner than expected.

Fed Chairman Jerome Powell has said it is past time to have an “adult conversation about fiscal responsibility.”

The debt-to-GDP ratio is currently around 120%, and politicians are not showing any sign of slowing spending.

Interest On Debt Unsustainable

Year-to-date, interest on Treasury debt exceeds $357 billion, showing a 37% increase from the same time previous year. It surpasses military spending and rivals only Social Security Administration or the Department of Health and Human Services. By year-end, the interest on the debt is projected to reach $1.1 trillion.

More Taxes Or Print Money

Higher debt must be financed with higher taxes or more money creation. Raising taxes might prove difficult, but the alternative of printing more money could result in rampant inflation. Americans have suffered in the past two years as inflation has made everyday necessities more expensive. Although the pace of price increases has slowed, food and gas prices are still higher than in the past.

Cuts to Social Programs

So far, government spending has been financed by selling U.S. debt to foreign nations. America’s ability to pay its debt is a concern for nations worldwide, which own around $7.6 trillion of our debt. Japan and China are the top two countries holding U.S. debt. Both countries have been reducing their holdings of U.S. Treasuries.

With Japan falling into a recession and China taking an aggressive stance towards the U.S., it could be harder to finance debt.

If the U.S. government can no longer find buyers for its $1.7 trillion annual debt, significant cuts must be imposed on social programs.

Is the US Headed for a Recession?

The economic indicators paint a challenging narrative for the current financial landscape. From the ominous signs of an inverted yield curve, historically a herald of impending recession, to the mounting household debt, surging delinquency rates, and concerning federal debt levels, the economic stage appears set for potential turbulence. As we navigate these indicators, it becomes apparent that the need for prudent fiscal measures is more crucial than ever. The looming questions about addressing these economic challenges, whether through tax hikes or increased money creation, cast a shadow over the future. As policymakers grapple with these dilemmas, the potential repercussions, including cuts to social programs, hang in the balance, emphasizing the urgency of a thoughtful and strategic approach to navigating the uncertain economic terrain ahead.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.