Liquid Assets: Definition, Examples, Location and Importance

Deciding how to invest your money depends on various factors, including the risk you are willing to endure and the potential need you have to gain access to that cash.

Some assets are more easily accessible than others and are equivalent to cash on hand. These assets are known as liquid assets, and it is critically important that you have access to enough liquid assets to get you through a financial emergency and ensure that you have the money you need to function on a day-to-day basis.

So, what are liquid assets? What are non-liquid assets? And how much of each should you have?

What Are Liquid Assets?

A liquid asset is any tangible or intangible asset that can be easily converted into cash quickly without incurring substantial loss in value.

These assets are highly desirable due to their fluid nature, enabling individuals or businesses to access cash or cash equivalents when needed.

How liquid an asset is ultimately depends on how quickly you can convert it into cash. Cash, of course, is legal tender and is the most liquid asset. Having access to cash means that you can buy a good or service.

After all, you can’t easily buy groceries with your house. In personal finance, taking an asset and putting it through a cash conversion – either through the physical or electronic market – defines a liquid investment.

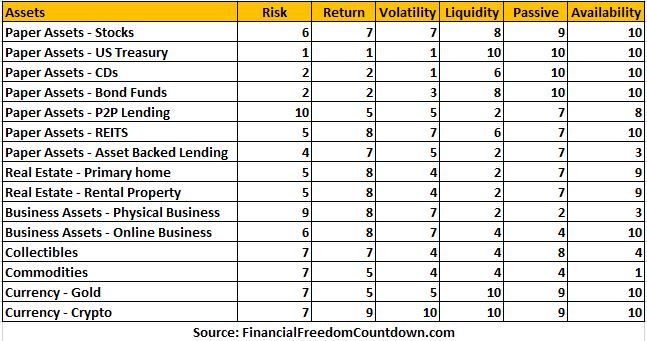

Liquidity is one factor when looking at what asset classes one should include in their portfolio.

Examples of liquid assets include cash, stocks, bonds, money market funds, and government securities. These assets are easily tradable for their market value and have high levels of liquidity. Unlike illiquid assets such as real estate or art, you can easily convert liquid assets into cash without significant transaction costs.

Moreover, liquid assets often retain their value and provide a certain level of stability. As a result, they are considered to be a reliable and secure form of investment. Investors and financial institutions typically use liquid assets to assess an entity’s financial health, mainly for liquidity ratios and solvency analysis. Overall, liquid assets are vital in maintaining financial stability and flexibility.

Liquid assets are used to define liquid net worth, which is usually smaller than the average net worth.

Examples of Liquid Assets

Liquid investments can be ranked depending on the ability of an asset to retain value when you need to sell it and the speed at which you can sell it.

Cash

Cash that you have immediate access to, like paper money. While local currency is preferable, foreign currency is also acceptable, depending on the country.

Bank Accounts

Cash equivalents are money in your checking account, savings account, or money market account that you can draw down immediately. These bank accounts should be easily accessible and present no problems or more than a nominal fee when attempting to withdraw the money.

Although bank accounts are accessible via ATM withdrawals when the bank is closed, most accounts have a daily withdrawal limit. A Certificate of deposit (CD) typically has a lock-in period, although withdrawal might be possible if you forfeit a few months of interest.

Bonds

Fixed-income investments such as bonds, including bond funds, are reasonably liquid. Government treasury notes or T-bills retain value and are backed by the full faith of the U.S. Government. Some treasury bonds, like I-Bonds and Series EE bonds, have a lock-in period before being redeemed.

When investing in bonds, be aware of the associated interest rate risks.

Stocks

Sometimes, money in marketable securities like individual stocks, ETFs, or mutual funds can be considered highly liquid assets. However, this ultimately depends on if there is a liquid market for them. The main factor that makes an asset liquid is a vast pool of ready buyers who can immediately convert your asset – including stock, bond, or mutual fund – into cash.

Although trading stocks now occurs through electronic markets, funds settlement takes three days. It would help if you considered trading holidays and hope the market values are not adversely impacted.

Some small-cap stocks have lower trading volumes and cannot be bought and sold quickly. Also, price fluctuations are to be expected when investing in stocks.

Precious Metals

Tangible assets like precious metals and gemstones can also be considered liquid assets as they tend to hold their value and can be quickly sold in the market. Gold or silver are typically in high demand and often used by investors looking to invest in a relatively safe asset class.

Because these assets have been around for centuries, an investment in precious metals is generally considered a highly safe investment. Furthermore, there are numerous well-established markets for all these metals, meaning you should be able to sell them quickly if needed.

Cryptocurrency

Cryptocurrency investments may have fallen out of favor, but crypto assets like Bitcoin or Ethereum trade globally 24/7.

Liquid Assets for Businesses

It is also worth noting that there are expanded definitions of what is considered a liquid asset when working in the business context. This matters even more for a company’s balance sheet when businesses are often required to report any liquid or illiquid asset’s cash value.

A company can effectively assess its liquidity by comparing the value of its liquid assets to its current liabilities. The Quick Ratio calculates whether a company can meet its short-term (one-year) costs and is calculated as

Quick Ratio = Liquidity assets / Current liabilities

Business assets tend to have additional definitions of liquid assets, including

Accounts Receivable

Accounts receivable is the cash a business owes based on previous sales.

However, the liquidity of these payments is debatable. On the one hand, customers owe money, and in most cases, your business will be able to collect this money.

On the other hand, accounts receivable may take some time to collect; in some cases, your business may never see the money. Retail customers who do not care about maintaining excellent credit scores may refuse to pay the company. That’s why accounts receivable are usually separated on a business’s balance sheet.

Accounts receivables on the balance sheet are classified as current assets since they represent the anticipated payments received within the following year.

Inventory

Most businesses have access to some inventory that they can sell.

However, like everything else, there is a hierarchy regarding this inventory’s liquidity. Some merchandise may be more challenging to move, including significant physical assets or merchandise that is difficult to sell. Also, inventory could become outdated over long periods.

Other standard inventory – including goods that are typically sold in the course of regular business – may be more manageable.

Location of Liquid Assets

One factor to be also considered is where these liquid assets are located.

For example, cash in investment accounts, such as a taxable brokerage, can be liquid, but the same cash account balances in retirement accounts are illiquid assets.

In my experience, people often focus on asset allocation and ignore asset location. Working with a tax professional and investment adviser is always advisable to determine the optimal asset location.

To that end, remember that liquid assets are in easy-to-access accounts which can include:

- Checking accounts

- Savings accounts

- Money market accounts

- Taxable brokerage accounts

- Revocable living trusts

Trust & Will provides state-specific trusts for the protection and transfer of your most important financial assets. You can also nominate legal guardians for your children to make sure they are looked after by someone you know and trust, in case something happens to you.

Why Are Liquid Assets Important?

For several reasons, liquid assets are paramount in financial planning and management.

Financial Flexibility

Firstly, liquid assets can be easily converted into cash within a short period without significant loss in value. This enhances financial flexibility, allowing individuals or businesses to meet their immediate liquidity needs or take advantage of investment opportunities at any given time, regardless of economic conditions.

For example, during the great financial crisis, you wanted to invest in real estate and see multi-family houses being sold at a discount. If your money was invested in stocks, you could not buy homes since stocks and real estate crashed simultaneously. Having bonds that you could convert to cash easily would have been beneficial.

Financial Cushion

Moreover, possessing liquid assets is a cushion against financial uncertainty, mitigating risks and ensuring stability. For instance, during unforeseen events such as medical emergencies or economic downturns, readily available liquid assets can prevent individuals from having to incur debt or make hasty investment decisions.

Mapped to Financial Goals

Furthermore, liquid assets are vital for achieving financial goals. By having a portion of one’s assets in readily accessible and highly liquid forms, individuals can plan for expected expenses or investments, ensuring their financial plans remain on track.

.

What Are Non-Liquid Assets?

Non-liquid or illiquid assets are more difficult to access and turn into cash or cash equivalents. There may be an established market for the investment, but it may take time to find a buyer and negotiate a deal.

Examples of illiquid assets include:

Real Estate

The most obvious form of an illiquid asset is real estate. Real estate is not a liquid asset, as it may have value, but the only way to access the value of a piece of real estate is to sell it (which takes time and is not guaranteed) or to borrow money against it – another time-consuming process.

Furthermore, selling a piece of real estate or land can be complex, and there is no guarantee about the cash value of that real estate.

Whether you are selling a mobile home or an apartment building, closing the sale would take at least 30 days. Real estate crowdfunding deals involve a lock-in period since you are investing with other individuals, and redemption is difficult before the project timelines are met.

Distressed real estate sales provide immediate cash, but you leave a lot of money on the table.

Collectibles

Collectibles – like art investments, furniture, jewelry, or baseball cards – can be precious. However, like real estate, there is not always a market for collectibles. Furthermore, they can take time to sell, and there is likely to be extensive negotiating about the sale price of that collectible.

Cars

A car is typically not considered a liquid asset due to its depreciating value and difficulty quickly converting it into cash.

Liquid assets are defined as assets that can be easily converted into cash without significant loss in value. While a car may have value, it is subject to depreciation, meaning its value decreases over time. Additionally, selling a car can be time-consuming, finding a buyer, negotiating a price, and completing paperwork. Therefore, a vehicle is generally not suitable as a liquid asset.

Private Equity

A 7 figure salary employee working for a startup should consider their company stock as non-liquid assets.

Similarly, the significant difference between mutual funds vs. hedge funds is that hedge funds often invest in assets that are not publicly traded. For example, David Swensen often invested in esoteric investments such as farmland, timber, and even intangible assets such as intellectual property and patents.

The lack of liquidity in these assets makes them less flexible for immediate financial needs. Non-liquid assets are typically held longer and can provide long-term value.

Real estate, for example, can appreciate over time and be an investment that generates monthly income. Similarly, artwork and jewelry may appreciate and provide potential investment returns.

Nevertheless, non-liquid assets also come with certain risks. The value of these assets may fluctuate due to market conditions or changes in demand for certain types of items.

Additionally, the costs associated with maintaining and securing these assets can impact their overall return. Therefore, individuals should consider the potential benefits and risks before investing in non-liquid assets.

What Would I Want To Use Liquid Assets For?

It is critical to your financial security that you have enough liquid assets to cover your regular day-to-day payments, any debt obligations you may have, and any potential emergencies. To that end, common liquid assets have a wide range of uses, and there are many reasons that you may need to have those assets.

The three most common uses are

Emergency Fund

Liquid assets are most necessary when building an emergency fund to manage unexpected expenses. We all need some emergency fund that will allow us to handle any immediate or emergency payment, like unexpected medical expenses, home repair, or job loss.

We will need access to some money market or savings account assets to manage those payments in these instances.

Depending on your financial situation, most financial advisors recommend that you have three to six months of liquid assets to cover your most essential expenses. You should keep this money in your emergency fund, which should be in extraordinarily low-risk or no-risk financial institutions, including FDIC-insured checking accounts, savings accounts, or treasury bills.

Loan Application

When applying for a business or mortgage loan, your lender will verify your assets and their liquidity before approval.

Major Upcoming Purchases

Furthermore, liquid assets are needed if you or your business needs to make a significant purchase. In these instances, you clearly can’t pay in real estate and will need access to cash from a bank account, money market accounts, or more.

This will ensure you can access the cash necessary to afford a down payment on a house or another major purchase.

It is essential to time the purchase duration with your asset allocation plan.

For example, saving the tuition fees in liquid assets is prudent if your child starts college next year. But if your kid is one year old, you could buy a rental property with a 15-year vs. a 30-year mortgage so the property is paid off when your child needs the college funds. You can then use the passive income from real estate to pay the college tuition. If your child decides not to pursue expensive college education, you could sell the rental property and fund their business venture.

How much liquid assets you need ultimately depends on various factors, including your total expenses and potential emergency expenses. Financial advisors recommend different things for people and businesses based on your circumstances.

Your best bet is to discuss the situation with a qualified financial advisor who can give you the necessary recommendations about how much cash or easily converted assets you need to have.

How Do You Start Building Liquid Assets?

Building liquid assets is an essential step towards achieving financial freedom. It is vital to establish a solid foundation by creating a budget and analyzing monthly expenses. This will help identify areas where spending can be reduced or eliminated, thereby freeing up funds for savings, which can be deployed as liquid assets.

If you do not already have a budget, sign up for a free account with Personal Capital. Once you have linked your accounts, Personal Capital analyses your various transactions and automatically creates a budget based on your current spending patterns.

You can use that as a starting point and customize your budget numbers. From now on, Personal Capital will automatically send you alerts when you are exceeding your budget so you can cut back. Read my Personal Capital review on how I use the various free features.

Starting early and being disciplined in saving or investing will create a robust portfolio of liquid assets.

FAQs on Liquid Assets

Is a house a liquid asset?

A house is not typically considered a liquid asset because selling a home can often be a lengthy process that involves listing the property, finding a buyer, negotiating a price, and going through various legal and financial procedures.

Unlike stocks or bonds, which can be sold relatively quickly, selling a house requires time and effort, making it less liquid than other assets. Yes, you can resort to cash-out refinancing, but even that process takes a month.

A Home Equity Line Of Credit (HELOC) set up in advance can turn a portion of your house into a liquid asset, but the HELOC is not guaranteed. Several banks restricted access to previously approved HELOCs during the Great Financial Crisis.

Are retirement accounts like IRAs and 401(k)s liquid assets?

Although retirement accounts could contain cash or cash equivalents, they are not considered liquid assets due to their withdrawal restrictions until retirement. Investments in 401(k)s, Individual Retirement Accounts (IRAs), and Roth IRAs are designed to help individuals save for retirement and enjoy tax advantages.

While there are exceptions, such as early withdrawals with penalties, these accounts generally require individuals to wait until they reach a certain age before making withdrawals without penalties. Therefore, retirement accounts should not be relied upon for immediate financial needs.

While it is possible to borrow against 401(k) balances as a loan to purchase a starter home, this does not make it a liquid asset in the traditional sense.

You can withdraw balances from Health Savings Accounts if you have prior or current medical expenses, such as pharmacy receipts or hospital bills, which indicate the amount you are responsible for paying.

Is Social Security a liquid asset?

Social Security is not considered a liquid asset. Although individuals pay into Social Security throughout their work, the funds are not easily accessible.

Social Security benefits are primarily intended to provide a source of income during retirement, and there are restrictions on when and how individuals can begin receiving these benefits. Social Security is designed to provide financial security after age 62.

Is my checking account a liquid asset?

A checking account is a liquid asset that can be readily converted into cash. Regarding liquidity, a checking account offers immediate access to funds through ATM withdrawals or electronic transfers.

Is life insurance a liquid asset?

Term life insurance is not a liquid asset. However, cash value policies such as whole life insurance or universal life can be considered liquid assets by implementing infinite banking concepts.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.