How To Get a Mortgage for an LLC-Owned Rental Property

Are you considering buying a rental property but worried about lawsuits? Have you heard that investing in an LLC-owned rental property might be best to protect yourself from potential liability issues but are unsure how to get a mortgage loan?

Today we will look at how to apply and qualify for a mortgage loan when purchasing an LLC-owned rental property. Whether you are new to real estate investing or want additional information on obtaining a mortgage for an LLC-owned rental property, we have covered all your questions and concerns.

What Is an LLC, and How Do I Start One?

An LLC, short for a limited liability company, is a business structure owned by one or more individuals or entities formed at a state level. It is worth noting that different states have different regulations for an LLC.

An LLC is a pass-through entity for tax purposes. Your LLC will not pay federal, state, or local taxes directly. This includes income taxes, property taxes, or capital gains tax. Instead, rental property investors will see the profit and loss statements of an LLC flow back to their taxes. This means that an LLC can directly impact your personal and business assets.

Starting an LLC involves working with a qualified attorney and ensuring you complete the necessary paperwork. Once your LLC is operational, the IRS will give you an employee identification number or EIN. This EIN is required for many financial operations, including opening a business bank account and credit cards, getting a rental property mortgage, and doing business in a state.

You can always use your social security number, but this defeats the purpose of creating an LLC and may expose you to significant financial liability.

Advantages of Owning Rental Property in an LLC

There is no question that there are many advantages to real estate investors who are looking to start an LLC, establish business credit, and begin to take advantage of investment property mortgage rates.

Limit Personal Liability

The most significant benefit to starting an LLC is self-protection. An LLC means that you can create a separate business account that is disconnected from your personal finances.

An LLC can effectively restrict your legal liability to the assets held under the LLC. For example, if someone trips on your rental property and sues you, the assets at risk would be limited to those owned by the LLC.

In other words, your personal finances would be protected, as the bank could only grab the assets of your business entity covered under your LLC. If you had the investment property in your name, you would face a situation where you have personal liability for these assets. This means that the bank could seize your assets – including your primary residence and all of your own personal assets.

This makes an LLC-owned rental property a popular and smart choice for many people.

Restrict Liability to Each Individual Property

The best practice is to have individual LLCs for each rental property. Although it might be more expensive and cumbersome to create individual LLCs, in case of a lawsuit and judgment against you, only that particular rental property and LLC assets would be at risk.

Let’s say you take out an investment property loan, but something goes wrong in your business, and you cannot make the payments on this conventional mortgage. In that instance, the bank or financing authority would seize the assets of the LLC. However, those asset seizures would be limited to the LLC only.

Real estate investors should not worry about other investment properties under separate LLCs.

Easier To Form Partnerships

An LLC also enhances your ability to partner with other investors or bring in alternative businesses. Creating an LLC allows you to build a unique corporate structure to pull in other investors and partners.

Even if you want to avoid going to the best crowdfunding platforms and raising money, an LLC mortgage is a useful strategy to invest in real estate with little or no money down. You can do all the grunt work while your money partner lends the money for the project, and profits are split as per the LLC documents.

Privacy Protection

It is also important to remember that using an LLC to buy a home or get a mortgage comes with some significant privacy considerations and advantages. As you likely know, any home purchase is public information.

When someone purchases a home, deed transfers are listed publicly, along with information on who bought the house and other identifying characteristics. If you buy a home with an LLC, the only thing that is published is information about the LLC.

You can use the LLC to protect your identity when investing in real estate. Such advantages may be critical in the real estate investing business, particularly if you have rented out enough properties to have some former tenants who don’t hold you in the highest regard. Unfortunately, this is common when you own rental properties.

Avoiding Hit to Personal Credit

If you had business trouble and didn’t have an LLC, it could negatively impact your personal credit scores. This would make it harder for you to get home equity loans, open new credit cards, and start a new business. You’d personally have to deal with higher interest rates and a variety of other financial challenges.

No Limit on Mortgages

While there is a limit on how many mortgages you can have in your personal name, building up a business credit history can be beneficial in the long run.

Yes, setting up an LLC and obtaining business credit might be more difficult at the start, but in the long run, building a business credit profile will make it easier for your LLC to open credit card accounts, get a mortgage, apply for financing, acquire liability insurance, and more.

Better Record Keeping

Having an investment property in an LLC also avoids inadvertently commingling personal and business expenses.

Keeping all the expenses and cash flow within the LLC will ensure you avoid running into audit issues. It is best to prevent transferring funds between personal and business accounts because a lawyer can “pierce the corporate veil” and undo your LLC asset protection plan. It is best to run all business income and expenses through the business checking account and credit cards tied to each respective LLC.

Challenges of Starting an LLC for Investment Properties

Extra Time and Effort

The time and cost of starting an LLC are not insignificant. You’ll have to employ various business experts, including an attorney and an accountant. Specifically, you’ll need an attorney to create articles of incorporation, ensure compliance with necessary regulations, and answer any questions about who can find the LLC.

Many states require an annual renewal fee to maintain an active and compliant LLC. I need to pay $800 annually in California even if the LLC is not conducting business.

This is both expensive and time-consuming. However, if you want to get involved in the real estate business, these costs are expected and often considered an essential part of doing business in this sector.

Harder To Get Mortgage Loans

While agency-backed mortgages have a limit of 10, they are much easier to obtain than a mortgage for an LLC-owned rental property.

LLC Mortgages More Expensive Than Conventional Mortgages

Mortgage for an LLC-owned rental property can be comparatively more costly than conventional lenders. For rental property LLC mortgages, the loan-to-value ratio typically remains below 80%, necessitating a higher down payment of 20% or more.

Rates are also possibly higher, so you must account for these costs when evaluating rental properties.

How To Get a Mortgage for an LLC-Owned Rental Property

It would be best if you resorted to creative financing strategies to get a mortgage for an LLC-owned rental property.

Conventional Mortgage

A conventional mortgage for an LLC can provide favorable terms, competitive interest rates, and flexible down payment options. However, it is essential to note that the lender will require a personal guarantee, a credit report, and personal financial information.

The loan will be a recourse loan, and the lender will come after your other income-producing assets if something goes wrong. Even with the drawback of personally guaranteeing the loan, it presents a valuable opportunity to build credit for your newly formed LLC.

Credit Unions

Local banks and credit unions in the market where your rental property is located are also viable options for obtaining a mortgage with your LLC.

Most local banks keep the mortgages in-house and do not sell them back to Fannie Mae and Freddie Mac. As a s result, they can be more flexible in providing a mortgage for an LLC-owned rental property.

Also, due to their community-focused approach, these smaller lenders may be more inclined to collaborate with you, recognizing the importance of your rental housing contribution in the market.

Portfolio Lenders

Portfolio lenders demonstrate greater flexibility in structuring LLC mortgages to align with your investment objectives. They typically expedite funding compared to conventional lenders and credit unions, which is a positive. The potentially higher fees and interest rates are significant disadvantages of portfolio lenders.

Private Mortgages

A private mortgage is similar to hard money loans; however, a private mortgage is more likely to be held for an extended period.

In cases where an investor cannot acquire a mortgage from a bank or financial institution, private mortgages become a viable financing strategy. The investor will borrow money from another person – similar to a mortgage from a bank – and pay that back over time.

Like a hard money loan, lenders and borrowers can negotiate everything about the funding. The borrower and lender will work together to determine the down payment, monthly payment, and other loan terms, which they will document in a real estate note.

Private mortgages are often between family members or friends and work well for the lenders, enabling them to build a real estate passive income source and turn someone else’s investment property into profit. The private money lender enjoys the advantages of real estate without needing to deal with being a landlord.

Seller Financing

Seller financing is a different form of financing used when the owner and the seller want to cut banks and other institutions out of the financing process. With seller financing, the seller and the new owner work out terms for purchasing the property and are more flexible with LLC loans for investment properties. It includes the length of a loan, interest rates, monthly payments, down payments, and consequences for default. Seller financing requires extensive negotiations with the actual owner of the property.

Seller financing can be preferable to bank financing in many ways. It can speed up the process of refinancing and cut out various fees. It can save time and, ultimately, money. Sellers willing to incur the risk of seller financing can make more money and turn over a property faster. Interest rates are usually higher with seller financing, meaning a seller can make more money.

If you’re an investor interested in seller financing, be prepared to talk with the property owner and educate them on how seller financing can turn the property into a monthly income investment.

Real Estate Crowdfunding

Real estate crowdfunding, also known as crowdfunded investing or property crowdfunding, allows several investors to pool their money together and buy a real estate investment property with the contributed pool.

Several crowdfunded platforms are available for investors to participate in crowdfunding arrangements. You can list your deal on these crowdfunded platforms and solicit funds.

Ensure you look at the checklist for evaluating crowdfunded deals and try to make your deal as attractive as possible for real estate investors. Consider signing up and investing in some of the existing deals so you understand the process from the perspective of retail investors.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investors. The minimum investment is $5,000.

Real Estate Syndication

A real estate syndication is a legal structure for individual investors to pool money together for investing in large real estate deals. The legal arrangement is either a Limited Liability Company (LLC) or a Limited Partnership (LP).

Instead of relying on crowdfunding platforms, you can directly reach out to individuals meeting the accredited investor status.

Ensure you have defined the legal structure and the Private Placement Memorandum (PPM) before raising capital from real estate investors. Define the waterfall equity distribution split and be upfront with investors on possible capital calls and risks.

Real estate syndication is a popular creative financing strategy for apartment building investment.

EquityMultiple is one of the best real estate syndication companies providing opportunities to compare and invest in residential or commercial real estate for accredited investors.

How Does an LLC Impact My Taxes

Ensure you select the correct filing status of the LLC with the IRS by consulting with a qualified tax professional.

An LLC doesn’t pay taxes directly. It operates as a pass-through entity. Because of this, an individual who opens an LLC can avoid the “double taxation” that would occur, meaning they are not taxed as a business and on a personal level for business gains.

Instead, an LLC ensures that you are only taxed once. This is a different situation than taxes levied against certain corporations, as corporations are often hit with a corporate net income tax AND then hit when profits move to the individual level. Since an LLC is a pass-through, you are only taxed at the individual level when your taxes move from your business to yours.

The tax benefits of an LLC not electing to be taxed as a C Corp are real. An LLC can ensure that you gain access to investment property loans and use all of the standard financial mechanisms of these loans, including a home equity loan.

Building Business Credit With an LLC

If you need an investment property loan or mortgage with an LLC, you need to build your business credit. An LLC means that you don’t have to put your personal assets at risk when starting a business venture or getting a loan, but that doesn’t necessarily make life easy. How can you get the funding to invest in a rental property or get an investment property loan if you are just starting an LLC?

The best thing you can do to build business credit with an LLC is immediately take out loans and create a solid repayment history. You can do this with something as simple as using a business credit card to pay your bills.

Remember, your LLC credit is different than your personal credit. In other words, you can have an excellent credit score, and it still won’t impact your business credit. It would help if you made an intentional effort to build a solid business credit with your LLC.

Ultimately, it would be best to spend as much time building your business credit as possible before applying for an LLC mortgage for a rental or investment property. Like a personal loan, the better your business credit, the lower your interest rates.

Dun & Bradstreet, Equifax business, and Experian business are the most prominent business credit reporting agencies. Several smaller ones specific to each industry also provide additional reporting.

With a solid business credit history, you can get loans on more favorable terms, ultimately saving thousands in business costs.

Can I Buy a Property in My Name and Transfer It to the LLC Later?

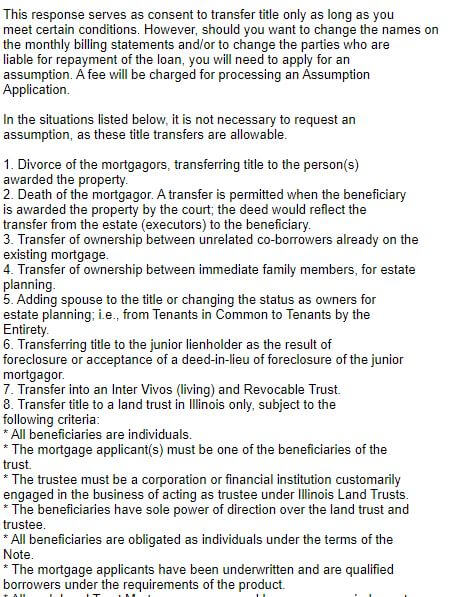

You can transfer the property to your LLC if you own your home outright. However, if your home is subject to a mortgage, such a transfer would activate both the due-on-sale clause

The lender considers the transfer of ownership as a sale. The due-on-sale clause stipulates the full repayment of the mortgage, and lenders can demand the remaining mortgage balance if you sell or transfer the property.

Even when creating a revocable living trust and moving property with a mortgage into the trust, getting a written confirmation from the lender is a good idea. When I moved my property to a revocable living trust, I documented the approval from the lender, as seen below.

If you do not already have a revocable living trust created, consider Trust & Will which provides state-specific trusts for the protection and transfer of your most important financial assets. You can also nominate legal guardians for your children to make sure they are looked after by someone you know and trust, in case something happens to you.

Is Buying Property Through LLC Worth It?

An investment property can do your average net worth a tremendous amount of good: It can expand your cash flow, allow you to build home equity, and ultimately enable you to get started in real estate investing.

However, establishing business credit and getting a mortgage loan for an investment property takes time and effort. You can get a loan personally, but you leave yourself exposed to legal challenges and can lose your assets if something goes wrong in your business. Using a rental property LLC mortgage approach is often preferable.

It’s essential to keep in mind that different LLCs operate differently. For example, imagine a situation in which you were creating an LLC to get an LLC mortgage and protect your personal assets. In this instance, the LLC process would be relatively quick: You’d make an LLC in which you were the only investor and didn’t have to worry about extensive operating agreements or other legal documents.

However, things might get complicated if you want to create an LLC with a partner, another business, or a foreign entity. In this circumstance, you’d have to work with corporate lawyers to ensure regulatory compliance, create an appropriate operating agreement, and set up the proper tax structure to pay any taxes.

In other words, the complexity of the LLC – including the partners you pull in – is ultimately responsible for how you pay taxes, how complicated the agreement is, and how you will manage any business-related income. Consider these costs when building out a budget for your rental property or LLC mortgage business.

Finally, remember that you still need to work with an attorney to separate your personal and LLC lives. There are a variety of highly complex possibilities in which the protections of an LLC can be breached, so it is best to check with an attorney to ensure you are protecting yourself.

There are many advantages to taking out a mortgage through your LLC. It can protect your privacy, shield you from legal liability, and ensure you can minimize the taxes you pay. The process can be somewhat complex, but there is no question that it is well worth it if you want to create generational wealth through real estate.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.