Trump Renegotiates Biden-Era Global Tax Deal, Giving U.S. Multinationals a Major Exemption

Nearly 150 countries have finalized an amended global tax agreement under the Organization for Economic Cooperation and Development (OECD), aimed at curbing profit shifting by multinational corporations.

But the most consequential twist is that large U.S.-based multinationals will be exempt from paying the 15% global minimum corporate tax overseas, marking a major departure from the original vision of the deal.

What the Original 2021 OECD Tax Plan Was Meant to Do

The OECD’s 2021 agreement sought to end the long-running “race to the bottom” in corporate taxation. By setting a 15% global minimum tax, the plan aimed to stop companies from using accounting strategies to book profits in low- or no-tax jurisdictions, regardless of where their real economic activity occurred.

The Biden-Era Global Tax Plan Was Built on Two Pillars

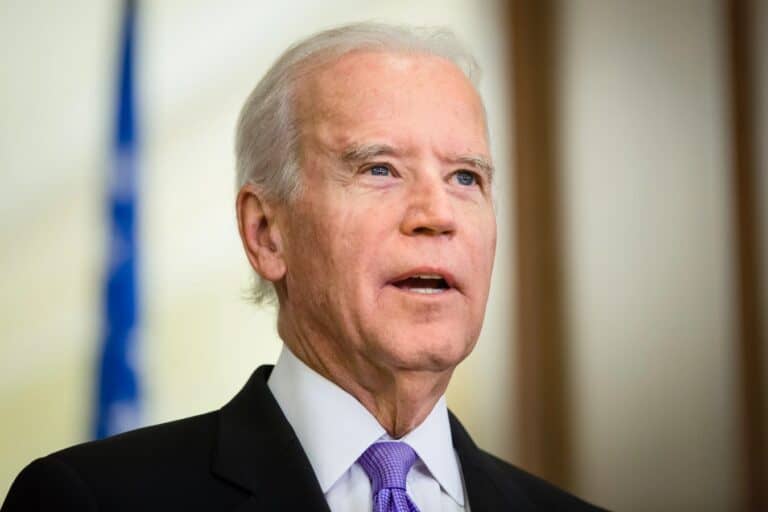

The original OECD agreement championed by the Biden administration in 2021 was designed around a two-pillar framework intended to overhaul how multinational corporations are taxed in a globalized economy. The goal was not just to raise revenue, but to modernize international tax rules that had failed to keep pace with digital business models and cross-border profit shifting.

Pillar One focused on where companies pay taxes. It aimed to reallocate taxing rights so that large multinational corporations; particularly digital and consumer-facing firms would pay taxes in countries where their customers and users are located, even if the company had little or no physical presence there. This was meant to address complaints from countries that global tech giants generated massive revenues within their borders while paying minimal local taxes.

Pillar Two established a 15% global minimum corporate tax, designed to eliminate incentives for profit shifting to low-tax jurisdictions. Under this pillar, if a multinational paid less than the minimum rate in a tax haven like Bermuda or the Cayman Islands, its home country could impose a “top-up” tax to make up the difference. Supporters argued this would end the decades-long race to the bottom in corporate taxation.

Together, the two pillars represented the most ambitious rewrite of global tax rules in nearly a century. Critics at the time warned the framework would reduce U.S. competitiveness, while supporters argued it would restore fairness, stabilize government revenues, and prevent multinational corporations from playing countries against one another.

The newly amended OECD deal keeps the broader framework intact but significantly weakens Pillar Two by exempting U.S.-headquartered multinationals; marking a sharp reversal from the Biden administration’s original vision.

Why U.S. Multinationals Are Now Exempt

After months of negotiations between the Trump administration and other G7 nations, the revised agreement carves out U.S.-headquartered companies from the OECD’s Pillar Two minimum tax. Instead, those firms will remain subject only to U.S. global minimum tax rules, reinforcing Washington’s control over how American companies are taxed worldwide.

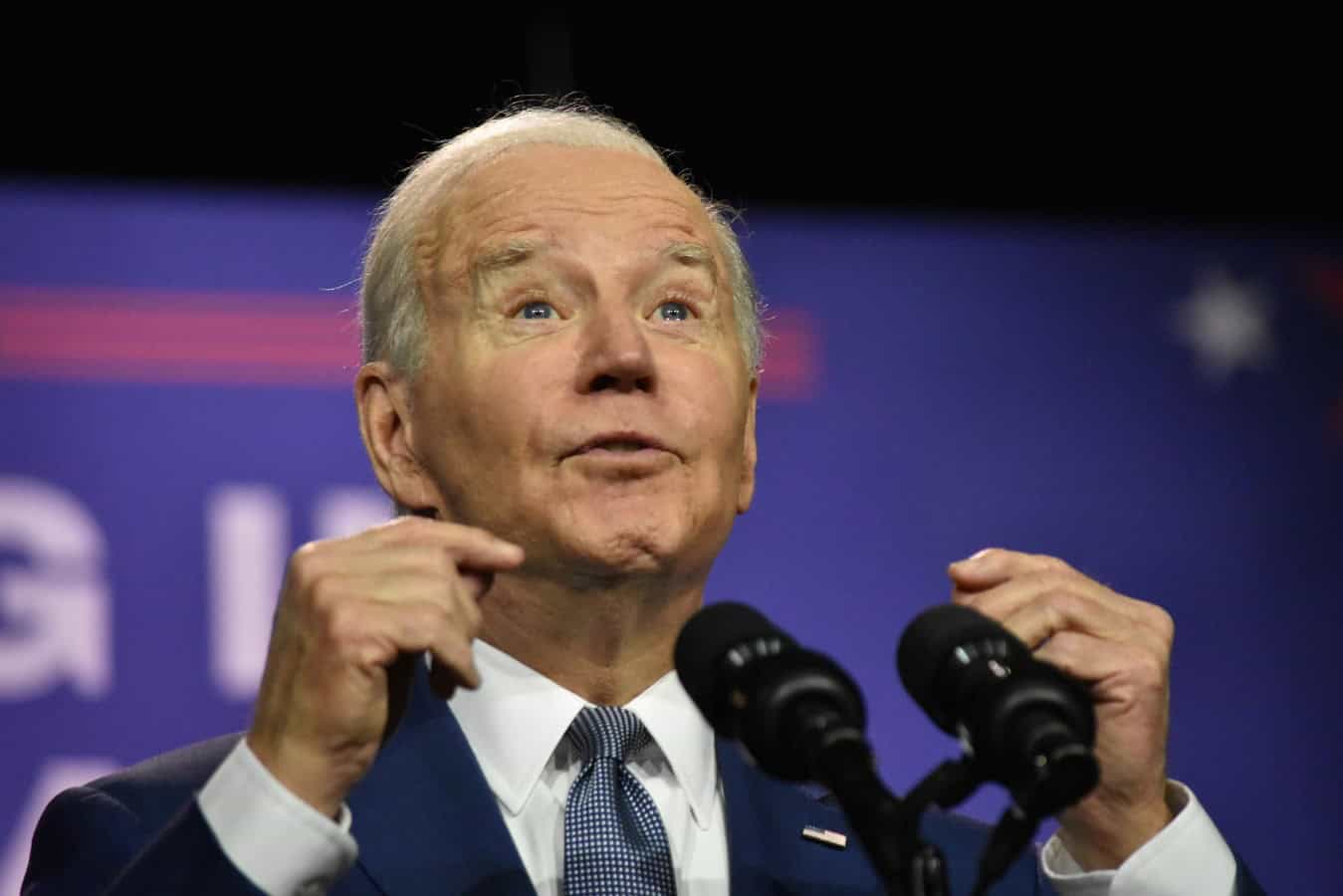

Trump Administration Claims a Sovereignty Win

Treasury Secretary Scott Bessent called the outcome a “historic victory” for U.S. sovereignty, arguing that the OECD framework would have allowed foreign governments to tax American companies extraterritorially. The administration framed the exemption as protecting U.S. workers, businesses, and congressionally approved incentives like the R&D tax credit.

OECD Says the Deal Still Strengthens Global Tax Cooperation

OECD Secretary-General Mathias Cormann defended the amended agreement as a “landmark decision in international tax co-operation.” He said the revised framework enhances tax certainty, reduces compliance complexity, and helps countries protect their tax bases; even with the U.S. exemption in place.

How the New Deal Waters Down the Global Minimum Tax

Critics argue the exemption significantly weakens the 2021 agreement. The original minimum tax was designed to prevent profit shifting by companies such as Apple and Nike to jurisdictions like Bermuda or the Cayman Islands, where they conduct little real business. Excluding the world’s largest economy, they say, undercuts the deal’s effectiveness.

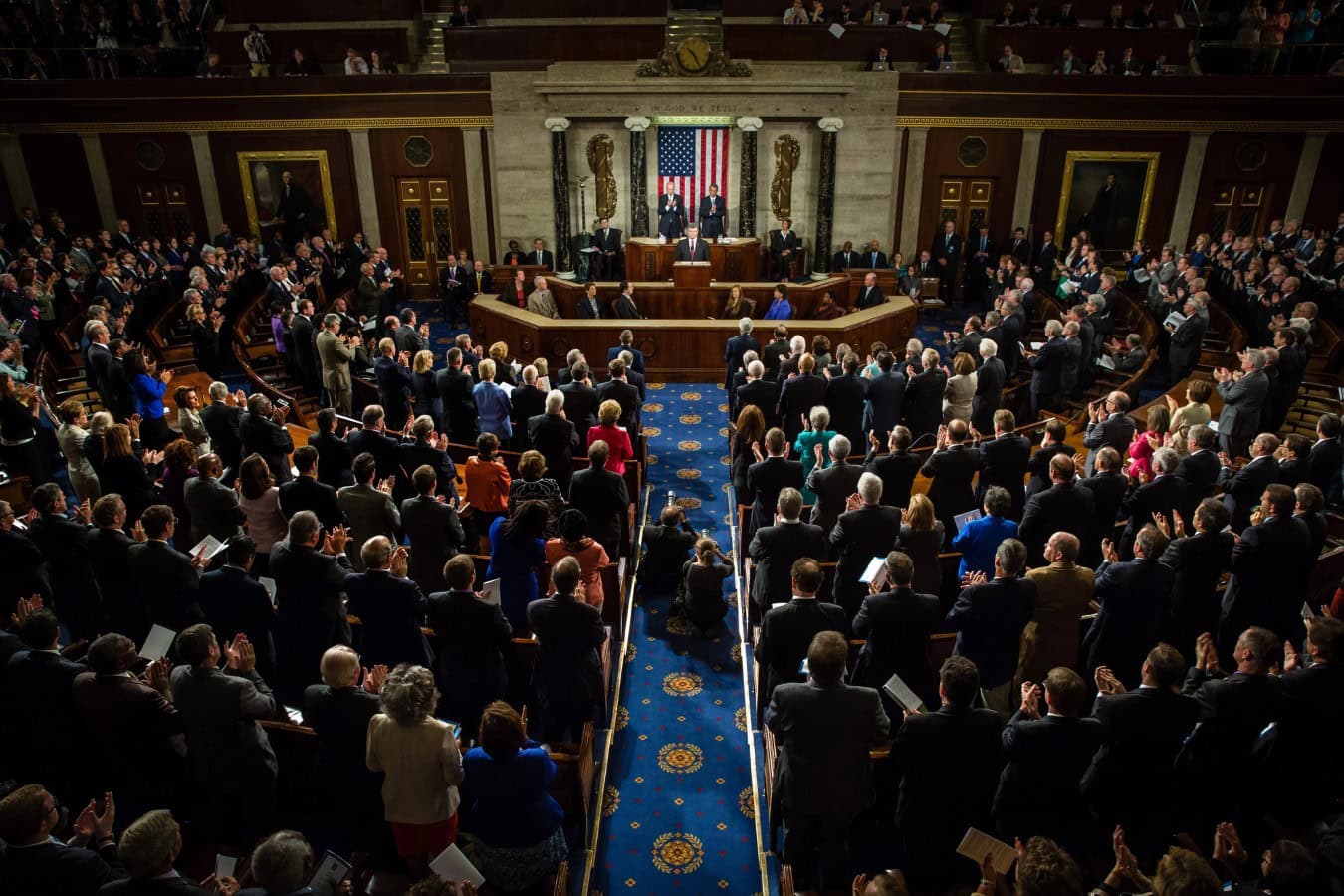

Republicans Cheer the Rollback of Biden-Era Policy

Congressional Republicans applauded the finalized agreement, calling it a reversal of what they viewed as the Biden administration’s “unilateral global tax surrender.” Senate Finance Chair Mike Crapo and House Ways and Means Chair Jason Smith said the outcome puts America First and restores U.S. competitiveness.

The House Ways and Means Chair put forth a statement titled “President Trump Puts America First in Unwinding Democrats’ Unilateral Global Tax Surrender” stating “Today marks a vital step in the effort to ensure that American workers and jobs will no longer be targeted by foreign competitors in a global tax surrender created by Democrats in the last Administration, thanks to a new agreement negotiated by President Trump and his Administration.”

Treasury Says OECD Deal Protects U.S. Jobs and R&D

Treasury Secretary Scott Bessent said the finalized agreement fulfills President Trump’s Day One commitment that the Biden administration’s OECD Pillar Two proposal would have no force or effect in the United States, while safeguarding domestic job creation and innovation incentives. In coordination with Congress and more than 145 countries in the OECD/G20 Inclusive Framework, Treasury secured a side-by-side arrangement keeping U.S.-headquartered companies subject only to U.S. global minimum tax rules, protecting the value of the R&D credit and other congressionally approved incentives for investment and employment. Bessent called the outcome a historic victory for U.S. tax sovereignty and American workers, adding that Treasury will continue engaging foreign governments to ensure implementation, promote global tax stability, and advance talks on digital economy taxation.

The Role of the Scrapped ‘Revenge Tax’

The breakthrough followed Congress rolling back a proposed “revenge tax” that would have allowed the U.S. to penalize companies and investors from countries deemed to impose unfair taxes on American firms. Removing that provision helped clear the path for renegotiating the OECD deal on more favorable terms for U.S. companies.

Transparency Groups Warn of a Return to Tax Havens

Tax watchdogs and transparency advocates have sharply criticized the revised agreement. Groups like the FACT Coalition warn it could undo nearly a decade of progress by allowing the largest and most profitable American corporations to continue parking profits in low-tax jurisdictions.

What This Means for the Future of Global Tax Rules

Supporters say the amended deal brings stability and respects national tax sovereignty, while critics argue it risks reviving global tax competition. As countries move toward implementation, the exemption for U.S. multinationals raises a central question: can a global minimum tax work if the biggest players are allowed to opt out?

Like Financial Freedom Countdown content? Be sure to follow us!

Nearly 500,000 West Virginia Social Security Recipients Are About to See Bigger Checks in 2026

Nearly half a million Social Security recipients in West Virginia are set to receive higher monthly payments as the state completes a long-planned phaseout of its income tax on Social Security benefits. Starting in 2026, benefits will no longer be taxed at the state level, putting more cash directly into retirees’ pockets.

Nearly 500,000 West Virginia Social Security Recipients Are About to See Bigger Checks in 2026

Forgotten IRS Retirement Rule Is Costing Americans $1.7 Billion a Year and It’s Still Catching Retirees Off Guard

Missing a required minimum distribution (RMD) might sound like a minor paperwork error. But new research from Vanguard shows it’s anything but small: investors who failed to take required withdrawals in 2024 triggered an estimated $1.7 billion in IRS penalties, with the biggest mistakes concentrated among people with the smallest retirement accounts. Here’s what the data reveals; and what retirees can do to avoid an expensive oversight.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.