Extensive 3-Year Study Reveals Why Universal Basic Income Handouts Don’t Work

The results of the largest American-controlled Universal Basic Income (UBI) experiment have been released. Funded by the founders of OpenAI, this study was likely intended to address potential job losses anticipated due to Artificial Intelligence.

In the experiment, 1,100 randomly selected households earning less than $29,900 annually received $1,000 per month for three years, effectively boosting their income by 40%. The UBI participants were spread across urban, suburban, and rural areas in Texas and Illinois.

Study Design

Most participants were recruited through mailings sent to a diverse range of addresses in Texas and Illinois, with an oversample of individuals estimated to be eligible. The mailings invited recipients to participate in a study offering “$50 or more.” From approximately 14,000 respondents who agreed, a weighted random sample of 3,000 people was selected to ensure racial and income diversity, ranging from 0-300% of the Federal Poverty Level (FPL).

All 3,000 participants were enrolled in a cash transfer program providing $50 per month. In the final randomization, 1,000 of the 3,000 were notified that their monthly payment would be increased to $1,000.

Total Household Income Dropped

UBI participants ended up earning $1,500 less, even though they were given an additional $12,000 annually. For every dollar received, total household income decreased by at least 21 cents.

Motivation to Work Decreased

UBI participants remained unemployed for an additional month compared to those in the control group.

On average, those receiving basic income were two percentage points less likely to be employed and worked approximately 1.3 hours fewer per week.

UBI participants worked fewer hours, with no significant improvements in the quality of their employment.

Greater Leisure Time

Participants spent more time on leisure based on survey data

Minimal Efforts to Improve Income

In theory, participants receiving the cash could afford to spend more time searching for jobs that better suit their needs. However, UBI participants made minimal efforts to enhance their education or training to increase their income.

Higher Self-Reported Disability Rates

UBI participants self-reported higher rates of disability, which they cited as a reason for limiting their work capacity.

No Improvement in Health Outcomes

It’s widely recognized that lower-income individuals often experience significantly worse health outcomes. Is poverty the root cause of this disparity, and could a substantial cash transfer help bridge this gap?

The study found that while the cash transfer initially led to significant improvements in stress and mental health, these benefits were short-lived. By the second year, both treatment and control groups reported similar levels of stress and mental health, with no detectable long-term improvements.

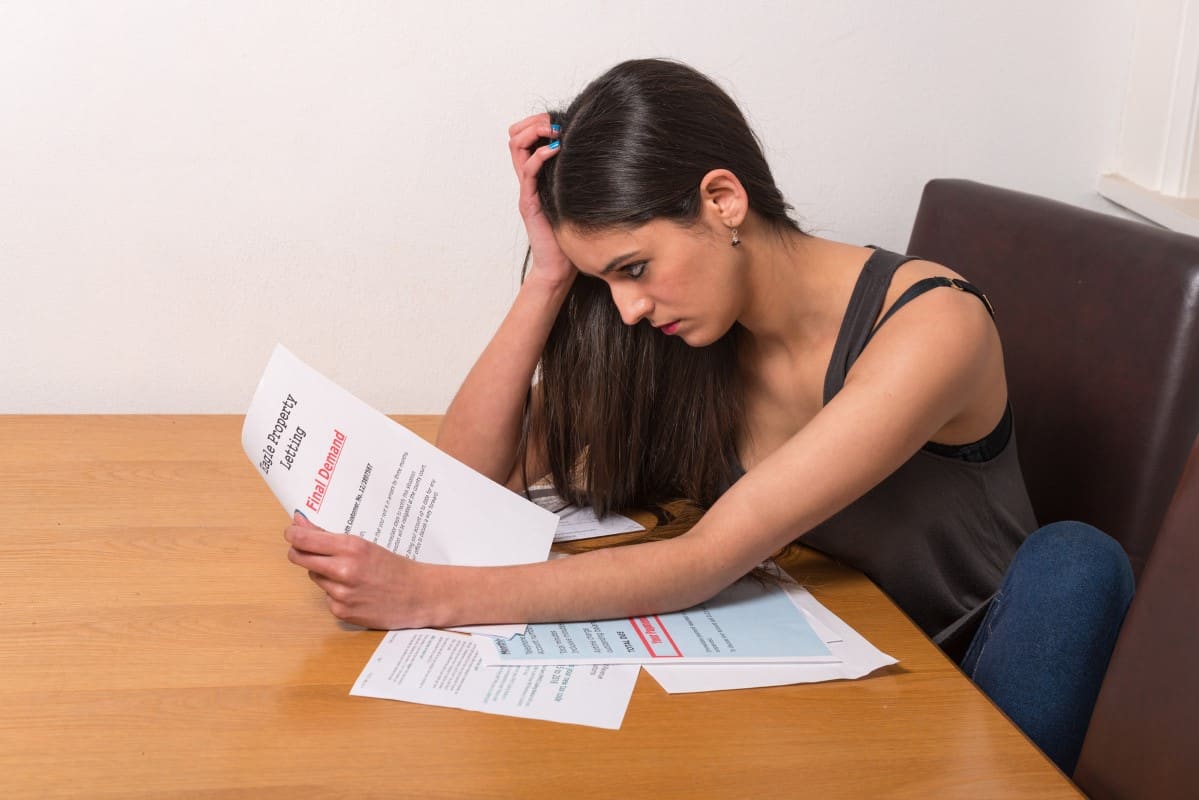

Financial Conditions Did Not Improve

Credit delinquencies, defaults (including bankruptcies and foreclosures), and credit utilization remained unchanged by the UBI. The positive effects on financial health were short-lived. This effect declined over time and turned slightly negative by the third year.

Combining the effects on assets and debt, the transfer did not significantly increase net worth. While it did offer short-term improvements in financial health and some measures of liquid savings, it did not lead to substantial gains in net worth, credit access, or other factors that might contribute to long-term improvements in household financial stability.

Conclusions of the Universal Basic Income Study

Overall, the negative impact on labor supply does not seem to be counterbalanced by increased engagement in other productive activities, and there is no evidence that participants secured better jobs during the 3-year duration of the program.

Additionally, the NBER study did not measure the impact of inflation on the overall economy due to the UBI handed out. Similarly, the impact on deficits and tax rates was not considered if UBI would be implemented across the entire country.

Like Financial Freedom Countdown content? Be sure to follow us!

Alarm Grows as Federal Reserve’s Data Shows Sharp Increase in Household Debt and Rising Delinquency Rates

In the second quarter of 2024, total household debt soared by $109 billion to reach $17.80 trillion, according to the Federal Reserve Bank of New York. This surge encompasses credit card balances, mortgage loans, and auto loans, all peaking at unprecedented levels. Meanwhile, delinquency rates for these debt types are on the rise, prompting worries among economists and financial analysts about the resilience of the U.S. consumer-driven economy.

Retirees Struggle with New Social Security 2025 COLA Forecast at a Meager 2.63% Amid High Inflation

As we await the official Social Security cost-of-living adjustment (COLA) numbers, the Senior Citizens League (TSCL) has revised its long-term Social Security COLA forecast for 2025 to 2.63%. While this is an increase from the June 2024 forecast of 2.57%, it might not be enough for seniors struggling to keep up with inflation.

Retirees Struggle with New Social Security 2025 COLA Forecast at a Meager 2.63% Amid High Inflation

Warren Buffet Sells Half of Apple Stock Amid Growing Recession Fears Shaking Global Markets

Warren Buffett’s Berkshire Hathaway made an unexpected decision last quarter by selling nearly half of its substantial Apple holdings. The Omaha-based conglomerate revealed in its earnings report that its investment in the iPhone manufacturer was reduced by just over 49%. The sale of Apple shares is part of a larger trend of selling by Buffett in the second quarter, during which Berkshire divested over $75 billion in equities. This increased the conglomerate’s cash reserves to a record $277 billion.

Warren Buffet Sells Half of Apple Stock Amid Growing Recession Fears Shaking Global Markets

Social Security Solvency Pushed to 2035, Medicare Extended to 2036: Here’s How It Impacts You

The latest annual trustees report for Social Security and Medicare, extends the projected depletion dates for both programs. However, officials warn that without significant policy changes, these vital programs could still be in jeopardy of failing to provide full benefits to retirees.

Social Security Solvency Pushed to 2035, Medicare Extended to 2036: Here’s How It Impacts You

Is the 4.28% Treasury I Bond Rate Still a Wise Investment Choice?

Inflation poses a serious threat. As inflation surged in the past two years, I bonds became a secure and appealing investment choice. However, with recent lower CPI figures, the composite rate for I bonds stands at 4.28%, a decrease from the attractive 9.62% annual rate investors enjoyed in May 2022. Given these reduced rates, investors are now weighing whether to continue purchasing or to sell their existing Series I bonds.

Is the 4.28% Treasury I Bond Rate Still a Wise Investment Choice?

Unlock Financial Freedom with These 15 Smart Investments for Monthly Passive Income

Dreaming of a steady monthly passive income? It’s not just for the wealthy—it’s attainable for anyone willing to explore their options. Whether you’re starting out or looking to diversify, discover how to build a reliable income stream from well-known choices to hidden opportunities.

Unlock Financial Freedom with These 15 Smart Investments for Monthly Passive Income

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.