Grocery Bills Remain High Despite Reported Inflation “Decline” Causing Shoppers To Still Struggle

Feeling perplexed by rising grocery prices despite reports of declining inflation? You’re not alone.

Despite claims of inflation easing, food prices have actually risen by 3.4% compared to the previous year.

This increase is more than the 20-year average of 2.5% annual inflation in retail food prices. If you’ve noticed higher bills at the checkout, you’re experiencing a real phenomenon—here’s why.

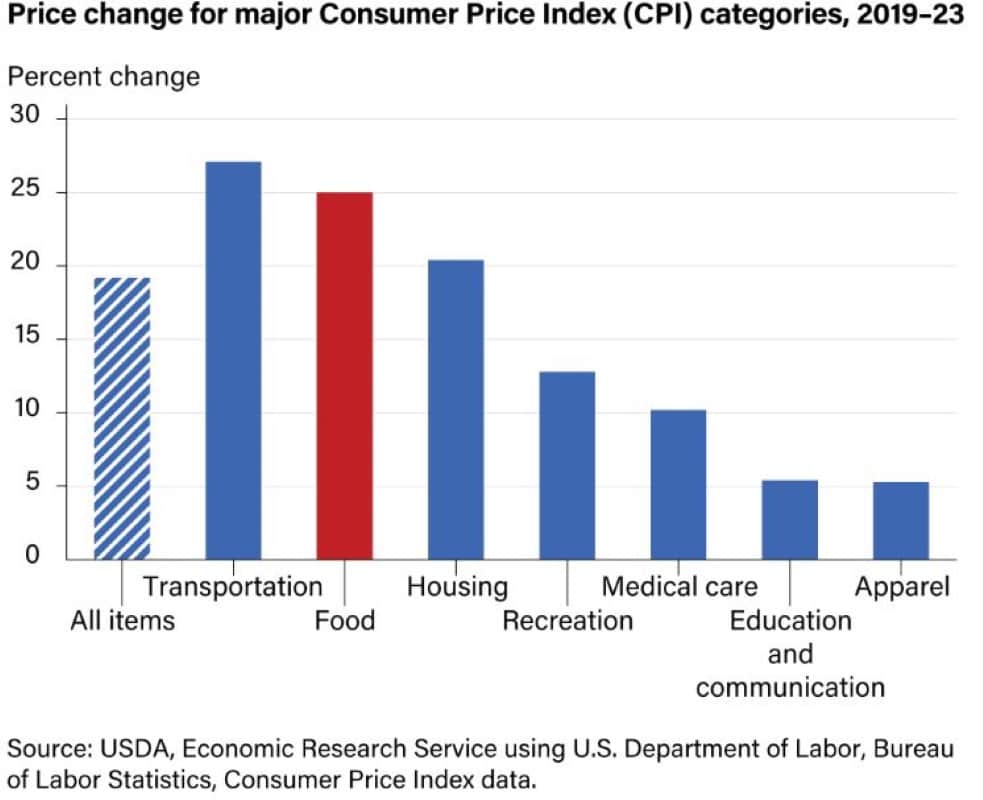

U.S. Food Prices Surged From 2019 to 2023

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25.0 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period. While food prices saw a rise lower than the 27.1-percent increase in transportation costs, they outpaced the upticks in housing, medical care, and all other primary categories.

Average U.S. Food Budget

According to the Census Bureau’s Household Pulse Survey, on average, families spend approximately $270 per week on grocery shopping, with expenses escalating with the addition of children to the household. Households with children typically allocate around $331 per week towards groceries, marking a 41% increase compared to families without children. The typical American household allocates over $1,000 monthly to groceries, though this expenditure fluctuates based on geographic location and family size.

California Tops The List As Most Expensive

California was at the top of the list for most expensive places to buy groceries, with the average household purchasing $297 worth of groceries per week. Neighboring state, Nevada follows closely behind with the average household spending $294 a week.

Midwest Has Below Average Grocery Bills

In the Midwest, households in states like Iowa, Nebraska, Michigan, and Indiana spent below the national average on groceries, with weekly expenses totaling less than $240, according to the Census Bureau.

Most Expensive Cities for Groceries

Miami ranks among the priciest cities in the U.S. for grocery shopping, with the average household spending approximately $327 weekly, 14% above the Florida statewide average. Meanwhile, California hosts three of the top 10 most expensive cities for groceries: Riverside, Los Angeles, and San Francisco..

The top 10 cities are

– Miami – $327.89

– Houston – $302.65

– Riverside – $300.50

– San Francisco – $298.44

– Los Angeles – $295.33

– Seattle – $289.23

– New York – $282.60

– Dallas- $282.21

– Chicago – $278.91

– Atlanta – $277.54

The information is sourced from the U.S. Census Household Pulse Survey

Despite the challenging landscape of rising grocery bills that many of us are facing, there’s a silver lining. We’re not powerless in this scenario. As we navigate through the confusion of governmental reassurances versus the reality of our dwindling bank balances, it’s crucial to arm ourselves with strategies that can help us tighten our belts without sacrificing nutrition or quality. Next, we’ll delve into practical tips and tricks that promise to ease the strain on your wallet, ensuring that even in the face of high inflation, your grocery budget remains firmly in your control.

Tip #1: Plan Your Meals

Planning your meals for the week ahead can significantly reduce impulse buys, ensuring you purchase only what you need. By aligning your shopping list with your meal plan, you can avoid wasting money on unnecessary items and minimize food waste.

Tip #2: Shop With a List

Never underestimate the power of shopping with a list. It keeps you focused, saves time, and helps resist the temptation of sales and promotions on items you don’t really need. Sticking to your list is a surefire way to stay within your budget.

Tip #3: Buy Generic

Brand names often come with a higher price tag due to marketing and packaging costs. Generic brands, however, offer the same quality at a fraction of the price. Don’t pay extra for a label; choosing generic can lead to substantial savings over time.

Tip #4: Use Coupons Wisely

Coupons can be a great way to save money, but only if used for items you already plan to buy. Digital coupons and grocery store apps have made it easier than ever to find deals on your favorite products. Combining coupons with store sales can maximize your savings.

Tip #5: Purchase in Bulk

Buying in bulk can lead to significant savings for non-perishable items and products you use regularly. However, be cautious—only buy quantities you can realistically use to avoid waste. Consider splitting large purchases with friends or family to enjoy bulk prices without the bulk quantity.

Tip #6: Opt for Seasonal Produce

Seasonal fruits and vegetables are not only fresher and tastier but also more affordable. Prices drop on produce when there’s an abundance of it during its peak season. Incorporating seasonal produce into your meals can lead to more delicious, cost-effective eating.

Tip #7: Limit Processed Foods

Processed foods might be convenient, but they’re often more expensive and less healthy than their whole food counterparts. Focus on buying whole ingredients and cooking from scratch when possible. This approach is not only better for your wallet but also for your health.

Tip #8: Embrace Meatless Meals

Meat is often one of the most expensive items on a grocery bill. Incorporating one or two meatless meals into your weekly menu can significantly reduce your grocery spending. There are plenty of nutritious and satisfying vegetarian recipes that can help you cut costs without sacrificing flavor.

Tip #9: Capitalize on Sales and Use Your Freezer

Take advantage of sales, especially for meat and poultry, which can be one of the largest expenses in your grocery budget. Most stores rotate their sales every 3-4 weeks, so when items like chicken are on sale, buy enough to last until the next sale cycle and freeze the excess. This strategy not only saves money but also ensures you have a stock of essentials on hand, reducing the need for last-minute, full-price purchases.

Embrace Savings to Tackle High Grocery Bills

In a time when the disconnect between official inflation reports and the reality of escalating grocery prices seems to widen, your frustration is completely justified. The surge in food prices reveals a challenging scenario for many American households. From the significant increase in the Consumer Price Index for food to the noticeable uptick in average household food budgets, it’s clear that the cost of living is on an upward trajectory, with grocery expenses leading the charge.

Regions like California and cities such as Miami have emerged as some of the priciest for grocery shoppers, underscoring the geographical disparity in the financial burden faced by families across the U.S. Yet, despite these daunting figures there are effective strategies you can employ to mitigate the impact of rising food costs on your household budget.

The typical budget templates such as the 50/30/20 allocate 50% of your take home pay to essentials such as rent, other housing bills, groceries. With rent and groceries going up simultaneously it is difficult for families to not go into debt.

Grocery spend as part of income has been in a steady downward trend for several decades. However, Americans were forced to spend 11.3% of their income on food in 2022, level not seen since 1980s as per the USDA. It has been 30 years since food ate up such a large part of the budget.

If you want to track your spending across categories sign up for Personal Capital which categories your current spending and creates a budget for you. You can read my Personal Capital review on how I use it.

By adopting practical measures such as meal planning, smart shopping, opting for generic brands, and making the most of sales and bulk purchases, you can stretch your dollar further without compromising on the quality or nutritional value of your food. Moreover, integrating cost-saving practices like embracing meatless meals, prioritizing seasonal produce, and reducing reliance on processed foods can lead to both financial and health benefits.

With these tips and a proactive approach to managing your grocery budget, you can ensure that even in the face of rising costs, your pantry remains stocked and your finances under control.

Like Financial Freedom Countdown content? Be sure to follow us!

Investors Snatch 26% of Affordable Homes, Crushing Dreams of Homeownership for Many

In the fourth quarter of 2023, real estate investors secured a whopping 26.1% of affordable homes sold in the U.S as per a Redfin report. This figure, a record high, marks a significant surge from the previous year’s 24%. Investors also acquired 13.6% of mid-priced homes (a slight decrease from 14.3% a year earlier) and 15.9% of high-priced homes (a slight increase from 15.4% a year earlier).

Investors Snatch 26% of Affordable Homes, Crushing Dreams of Homeownership for Many

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

As spring blooms and road trip season kicks into high gear, drivers face the challenge of balancing wanderlust with the rising cost of fuel. The average regular gas price as of March 2024 is $3.45 per gallon and at the highest level since November. But fear not! We’ve compiled 12 invaluable tips to help you navigate the highways and byways while keeping your gas budget in check. From clever tricks to tried-and-tested techniques, discover how you can maximize your mileage and minimize your spending, ensuring that your spring road adventures are not just memorable but also affordable. Whether you’re planning a cross-country expedition or a weekend getaway, these tips will empower you to make the most of every gallon, so you can hit the road with confidence and ease.

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

Dreaming of a consistent passive income every month from your investments? It’s not just a dream for the wealthy; it’s achievable for anyone willing to explore the possibilities. We will uncover various investments that promise monthly returns, from the well-known to the hidden gems. Whether you’re new to investing or looking to diversify your portfolio, discover how to create a dependable monthly income stream and take a step towards financial stability.

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.