Unraveling Online Romance Scams: Here Are the 8 Warning Signs to Protect Your Heart and Wallet

According to the Federal Trade Commission (FTC), more than $1.3 billion vanished in 2022 due to romance scams. The surge in online dating has amplified this deception, impacting more than 70,000 Americans.

Although Valentine’s Day is over, young and old alike are falling prey to romance scams throughout the year.

Popularity of Online Dating

With the rise of online dating, romance scams are easier to accomplish. You’re eager for a face-to-face meeting, but they can’t comply. Their excuse is often seamlessly woven into their fabricated identity.

Asserting to be stationed on a distant military base is the most prevalent pretext, while working abroad or traveling for work is another frequent reason. Frequently, these perpetrators focus on older individuals and those facing challenges in relationships or experiencing emotional vulnerability.

According to the FTC report, romance scammers frequently target individuals seeking love through dating apps. However, reports of romance scams initiated with unsolicited private messages on social media platforms are even more prevalent.

Surprisingly, 40% of those who reported financial losses to romance scams disclosed that the initial contact occurred on social media, while 19% mentioned it began on a website or app.

Numerous victims reported that the scammer swiftly transitioned from charming conversations on dating apps to WhatsApp, Google Chat, or Telegram platforms.

Generational Divide With Online Scams

Younger individuals are targeted differently compared to older folks. Individuals aged 18 to 29 were over six times more likely to report falling victim to “sextortion” compared to those aged 30 and above.

That’s when scammers manipulate individuals into sharing explicit photos. Once shared, the once lovely potential companions turn dark, threatening to expose victims to their social media connections.

Approximately 58% of sextortion reports in 2022 cited social media as the initial contact method, with Instagram and Snapchat being the most commonly mentioned platforms.

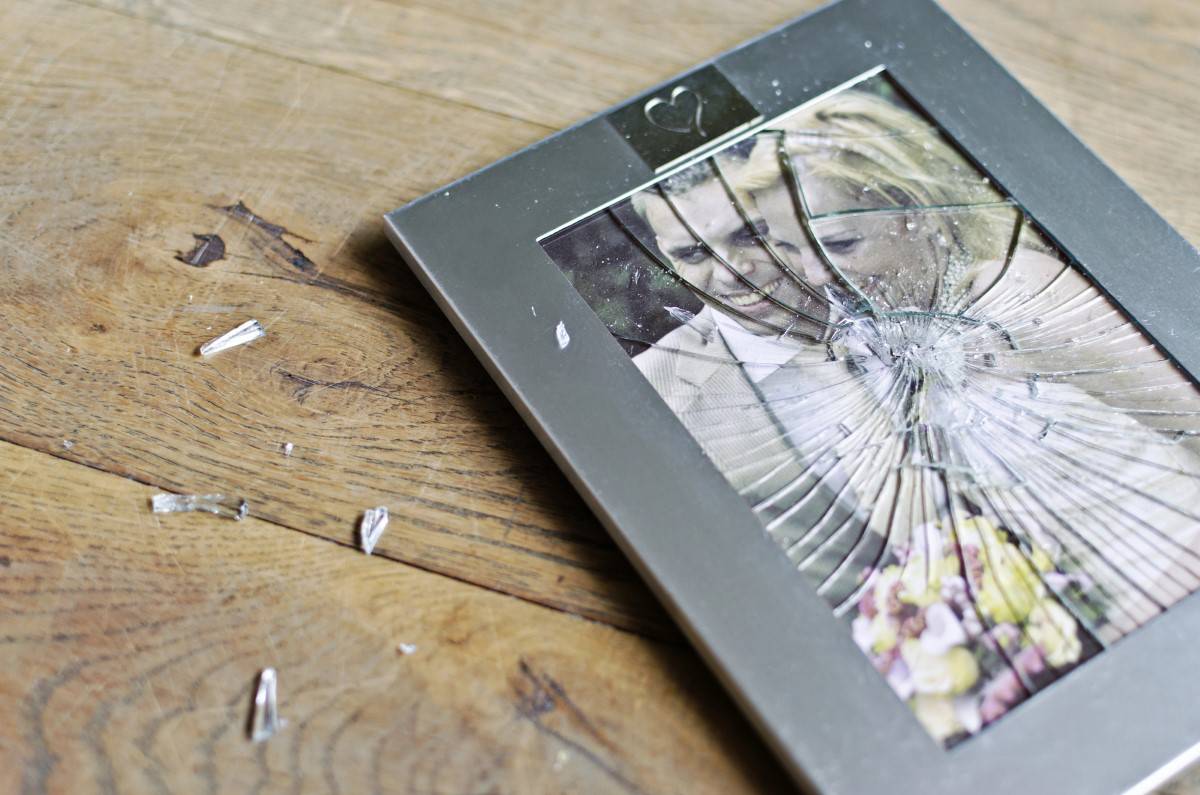

Older adults experiencing loneliness and isolation are particularly susceptible to romance scammers posing as helpful individuals.

Romance Scams Are Hard To Investigate

Proving and investigating this crime poses significant challenges, primarily because many scammers operate overseas. They function not as solitary operators but as part of organized fraud rings, employing sophisticated techniques. Additionally, these scammers are known to engage in phone number spoofing.

They may even hire actors to communicate with victims over the phone, enhancing the establishment of trust obtained through deceptive means.

Many victims hesitate to report the crime due to feelings of embarrassment and humiliation arising from being deceived, primarily when they have invested emotionally and financially in the relationship. This leads victims to send money to scammers and exposes them to additional fraudulent schemes.

The personal and intimate information shared by victims is often exploited for identity fraud and financial account takeovers, among other scams.

Scammers sometimes manipulate victims into unwittingly participating in criminal activities, such as laundering and transferring fraudulent funds, leaving the victims financially and potentially criminally liable. Here are 8 tips to identify scammers

#1 Online Posts

Perpetrators conduct thorough research on prospective victims. They scour social media and dating platforms to uncover details about their lives and personalities. Proficient in manipulation, they exploit the information gathered from open and personal posts, strategically building a connection with the victim over an extended period.

This gradual approach creates a genuine connection and romantic interest and leads victims to invest emotionally in the online relationship. The anonymity afforded by the internet allows criminals to operate covertly, spending unlimited time searching for potential victims and patiently waiting for someone to fall prey to their tactics.

#2 Inappropriate Photos

Requests for inappropriate photos or videos should be a red flag. Fraudsters coerce individuals into divulging explicit photos and frequently resort to threats of publicizing these images to their social media connections.

#3 Unable To Meet

Remain vigilant if the individual repeatedly fails to appear for scheduled meetings and consistently provides excuses. Fraudsters frequently present themselves as having high net worth or hailing from well-to-do or influential families, citing extensive international travel due to their business interests.

They employ a strategy of rapidly cultivating relationships, aiming to gain the trust of their victims swiftly and occasionally proposing marriage. However, when victims attempt to arrange face-to-face meetings, the scammers consistently fail to show up, providing a series of excuses.

#4 Asking Financial Information

Be suspicious, and do not send money or share any financial information. Be cautious of providing financial information, as scammers may use it for extortion. Refrain from sending money to individuals you’ve only interacted with online or through phone conversations, primarily when the request is via cryptocurrency, wire transfers, or gift cards.

#5 Offering Investment Advice

Scammers may present themselves as successful stock investors offering to teach you the ropes, but any funds you “invest,” end up in their pockets. They may tout their success with stock investments and offer to “help” you increase your net worth.

#6 False Statements

Alternatively, they could claim to have sent you a valuable package or mistakenly detained by foreign government officials, requiring you to send money for fictional “customs” or other fees. It’s all a deception — you send the money, and the promised package never materializes.

#7 Ask To Send Money

Some romance scammers also fabricate stories about being sick, injured, or in legal trouble, creating a false pretext to persuade you to send them money. Scammers will say they have an emergency and do not have funds to buy tickets to see you. Or they can’t afford to pay their phone bill. They will urge you to purchase gift cards, transfer funds via wire, or send cryptocurrency. Once you’ve sent the money, it’s unlikely you’ll recover it.

#8 Fake Pictures

Perform a reverse image search on the individual’s profile picture. Look for any associations with a different name or discrepancies in the details. These could be indicators of a scam.

5 Tips to Prevent Financial Losses from Scammers

If you suspect you’ve fallen victim to a scam,

– Cease communication with the individual promptly.

– Discuss the situation with someone you trust, and provide details.

– Report the incident to local law enforcement.

– File a fraud complaint with the Federal Trade Commission.

– Even if recovering losses is no longer possible, sharing details can prevent others from falling victim to similar scams.

Protect Your Loved Ones

Increase awareness to safeguard yourself and your older loved ones. While discussing romance scams may be uncomfortable, ensure that you, your family, and your friends are well-informed about them.

The more knowledge you have about these scams, the more effectively you can protect yourself and others from falling victim to them. Regularly reach out to older loved ones. Scammers specifically aim to exploit individuals living alone or coping with the loss of a spouse, recognizing them as more susceptible targets.

Like Financial Freedom Countdown content? Be sure to follow us!

Surging 401(k) Hardship Withdrawals Unveil a Growing Concern Threatening Middle-Class Financial Stability

Recent reports from major retirement players like Vanguard, Fidelity Investments, and Bank of America point to a troubling trend. More individuals are resorting to hardship withdrawals from their 401(k) accounts, signaling a rise in immediate financial strains. This emerging pattern indicates that many Americans are navigating severe financial challenges.

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

Homeownership Crisis: How the American Dream Slipped Away in Just 4 Years

Today, aspiring homeowners face a daunting financial reality: earning over $106,000 is now a prerequisite for affording a home comfortably—an 80% increase from January 2020. Median income has risen only 23% in the same time frame putting the dream of homeownership out of reach for many Americans as per the latest report from Zillow.

Homeownership Crisis: How the American Dream Slipped Away in Just 4 Years

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.