Surge in 401(k) Hardship Withdrawals Highlights Growing Middle-Class Financial Struggles

Recent findings from prominent retirement firms such as Vanguard, Fidelity Investments, and Bank of America reveal a troubling trend as an increasing number of individuals are tapping into their 401(k) accounts for hardship withdrawals, highlighting the escalating financial pressures and distress facing many Americans.

Trends From Bank Of America, Vanguard, Fidelity

Stock market investments have done well in 2023 after a dismal performance in 2022. The S&P 500 has risen over 20% year-to-date and is close to the previous all-time high.

However, recent reports by Bank of America indicate that many Americans are prematurely tapping into their retirement savings. The number of participants taking hardship distributions increased 36% year-over-year.

The Vanguard 2023 report shows hardship withdrawals, a likely indicator of financial stress, were rising.

The Fidelity report shows that in the third quarter of 2023, 2.3% of workers took a hardship withdrawal, up from 1.8% in 2022. The top two reasons behind this uptick were avoiding foreclosure/eviction and medical expenses.

Unraveling the Causes Behind the Surge in 401(k) Hardship Withdrawals

Various pressing circumstances prompt individuals to consider these withdrawals, from unforeseen medical expenses to sudden job loss. Decreased personal savings, the rising cost of essentials due to inflation, and high credit card debt indicate ongoing challenges in the financial landscape.

IRS Cautions Against 401(k) Hardship Withdrawals

As per the IRS, hardship withdrawals allow workers to tap their 401(k) for an “immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need.” However, the penalty can be waived if workers provide adequate evidence that the money is being used for a qualified hardship, such as an unreimbursed medical expense totaling more than 10% of the individual’s adjusted gross income.

Is a 401(k) Loan Better?

Considering the restrictions on contributing for the next six months, opting for a 401(k) loan might be more advantageous in certain situations. Under federal regulations, employees can borrow up to 50% of their account balance or a maximum of $50,000, whichever is lower, without facing penalties, provided the loan is repaid within five years.

An advantage of opting for a 401(k) loan over a hardship withdrawal is that when you borrow from a 401(k), you pay back the loan with interest, and that extra interest goes back into your own account. This helps compensate for the lost investment gains when you borrowed the money from your retirement account. 401(k) loans do not report to the credit bureaus and do not impact credit scores.

Disadvantages of a 401(k) Loan

The challenge of a 401(k) loan is that in the event of a job loss or securing new employment, many employers may demand prompt repayment of the remaining balance within a shorter period. Also, repaying the loan using after-tax dollars means you will get double-taxed when eventually receiving retirement age-appropriate distributions.

Opt for Hardship Withdrawals Only as a Final Choice

Many financial advisors discourage tapping into 401(k) investments as it involves additional taxes and penalties. You also lose out on the potential growth from compound interest.

Riley Adams, CPA and founder of WealthUp, says, “A 401(k) hardship withdrawal is a tough decision, not one that should be made lightly. Considering the future lost returns and the immediate tax implications you’ll likely face from withdrawing your money, it behooves you to consider other options before pushing ahead. Regarding the hit you can expect to take from a tax perspective, you’ll need to pay income taxes on any previously untaxed earnings you’ve placed into the account and an additional 10% penalty unless you’re 59.5 or older. Further, you’re not eligible to contribute to your 401(k) again for six months after you receive the distribution.”

It is always better to consult with a licensed financial and tax advisor since everyone has unique circumstances.

Few Options for Working Americans

Currently, very few options exist to tide over emergencies. Selling vested restricted stock units (RSUs) or shares from employee stock purchase plans and liquidating brokerage assets are alternative methods to acquire immediate funds when an emergency fund isn’t available. Accessing a home equity line of credit (HELOC) or cash-out refinancing is risky if you cannot repay the money.

SECURE ACT 2.0 Offers Some Relief

Congress included the SECURE Act 2.0 provisions to provide easier access to emergency savings within retirement accounts. Beginning in 2024, individuals under 59.5 can withdraw up to $1,000 from their retirement account for emergency expenses without the customary 10% tax penalty on early withdrawals. Nonetheless, penalties may apply if you do not replenish these funds within three years and require another withdrawal due to a similar circumstance.

Companies may allow their employees to set up emergency savings accounts through automatic payroll deductions, with an upper limit of $2,500 per annum and the first four withdrawals in a year free from taxes and penalties.

A Tale of Two Americas

Despite the challenges presented by increased hardship withdrawals, reports indicate that certain 401(k) balances have risen compared to the previous year, signaling resilience in some retirement accounts. The Bank of America report suggests that average 401(k) balances will be up nearly 10% in 2023. The stock market’s strong performance has undoubtedly helped Americans who managed to continue contributing to their retirement accounts.

However, the high average 401(k) balances present a misleadingly optimistic outlook, while the starkly contrasting lower median values underscore the divided financial landscape in America.

The Vanguard study showed that in 2022, the average account balance for Vanguard participants was $112,572, and the median balance was only $27,376.

The U.S. Census Bureau paints a similarly bleak picture of median IRA and 401(k) account balances at $30,000.

The high inflation rate and wages not keeping pace with the rise in prices of goods and services have forced cash-strapped Americans to dip into their retirement savings to make ends meet. The low unemployment rate provides hope, indicating that not all is lost for Americans’ financial futures. There remains an opportunity for individuals to contribute to their retirement savings, mainly if inflation decreases, enabling them to navigate financial hurdles and continue securing their long-term economic well-being.

Like Financial Freedom Countdown content? Be sure to follow us!

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

Several key elements of the Tax Cuts and Jobs Act (TCJA) are scheduled to lapse by 2025. This pivotal tax reform, implemented during President Trump’s tenure, brought substantial changes to the U.S. tax structure. With the expiration drawing near, it’s crucial for individuals to take proactive steps in their tax planning.

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

JPMorgan’s Stark Warning: How Impending Stagflation Could Upend Your Financial Future

JPMorgan has cautioned that the present economic landscape might evolve into a scenario reminiscent of the 1970s, featuring stagflation characterized by elevated inflation and sluggish growth. JPMorgan draws parallels between current geopolitical tensions and those of the 1970s, suggesting a potential inflationary impact.

JPMorgan’s Stark Warning: How Impending Stagflation Could Upend Your Financial Future

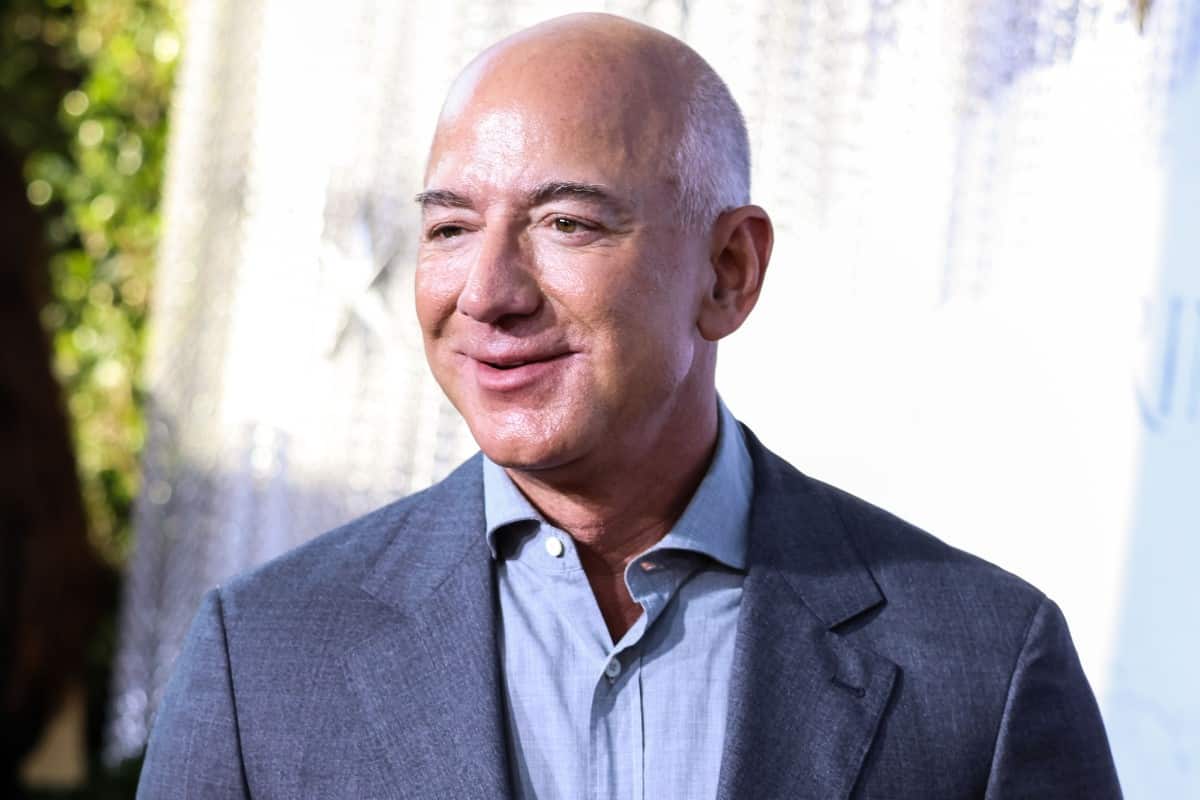

Jeff Bezos’ Move Sparks Intense Debate Over Tax Policies

Amazon tycoon Jeff Bezos made waves in recent headlines by announcing his move from Seattle to Miami. This unexpected decision has piqued interest, sparking speculation about the motives behind the relocation and its potential long-term impacts for Washington State.

Jeff Bezos’ Move Sparks Intense Debate Over Tax Policies

Transform Your Finances by Shifting From an Employee to an Investor Mindset With Kiyosaki’s Cashflow Quadrant Methodology

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

The “Buy, Borrow, Die” strategy is a favorite among the affluent, who work with financial planners to sustain their lavish lifestyles while slashing their tax bills. Though it seems like a modern trend, Professor Ed McCaffery coined the term in the mid-1990s to explain how the wealthy legally avoid paying taxes.

Buy, Borrow, Die: The Controversial Tax Loophole the Rich Use to Build Generational Wealth

AARP Survey Reveals Over 50% of Americans 50 and Older Fear Financial Ruin in Retirement

A recent AARP survey highlights a dire situation for older Americans: 20% of adults aged 50 and above have no retirement savings at all. This lack of financial preparedness is causing significant anxiety, with 61% of this age group worried they won’t have enough money to support themselves in retirement.

AARP Survey Reveals Over 50% of Americans 50 and Older Fear Financial Ruin in Retirement

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.