Trump Tax Cuts Set to Expire Soon: Essential Action Steps to Navigate Now

As the clock ticks towards 2025, pivotal components of the Tax Cuts and Jobs Act (TCJA) initiated by President Trump are poised to expire. With the impending expiration of certain provisions, individuals are urged to seize the reins of their tax strategy proactively.

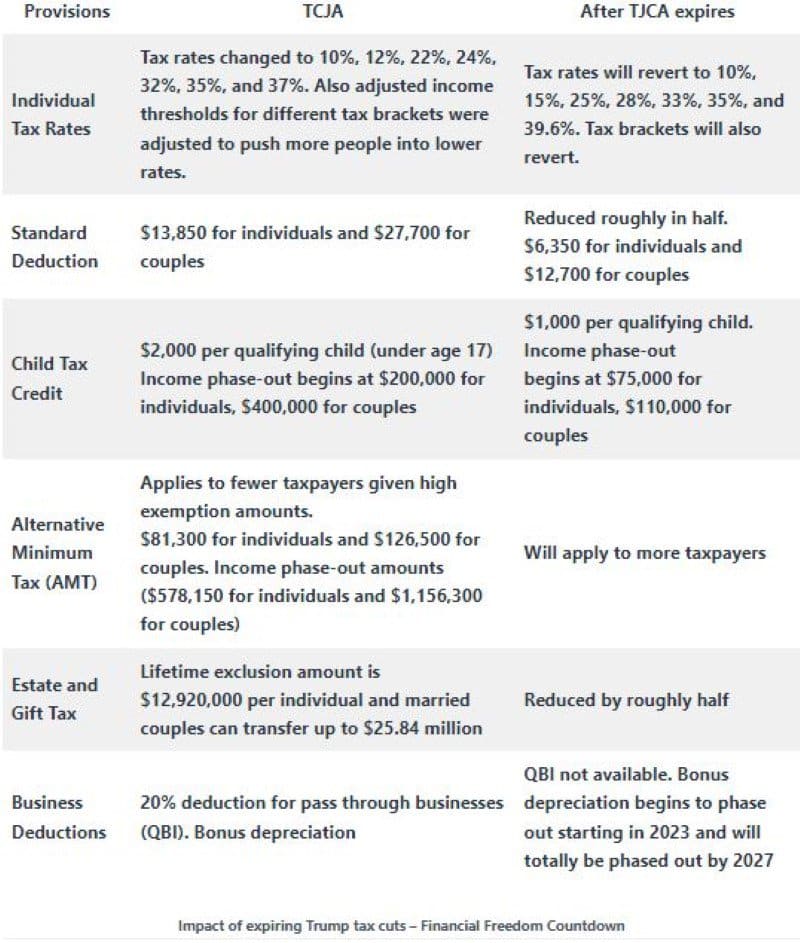

Individual Tax Rates Lowered

The TCJA revised the tax structure by reducing tax rates across various income brackets and modifying the income ranges associated with each tax bracket.

Previously, there were seven tax brackets with respective rates of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Under the TCJA, these were adjusted to rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%, resulting in a reduction of taxes for the majority of taxpayers.

Standard Deduction Doubled

The standard deduction was nearly doubled under the TCJA. It increased from $13,000 to $24,000 for joint filers and $6,500 to $12,000 for individuals.

Higher Alternative Minimum Tax (AMT) Exemption Amounts

The TCJA also changed how the Alternative Minimum Tax (AMT) is calculated, so it applied to only high-income individuals. It now only affects fewer people due to more significant exemption amounts ($81,300 for individuals and $126,500 for couples). However, after the TCJA expires, more people might have to pay it again because the exemption amounts and income phase-out thresholds will decrease.

Child Tax Credit Doubled

The TCJA doubled the child tax credit from $1,000 to $2,000 per child. Currently, you can get this credit for each child under 17, and it starts to phase out if you make more than $200,000 as an individual or $400,000 as a couple.

After the TCJA expires, the child tax credit will decrease to $1,000 per qualifying child, and it will start to phase out if you make more than $75,000 as an individual or $110,000 as a couple.

Retirement Planning

When the TCJA expires, the tax brackets will go back to what they were before, which means some people might have to pay more in taxes since the top tax bracket will increase from the current 37% to 39.6%.

Given this situation, it would be prudent to explore avenues for pulling income forward within the next few years to leverage the current lower brackets. You can do this by exercising stock options now and avoiding deferred compensation plans.

Traditional IRAs require minimum distributions (RMDs) commencing at age 73 and are taxable as ordinary income. On the other hand, Roth IRAs do not impose RMDs, and all future growth and distributions remain exempt from taxation.

One of the benefits of early retirement is that taxpayers have several years between their retirement date and RMD age to convert their IRAs to Roth IRAs in a lower tax bracket.

If you are not planning for early retirement and your income is expected to continue to increase over the next couple of years, by converting your traditional IRA to a Roth IRA before 2026, you would assume the upfront income tax liability (potentially at a lower tax rate), rather than facing it at the time of distribution.

The SECURE Act eliminated the Stretch IRA provisions. For individuals who are subject to the 10-year rule on inherited IRAs, it is advisable to contemplate the possibility of opting for more substantial distributions before the expiration of the TCJA, especially if there is concern regarding the potential rise in tax rates during the later stages of the mandatory 10-year window for complete distribution of the account.

Capital Gains Tax

With stock markets at record highs, investing in stocks has resulted in a lot of unrealized capital gains. With the TJCA, the tax brackets for long-term capital gains and qualified dividends are not linked to the ordinary income tax brackets. Check with your tax advisor on selling some of your stocks if you anticipate potentially higher future tax rates.

You could maximize Long Term Capital Gains while in the lower bracket for your marginal rate and harvesting losses to offset gains when appropriate.

Lifetime Gift and Estate Tax Exemption Doubled

The TCJA doubled the lifetime gift and estate tax exemption limits.

As of 2023, individuals are eligible to transfer up to $12.92 million, while married couples can transfer up to $25.84 million without incurring federal gift taxes or estate taxes, either during their lifetime or as part of their estate. This historically high exemption amount will be halved after the 2025 tax year. Check with your tax advisor if it is worth accelerating those gifting plans to your children and grandchildren each year. For those with even larger estates, it is time to consider possible larger lifetime gifts.

Tax strategy should be a key consideration when setting up living trusts.

Business Deductions

The TCJA introduced qualified business income (QBI) deduction, facilitating pass-through businesses to deduct a maximum of 20 percent of their earnings. Notice 2019-07 introduced a new safe harbor provision for rental real estate under Section 199A of the Internal Revenue Code, making rental properties eligible for QBI.

Under the Tax Cuts and Jobs Act (TCJA), the qualification for 100% bonus depreciation was introduced depending on the year you placed the assets into service. For real estate investing, many interior upgrades to buildings are eligible for purposes of bonus depreciation. Utilizing a cost segregation study is one of the methods to ensure eligibility for the available bonus depreciation percentage.

Current provisions allow for a quicker depreciation of certain assets, which is a boon for reducing taxable income. However, post-sunset, the elongation of this timeline could mean higher taxable income. Check with your tax advisor for capitalizing on the existing provisions by accelerating depreciation to lower your taxable bracket.

What Happens if Trump Tax Cuts Expire?

As the TCJA provisions edge closer to their expiration date of 2025, individuals must remain proactive in their tax planning efforts. It is crucial to reassess your investment strategy and explore opportunities to take advantage of the current tax provisions.

Hope for Extension of Tax Cuts Looks Bleak

With the 2024 Presidential election season in full swing, animosity between the parties is expected to ratchet higher. Without prompt action from Congress, the opportunity to take advantage of various tax benefits the TCJA provides is swiftly diminishing.

Although there is still time to negotiate and extend specific provisions, with the current gridlock, the automatic expiration of the various tax provisions seems more likely.

Tax planning can be complex, especially when dealing with changing tax laws. Seek guidance from a licensed tax professional to ensure your financial goals align with the evolving tax landscape.

Like this content? Follow Financial Freedom Countdown

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

National Debt Exceeds Previous Projections, Signaling Troubling Times Ahead for the U.S. Economy as per CBO March report

The Congressional Budget Office (CBO) performs nonpartisan analysis for the U.S. Congress. The latest Budget and Economic Outlook released March 2024, offered dire projections for the country’s fiscal and economic landscape over the upcoming decades. Unfortunately the national debt is higher than initially anticipated and is projected to hit $141 trillion by 2054.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.