Cash Out Refinance And Why Am I Doing It

Most retired folks would advise paying off your mortgage as you are closer to retirement. In fact, they prefer to be mortgage free once they no longer have a steady paycheck. Then why am I considering doing a cash out refinance and taking out a $690,000 loan on my primary residence?

What Is A Cash Out Refinance

In a traditional refinance, you replace your existing mortgage with a new one for the same balance but with a lower interest rate or lower term or both.

A cash out refinance is different from a traditional refinance.

A cash out refinance enables you to borrow money at the same time you refinance your loan. You refinance your mortgage and receive a check at closing.

New Loan balance = Old loan balance + Check + Closing cost

You can do a cash out refinancing only when you have substantial “equity” in your house. Equity is built in your house when

- the house you bought has appreciated significantly or

- you have paid down a large part of your mortgage and now want to extract that money out for another opportunity or

- combination of both

I currently have a loan balance of $230,000 on my house; but my house is valued close to a $940,000.

And no, I’m not living in a mansion. This is the average price of houses in the San Francisco Bay Area. In fact, my house is considered a fixer upper.

Given that I have significant equity in my house and the Fed is punishing savers by constantly lowering rates; why not get in some of the action.

How Much Can I Cash Out Refinance

Any lender wanting to do cash out refinancing would want some equity to be still present in the house. Given the tightening of the banking regulations after the Great Financial Crisis; you can get a new loan for maximum 80% of your appraised value.

Most lenders are more cautious and would only loan 70% of the appraised value.

Is Cash Out Refinance A Good Idea

There are several pros and cons of a cash out refinance.

Pros of a Cash Out Refinance

- Interest Rate: Given that we have been in a secular downward trend with respect to interest rates; it is quite possible that the current interest rate would be lower that your prior rate.

- Large loan amount: It is an easy route to get your hands on a significantly large sum of money in one transaction.

- Tax benefits: Interest rates on loans can be tax deductible depending on several factors. Talk to your CPA

- Pay off other debts: If you have other higher interest rate debt like student loan, medical bills etc; it could be advantageous to consider cash out refinancing. Check with your financial advisor and plan accordingly.

Cons of a Cash out Refinance

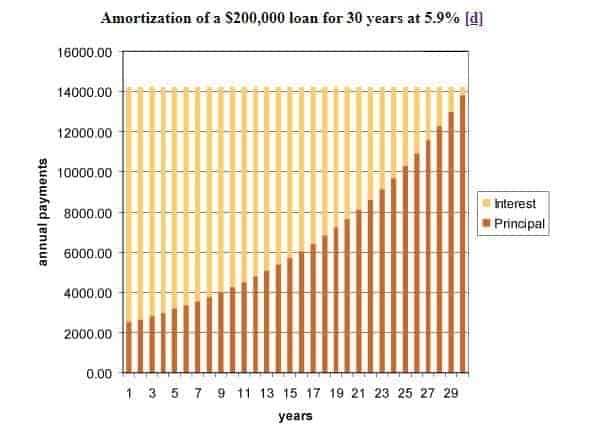

- Total interest: Due to the nature of the amortization schedule; you pay most of the interest in the early part of the loan and very little principal. Since you now restart the clock; you will end up paying a lot more in interest over the life of the loan.

- Losing your house: Typically it makes sense to use the cash out refinancing to pay off higher interest loans. But never trade an unsecured loan for a secured loan unless you know what you are doing. Eg: Using the cash out refinance to pay a student loan might make sense whereas paying a credit card might not make sense. Evaluate your options accordingly.

I hope the pros and cons help you determine if you should cash out refinance to buy another home, pay for college, pay off your car, pay your credit card etc

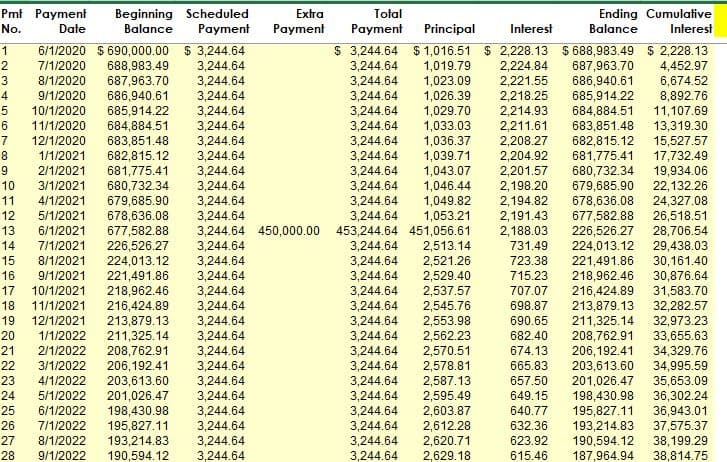

The above graph from the Federal Reserve shows one of the cons of cash out refinancing. Notice how the interest is front loaded and most of the monthly payment is used to service the debt initially.

Which Is Better – Cash Out Refinance or Home Equity Line Of Credit (HELOC)

There are a number of differences between cash out refinancing and HELOC

- Interest rate variability: Cash out refinance has a fixed rate while HELOCs generally are tied to a prime rate which is adjusted regularly.

- Level of interest rate: If today’s mortgage rates are higher than your fixed rate mortgage; a HELOC might work better.

- Cancellation: A HELOC can be cancelled by a lender if they deem you to be a risk or the house price decreases. On the the other hand, once you receive the cash out refinance check; as long as you make the monthly payments you are good (even if the house price drops). During the Great Financial Crisis a lot of lenders either closed the HELOC or reduced it unilaterally.Number of loans: Cash out refinance is one loan whereas HELOC is akin to a second mortgage on top of your first mortgage.

- Amount: Typically you get a bigger check with your cash out refinance compared to a HELOC

- Eligibility: It is generally easier to qualify for a cash out refinancing compared to a HELOC

- Term: Cash out refinance loans can be paid back over a 30 year period whereas HELOC need to paid back in less than 15 years

- Tax deduction for interest: After the 2018 TJCA, HELOC must be used to buy, build or improve the home. A cash out refinance is treated like a regular mortgage and loans upto $750,000 can get the benefit. Check with your CPA with respect to tax benefits.

What Are Cash Out Refinance Rates

If you have been shopping around; you would have noticed that cash out refinance does cost more than a traditional mortgage.

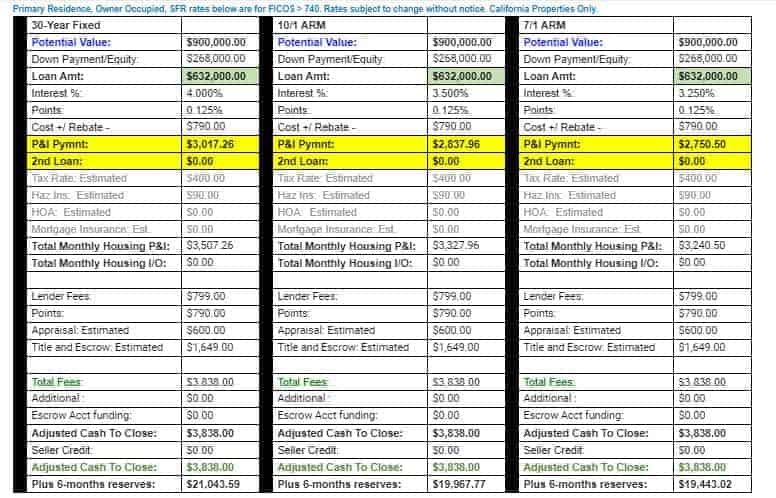

So in my case if I was buying a house currently; I would pay 3.375% for a 30 year term. However the cheapest rate I could obtain on a cash out refinance was 3.875%.

Cash Out Refinance rates will always be higher than a Traditional Refinance rate since the lender assigns a higher risk to Cash Out Refinance transactions

My plan of action is to do the cash out refinance and in 6 months; assuming rates stay around the same level; look to do a regular refinancing again.

Here are the Cash out refinancing rates for various terms which was quoted.

- Make sure you get at least 3-5 different quotes

- You will need to provide your SSN. Typically all mortgage inquiries within 14 days are combined for purpose of calculating your credit score. So don’t fret about it. Sign up for a Credit Karma account to monitor your free credit reports and free credit scores from Equifax and TransUnion

- If it is a large bank, negotiate if moving your other assets would reduce your rate. Eg: Moving $250,000 of cash/stocks might lower your rate by 0.125%

Notice how the ARMs have lower rates. Given that mortgages are hard to obtain when you have no W2 income; decided not to go that route.

Tax Implications of Cash Out Refinance

The money you get from either a cash out refinance or a HELOC is not taxable because it is borrowed money you have to pay back. Consequently, I do not anticipate any tax implications. Given the constantly changing tax laws though it is wise to check with your CPA.

Does Cash Out Refinance Affect Property Taxes

Property Taxes in California are based on the purchase price of your property and are adjusted by a certain factor every year. I do not expect any change to my property taxes under the current tax laws.

Of course, tax laws can change at state and local level. Consult a licensed tax professional for the most recent laws and how it applies to your unique situation.

Why Am I Doing A Cash Out Refinance

If I look at my asset allocation; over 40% of my net worth is trapped in my primary residence. This is not uncommon for people who live in the San Francisco Bay Area.

So my plan is to refinance my loan, cash out the $450,000 in equity and then wait for an opportunity to buy distressed assets at lower prices.

As you know from my prior posts; I have talked about how bad the recession will get and how to prepare for the upcoming recession.

One of the items in the post was to plan your next major purchase. Because so much is unknown about the future; I am not yet certain of the asset class or the level which would make me pull the trigger. But I would prefer to have the cash ready should such an opportunity arise.

I know it when I see it

– Justice Potter Stewart

What If I Do Not Find The Right Opportunity

If I do not find the right opportunity in the next 12 months; I would just use the Cash Out Refinance money to make an additional principal payment on my mortgage.

I have decided that the 12 month time frame is ideal because it provides sufficient time for the global macro events to play out. Sitting in cash long term is a losing strategy; so I want to be disciplined with my time horizon.

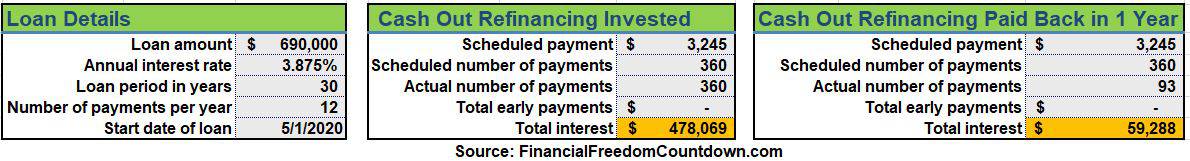

Let us look at 2 scenarios with concrete numbers.

The “Cash Out Refinancing Invested” table indicates that if my price targets are reached and I invest the money; I would be paying a whooping $478,082 in interest cost alone. Given the approximate rate of 4%; I need to make sure my investment would yield a lot more than 4% annually.

The “Cash Out Refinancing Paid Back in 1 Year” table indicates that if I do not find an attractive enough investment in 1 year; I would pay back the amount as additional principal on my loan.

Given the fact that my loan has no pre-payment penalty I should be able to do that easily. Notice how my total interest paid drops down from $478,082 in the previous scenario to a meager $59,287.

While additional principal does not reduce my monthly costs; it does reduce the term of the loan from 30 years to 8 years.

Mortgage Loan Pre-Payment

Amortization tables for house mortgage are skewed such that a large chunk of your monthly installment; goes towards interest. Hence any mortgage loan pre-payment should be done in the earlier years to have an out sized impact.

The Amortization table below indicates how I would prepay the cashed out equity as extra payment, if I do not find the right opportunity. The front loaded interest shows how early pre-payment is an advantage.

Risk Considerations With Using Home Equity For Investments

- Investment should return at least 6% annualized to make this worth the effort.

- Has to be invested in a relatively safe and proven asset class such as stocks or real estate.

- If it is a Real Estate transaction; I would deploy the cash in one fell swoop.

- If it is stocks and we have considerable volatility; I would use M1 Finance and dollar cost average for free.

- I have lost money in stocks and crowd funded real estate in the past. I do not claim to be an expert.

- Before I invest in any asset class, I need to set clearly defined entry and exit criteria.

- Need to figure out a way to pay my monthly mortgage. Currently my mortgage is covered by my rental income. Since my payments would more than double; I need to come up with additional $1800/month.

- In any investment, sequence of returns matter. While history indicates that US stock market in last 10 years has returned at least 6%; the returns have been lumpy. One year you have great returns and the next year you have losses. The fixed mortgage bill is due every month. If you can’t pay your mortgage without relying on your investment returns; you will lose your property.

- This is a risky leveraged strategy. Leverage amplifies your returns and your losses. My risk tolerance is different from your so consult a licensed professional. Hopefully this post provides you with enough information to have that discussion.

Summary Of Cash-Out Refinancing Strategy

Cash Out Refinance offers several benefits as long as you understand the pros and cons & use the money to generate returns higher than your interest rate.

We discussed cash-out refinancing and also HELOC.

A third option is using home equity investment products, like Hometap, which give you access to the equity you’ve built up in your home debt-free and without monthly payments. A Hometap Investment can get you the cash you need in as little as three weeks. And you can put it toward whatever is most important to you, whether that’s paying off debt, renovating your home, paying for a child’s education, or putting a down payment on a second home.

Evaluate all three options and run the numbers to determine what strategy is most suitable for your unique situation.

Readers, what do you think of my strategy to opportunistically tap into my home equity via a cash out refinancing? Are there any aspects I might have overlooked in terms of risk?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

If you have a high risk tolerance then a cash out refinance is definitely a useful option.

Know you’ve highlighted your target of 6%, although with recent analysts predicting a potential decade of lower stock market gains, that 6% might be a difficult ask. Although that said, no one really knows, could double in the next 10 years!

Cash out refinances are really popular for property developers that use the buy, refurbish, refinance (BRR) method. That’s mainly because they need to redeploy the cash and have their next investment ready to go.

Have you looked into an offset mortgage? It might come with a slightly higher interest rate although it will allow you to have have cash on hand ready to deploy & seize opportunities if they arise. Ideally then you’ll get the best of both, 4% guaranteed savings and the ability to buy any future dips/drops.

Hi John, I believe offset mortgages are common in UK but not eligible for use in USA due to tax laws. I agree that predictions wrt next decade of stock returns are all over the place. But both the stock and bond markets have surprised us all for the last decade; so it is a guessing game at this point. Personally; I am bullish on the US market. But given the sharp rebound I might not be able to deploy the cash.

More debt! Nice. Our philosophies are exactly opposite, but that’s the beauty of our country and our markets. It’s great we can all do things that are appropriate for us.

Yes. The post was inspired by your last comment wrt what is my next plan. Leverage on property is risky but lesser than margin calls. I have a higher tolerance for risk based on all my alternative “investments”