Bernie Sanders targets 401(k) system, says retirement security is slipping for millions

In a Fox News op-ed, Bernie Sanders argues that America’s retirement system is fundamentally broken, writing that it is a “disaster for working people.” He points to a dramatic shift away from pensions toward individual savings systems that leave millions unprepared for retirement.

Working people once relied on stable, employer-backed pensions. Today, Sanders says, nearly 45% of Americans aged 55 to 64 have no retirement savings at all.

Millions of older Americans have nothing saved

The scale of the crisis is significant. Sanders notes that nearly half of older Americans approaching retirement have no savings and no clear path forward.

For those already retired, the situation can be even worse, especially for individuals who can no longer work and have exhausted what little savings they had.

Seniors struggling to survive on minimal income

Sanders highlights the financial reality facing many seniors: one in four lives on less than $15,000 per year, and more than half survive on under $30,000 annually.

“Think about that. How do you pay the rent, pay for health care and prescription drugs, and put food on the table on just $15,000 or $30,000 a year? The answer is that many cannot.”

The U.S. lags behind other wealthy nations

Citing data from the Organisation for Economic Co-operation and Development, Sanders argues that the U.S. has one of the highest senior poverty rates among developed countries.

He contrasts this with significantly lower rates in countries like Denmark, France, Germany, Canada, and the United Kingdom, arguing that America’s outcomes are unacceptable given its wealth.

The disappearance of pensions

A central theme in Sanders’ argument is the decline of defined benefit pensions, which once guaranteed retirement income.

Fifty years ago, many employers promised long-term workers a stable monthly income in retirement. Today, Sanders says, those plans are “an endangered species,” replaced by systems that shift risk onto workers.

A growing risk of retirement insecurity

The consequences are measurable. Sanders notes that the share of Americans at risk of failing to maintain their standard of living in retirement has risen from 31% in 1983 to 39% in 2022.

He argues that this trend shows the country is “moving in exactly the wrong direction.”

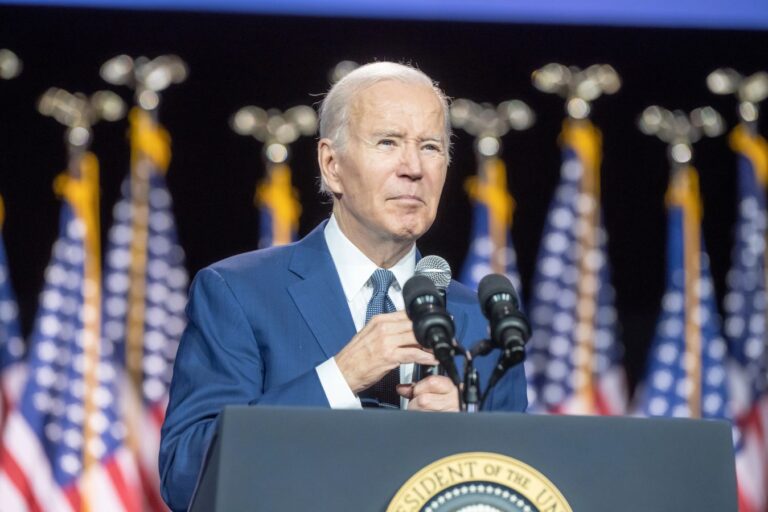

Expanding Social Security as a core solution

Sanders calls for strengthening; not cutting; Social Security Administration benefits.

He points to his proposed Social Security Expansion Act, which would increase benefits and extend the program’s solvency for 75 years while lifting millions of seniors out of poverty.

Taxing higher earners to fund benefits

To pay for expansion, Sanders proposes applying Social Security payroll taxes more broadly, particularly to higher-income individuals.

He criticizes the current cap on taxable income, arguing it allows wealthy individuals to pay a lower effective rate than average workers.

The 401(k) system under fire

Sanders is also sharply critical of the modern 401(k) system, arguing it is “rigged against employees.”

He says retirement outcomes now depend heavily on market performance and individual investment decisions, rather than guaranteed benefits. This creates instability and disproportionately disadvantages lower-income workers.

Concerns about riskier investment options

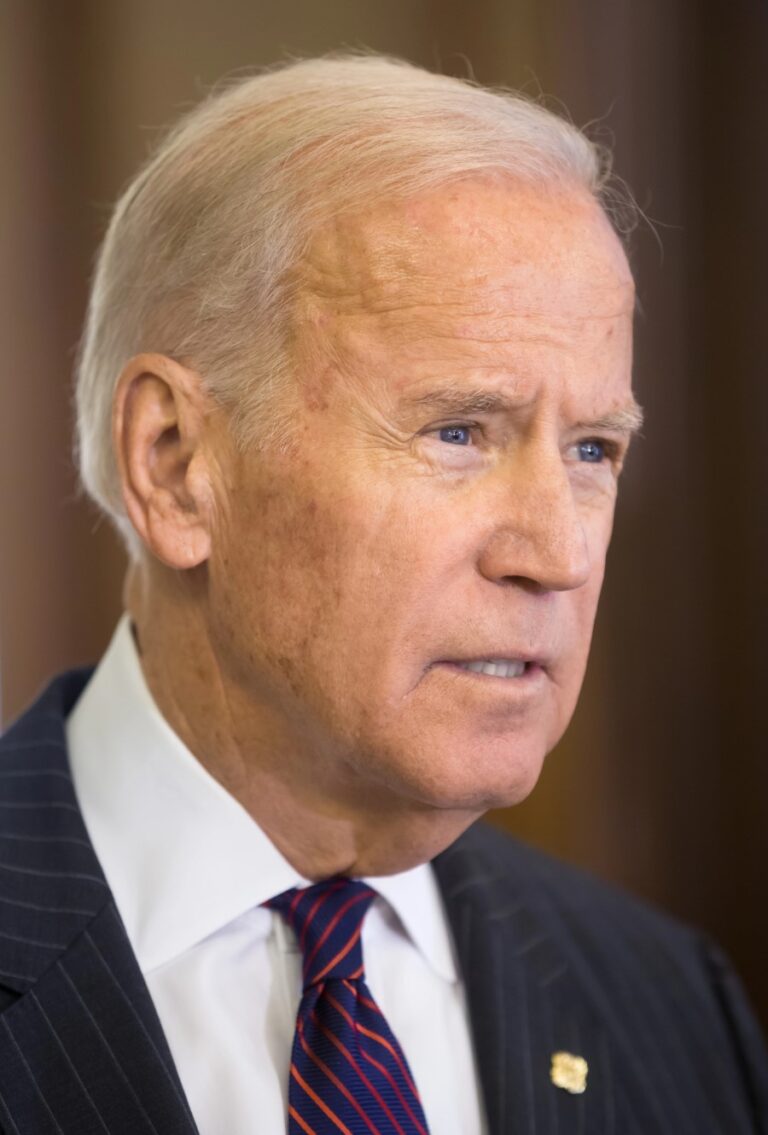

Alongside Elizabeth Warren, Sanders has raised concerns about proposals to allow private equity and cryptocurrency investments in 401(k) plans.

They argue such changes could expose workers to unnecessary risk, especially if individuals do not fully understand the volatility or fees associated with these assets.

A push to require employer retirement plans

Beyond Social Security, Sanders proposes requiring employers to provide retirement plans or offer access to a federal pension-style system similar to what government employees receive.

He points to the Federal Employees Retirement System as a model that could be expanded to private-sector workers.

Inequality at the center of the crisis

At its core, Sanders frames the retirement crisis as a symptom of broader economic inequality.

He contrasts large executive payouts; such as multimillion-dollar “golden parachutes”; with the lack of retirement security for ordinary workers, arguing the system disproportionately benefits the wealthy.

Retirement should mean dignity

Sanders concludes that retirement in America should not be uncertain or precarious.

Sanders’ proposed “Pensions for All” Act aims to reintroduce predictable, guaranteed retirement income for American workers.

He argues that pensions provide stability that defined-contribution plans like 401(k)s cannot match.

His overarching message is that after a lifetime of work, Americans deserve dignity and security; not a system that leaves their future dependent on market swings and insufficient savings.

Like Financial Freedom Countdown content? Be sure to follow us!

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.