Deferred Compensation Plan: Best Way To Reduce Taxes

If you have struggled to reduce your taxes as a high income salaried employee, Deferred Compensation Plan can be the solution. Deferred Compensation plan is especially suited for the Financially Independent Retire Early (FIRE) crowd. But, there are certain aspects one needs to consider.

Types Of Deferred Compensation Plan

Generally speaking the 2 types of Deferred Compensation Plan are Qualified and Non-qualified Deferred Compensation Plan.

A Qualified Deferred Compensation Plans complies with Employee Retirement Income Security Act (ERISA) and include 401(k) and 403(b) plans. These plans are well known and will not be covered in the article.

When we talk about Deferred Compensation plan we are specifically talking about Non-qualified Deferred Compensation Plan.

Difference Between 401(k) And Deferred Compensation Plan

401(k) plans have defined contribution limits and are subject to protections under ERISA.

Deferred Compensation Plans do not have limits specified by the government. The downside is that ERISA protections are no longer available.

You can choose to enroll in both the 401(k) and Deferred Compensation Plan. In fact, the general recommendation is to maximize the 401(k). And use the Deferred Compensation Plan when you want to shelter income more than that permitted by 401(k) limits.

Difference Between Roth IRA And Deferred Compensation Plan

Roth IRA and Deferred Compensation Plan both grow tax free. However, with Roth IRA, you pay taxes now on your contribution. With Deferred Compensation Plan you pay taxes on both the growth and contribution when you receive the money.

What is A Deferred Compensation Plan?

The Deferred Compensation Plan is offered to a select group of management and highly compensated employees. The Plan allows you to save for the future on a before-tax basis.

How does Deferred Compensation Plan work?

Every year you can defer a certain percentage of your salary. Your deferrals are taken on a before-tax basis, and will reduce your federal taxable income. For example, if your federal taxable income is $300,000, but you defer $225,000 under the Plan, your federal taxable income reported to the IRS would be $75,000. And not $300,000.

Your deferrals and any notional investment returns on your deferrals will not be included in your federal and state taxable income; until they are actually paid to you.

Your deferrals will still be subject to FICA (Social Security and Medicare) tax withholding in the year that you earn the deferrals.

When your account is paid to you, the entire amount will be included in your gross income for federal income tax purposes in the year paid. And you will be taxed at ordinary income rates. When you receive a distribution from the Plan, required federal, state and local taxes will be withheld from the distribution.

Distributions from the Plan cannot be “rolled over” to an Individual Retirement Account (IRA) or other tax-qualified plan.

How does Deferred Compensation Plan Reduce Taxes?

The Plan provides eligible employees the opportunity to save on a before-tax basis. By making deferrals under the Plan, you avoid paying current federal income taxes on the income you defer. And any notional earnings on your investment will grow tax-deferred.

Deferring a portion of your salary for later cuts down your tax bill because you have less income to report now. And you will be in a lower tax bracket at retirement.

Deferred Compensation Plan does not provide any FICA tax savings.

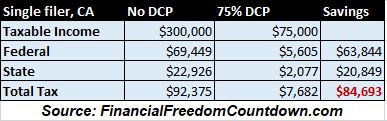

Let us look at an individual in California earning $300,000. For tax purposes assume single filing status and contributes $18,500 to 401(k)

If this individual decides to defer 75% of his compensation; his Federal and State taxes are drastically reduced.

In this example he can save $84,693 annually in taxes!

Deferred Compensation Plan Elections

Elections need to be made every year during the election period.

Your Compensation Deferral Election will not automatically continue in effect for each subsequent Plan Year.

You are required to make a new election during each annual election period, effective for the following Plan Year.

If you are newly hired, promoted, or otherwise become eligible to participate in the Plan after January 1st of a given year, your eligibility to participate in the Plan will be evaluated on the first day of the following month.

If you fail to make a Compensation Deferral election within this initial 30 day enrollment period, you cannot elect to defer Compensation until the following Plan Year.

Think of it like annual open enrollment. So do not miss the window.

Deferred Compensation Plan Investments

The salary or bonus you defer can be invested. Often, the same plan options which are in your 401(k) plan are available to invest your Deferred Compensation Plan contributions.

You elect how your deferred salary or bonus will be allocated among any combination of investment options. Your account balance will be credited or debited for notional investment gains or losses, appreciation, and depreciation based upon the performance of the notional investment options you choose.

The notional investment returns also are credited on a before-tax basis

Who Is Eligible for Deferred Compensation Plan?

It totally depends on your organization. This is generally available at director or higher level.

Companies may also impose additional criteria in terms of total compensation.

It is always a good option to ask HR if your company provides Deferred Compensation Plan.

Risks with Deferred Compensation Plan

In order to achieve the favorable tax treatment provided by the Plan, benefits under the Plan are payable from the general corporate assets of your Employer. If your Employer becomes insolvent, it may be unable to pay all or part of your benefits under the Plan.

Your Employer may deposit some or all of the contributions credited under the Plan into a special trust.

The trust is designed to help the Employer pay benefits owed under the

Plan. The trust may limit your Employer’s ability to use money deposited into the trust for a purpose other than the payment of Plan benefits.

However, the money in the trust is always subject to the claims of your Employer’s creditors. Therefore, the trust does not ensure that your Plan benefits will be protected in the event that your Employer becomes insolvent.

When you are trying to figure out how much you should put in the deferred compensation plan; always weigh the risks against the tax savings.

The Plan provides employees with an unfunded, unsecured promise to pay the benefits described. As an unfunded deferred compensation plan for highly compensated employees the Plan is not qualified under section 401(a) of the Internal Revenue Code. However, under current federal tax

laws, it is intended that your deferrals and the related notional investment returns will not be included in your gross income for federal income tax purposes until such amounts are actually paid to you.

This risk is the reason the IRS provides favorable tax treatment. Make sure the company is financially secure.

Deferred Compensation Plan Distribution

Different rules apply to the distribution of your account(s), depending upon whether employment is terminated before or after a certain age.

If employment is terminated before the age specified, then the entire account balance including any notional gains (or losses) is provided as a lump-sum.

This is quite disadvantageous on a tax basis because you will receive a large lump-sum amount. This increases your total compensation for the year and puts you in a higher bracket.

If employment is terminated after the age specified, then the account balance including any notional gains (or losses) is provided as elected. So you could elect to receive the money in a lump-sum. Or a better option for tax savings would be to receive the money in annual installments

In effect, you create a pension for yourself.

By this time you are already retired, your only income would be the Deferred Compensation Plan distributions. Since our tax system is progressive, you would end up paying a lot less taxes in this manner.

The disadvantage of Deferred Compensation Plans with respect distribution is that you need to decide now how you want to receive the money several years in the future. Deferred Compensation Plans generally do not let you change the distribution schedule.

So you might have opted for lump sum payment and find out you prefer annual payments to spread out the money and reduce taxes even further.

You could have also opted for annual payments and realize that you would have preferred a lump sum payment due to the shaky future of the company. Or you want to have a celebration to commemorate your retirement.

Is Deferred Compensation Plan A Good Idea?

Deferred Compensation Plan is great as long as you can continue working for the company till the desired distribution date.

Stock options which vest over a period of time are often described as Golden hand cuffs. Deferred Compensation Plan can be considered equivalent to golden shackles.

Also at the distribution date, your tax rate should be lower than your earning years. I am sure most readers would have made sure they accumulate.

Another factor to be considered when making your annual enrollment decision is the solvency of the company.

You have to be cognizant that the company is not at risk of bankruptcy. This is often harder than it seems. We all know companies which were seemed fine and suddenly filed for bankruptcy.

If the company files for bankruptcy, then the Deferred Compensation Plan contribution amount and any notional gains will be subject to claims of creditors. In that case, you would have been picking up pennies in front of the steamroller. Never let the tax tail wag the dog.

Readers, would you ever opt for Deferred Compensation Plan? If you did enroll, what was your experience?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.