What you need to know about Financial Independence Day

Not a day goes by without social media reminding us that it is a day to celebrate some holiday. It varies from Pay A Compliment Day (February 6) to Take A Starving Artist Out To Lunch Day (July 2). In fact, if you fear you are missing out on some celebration you can refer to Chase’s Calendar of Events 2019: The Ultimate Go-to Guide for Special Days, Weeks and Months.

Apparently 25th April is National Hug a Plumber Day. Although Plumbers are important, not sure why there is holiday dedicated to hugging one.

There is one holiday though which is not yet celebrated; but I am totally on-board with having it’s own day. My blogger buddy Ty suggested April 25th (425) as International Financial Independence Day.

Why 425 and what is the significance of this number to Financial Freedom?

4 Percent Rule?

William Bengen, a retired financial adviser first articulated 4% as a rule of thumb for withdrawal rates from retirement savings. He conducted a number of empirical simulations of historical market behavior and concluded that a person could withdraw, up to 4 percent annually from their portfolio without fear of outliving their money.

As an example, if you have $1,000,000 invested in a diversified stock portfolio you can withdraw $40,000 annually.

Rule of 25X

Based on the above 4 percent rule; we can reverse engineer how much we need to have saved before we can say we have achieved Financial Freedom and can live exclusively on our investments passively.

In order to calculate our “retirement nest egg” before quitting we first need to estimate our annual expenses. Once we know our annual expense we simply multiply the number by 25 to know what we should have saved . Using the same numbers as above if my annual expense is $40,000 then I need to save $40,000*25 = $1,000,000. This million dollars needs to be invested in a diversified stock portfolio which would then yield approximately $40,000 annually based on the 4 percent rule. I can then live off the $40,000 annually without technically needing to touch my principal.

Criticism of the 4 percent rule

- The initial studies were based on shorter retirement spans and not tested for early retirement type of scenarios where one needs to generate passive income from their portfolio for six to seven decades.

- Stock markets by their nature are volatile and over a period of time while we do get average returns; often we would have wild swings one year to the next. This introduces “Sequence of Returns” risk which basically means that the order in which a retiree experiences up and down years is important. If one experiences several down years at the start of retirement, then the portfolio would be depleted to such an extent that recovery would be difficult.

- The studies were carried out based on US stock performance but similar results have not been tested in other markets around the world.

- The CAPE ratio when this study was carried out was lower than the current CAPE ratio. Some experts believe the current higher CAPE valuations would result in below average performance for the future.

- It does not take into account other scenarios such as Hyperinflation, Deflation, etc.

- Past performance is no guarantee of future performance.

While all the above points are valid; the 4% rule of thumb at least gives us a pretty good starting point for us to plan our Financial Freedom.

Why am I celebrating Financial Independence Day?

I have mentioned earlier how the book “Your Money or your Life” by Vicki Robin changed my outlook and gave purpose to my savings. The unfortunate part is that all of us have limited life span. As we grow older, we realize that time is the most precious resource and no one can generate more time. The wealthiest person in the world or the poorest; has the same average life span. Of course, individuals might have different lifespans; but at an aggregate level we can all hope to live for around 100 years.

[bctt tweet="Take back control of your life on Financial Independence Day"]

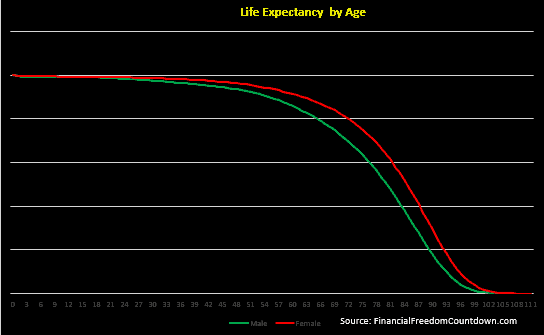

Life Expectancy by Age

I’ve taken data from the Social Security Administration to plot the expected life span of males and females based on age.

Notice how the life expectancy starts declining at a rapid clip after 75.

While we may think that even after we retire at the age of 65, we have plenty of time; that is simply not true. Humans are social animals and the most enjoyable time is spent in the companionship of others.

How much time is available to be spent with others?

Wait but why has an excellent post which actually measures time in terms of activities or events; instead of an arbitrary unit such as years. In fact, when analyzing life; he looks at the intersection of time spent together between individuals. “When you look at that reality, you realize that despite not being at the end of your life, you may very well be nearing the end of your time with some of the most important people in your life. If I lay out the total days, I’ll ever spend with each of my parents—assuming I’m as lucky as can be—this becomes starkly clear”

This highlights a fact which has been in the back of my mind but only recently become evident. As an immigrant who came to this country to build a new life for myself; I’ve had to sacrifice a number of years which could have been spent with my parents had I continued to live close to them instead of relocating across the seven seas.

I am sure most of you would have had a similar experience whether it was moving for college or for work. Financial Freedom now gives me the opportunity to spend quality time with my parents instead of continuing to slave at a 9-5 job.

If I did not achieve Financial Freedom; I would have very little time to spend with my parents. I am sure when you look at life through that lens you would come to a similar conclusion.

Readers, what does 425 financial independence day mean to you and what is your motivation to achieve Financial Freedom?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

I am fascinated by this idea

If you allow me I will make this date viral and at least in India make it viral.

425 is surely fascinating.

Can I go ahead ?

Srikanth Matrubai,

Author – Dont Retire Rich

Yes. Please go ahead and link back to this article.