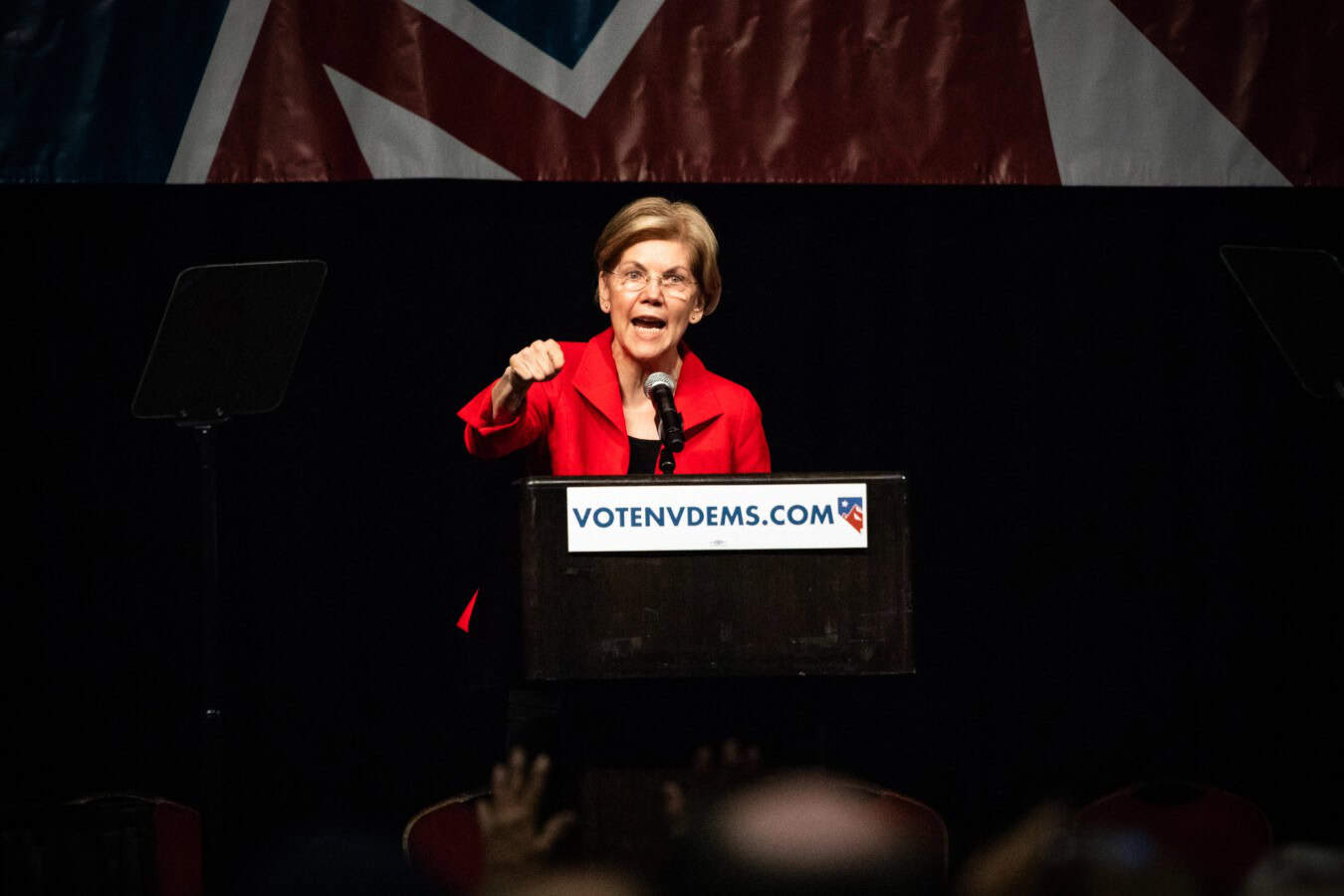

Elizabeth Warren Warns Americans Could ‘Lose Big’ as Crypto Moves Into 401(k) Plans

Senator Elizabeth Warren is raising alarms about the risks of allowing cryptocurrency investments in Americans’ retirement accounts. In a letter to Securities and Exchange Commission Chair Paul Atkins, Warren warned that expanding crypto access within 401(k) plans could expose workers to steep financial losses. The Massachusetts Democrat is urging regulators to explain how they plan to protect investors as the Trump administration advances policies encouraging alternative assets in retirement savings.

Trump Executive Order Opens Door for Crypto in Retirement Plans

The debate follows President Donald Trump’s August executive order designed to expand access to alternative assets, including cryptocurrencies and private equity funds, within traditional retirement accounts like 401(k)s. The order directs federal agencies, including the Labor Department, to reevaluate rules governing qualified retirement investments under the Employee Retirement Income Security Act (ERISA). Supporters argue the move could broaden investment opportunities, while critics worry it could introduce higher risk into accounts that millions of Americans depend on for retirement security.

Warren Warns Retirement Savings Are Not a ‘Playground for Financial Risk’

Warren strongly criticized the administration’s move in her letter, stating, “For most Americans, their 401(k) represents a lifeline to retirement security rather than a playground for financial risk. Allowing crypto into American retirement accounts creates fertile ground for workers and families to lose big.” She argued that crypto assets’ volatility, lack of transparency, and potential conflicts of interest could undermine long-term financial stability for retirement savers.

Concerns About Crypto Volatility and Unpredictable Returns

The senator pointed to a 2024 Government Accountability Office study highlighting the unpredictable nature of cryptocurrencies. The study found that crypto assets experience unusually high volatility and lack standardized methods for forecasting future returns. Warren cited market downturns as further evidence, including a sharp bitcoin decline that wiped out hundreds of billions of dollars in value in a matter of weeks.

Questions About Trump’s Changing Crypto Stance

Warren also questioned President Trump’s evolving views on cryptocurrency. She referenced his earlier comments describing bitcoin as potentially fraudulent or based on unstable fundamentals. She additionally cited estimates from the Center for American Progress suggesting that Trump and his family accumulated more than $1.2 billion in crypto-related financial gains during the year following his 2024 reelection.

Fears of Higher Fees and Greater Losses for Investors

The senator warned that introducing alternative assets into retirement accounts could increase costs for participants. “There is no reason to expect that inviting plans to offer these alternative investments will lead to better outcomes overall for participants — especially considering the higher fees and expenses that typically come with them,” Warren wrote. She argued that the addition of complex or speculative assets could ultimately increase the risk of substantial losses for workers who rely on retirement savings.

Tokenization Legislation Raises Regulatory Concerns

Warren also expressed concerns about proposed crypto market structure legislation being debated in Congress. She warned that certain provisions could create a tokenization loophole, allowing financial products offered on blockchain networks to bypass traditional securities oversight. According to Warren, such changes could weaken the SEC’s regulatory authority and introduce additional risk to retirement investments with introduction of bitcoin as an asset.

Labor Unions Join Opposition to Crypto Retirement Expansion

Several major labor organizations have echoed Warren’s concerns. Groups including the American Federation of Teachers and the AFL-CIO have warned that expanding crypto investment options could put retirement savings at risk. The unions also worry that tokenization efforts could limit regulatory safeguards that currently protect retirement account participants.

Warren Requests Detailed Investor Protection Plans From SEC

In her letter, Warren asked the SEC to address several questions about its approach to regulating crypto assets. She sought clarification on whether companies investing in cryptocurrencies are providing accurate valuations and whether regulators are actively studying manipulation risks within crypto markets. Warren also asked how the SEC plans to educate retail investors about the risks associated with purchasing digital assets, particularly through 401(k) accounts.

SEC Declines to Comment as Crypto Debate Intensifies

Through a spokesperson, the SEC declined to comment on Warren’s letter. However, the agency is expected to play a central role in shaping how cryptocurrency investments are regulated if they become more widely available in retirement plans. The issue is gaining urgency as congressional committees prepare hearings focused on broader crypto market regulation.

SEC Chair Signals Support for Crypto Innovation With Guardrails

Chair Paul Atkins has indicated that he supports expanding the crypto industry while maintaining investor protections. Speaking about the SEC’s “Project Crypto,” Atkins said regulators aim to create clear rules that encourage innovation while helping investors understand potential risks of alternative assets. He has also emphasized that fraud enforcement will remain a priority, stating that the agency will continue pursuing bad actors who misuse investor funds.

A Growing Policy Clash Over Crypto’s Role in Retirement

The clash between Warren and the Trump administration highlights the broader national debate over cryptocurrency’s place in mainstream finance. Supporters see expanded crypto access as a way to modernize investment options and increase financial participation. Critics warn that exposing retirement accounts to volatile digital assets could jeopardize long-term savings for millions of Americans. As regulators and lawmakers continue shaping policy, the future role of crypto investments in retirement planning remains uncertain.

Like Financial Freedom Countdown content? Be sure to follow us!

IRS Opens Tax Filing Season Today as Trump Tax Law Promises Bigger Refunds and Changes to Your Paycheck

The Internal Revenue Service officially opened the tax filing season today, Monday, January 26, as millions of Americans file their first returns under President Donald Trump’s One, Big, Beautiful Bill; a sweeping tax law that could deliver larger refunds for many middle-income households. New deductions, expanded child tax credits, and updated IRS withholding rules ensures most filers will see bigger refund checks this spring, and future paychecks may also change as employers adjust to the new tax landscape.

Your Child Could Get $1,000 With a New Trump Account and Major U.S. Employers Pledge to Match It

JPMorgan Chase, Intel, Nvidia, IBM, Bank of America and Wells Fargo are among a growing list of major corporations pledging to match a new $1,000 government contribution to children’s investment accounts under President Donald Trump’s flagship “Trump Accounts” initiative. The announcements mark a significant expansion of private-sector participation in a program the administration says could eventually channel trillions of dollars into long-term savings for young Americans.

Your Child Could Get $1,000 With a New Trump Account and Major U.S. Employers Pledge to Match It

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.