Alternative Investments: Is It Worth Investing and What Are the Pros and Cons?

There is no shortage of options when it comes to your personal finance. We have broadly covered some of the best assets to own, including traditional options such as investing in stocks, real estate, or bonds.

You’ve probably heard that alternative investments can be a great way to secure your financial future, but you’re not sure where to start.

Alternative assets are an excellent way to diversify your portfolio, but the world of alternative investments is complex and confusing. It’s hard to know where to start when investing your money, especially for investors who don’t have the proper knowledge or experience.

For decades, institutional investors, pension funds, and accredited investors have dabbled in alternative investments. Individuals are now starting to shift their strategies towards other investment areas with the hopes of diversification and risk reduction.

Alternative investments are becoming a more substantial part of portfolio diversification, despite the genuine investment risk that they present. However, the term “alternative investments” is often misunderstood, which begs an important question: What are alternative investments? And what risks are posed by them?

What Are Alternative Investments?

Alternative investments are assets outside of the standard world of financial practice and encompass everything from private equity to commodities to cryptocurrency and more. The term is extensive by design, as it includes a wide array of financial instruments. There is always some form of alternative investment that is becoming more and more popular. Many people will rush into a perceived safe haven in times of declining markets.

Alternative investments usually have many characteristics that are not held by traditional investments, such as:

- They are usually not regulated by any regulatory body, such as the securities and exchange commission. It may create more market opportunities, but it also creates a “wild wild west” atmosphere that may allow investors to get easily ripped off.

- The public at large less understands these areas. People often fail to recognize the risks and rewards of alternative investments, creating a scenario where many people get rich, but many could lose massive amounts of money.

- They are typically relatively narrow in scope, focusing on a tiny slice of a market.

- They are often very new. It can be challenging to evaluate the risk or reward potential fully.

Examples of Alternative Investments

Cryptocurrency

Cryptocurrency is arguably one of the most popular alternative investments available today, with trillions invested in various currencies.

A cryptocurrency is an alternative form of currency. It is electronic only and exists on the blockchain. There are more than 10,000 forms of cryptocurrency at the moment, all of which have various values and popularity. In slightly over a decade since Satoshi wrote the bitcoin white paper, the market cap for all cryptocurrencies is estimated to be over $2 trillion.

Cryptocurrencies are highly volatile – for example, Bitcoin, the most well-known crypto at the moment, has lost more than 40% of its value from its high a few months ago. The volatility is relatively standard for Bitcoin, which has seen wild changes in its value that are not seen on any other traditional market.

Unlike other traditional currencies, cryptocurrencies are not backed by any tangible assets. It means that their worth and value are entirely determined by market sentiment. It helps to explain why cryptos are so volatile: A quick change in feelings about a currency, or a tweet from the right person, can send the price of crypto into a tailspin.

Investing in cryptocurrency has always been easy if you stuck to the significant tokens like Bitcoin and Ethereum: You can do so on various crypto exchanges or with the Bitcoin ETF approval you could directly buy the ETF.

In 2021, the SEC approved the first futures-based ETF that tracks bitcoin.

Individual investors also have the option to now invest in cryptocurrency IRA.

Since Bitcoin and Ethereum have become more mainstream, the risk curve and speculation have moved into NFTs and Metaverse crypto tokens.

Commodities

Commodities are literal, physical things. They take many forms, including

- Hard commodities. These are typically mined items and include precious metals, like gold, silver, palladium, lithium, and oil. These are among the most commonly used commodities and the oldest.

- Soft commodities. These are typically crown or herded and include agricultural products like wheat, soy, or oranges. They also comprise living products, like cattle.

These alternative investments are popular for many reasons. On the one hand, they will almost always be in demand.

Both hard and soft commodities have been around for centuries and are either used extensively by individuals or have a long-term place in various economies. Based on multiple factors, prices move up and down on these commodities, including changes in demand, crop availability, and macroeconomic conditions.

There are many reasons why someone may want to purchase commodities. Hard commodities are often used to hedge against inflation or during turbulent economic times. Investors will frequently invest in gold or silver in times of trouble, as investors consider it an extremely safe investment.

Besides directly buying gold or silver, it is harder to invest in other commodities. One could own shares of mining companies that drill for lithium, nickel, and cobalt, which are projected to be in higher demand, focusing on ESG investing and the rise of electric vehicles and batteries.

Unfortunately, the prices of these mining companies are quite volatile as they purchase mines based on certain assumptions which might not always pan out. Successful mining companies move from an explorer to a producer but still need lots of cash to operate, resulting in share dilution. When buying volatile stocks, I always prefer to dollar cost average using a no-fee platform like M1Finance, which permits me to invest as little as $100 spread across several companies. You can read my M1Finance review and why I prefer it over other larger platforms like Schwab or Fidelity.

Investing in agricultural land was always problematic due to the regulations, the enormous cost of owning farmland, and the lack of local knowledge. With the advent of crowdfunding, one can now invest in farmland.

Art or Collectibles

Art investment and collectibles have become more popular of late. As the name implies, this means investors who make purchases of art or other collectibles, such as valuable furniture, baseball cards, or more. The theory behind these purchases is that the value of the investment will increase over time, potentially outpacing the growth of the stock market or the economy at large.

There are real challenges with investing in collectibles. For one thing, it can be impossible to predict when a collectible will rise in value versus other forms of investments. A baseball card that may seem set to skyrocket in value may turn out to be a dud, losing the investor money. Collectables must be authenticated, and fraud is a genuine concern. Finally, collectibles have no intrinsic value – the value must be agreed upon by the purchaser, seller, and collectible community at large. It can create real challenges when it comes to planning for investment.

Crowdfunded investing has eliminated the barriers of high cost and lack of access to art investment.

Hedge Funds

Hedge funds involve investors pooling their money and hiring an outside financial manager to manage their investments and grow their wealth. A hedge fund will not just make stock or equity purchases but instead will invest money in an array of sources that is typically inaccessible to “regular” investors, including derivatives or private debt. Hedge fund strategies tend to be very different than those of other investors, and these funds will usually be transparent about their process to their prospective investors ahead of time.

It is essential to be aware that hedge fund investments may be less liquid, use leverage, have less transparency, and charge higher fees, including a performance incentive.

The track record of success for hedge funds that permit external capital is hard to track.

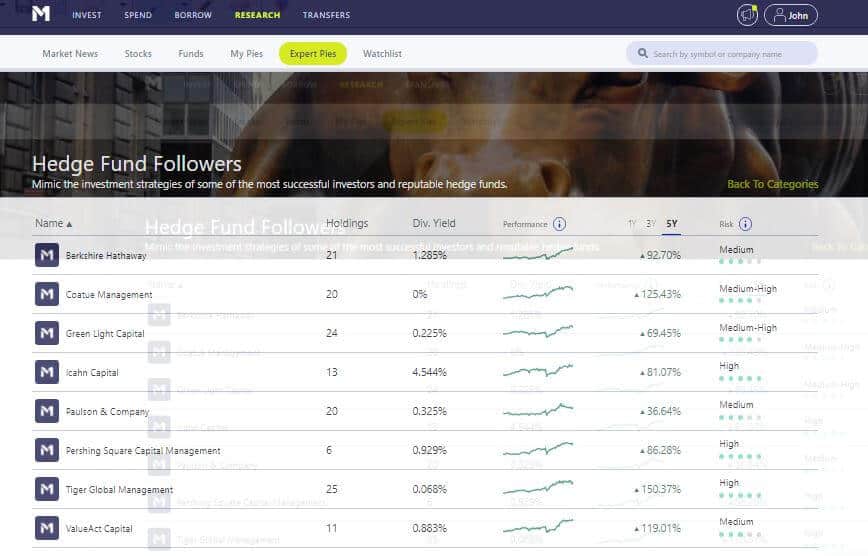

M1Finance has created “Expert Pies” based on some of the most successful hedge funds using the public filings of their holding. You can read my M1Finance review for more details.

Venture Capital

Venture capital is a particular type of private equity. Like hedge funds, these funds tend to be closed off to the public at large. Venture capital funds will invest in startups and usually are associated with technology companies. They will thus provide seed money to help get a company started, often providing critical funding at a time when a product or service is just being rolled out to the public. A fund will acquire a stake in the company, which they can sell later for a healthy profit.

This type of fund capital can be hazardous. There is never any guarantee of success for the investment fund. However, this fund can provide a massive return on investment when done right. At the same time, it occupies a critical space within the tech world, as capital is essential to ensuring that a business can get off the ground.

You must have read that early investors in Google or Facebook became very wealthy by investing in VC rounds. Unfortunately, a large number of startups fail. Hence, one needs to be knowledgeable enough about the startup and have deep pockets to participate in seed funding to Series D.

The advent of SPACs was supposed to help everyday investors gain access to private companies before they listed on the exchanges. While some like Draft Kings and Virgin Galactic were successes, many SPACs have not outperformed the broader markets.

Real Estate Crowdfunding

With the passage of the JOBS Act, one can use real estate crowdfunding to purchase residential, commercial, or agricultural land which was inaccessible to investors earlier. Like any other form of crowdfunding, various investors essentially pool their money and use it to purchase real estate. A professional or a real estate firm manages the capital and the property.

Real estate crowdfunding can allow people to make large purchases that they would not be able to otherwise. However, it also comes with a loss of some control over the asset.

Risks of Alternative Investments

All of the above methods of investment hold a great deal of potential. However, there are huge risks involved with all of the above methods. Consider the following:

Lack of Regulation and Fraud

Perhaps the greatest danger of any alternative investment is the lack of regulation. Many investors believe a lack of code to be a good thing, as they feel that overregulated markets are limited in growth. However, with many alternative investments, this can be a real danger.

A lack of regulation can take many forms, including a lack of transparency, unlicensed and unscrupulous vendors, and outright inaccurate or fraudulent information being exchanged. It can result in investors making poor decisions or losing their money to thieves.

Since alternative investments are usually new, governmental units find it difficult to regulate these markets appropriately and investigate potential threats. As a result, consumers must be extra cautious when investing in an alternative investment plan.

Extreme Volatility

One of the characteristics of many alternative markets is that they are often highly volatile. This volatility is often seen in the rapid swings in prices of a commodity over a brief period. Some traders have the resources or timeframe to absorb this volatility, knowing they will still have money even if a trade goes wrong. They may also have the ability to make up any trade losses with additional gains later down the line.

However, other traders may not adequately measure the risk that this volatility may take. For an example, look at the price of Bitcoin: It approached a high of roughly $64,400 in November 2021. Today, it is worth approximately $44,600 – a decline of almost 1/3 of its total value. Someone who had invested heavily in the coin would now be out a massive chunk of their investment.

To be clear, some traders appreciate volatility – they even look for it, as they view it as a chance to profit. This strategy works well for some – but not for others. If you are going to invest in an alternative investment, you should be prepared to manage and address this volatility.

Limited History

The old axion “Past performance doesn’t guarantee future success” is true. However, it doesn’t change the fact that past performance is often the only thing that investors have to judge a market investment by. As such, they often rely on history.

With alternative investments, this can be a considerable challenge. Many alternative investments are brand new. It can be difficult – or impossible – to judge how successful an investment will be. This lack of historical data or performance is not the end of the world, provided that an alternative investment can provide a solid use case for why it will be successful. However, in many cases, that isn’t possible.

Failure to Appreciate as Hoped

Another challenge is that many alternative investments don’t appreciate. It is often the case with collectibles. You may purchase a collectible – such as a baseball card – with the understanding that its value will increase over time. However, the player on the card may fail to live up to their potential and fade into obscurity, thus minimizing any potential appreciation in the card’s value.

In this case, you may lose money on the initial outlay. It isn’t the end of the world, but what may be more damaging is the opportunity cost: If you had put the money you spent on the collectible elsewhere, you might have stood to gain more money.

Who Can Invest in Alternative Investments?

The answer to this question usually depends on the specifics of the investment in question. Most alternative investments are restricted to investors meeting the accredited investor qualifications.

For example, farmland investing is only for accredited investors. But real estate crowdfunding depends on the type of investment. Streitwise permits non-accredited investors to participate in real estate with only a $2,500 investment through their eREIT product. While EquityMultiple deals with commercial real estate and are restricted to accredited investors with a $5,000 minimum

Similarly, venture investing is not easily accessible while having lower barriers to entry to invest in cryptocurrency. You only need access to the internet and a way to pay – you don’t need any advanced licensing or training to start making crypto purchases.

How Can I Invest in Alternative Investments?

It depends on the investment in question. The internet has made investing in alternative investments much easier, and an individual can often download an app or visit a website to make the investment they wish to. However, proper alternative investments require a good look into the field in question, extensive research, and a keen eye. Never invest in an area that you don’t understand, and always make sure to check and ensure that the information you have been given is accurate.

Some alternative investments have low barriers to entry. Of course, this can be a double-edged sword. On the one hand, I invested in Bitcoin when it was only $8,000, and many individuals could buy at similar or lower levels. On the other hand, some of my investments haven’t panned out as expected, documented in my worst investments article.

The barriers to entry often ensure that investors are more savvy and protected. As such, you should research any alternative investment, and any information given should be independently examined by someone who does not stand to profit from the trade.

Platforms like Yieldstreet provide investment options in art, legal financing, structured notes, supply chain financing, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $2,500.

Final Thoughts on Alternative Investments

As with any investment, it is crucial to research before making a final decision about whether or not to invest. It includes: having an understanding of what alternatives investments are and how they work; knowing which alternative investments suit your portfolio and why

As you can see, there are many benefits and challenges to investing in alternative investments. Weigh the pros and cons of your situation before considering an alternative investment as a way to grow capital or diversify portfolio holdings.

Readers, have you considered alternative investments as part of your portfolio? Did you invest in any of the investments listed above, and what was your experience?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.