Everyone Needs Bitcoin – Not Just Jews, Gypsies And Gays

The world is changed. I feel it in the water. I feel it in the earth. I smell it in the air. Much that once was is lost, for none now live who remember it. – Lord of the Rings

Germany – 1919 to 1945

The 1919 Treaty of Versailles forced Germany to pay 130B Deutschmark in repatriation. Paying the crushing reparations destabilized the economy, producing ruinous, runaway inflation. By 1923, hyperinflation kicked in, and consumers needed a wheelbarrow of paper money to buy a loaf of bread. Germany needed to make payments in goods; as the currency became worthless. The country did not have significant gold reserves.

The 1919 Treaty also forced Germany to disarm. Against this bleak economic backdrop, Hitler wanted to build an army from the ground up, to be bigger and better than every other army.

In 1933, Hitler came to power in Germany. In 1933, Hitler and the Jewish League agreed to the Haavara Agreement in which, over time, German Jews and their finances could settle in Palestine. By the end of 1933, of the 600,000 German Jews, 100,000 had already emigrated to Palestine.

Germany discouraged emigration by restricting the amount of money Jews could take from German banks and imposed high emigrations taxes. In 1938, Hitler’s government issued the “Decree for the Reporting of Jewish-Owned Property”, requiring all Jews in Germany and Austria to register any property or assets valued at more than 5,000 Reichsmarks. German officials identified Jews residing in Germany through census records and tax returns. Jewish wealth confiscated by the Nazis paid for roughly one-third of Germany’s World War II effort.

History doesn’t repeat itself, but it does rhyme.

Mark Twain

World – 1990 to present

If you think this can NEVER happen in my country, you might be mistaken. In the current political environment, every country is divided. There is no one at the center, and you are forced to choose either left or right. “If you are not with us, you are against us” is the current mood. This situation will become more and more divisive with every political cycle.

Anything from political affiliations to ethnicity to wealth to sexual orientation can make you a target. History is rife with examples when politicians can convince one group to strip away the rights of another group; all under the guise of “equality and fairness.”

Political views

Imagine the regime in your country becomes hostile towards your political leanings. The government knows which party you vote for based on your voter registration. In the US, most people voluntarily self identify publicly as either Democrat or Republican.

Financial views

We have an election cycle where Presidential candidates tweet, “Billionaires shouldn’t exist.” Anyone pursuing Financial Freedom would have accumulated or is on the path to accumulating wealth producing assets. In the US, as per the Federal Reserve, the median net worth is only $97,300. Even if you have five times the median net worth, you could be an easy target for the angry mobs. You don’t even need to be a millionaire to be tarred and feathered. The regime also knows all your financial details, including foreign country holdings, thanks to your tax returns, FBAR, FINCEN, and has the power to freeze your assets at a moment’s notice.

Sexual Orientation

Although sexuality-based discrimination is illegal in developed countries, LGBT individuals still face the possible threat of violence in their daily lives. There are 80+ countries (notably throughout the Middle East, Central Asia, and most of Africa, but also some of the Caribbean and Oceania) where laws actively favor discrimination and violence.

Ethnicity and Religion

We are all aware as economic conditions deteriorate, one group believes the rich are responsible for their woes, and another group believes outsiders are responsible for all their hardships. Ethnicity based on skin color is hard to hide and most convenient to target. Unfortunately, people are being killed based on race or religion at this very moment.

My Experience With Sectarian Violence

For folks who may not be aware of my origin story, I was born in India, specifically Mumbai (Bombay). You may be right in thinking that Mumbai is the financial capital, with India being the world’s largest democracy. Everything is sunshine and roses. You study history books about your country and the sectarian violence during independence, which killed between 200,000 to 2,000,000 people

Bungalows and mansions were burned and looted, women were raped, children were killed in front of their siblings. Trains carrying refugees between the two new nations arrived full of corpses; their passengers had been killed by mobs en route. These were called “blood trains”: “All too often they crossed the border in funereal silence, blood seeping from under their carriage doors,” – Hajari in his book Midnight Furies

But things change. Politicians want to get elected by pitting one group against another. Enough hate has been sown on both ends. Trust among neighbors has eventually vanished and no one believes anyone anymore. They are all stuck in their own version of reality.

The Bombay riots, which erupted in December 1992, resulted in 700 people being slaughtered in the city in less than 45 days. As sectarian violence gripped the city, politicians and elected representatives either turned a blind eye or actively incited their mobs. Curfew is declared, and the army conducts flag marches on the streets. Nothing can quell the violence.

You walk to school and then come across a mob rushing with swords. Based on their attire; you know their religious affiliation. You quickly try to run in the opposite direction to where they are headed while keeping your eyes lowered and hoping they don’t notice a kid. Suddenly you realize that it is an ambush. The other group is ready and outnumbering the first group. Right in front of your eyes you watch people getting hacked to death. Blood gushing on the streets; as people are being slaughtered.

[bctt tweet=”You wake up in the middle of the night; after all those years, screaming in your sleep. The visions are a distant memory; but nightmares never go away.” username=”FFCsocial”]

I am sure some readers will say “FFC, you are paranoid and crazy. You are no longer in a third world country but in the land of the free.” Maybe that is true. But having witnessed elected governments persecute one section of the population while the neighbors turn against each other; does not inspire confidence.

We are living in unprecedented times globally. People are more divided than ever, and it could be only a matter of time before things start to breakdown. This is a global phenomenon where populist right-wing and left-wing candidates vs. centrists are dominating politics and winning elections. Watch it happen in the USA, India, Philippines, Poland, Spain, etc.

Is this something you are willing to bet your life and those of your loved ones? Are you able to walk away TODAY with some of your assets, like the Jews who left Germany in 1933? Or would all your assets be linked to government entities, and you are unable to leave, knowing that persecution and death are imminent?

This blog is not just gloom and doom but also supposed to provide possible solutions. When we look at the list of assets that any government cannot confiscate, we find out that it is a very shortlist.

Physical gold used to be a great asset. Living in the San Francisco Bay Area, I have many friends from Vietnam whose relatives lost their gold to pirates or corrupt government officials when fleeing the country.

What Is Bitcoin?

On 3 January 2009, the bitcoin network was created when Satoshi Nakamoto mined the first block of the chain, known as the genesis block. Embedded in the genesis block was the following text: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. We can assume that this note alludes to the instability in the financial system during that period. This was the Great Financial crisis, which had wide-ranging repercussions across the globe. The anti-inflationary nature of Bitcoin has been widely publicized. It cannot be printed or debased. Only 21 million bitcoins will ever exist.

Economists define money as a store of value, a medium of exchange, and a unit of account. Bitcoin is peer-to-peer electronic “money” that is valuable because of the monetary autonomy it brings to its users. Peer-to-peer means that no central authority issues new money or tracks transactions.

Advantages Of Bitcoin

Bitcoin

- Transactions are permissionless and borderless. Storage on a distributed ledger permits anyone to verify a transaction securely.

- Does not need any identification to use. As long as you control your private keys, you own the funds.

- Takes up no physical space regardless of amount. Easy to store and carry.

- Can be stored encrypted on a hard wallet or paper backup (private key).

- Is censorship-resistant. Nobody can block or freeze a transaction of any amount. Not subject to any country’s sanctions.

- Irreversible once settled. It cannot be undone.

- Always available 24*7.

- Has very low transaction costs.

- Is global. A citizen from Mongolia can use it to transact with someone in Europe without a credit history or trust needed.

- Can be carried across borders without being noticed.

The advantage of Bitcoin over any other asset class is that no government or entity can freeze your funds or accounts. You don’t have to physically carry it with you, which makes it easy to cross borders or travel without drawing attention to yourself.

The Current State Of Bitcoin

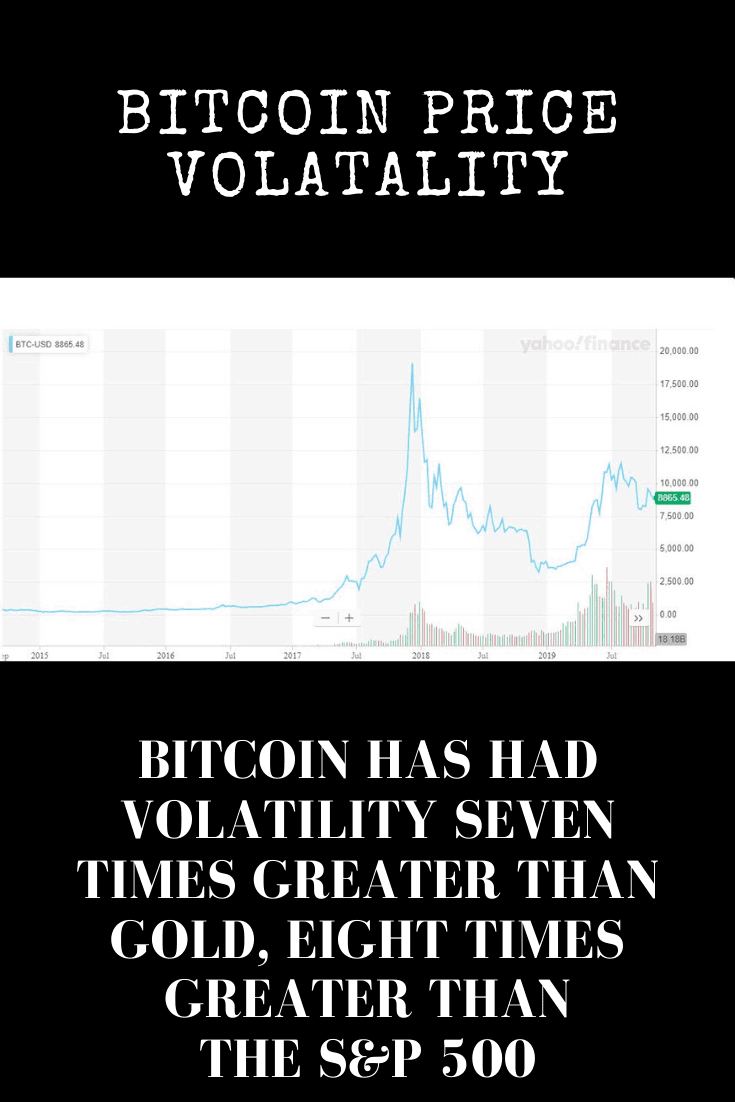

I have to caution everyone that Bitcoin took ten years to gain notoriety and have its ticker on CNBC. Several institutional players from Fidelity to Intercontinental Exchange have now started building platforms related to cryptocurrencies. Endowments and hedge funds have invested either in the companies building platforms or in tokens directly. In spite of all these progressive steps, Bitcoin is still considered to be in its infancy. The epic bull market of 2017 got everyone interested and then folks interested in speculative gains left. Bitcoin has had volatility seven times greater than gold, eight times greater than the S&P 500, so it is not for the faint of heart.

Bitcoin FAQs

It has become popular in the personal finance and mainstream community to hate on Bitcoin. While some like Ramit Sethi adopt a more realistic approach, others like Mr. Money Mustache are outright dismissive.

Here are some common FAQs

Can Bitcoin be hacked?

The network is secured based on POW (Proof of Work). Bitcoin has now reached escape velocity such that even NSA can throw all its computing power and be unable to break the network.

What you hear about in the news are exchange hacks. Remember, bitcoin exchanges are not FDIC insured banks. When you store your coins in any location besides your private wallet, it is akin to leaving your money on the front porch. Don’t cry if someone steals it. “Not your keys, not your coin” is an adage you should always remember. Even if you are an active cryptocurrency trader, you do not need to leave your coins on an exchange. Hopefully, this answers the will bitcoin be banned, can bitcoin be hacked, shutdown, regulated, or stopped question.

Can quantum computing destroy Bitcoin?

The same quantum computers used to destroy bitcoin can be used to also secure the network.

Is Bitcoin used for illegal activities?

Bitcoin is traceable, so I am unsure why people have this misconceived notion that it is used for illegal activities. The USD is used for more illicit activities compared to bitcoin. Even in this day and age, cold hard cash is untraceable and used for illegal activities. The unlawful activity usage is the most common narrative used to discourage ownership of Bitcoin. Exchanges across the globe, including in the USA, provide options to exchange your USD to BTC. So don’t let this fake narrative discourage you from ownership. If Bitcoin was illegal, why would the IRS issue guidance regarding tax reporting?

Does Bitcoin use a lot of energy, or is bitcoin energy usage harmful?

These claims are similar to the energy usage articles created when the Internet was launched. The widely quoted stats are from estimates not based on hard data and have since been debunked.

Will Bitcoin go up or down in value?

I don’t know. Only invest money you are willing to lose. Given the asymmetric nature of bitcoin; a tiny fraction invested could be valuable in times of need.

Can Bitcoin go to zero?

Anything is possible. Assume this will go to zero.

Will Bitcoin replace money?

Bitcoin is money, just like gold. It does not need to replace fiat currency (issued by central banks) to be valued.

Can Bitcoin be traced?

Yes. Bitcoin transactions at this point can be traced. Zcash and Monero are privacy coins, although they have different architecture. Monero (XMR) has an architecture similar to Bitcoin, so it would not be too difficult for Bitcoin to adopt this privacy feature in the future.

Can Bitcoin be shut down?

No. Bitcoin has reached escape velocity, and even throwing all the NSA supercomputer power cannot shut it down. The advantage of Bitcoin is that no government or entity can freeze your funds or accounts.

Can Bitcoin be trusted?

Bitcoin is not centralized and has never been hacked. Transactions on the blockchain are validated by the miners using the Proof of Work (PoW) algorithm.

Can Bitcoin be stolen?

Bitcoin has not yet been hacked, so it is doubtful it will fail technically. By failure, if you mean price decrease to zero, then no one knows the answer. It has been ten years since the Bitcoin network was launched and still holds some value today. It is still early days though, in terms of an experimental currency.

Can Bitcoin fail?

Bitcoin has not yet been hacked so it is doubtful it will fail technically. By failure if you mean price decrease to zero then no one knows the answer. It has been ten years since the Bitcoin network was launched and it is still holds some value today. It is still early days though, in terms of an experimental currency.

Can Bitcoin still be mined?

Yes. Bitcoin can still be mined. With each halving, the computations become more complex.

Can I run a full Bitcoin node?

Yes. You can use a $35 Raspberry pi to run your full node on the network. It enables users to verify their transactions over the network independently, without having to trust third-party services. However, you do not need to go this route unless you are interested. The network confirmations are good enough for me.

Who is Satoshi Nakamoto?

No one knows, and there is a good reason that this individual or group of individuals is anonymous. Although many have claimed to be Satoshi, you should only believe the person who can move the coins in Satoshi’s wallet to be the real one. At this point, everyone is watching that address. I am sure it will spark global headlines if any movement happens. The wallet has approximately 1 million BTC.

Who controls Bitcoin?

No centralized agency controls Bitcoin. The advantage of Bitcoin that no government or entity can freeze your funds or hold your bitcoin.

Where is Bitcoin accepted?

Bitcoin is more widely accepted in Asia, South America, and parts of Easter Europe. Several large retailers from Microsoft, Starbucks, Whole Foods, NewEgg, etc accept Bitcoin. I have even seen Bitcoin ATMs in a few malls in the San Francisco Bay Area. With global geopolitical events causing crypto to go mainstream, you can now buy several items with bitcoin.

Which Bitcoin exchange is safest?

No Bitcoin exchange is safe. You buy from the exchange and then immediately move it to your wallet. Exchanges have frequently been hacked, starting from the infamous Mt. Gox hack to Binance.

Which bitcoin exchange can be used to buy/sell?

Coinbase and Binance.US have sufficient volume in the US. Since the coins offered by each exchange vary significantly I would open up accounts with all 3 and then research coins to buy.

You can even buy crypto in your IRA using AltoIRA which works seamlessly with Coinbase and takes care of all the paperwork.

Internationally, Binance followed by Kucoin, Huobi, etc., can be used as exchanges. I consider the international ones to be riskier.

Which Bitcoin should I buy?

There are several forks of bitcoin, but the original one is BTC. Don’t assume the cheaper fork is better. And if the price is too high, remember you can always buy bitcoin fractions on any exchange such as Coinbase or Binance.US

What Bitcoin wallet should I use?

At this point, Ledger and Trezor are the two best hardware wallets to store your Bitcoin and other crypto-assets. Buy these directly from the manufactures. Please do not buy from eBay or Amazon, or any 3rd parties; because the person selling it to you will have the keys to the wallet and can withdraw the coins as soon as you load the wallet. You can also use a paper wallet, but not recommended unless you know what you are doing.

Are Bitcoin gains taxable?

All cryptocurrency gains and losses follow the capital gains/loss rule in the US. Check with your CPA and make sure they include those transactions and refer to IRS guidance. Few US exchanges like Coinbase provide details of specific transactions directly to IRS. In July 2019, the IRS began mailing educational letters to more than 10,000 taxpayers who may have reported transactions involving virtual currency incorrectly or not at all..

Besides Bitcoin, what are the other crypto currencies?

I have only covered Bitcoin in-depth, but there are several other cryptocurrencies. Some of them have unique use cases, but the adoption of those use cases is still in the infancy. While a few coins hold promise and might be successful, the risk-reward is not favorable. Remember, during the dot-com, entrepreneurs launched many companies, and only a few now remain.

What are ICOs?

Once you start venturing outside Bitcoin, you would come across several “altcoins.” Some of them are also called “shitcoins” since many are worthless now and unable to deliver their roadmap. Some founders genuinely tried and failed, and others did an exit scam. They most commonly raised funds via ICOs (initial coin offerings).

What are IEOs?

Lately non US crypto exchanges wanting a piece of action, have also started offering IEOs (initial Exchange offerings). IEOs are similar to ICOs but instead of using established blockchains such as Etherum (ETH); you have to use the exchange coin to buy it. Eg: Binance has users buy BNB (Binance Coin) which is then used to buy KAVA tokens.

Does GBTC track Bitcoin?

Grayscale Bitcoin Trust (GBTC) tracks bitcoin with a huge tracking error. Often GBTC used to trade at a 15% to 30% premium to the price of Bitcoin and now it is trading at a discount to BTC price. If you are wondering if GBTC stock is a good buy; the answer is no.

1) You have a tracking error with the price of Bitcoin.

2) You do not actually own the underlying Bitcoin because you do not have the keys to it. “Not your keys, not your coins” is something you should always remember. You cannot transfer the Bitcoin to your personal wallet.

3) There are better option if you want to buy crypto in your IRA using a crypto dedicated platform like AltoIRA which works seamlessly with Coinbase and takes care of all the paperwork.

Can I buy Bitcoin on Robinhood

When you buy a Bitcoin on Robinhood, it is not actual bitcoin but only a paper derivative. I would not recommend buying Bitcoin using this method because

1) You have to keep this paper derivative Bitcoin on Robinhood.

2) You cannot transfer it to your own wallet.

3) It cannot be used for transactions like the real bitcoin you can buy on other exchanges.

4) “Not your keys, not your coins”. If Robinhood gets hacked I am not sure what is the level of protection. Robinhood Crypto is a different entity compared to Robinhood Financial. The stocks you buy from Robinhood Financial are protected by SPIC up to a limit of $500,000. For Robinhood Crypto they do mention having insurance from an external party but you need to validate policy limits and read the fine print.

It is better to open up an account on Coinbase or Binance.US which allow you to own your crypto and also provide many more coins besides bitcoin and ETH.

Can I buy Bitcoin on PayPal

Paypal announced that options for buying crypto including Bitcoin and Ethereum within the PayPal digital wallet. However since the cryto cannot be transferred to other accounts or outside of PayPal. Personally, I would avoid this route and directly buy crypto from exchanges like Coinbase or Binance.US which allow you to own your crypto and also provide many more coins besides bitcoin and ETH

What is Mining, Proof-of-Work and Cryptography

Check out this post for the technical bitcoin jargon explained in simple terms.

Can I buy cryto or Bitcoin in my IRA?

Yes!, You can buy crypto in your IRA using AltoIRA which works seamlessly with Coinbase and takes care of all the paperwork.

Final Thoughts On Bitcoin

I do not advocate being an alarmist but at the same time do not bury my head in the sand. The time to build a well is long before you are thirsty.

I am a pretty positive person. I usually focus on improving Human Capital, evaluate stock investment platforms, have a primary and rental house in the San Francisco Bay Area, invest in crowdfunded real estate, and file taxes with various legal tax saving strategies. So definitely, do not consider myself a conspiracy theory guy.

However, it is prudent to have a fraction of my net worth in an asset that can be used to get out; when things get out of hand. It is certainly NOT recommended as a speculative investment; but rather as insurance. It is also an asymmetric risk play in the sense that you do not need a large amount. Even the 2% net worth invested; would increase exponentially if you ever need to use it.

I would start now by exploring options for assets that are resistant to confiscation, can be moved easily across borders, and used for micropayments. You do not need to move all your assets into Bitcoin but have your fiat on-ramps in place. Learning how to store and transact; long before you need it would be helpful. Consider this an emergency bug out bag in your closet; that you hope never to use but lets you sleep at night.

The Jews who noticed the changing environment and had the means and foresight to leave; are the ones who survived and thrived in foreign lands. They could go with most of their net worth early on. Many Jews who considered leaving and had immovable assets either in property or business could not escape while the entire regime was gradually turning hostile to them. The German government forbade emigration after October 1941. The Jews who remained were murdered in ghettos or taken to Nazi concentration camps, where most of them were killed.

Summary

Readers, have you ever considered what are the safe assets available which cannot be confiscated by the government?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Interesting take on personal finance and history. So much of PF blogs ignore history and the unlikely yet possible implications of dramatic shifts in countries. Nevermind being prepared for it… in a sense of getting out with your life or living through it.

Exactly. Better to be ready and prepared.