Alarm Grows as Federal Reserve’s Data Shows Sharp Increase in Household Debt and Rising Delinquency Rates

In the second quarter of 2024, total household debt soared by $109 billion to reach $17.80 trillion, according to the Federal Reserve Bank of New York. This surge encompasses credit card balances, mortgage loans, and auto loans, all peaking at unprecedented levels.

Meanwhile, delinquency rates for these debt types are on the rise, prompting worries among economists and financial analysts about the resilience of the U.S. consumer-driven economy.

Credit Card Balances Hit Record High

The outstanding credit card balances, currently at $1.142 trillion, increasing by $111 billion from a year ago.

On an annualized basis, around 9.1% of credit card balances shifted into delinquency. Serious credit card delinquencies increased across all age groups, particularly among younger borrowers, surpassing 2020 levels.

Auto Loan Delinquencies Accelerating

Auto loan balances continued their upward trend and currently stand at $1.626 trillion, maintaining the trajectory observed since the second quarter of 2020.

On an annualized basis, about 8% of auto loans became delinquent.

Housing Debt on the Rise

Mortgage balances increased by $505 billion from the previous year, reaching $12.52 trillion at the end of June.

Americans under financial stress have resorted to using their home equity lines of credit (HELOC). The HELOC balances rose by $4 billion, marking the ninth consecutive quarterly increase since Q1 2022, reaching a total of $380 billion.

Student Loans Unchanged Due to Favorable Policies

The outstanding student loan debt remained relatively constant, at $1.60 trillion.

But the constant level of student debt could be misleading due to policy changes. Credit bureau reports will reflect the missed Federal student loan payments only at the end of 2024.

Due to these policies, less than 1% of the total student debt was reported as 90+ days delinquent or in default in 2023 and is expected to remain low until at least the end of 2024

Surging Transportation, Food and Housing Costs Crushing Americans

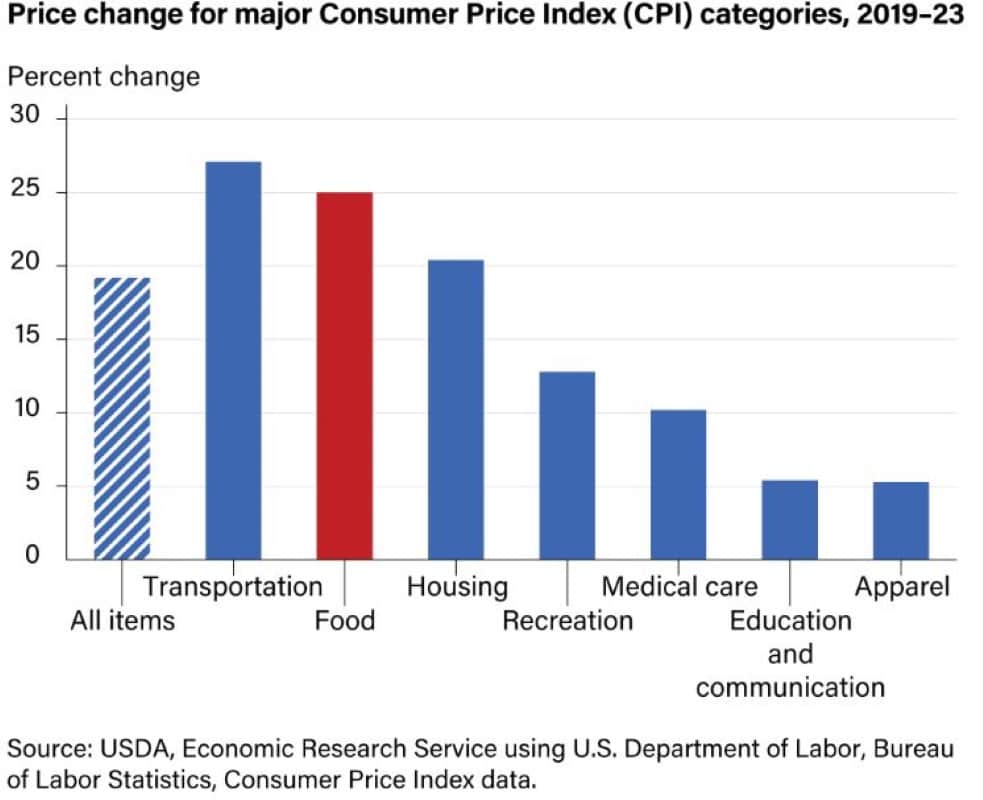

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period as per USDA data.

While food prices saw a rise lower than the 27.1 percent increase in transportation costs, they outpaced the upticks in housing, medical care, and all other primary categories.

Inflation Top Concern As Per Gallup Poll

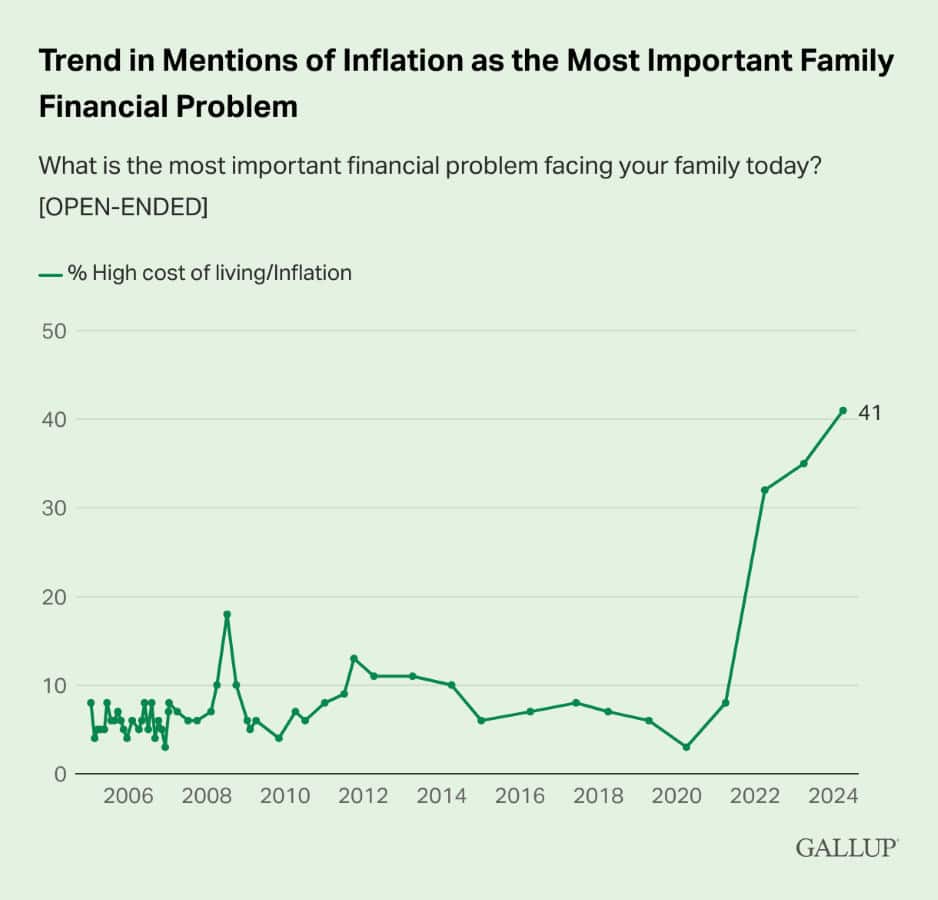

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak. This year, 41% cite the issue, a slight increase from 35% last year.

The latest findings come from Gallup’s annual Economy and Personal Finance poll, conducted between April 1 and 22, 2024. Since 2005, Gallup has asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

Americans Under Increased Financial Stress

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

The credit quality of recently originated loans remained stable, with 4% of mortgages and 15% of auto loans extended to borrowers with credit scores below 620, showing little change from the third quarter. The median credit score for newly originated mortgages remained consistent at 770. In contrast, the median credit score for recently originated auto loans increased by one point compared to the previous quarter, reaching 720.

Americans are experiencing rising prices in various areas, including purchases made with credit cards, grocery expenses, fuel costs, and other goods. It is plausible that the escalating prices and resulting debt service payments negatively impact borrowers’ financial positions and make it more challenging to meet their financial obligations.

Since consumer spending is a critical component of the U.S. Gross Domestic Product, an uptick in delinquency rates as individuals attempt to manage debt payments with fewer financial resources could prove disastrous.

Like Financial Freedom Countdown content? Be sure to follow us!

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Recent reports from prominent financial institutions like Fidelity Investments, Bank of America, and Vanguard reveal a concerning trend: an uptick in the share of retirement plan participants resorting to hardship withdrawals from their 401(k) accounts. More individuals face immediate and significant financial strains, leading them to tap into their retirement savings as a solution. This rising trend signals a worrisome pattern, shedding light on the challenges many Americans are encountering.

Increasing 401(k) Hardship Withdrawals Cast a Shadow on Middle-Class Financial Stability

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

Dreaming of a consistent passive income every month from your investments? It’s not just a dream for the wealthy; it’s achievable for anyone willing to explore the possibilities. We will uncover various investments that promise monthly returns, from the well-known to the hidden gems. Whether you’re new to investing or looking to diversify your portfolio, discover how to create a dependable monthly income stream and take a step towards financial stability.

Unlock Passive Income: 15 Smart Investments That Pay You Monthly

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

11 Retirement Jobs to Tackle Inflation and Prevent Money Shortages

Embracing retirement is a remarkable milestone after years of diligent planning, and a time eagerly anticipated for adventures, relaxation, and finally ticking off those long-awaited tasks. Yet, the novelty of leisure can wane, leaving many retirees seeking more than just rest. The allure of rejoining the workforce, albeit in a low-pressure role, becomes not just about staying busy but a strategic move to offset inflation worries and ensure financial security. For retirees, the ideal post-retirement job marries minimal stress with the chance to leverage their vast reservoir of expertise and skills. Fortunately, the quest for fulfilling, low-stress work often leads to some of the most engaging and satisfying opportunities available for the retired demographic. As we explore options for retirees to remain both mentally and physically active while also navigating the challenges of potential money shortages, let’s first delve into five key benefits of finding such golden opportunities in retirement.

11 Retirement Jobs to Tackle Inflation and Prevent Money Shortages

Critical Social Security Strategies Every Single Person Needs to Know for Unlocking Higher Payouts

Although singles have fewer Social Security filing options than married couples, strategic planning on when to claim benefits can greatly benefit those flying solo.

Critical Social Security Strategies Every Single Person Needs to Know for Unlocking Higher Payouts

Retirees Struggle with New Social Security 2025 COLA Forecast at a Meager 2.63% Amid High Inflation

As we await the official Social Security cost-of-living adjustment (COLA) numbers, the Senior Citizens League (TSCL) has revised its long-term Social Security COLA forecast for 2025 to 2.63%. While this is an increase from the June 2024 forecast of 2.57%, it might not be enough for seniors struggling to keep up with inflation.

Retirees Struggle with New Social Security 2025 COLA Forecast at a Meager 2.63% Amid High Inflation

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.