Homebuyers With Good Credit Forced to Subsidize Others’ High-Risk Mortgages

The Federal Housing Finance Agency (FHFA) has updated the loan fee structure of mortgages leading to cries of unfair fees imposed on borrowers with excellent credit scores to subsidize the ones with lower credit scores. The revised fees will take effect beginning May 1st, 2023.

The Single-Family Pricing Framework Updated by FHFA

FHFA Director Sandra Thompson, a Biden appointee, is focused on “facilitating equitable and sustainable access to homeownership.” Low cash flow, high debt-to-income (DTI) ratios, and lack of liquid assets are the top three factors preventing Americans with low FICO scores from buying homes. DTI ratio is calculated by dividing the homebuyer’s monthly debt payments by their gross income and is used by lenders to determine loan eligibility.

The FHFA revamped and adjusted the upfront fee matrices for purchase, rate-term refinance, and cash-out refinance loans to ensure that borrowers with lower income or net worth can still afford single-family homes.

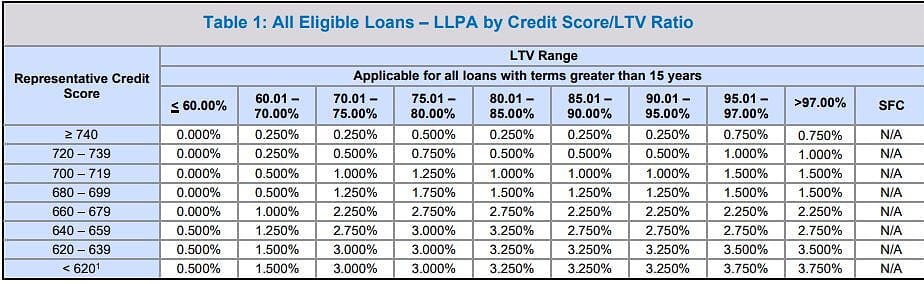

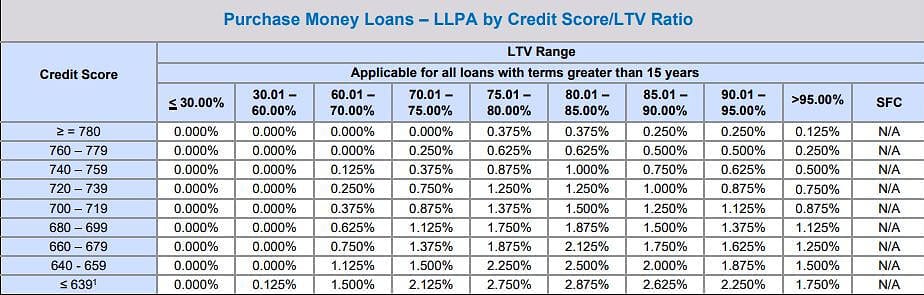

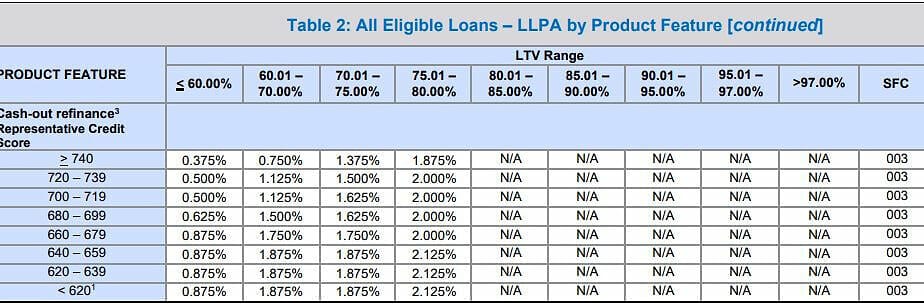

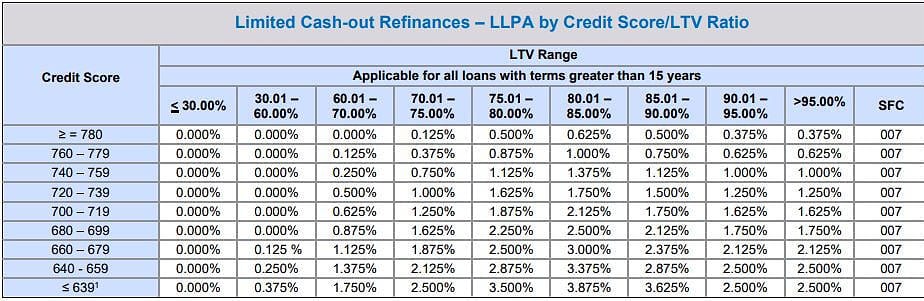

The fees or costs refer to the Loan Level Price Adjustments (LLPAs) that Fannie Mae and Freddie Mac impose. These entities guarantee the majority of new mortgages. The LLPAs depend on various loan features such as credit score, loan-to-value ratio, occupancy type (owner vs. non-owner occupied homes), and, most recently, debt-to-income ratio.

As a result of the changes, the penalty for a credit score below 680 has been reduced. For example, if your score is 659 and you’re borrowing 75% value of your home, you will pay a 1.5% fee on the loan balance. Previously, the fee would have been higher at 2.75%. On a hypothetical $1,000,000 loan, that’s a difference of $12,500 in closing costs.

While the changes seem positive for individuals with lower credit scores, things got worse for borrowers with higher credit scores. Buyers with good credit scores above 680 will see a significant rise in mortgage fees under the new regulations, especially for those making a 15% to 20% down payment.

Consider a borrower with a 759 credit score borrowing 85% home value. Previously the fee would have been 0.25%, and now the fee has increased to 1.00%.

What Loans Will Be Impacted?

The new pricing structure applies to all loans that Fannie Mae and Freddie Mac guarantee, no matter which lender provides the loan. This means that almost all loans, except for FHA, VA, certain jumbo, and “non-conforming” loans, will be affected starting May 1st, 2023.

David Stevens, who Obama appointed to serve as Assistant Secretary of Housing and Federal Housing Commissioner, criticized the proposed changes. “Recently, the FHFA pushed the GSE’s to modify their LLPA pricing to create a stronger cross subsidy that lowered fees for high loan to value (ltv) and lower FICO borrowers while raising costs on better credit worthy consumers. This was an intentional disruption to traditional risk based pricing in order to subsidize the lower rates now offered to these higher risk borrowers.”

In many scenarios, LLPAs are changing to lower costs for individuals with poor credit scores and raise prices for those with higher credit scores. Although a low-credit borrower isn’t paying less than a high-credit borrower, the gap between what they pay is just smaller than it was.

There is also an additional upfront fee if your debt-to-income (DTI) ratio is 40% or more and you borrow over 60% of your home’s value. The DTI changes have been postponed until August 1st following backlash.

Cash-out refinance loans will also have a significant increase in fees.

Long Term Consequences

Homeownership is great for fostering capital accumulation and improving generational wealth. The Federal Reserve’s multiple interest rate hikes have negatively affected the housing market. These hikes have caused mortgage rates to exceed 6%, about twice the rate from early 2022. The reason behind these rate hikes is the Fed’s attempt to combat inflation, which reached its highest point in 40 years at 9.1% last summer.

Although the goals of the FHFA to support borrowers with poor credit are admirable, there could be unintended consequences.

Besides the appearance of punishing borrowers with good credit scores, easing the buying process for poor credit borrowers could destabilize the housing market in the long run. The housing crash leading to the Great Financial Crisis was fueled by mortgage loans provided to borrowers without sufficient income and poor credit.

The Mortgage Bankers Association (MBA) has sent a letter to FHFA Director Sandra Thompson expressing concerns about the changes to the single-family pricing framework for Fannie Mae and Freddie Mac announced by the FHFA. MBA President Robert Broeksmit reiterated concerns about the proposed changes, mainly adding an LLPA based on DTI. The letter states that “the reasons for introducing DTI ratio into the enterprises’ pricing framework remain unclear. MBA believes the DTI ratio LLPA is unworkable and should be removed”.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

I’ve noticed a trend in the news to place this as political decision mentioning the President who appointed the people. I think it’s a little weird how it’s implying politics. Such publications should either be open that they think it’s political or not.

It’s worth pointing that out that Thompson was the Deputy Director of the Division of Housing Mission and Goals (DHMG) since 2013 and worked in the area.

I don’t see as rates as pre-ordained that the range has to be 0.250% to 3.250% and changing it to 0.375% to 2.875% (for the 80% LTV rate) is either a bonus or a penalty. Bad credit is still punished and good credit is still rewarded. It’s just less.

I think it’s a positive development to slightly de-emphasize credit scores at least until they can be cleansed of their racial bias.

Decisions by political appointees are political because they are carrying out the respective administration’s agenda. Every administration and their appointees should be able to justify their decisions and live with the positive and negative consequences of their actions. In this case, the statement indicates what is the motive.

I would disagree that credit scores have any racial bias and I say that as someone who did not even know what is a credit score when I came to this country. People born in the U.S. are better off than 90% of the rest of the world population. Life is unfair. We need to find our own unfair advantage and leverage it is my philosophy.