20 Brilliant Strategies to Invest in Real Estate with Little to No Money

Reviewing the list of income-producing assets backed by collateral, real estate typically features high. In fact, real estate is one of the best ways to build generational wealth.

However, investing in real estate usually requires money. Typically, you need at least a 25% down payment for buying a rental property. Often individuals wonder how to invest in real estate with little or no money.

Your lack of funds will have to be made up by sweat equity or adjustments in your lifestyle. After all, there is no free lunch. Let’s get started!

House Flipping

Flipping houses involve buying a home, fixing it up, and selling for a profit. Spending money to buy and fix a place with little or no money is challenging. It would be best if you then turned to hard money lending. As long as you have a great deal, you can find lenders who will loan you the money using the property you are flipping as collateral. While most lenders ideally want some money from you in the deal as “skin in the game,” you can find lenders willing to lend at a higher rate to compensate for the real estate investment risks.

If you cannot find lenders within your network for private money loans, you can advertise the deal on crowdfunded real estate platforms. Refer to my article which includes a checklist to evaluate a real estate crowdfunded deal. Based on what makes a deal attractive for an investor, look at how you can structure your deal when you ask for money on those websites by meeting most of the listed criteria.

Buy-Rehab-Rent-Refinance-Repeat (BRRRR)

BRRRR is a combination of the flipping and the “buy and hold” method. The acronym stands for Buy-Rehab-Rent-Refinance-Repeat. In this method, one would buy a house using a hard money loan and rehab it like flipping houses. But instead of selling it after the rehab, the owner would rent it out.

The rental income is then used to refinance the loan. Banks want to see at least a year of rental income before deciding if the investment property qualifies for a bank loan. The refinance involves obtaining a bank mortgage and repaying the hard money lender. The advantage of the bank loan is that it is available at a lower rate than the hard money loan.

After the refinance is completed, you can extract the house’s equity and then use it to fund your next buy and hold or flip. As long as the market stays steady, you can keep repeating for the next house, using the prior houses’ profit.

Live-In Flip

With a Live-in flip, you rehab a house, but you live in it and then sell it instead of immediately selling it. For this method to work, you need to have patience since you will be living in a perpetual construction zone. Also, you need high income-skills to carry out most of the repairs yourself.

This method is advantageous from a tax perspective. Owners are exempted from paying capital gains taxes on the sale (up to $250,000 for an individual and $500,000 for a couple); as long as they have lived at the property for at least 2 out of the previous five years. The tax-free money you obtain can fund your next rental property.

The U.S. Department of Housing and Development provides section 203(k) loan to turn “fixer-uppers” into dream homes. The loans are beneficial to invest in real estate with little money since the down payment can be as little as 3 percent, and the construction cost is also included in the loan amount.

House Hacking

House hacking is a strategy where you live in one part of the house and rent out the others. This is the ideal strategy for an individual who wants to invest in real estate with little or no money.

1. You get good at analyzing a property as an investment based on numbers and not emotions. People often buy their primary home and think it is an investment; in fact, it could be losing money.

2. You get to experience being a landlord and resolving tenant issues.

3. You can self-manage the property and understand a property manager’s roles and responsibilities.

4. If you want to improve your do-it-yourself skills, your own house is great to learn about minor repairs.

House hacking works for investing with little money because you can get a loan with a lower down payment in this scenario since it is owner-occupied. Depending on your circumstances,

– FHA loans from HUD for first time home buyers are available with just a 3.5% down payment.

– Veterans get loans from the U.S. Department of Veterans Affairs with a 0% down payment.

– USDA loans are available for rural areas.

Airbnb or Short-Term Rentals

Airbnb is an advanced version of house hacking. Instead of renting out your house to long term tenants, you host travelers from around the world. Of course, make sure you have the required safety precautions in place.

The returns with Airbnb are significantly higher than the long term rentals. But you are now operating as a hotel. Guests will have higher expectations, and you need to furnish and market your house appropriately. Check your local laws for Airbnb restrictions. Generally, having an Airbnb where the owner lives In the same property is more acceptable than the entire house being vacant and hosted as Airbnb.

Master Lease

Using a master lease, you can operate an Airbnb without owning a house. Most landlords prefer long term rentals since they do not want to deal with Airbnb guests. You can sign a long term rental agreement with the landlord and then sublet various rooms or rent out on Airbnb. Usually, Airbnb has a larger profit margin compared to subleasing each room.

Of course, be upfront with your landlord when you rent their property. Most landlords would be fine with a master lease as long as you pay the rent on time and meet their requirements.

Duplex With FHA Loan

The house hacking and Airbnb options are excellent, but you lose your privacy with strangers in your house. If you prefer privacy, buying a duplex with an FHA loan might be a better option.

Using an FHA loan, you can count the future rental income from the other half of the duplex to help you qualify for a larger loan. You will need more down payment since the duplex purchase price will be higher than a single unit. But your monthly payment is almost the same with the rental income paying the additional monthly mortgage.

Some lenders might require prior landlord experience to count future rental income while qualifying for a loan, but FHA lenders typically waive this requirement.

Cash-Out Refinance

If you already own a house that has appreciated significantly or paid down your mortgage and are cash poor, then cash-out refinance is a great option.

A cash-out refinance enables you to borrow money at the same time you refinance your loan. You refinance your mortgage and receive a check at closing.

New Loan balance = Old loan balance + Check + Closing cost

You can use the check you receive at the closing to fund your next real estate investment. Of course, this approach has pros and cons, so read my cash out refinance article to make an informed decision. The mortgage rate with a cash-out refinance will be slightly higher than a regular mortgage.

Home Equity Line Of Credit (HELOC)

A home equity line of credit (HELOC) is a line of credit secured by the equity in your primary residence. You can use the HELOC funds for home improvement. One of the ways to invest in real estate with little or no money is to tap into your HELOC and use it to add additional living space to your house.

The HELOC funds can be used to add a master bedroom or even a new accessory dwelling unit (ADU). The additional living space can be rented out or even used for Airbnb. The HELOC usually has a lower interest rate than other types of loans, and the interest may even be tax-deductible. Refer to IRS publication for tax guidance.

Seller Financing

With seller financing, you have the seller act as a bank. This approach’s advantage is that you have a lot of flexibility with the loan duration, interest rate, and payment terms, which can help you invest in real estate with little or no money. Seller financing is an excellent example of using other people’s money for creative financing.

The seller’s benefit is that they no longer have the headache of managing the investment properties. Also, since they are getting paid every month over several years instead of a lump sum payment, their tax burden is reduced. Also, they get a fixed monthly payment per month. And if the buyer fails to make the monthly payment, they can take back the property.

If structured correctly, seller financing can be an actual win-win situation for both parties.

Lease Option

Using a lease option, you rent a property with the opportunity to buy it at a fixed price in the future. You pay a higher rental price compared to market rent and can create a lease so that the excess rental payment goes towards the house’s purchase price in the future.

Rent-to-own mobile homes often have lease options to help individuals purchase the home at a later date.

For individuals with low credit scores, the lease option is a great way to invest in real estate with little or no money while continuing to repair their bad credit.

If you decide to use a lease option, make sure you get a written agreement with all the terms and conditions drafted by a lawyer.

Equity Partnership

Instead of investing in a rental property by yourself, you team up with a partner. The advantage of an equity partnership is that each of you brings something to the table. Since you want to invest in real estate with little or no money, your partner provides the property’s funding or takes out a loan in their name. You are responsible for all the other activities related to finding the deal to maintenance to dealing with the landlord.

You split the profits at the end of the deal or every month. Your partner provides the financing, and you are bringing your time and energy to the contract. For equity partnerships to be successful, make sure you write down each partner’s roles and responsibilities. And also how you will split the profits in a formal contract. The contract should govern the equity partnership in case of any disputes.

Wholesaling

Wholesale real estate investing is when you buy the property with the intent to sell it to someone at a higher price immediately. Unlike flipping, the wholesaler doesn’t do any renovation or put money in the deal. The wholesaler acquires the contract from the property’s seller and assigns that contract to a buyer for a fee.

Wholesaling real estate isn’t selling the property but selling the right to buy the property. There are several ways on how to close a wholesale property. Check the details in my post on wholesale real estate investing for beginners.

Bird Dogging

Bird dogging is half of the wholesale investing process. The significant difference between wholesaling and bird-dogging is that you do not close the deal as a “bird dog.” You only hunt the deal and bring it to a real estate investor for closing.

You get paid a finder’s fee by the investor for your efforts in finding and bringing the deal to them. Note that some states require you should have a real estate license to be paid a finder’s fee. As always, research your local laws. If you decide to make real estate your career; it might not be a bad idea to relocate to one of the best states for real estate investors.

Real Estate Investment Trusts (REITs)

Real estate investment trust (REIT) is one of the cheapest and easiest options to invest in real estate with little money. REITs are traded on the major exchanges like stocks. They invest in real estate directly, either through property purchases or through mortgage investments. Many REITs specialize in a particular type of real estate or a specific region.

The added benefit of REITs is you obtain portfolio diversification. For very little money, you get exposure to rental properties in different areas and also other types of real estate investments from apartment rentals to office buildings to malls to commercial real estate to warehouses. REITs also provide dividends, which can form a great real estate passive income stream.

Investing in REITs can be done for less than $100 using M1Finance. The advantage of M1 Finance is that you can auto-invest with the benefit of dollar-cost averaging. You can read about the pros and cons of M1Finance and how to get started. VNQ is one of the largest and most popular REITs from Vanguard.

Crowdfunded Real Estate

Real estate crowdfunding enables several investors to come together and invest smaller sums of money. The contributed pool of money is large enough to fund a real estate project. It is a win-win for both the investors and the developers.

Crowdfunding platforms have several deals that require in-depth analysis. Refer to my checklist for evaluating a real estate crowdfunded deal.

Of course, if you do have substantially more money to invest, a better option could be Real Estate Syndication. The challenge with syndications is that most of them are open to only accredited investors. Check to see how you can qualify to be an accredited investor.

Farmland Investing

Farmland investing is a specialized form of real estate investing. Instead of providing housing, you provide land for the farmers to grow their crops and share in the profit.

Typically it takes a lot of money and experience to buy farmland. However, with the advent of crowdsourced farmland investing, you can invest a smaller amount and own a farmland LLC piece.

Real Estate Agent

Working as a real estate agent is not directly investing. But it might be a safer approach if you want to invest in real estate with little or no money.

1. As a real estate agent, you get paid to learn the business.

2. You become an expert in your local real estate market, knowing the prices and what makes a good deal.

3. You increase your real estate network and get to know more contractors and investors, which is useful when you start to use any of the above investing methods.

Buy Land

Although buying land at auction or estate deals might seem to be the cheapest way to invest in real estate with little money, I would not recommend this method. The strategy relies on someone in the future, wanting to buy the land from you at a higher price.

The challenge with this approach is it depends on a lot of luck. Sure, the government might build a freeway next to your land, and it will become valuable, but you need to keep paying taxes on the ground you own. Even if this possibility becomes a reality someday, you would have lost money in taxes. Also, securing the land and ensuring no unauthorized squatters occupy the ground might be expensive.

I’d avoid this strategy unless you are very confident that the land you won would be in high demand soon. Also, check for back taxes, liens, closing fees, etc. to determine the total cost of the transaction,

Read Real Estate Books

If you are new to real estate investing or an experienced investor trying out a new strategy, I would highly advise buying books. Increasing your knowledge and learning from other professional investors could be the best way to get started investing in real estate with little or no money. Real estate can make money, but if done incorrectly, you could lose money as well.

If you have no money to invest in real estate, borrow real estate books from your local library. I created a list of the best real estate books for beginners, which helped me tremendously when I started investing.

How Do Beginners Invest In Real Estate?

As a beginner, it is always better to partner up with an experienced investor. Even if you do not make any money on your first deal, the knowledge you gain and the network you build will be invaluable for future deals.

1. Read up on real estate to have theoretical knowledge of the local market, various investing strategies outlined above, and what niche you would like to operate.

2. Look at the MLS listings via Zillow, Redfin, etc., in your area. Check the rental rates using free tools like Rentometer. Run the numbers using a calculator to know the optimal buy price to make a rental profitable.

3. Local real estate meetups are a great place to meet other investors. Take on the dull, tedious work the real estate investors want to offload so you can add value to them and ask them to mentor you. You have to provide value before expecting them to invest time and energy mentoring you.

How Much Money Do You Need To Start Investing In Real Estate?

If you are wondering, “how can I invest in real estate with $500” or a similar amount, then using the strategies listed in this article, you can technically invest in real estate with little or no money. However, it is always advisable to have some liquid cash depending on your strategy.

For example:

– If you pick bird-dogging, you need the cost of gas to find deals.

– If you decide to be a wholesaler, you need to spend money on bandit signs or driving for dollars.

– If you decide to house hack with an FHA loan, you need the 3.5% down payment.

– Investing in REITs can be done for less than $100 using M1Finance. VNQ is one of the largest and most popular REITs from Vanguard. You can read my complete M1 Finance review to get started investing.

– Investing in real estate crowdfunding.

The amount of money you need to start investing in real estate depends on your strategy.

Can You Invest In Real Estate With Bad Credit?

You can certainly invest in real estate with low or bad credit; using some of the strategies described above, such as

1. House flipping

2. Live-in flip

3. House hacking

4. Airbnb

5. Lease option

6. Seller financing

7. Equity partnership

8. Wholesaling

9. Bird dogging

10. REITs

11. Crowdfunded Real Estate

12. Real estate Agent

However, I do not recommend this approach. Once you start investing in real estate, you will realize that at any point, you need cash reserves to cover unexpected expenses. And there will always be challenges such as missed rental payment, broken water heater, roof repairs, etc.

Not having an excellent credit score is usually a symptom of not having managed finances in the past. No matter the cause, lenders don’t look upon it favorably. In the worst case scenario, you might lose your rental investment, which you have worked hard to get.

A better strategy would be to spend the time learning about real estate with books, networking, and getting good at analyzing rental properties while improving your credit scores. Build a budget and save money using free tools like Empower which has a budget tracker included. There would always be rental properties available in the future to buy. Plus, after you improve your credit score and have saved money for down payment, you can get better loans.

Like Financial Freedom Countdown content? Be sure to follow us!

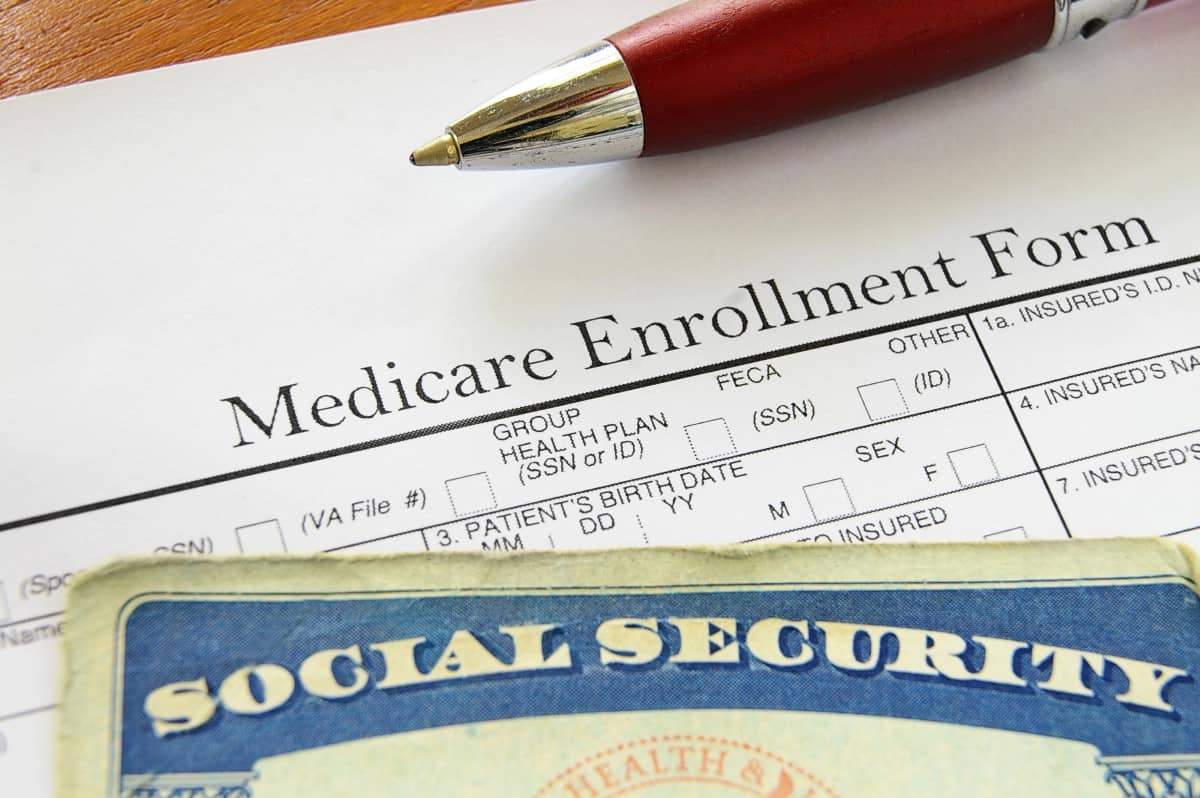

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

Surging 401(k) Hardship Withdrawals Unveil a Growing Concern Threatening Middle-Class Financial Stability

Recent reports from major retirement players like Vanguard, Fidelity Investments, and Bank of America point to a troubling trend. More individuals are resorting to hardship withdrawals from their 401(k) accounts, signaling a rise in immediate financial strains. This emerging pattern indicates that many Americans are navigating severe financial challenges.

Escape the Rat Race: Focusing on the Two Key Numbers for Financial Independence

You want to retire, but it seems too far away. Most people can’t quit until they hit a specific number in their bank account. But every financial calculator spits out generic numbers. Discovering the road to financial independence starts with understanding just two crucial numbers. Let us delve into the key metrics of retirement expenses and safe withdrawal rate, and how you can calculate it for your lifestyle.

Escape the Rat Race: Focusing on the Two Key Numbers for Financial Independence

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

As spring blooms and road trip season kicks into high gear, drivers face the challenge of balancing wanderlust with the rising cost of fuel. The average regular gas price as of March 2024 is $3.45 per gallon and at the highest level since November. But fear not! We’ve compiled 12 invaluable tips to help you navigate the highways and byways while keeping your gas budget in check. From clever tricks to tried-and-tested techniques, discover how you can maximize your mileage and minimize your spending, ensuring that your spring road adventures are not just memorable but also affordable. Whether you’re planning a cross-country expedition or a weekend getaway, these tips will empower you to make the most of every gallon, so you can hit the road with confidence and ease.

Unlock Savings at the Pump: 12 Essential Strategies for Reducing Your Fuel Expenses

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.