M1 Finance Review 2024: Is it the Perfect Investment Platform?

Investing is hard due to a myriad of factors ranging from behavioral to psychological.

Getting started with investing and continuing with investing should ideally be automated so we do not second guess ourselves; trying to time the market or chase the next hot sector. Despite all the technological advances and myriad of brokerages competing for our investment dollars, there are not many perfect investment platforms.

I reviewed a number of investment platforms and scored them based on the advantages offered by each platform. I will update this post if better alternatives emerge in the future.

Review of M1 Finance compared to Vanguard, Schwab, Fidelity, Wealthfront and Betterment indicates that it is currently the perfect investment platform.

Characteristics Of My Perfect Investment Platform

My ideal dream platform would have zero fees, wide selection of low expense ratio funds and very low minimum investment. In addition to these basic characteristics, it should help one get started with a basic asset allocation. It should also automate investing and re-balance my portfolio automatically back to the desired asset allocation with zero tax implications. Would be great if it also did tax loss harvesting.

Let us examine each aspect of my perfect investment platform in detail.

Zero fees:

In this day and age when almost anything can be done online; it is criminal to charge fees for the act of investing. Fees could have been justified back in the day when you needed a human to answer the phone or manually place a trade. Wealthfront and Betterment charge 0.25% fee on all accounts.

Charging a fee based on your total assets is egregious. Initially when your balance is small you might not notice it. As your balance grows, this becomes a larger and larger recurring annual expense. Every dollar you don’t pay in fees is another dollar in your pocket, compounding for your future. For this reason, I have excluded Betterment and Wealthfront.

One might argue that the fee is justified based on their claim of Tax loss harvesting. I have not seen any published data wrt what is the quantum of benefit these firms have provided with tax loss harvesting to justify the fees. In fact, the SEC fined Betterment in 2018 as wash sales occurred in at least 31 percent of accounts enrolled in Wealthfront’s tax loss harvesting strategy.

On the bright side, Vanguard, Fidelity, Schwab do not currently charge fees.

All M1 clients now have access to the best of M1 including premium features and competitive rates. With these changes, M1 introduced a monthly platform fee of $3.00 which is waived for clients who have $10,000 or more in M1 assets at least one day during each billing cycle or an active Personal Loan. There is a 90 day grace period before the platform fee is applied to new clients.

Verdict: Betterment and Wealthfront out. Neutral for the remaining contenders since they charge no fees or minimal fixed fees.

Selection of Funds:

Vanguard, Schwab and Fidelity have an extensive selection of funds; albeit restricted to mostly their own fund families. However since most of their own index funds have a low expense ratio, this is not a major negative. M1 Finance supports most common stocks, ETFs and close ended funds listed on supported exchanges. So you get everything from Fidelity, Schwab, Vanguard, iShares, individual stocks, etc

Verdict: Slight edge to M1 Finance.

Minimum Investment:

Although I love Vanguard for popularizing index funds and being a pioneer wrt forcing lower expense ratios across the industry; the minimum investment is an area where it fails miserably. Most Vanguard index funds have a minimum of $3,000 and some like the technology index fund have a whooping $100,000 minimum.

Fidelity has no minimum investment.

Schwab and M1 Brokerage accounts have a minimum of $100. Retirement accounts at M1 have an initial minimum deposit of $500.

High-Yield Cash accounts at M1 do not have an initial minimum deposit.

Firstly, it is easier to get folks investing weekly with smaller amounts instead of expecting them to save and wait till they have $3,000. Saving that amount and resisting the temptation to avoid spending it before it reaches that minimum threshold is hard.

Secondly, having to invest $3,000 in one swoop, will also lead most folks to second guess themselves. They will wonder if this is the right time to invest or should they wait for “lower” prices. The result of this analysis paralysis will result in them never getting started.

Thirdly, and most importantly, we are all humans and psychology is paramount. If someone diligently saves $3,000 and invests it; and the market drops suddenly, they will freak out and may shy away from any further investments. Psychology and behavior are important for investing which is why I rank this aspect quite high.

Verdict: Slight edge to Fidelity over Schwab and M1 Finance. Huge negative for Vanguard.

Auto Invest:

The best results from investing come from putting money to work in the market with regular frequency. It is hard to know what causes the markets to rise and fall on a daily basis. Also trying to time the market is a fool’s errand and will result in lower returns. Whether you own a business or work at a job, people get paid in a periodic fashion (monthly or every two weeks). Instead of deciding when to invest and how much to invest, the best course of action is to invest in a periodic fashion (as soon as you get paid) and automate that investing behavior.

Verdict: Neutral since all have auto investment feature.

Pre-defined asset allocation:

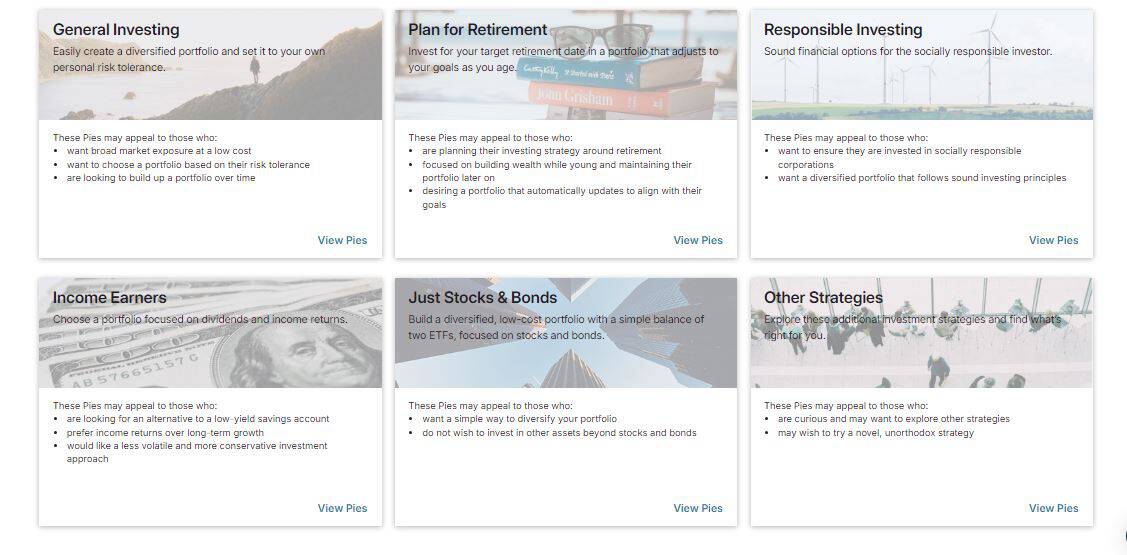

In order to get started with investing; it would be great if there was a way for investors to select a pre-defined asset allocation. Fidelity, Schwab and Vanguard have Target date funds. M1 Finance has a much more extensive menu, if you are not a DIY investor in the form of pies. Some of their unique “model portfolios” offer

- General Investing: Easily create a diversified portfolio and set it to your own personal risk tolerance.

- Plan for Retirement: Invest for your target retirement date in a portfolio that adjusts to your goals as you age.

- Responsible Investing: These are for the socially responsible investor to align their investments with the worldwide promotion of positive social and environmental values. Given that there is a lot of focus on climate change, gun control, etc you can invest in these pies which exclude companies not aligned with your values while simultaneously rewarding companies making positive social and environmental impacts.

- Income Earners: Choose a portfolio focused on dividends and income returns. You would notice that these have a higher dividend yield compared to other pies.

Verdict: M1 Finance has a unique offering for all investors to get started. Several options from planning for retirement to income earners and everything in-between.

Auto Rebalance:

After you have decided on your asset allocation; it is always a good practice to periodically rebalance your portfolio. Rebalancing restores asset classes to their target allocations by selling assets that have appreciated and buying those that have declined. It is at its core a risk-minimizing strategy and also meant to increase returns due to the reversion to mean theory.

Vanguard, Schwab and Fidelity unfortunately DO NOT have auto rebalancing. You have to manually perform this action on a periodic basis. What is even worse; is that with Vanguard, Fidelity and Schwab since you are actually selling your winning stocks, funds, ETFs you would need to pay capital gains tax.

M1 Finance has a totally automated and tax efficient approach to rebalancing. Dynamic rebalancing with auto-invest on gradually rebalances your portfolio over time as new deposits are

automatically invested into underweight holdings. This allows your portfolio to balance back towards your targets without selling, avoiding potential tax implications from rebalancing trades.

Verdict: Huge positive for M1 Finance since it does this in an automated and tax efficient manner.

Another advantage of M1 Finance is that you can also buy fractional stocks and ETFs. My former coworker keeps pondering when should he buy Amazon and at what price 🙂 So if you are enamored by Amazon and don’t want to invest a hefty chunk to buy one share; you can just add Amazon to your pie and based on your asset allocation, M1 Finance will auto buy it even in fractions. This is especially useful for High Beta stocks like Amazon, Apple, Netflix, etc which swing wildly over a period of time. This is not important to me; but I am sure some investors would like this additional feature.

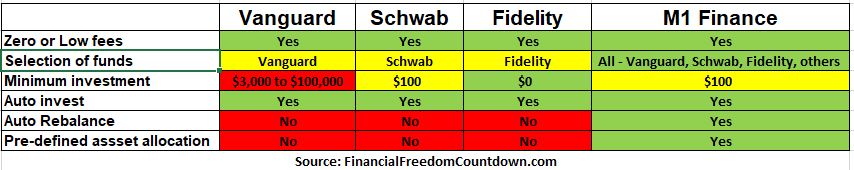

Here is a quick summary comparing all the platforms as discussed

Is M1 Finance Safe?

M1 Finance is covered under the SIPC. The SIPC covers up to $500,000, including $250,000 in cash, in the event of broker failure. Also it is a Broker/Dealer Regulated by FINRA

The High-Yield Cash account also offers $3.75M in FDIC insurance through a deposit network.

How does M1 Finance Optimize Taxes When Selling Securities?

M1 Finance uses a tax minimization method when you want to sell your stocks/ETFs. If you request a withdrawal from your account; the algorithm determines which securities to sell, based on target allocations. It then sells securities based on a tax efficient order

Short-term capital loss, from the biggest loss to the smallest.

Long-term capital loss, from the biggest loss to the smallest.

Short-term zero gain/loss.

Long-term zero gain/loss.

Long-term capital gains, from the smallest gain to the biggest.

Short-term capital gains, from the smallest gain to the biggest.

Does M1 Finance let you buy Index Funds?

Yes. M1 Finance does not have it’s own funds or ETFs. The advantage is you can buy Index funds (ETFs) from most of the major fund families including Vanguard, Schwab, Fidelity, etc.

How does M1 Finance make money?

This was the part I was most curious to figure out. M1 Finance makes money in several ways to ensure they are profitable while not charging management fees or commissions.

1. High-Yield Cash Account (Earn):

M1 offers a cash account for short-term investments with no fees. M1 retains a portion of the interest earned from partner banks, while passing most on to clients. The account’s APY is linked to the Effective Federal Funds rate..

2. Invest Platform:

M1 doesn’t charge trading commissions or fees for deposits/withdrawals. Instead, it generates revenue through:

- Cash Lending: The platform lends client cash to banks overnight, tracking the Federal Funds rate. Compared to other brokerages, clients hold less cash due to features like fractional shares and automatic investment for balances over $25.

- Securities Lending: M1 borrows and lends high-demand securities, while clients retain ownership of their securities and rights to dividends.

- Payment for Order Flow: M1 receives small payments per share from market makers for executing trades, improving prices for clients.

3. Crypto Transactions:

M1 charges no commission for crypto trades but has a 1% fee on transactions through Apex Crypto, reflected in execution prices.

4. Borrow Services:

- Margin Loans: Clients can borrow against their portfolios without selling assets, allowing potential tax benefits. M1 charges lower rates than typical loans while profiting from the difference.

- Personal Loans: Interest from personal loans constitutes M1’s profit margin.

5. Spend Services:

- Interchange Fees: M1 earns a percentage of transactions through the Owner’s Rewards Card, which integrates into client portfolios.

- Membership Fees: Clients with less than $10,000 incur a $3 monthly fee unless they have an active personal loan.

To summarize, the ways M1 Finance makes money are common revenue streams for most financial services companies. I am glad it is used to subsidize my perfect investment platform.

Getting started

- Sign up using this link and create your account using your email id and password

- Answer a few questions about yourself

- Connect your bank account where you setup automatic funds to invest. You can select the frequency and amount you wish to fund.

- Build a sample portfolio either using your own individual stocks, ETFs or select one of the expert pre-made pies.

- And you are set!

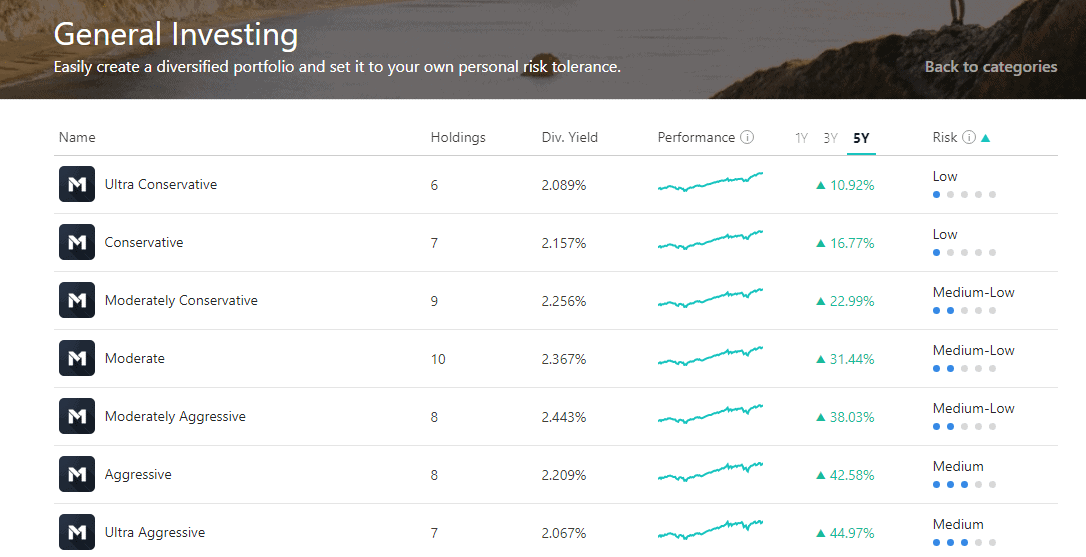

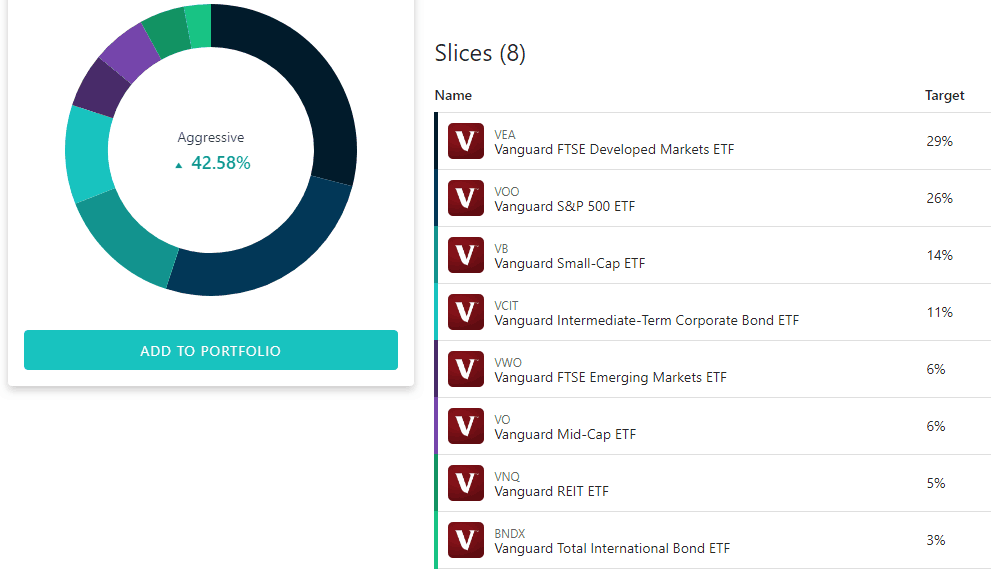

You can drill down into the pre-made pies to even check what ETFs each of them contain. Here are the options in General Investing

If I click on the Aggressive I can see what is under the hood. Comforting to notice that these are standard low cost Vanguard ETFs.

Cons of M1 Finance

- Not for traders: This platform is more suited to buy and hold investors who want to grow their wealth. Although you can sell your stocks/ETFs any time it is not suited for traders. The “set it and forget it” model helps remove any psychological barriers wrt investing.

- No Tax loss harvesting: Ideally I would like this to be an additional feature but not a deal breaker for now

- Model Portfolios do not take into account outside investments: It would be good if M1 Finance could take into account my external accounts such as an employer 401(k) and recommend pies based on what I already own.

Final Thoughts On M1 Finance

Review of M1 Finance compared to Vanguard, Schwab, Fidelity, Wealthfront and Betterment indicates that it is currently the perfect investment platform due to low fees, very low minimums, automated investment with automatic rebalancing. Pre-built asset allocations and fractional shares compliment the pies like whipped cream.

I have been using the platform for over a year and am highly satisfied, Hoping other platforms emulate these features so we can all win.

Readers, have you tried M1 Finance so far. If so, what are the features you like or don’t like?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

One Comment