The Beginner’s Guide to Real Estate Crowdfunding: Pros, Cons and Tax Advantages

Wealthy individuals once dominated the private real estate investment world, but that changed with online real estate crowdfunding investment platforms.

Real estate crowdfunding is an exciting, unique investment opportunity that allows everyday people like you and me to make money by investing in institutional quality real estate projects. It is the perfect way for real estate investors who want more control over their investments and are tired of traditional stock market options. But it’s not without its own set of pros and cons that you need to be aware of before getting started.

In this article, we will discuss everything there is about crowdfunding for real estate investors so that you can decide if this real estate passive income investment option is right for you! We cover what it takes to get started, how much money you need, which real estate crowdfunding sites we recommend using, how it works with taxes, and more!

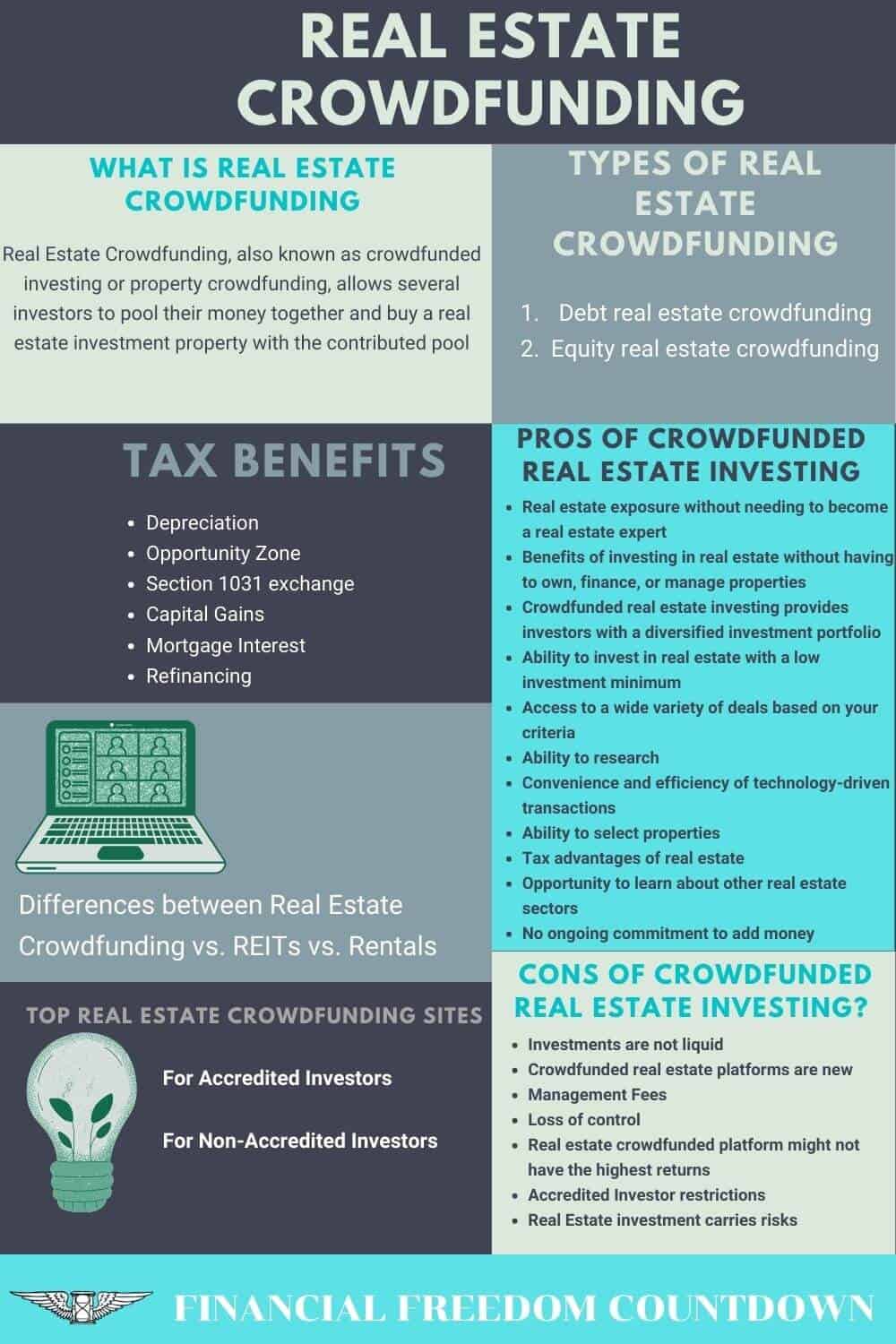

What Is Crowdfunding For Real Estate?

Real Estate Crowdfunding, also known as crowdfunded investing or property crowdfunding, allows several investors to pool their money together and buy a real estate investment property with the contributed pool.

Crowdfunding for real estate investors is a way to diversify their investments and own multiple properties with less risk than if they were doing it alone. The process gives individual investors access to the real estate market without owning, financing, or managing properties.

For a developer or a real estate professional, raising money from individual investors helps finance the project without needing to fund the entire commercial real estate development by themselves.

Is Crowdfunded Real Estate Investment Legal?

Yes. Before the Jumpstart Our Business Startup (JOBS) Act, real estate investors could only buy their own investment property or invest in publicly traded companies that owned property such as real estate investment trusts (REITs).

Or investors could pool money together to invest in real estate syndications limited solely to friends and family, and the deal sponsor couldn’t solicit funds online. Due to the high amount of money required, commercial real estate investments were feasible only for institutional investors.

That changed with the passage of the JOBS Act in 2012, which made high net worth individuals who meet the accredited investor qualifications eligible to invest in the real estate market.

In 2016, the SEC implemented Title III, allowing non-accredited investors to participate online in the real estate market (Regulation A+). From that point onwards, real estate crowdfunding investment opportunities were available to everyone. Crowdfunding now greatly expanded the pool of potential investors for raising money. It also provided alternative investment opportunities to individual investors.

Types Of Real Estate Crowdfunding

There are two main crowdfunding options based on the capital stack for those interested in crowdfunding real estate projects.

- Debt real estate crowdfunding

- Equity real estate crowdfunding

Debt crowdfunding

In debt investing, also called “real estate note investing,” an investor lends money to a project in the form of a bridge loan (short duration) or hard money loans (slightly longer covering the entire rehab and fix part of the project) in exchange for interest on the loan.

The contract (also called a promissory note) specifies the duration, interest payment, and clauses for extensions and pre-payments. Loans can be structured to pay interest periodically or pay the entire amount with the principal at the end of the term.

Equity crowdfunding

In equity crowdfunded real estate, the investor is a part-owner and shares the profit generated. Crowdfunding investors can make money if their investment does well by taking a percentage of any profit made on the sale when it sells. Investors typically also get regular income in the form of rent payments from the property. Equity crowdfunding is more common in commercial real estate development.

By structuring participation in the real estate project as equity crowdfunding, the principal partner can offer each investor an ownership share in the property instead of paying the interest, which provides greater flexibility.

Equity crowdfunded real estate deals can be further sub-divided into preferred equity and common equity. Preferred equity is the next step up from debt investment in a company’s capital stack. Preferred shareholders get paid before common equity.

Pros And Cons Of Debt Vs. Equity Real Estate Crowdfunding

Both debt crowdfunding and equity crowdfunding have their own sets of advantages that may be more helpful for some real estate investors than others.

The biggest pro about debt crowdfunding is the low risk because the property backs the money you invest in the project. If something goes wrong, the property is foreclosed, and you get paid first. Of course, the property’s value needs to be higher than the loan amount for you not to suffer a loss. But generally, debt investment is the safest form of crowdfunded investment.

Also, debt real estate crowdfunding has a shorter hold period compared to equity crowdfunded deals.

The biggest pro about equity crowdfunding is the higher average annual returns obtained by taking a percentage of any proceeds on the sale, which means more money in your pocket if everything goes well! The price appreciation works when the deal sponsor can force price appreciation and change the cap rate. Profit on debt investments is limited to the interest rate of the real estate developer’s mortgage loan.

However, the downside to equity crowdfunding is the higher risk if the project does not go as planned. Equity crowdfunded real estate also has higher management fees since commercial real estate development is complex and involves many moving parts.

| Debt Real Estate Crowdfunded Investments | Equity Real Estate Crowdfunded Investments |

|---|---|

| Short Term | Longer Term |

| Secured Debt | Higher Risk |

| Single-phase project | Multiple phases |

| Easier to evaluate returns and outcome | More complicated evaluation |

| Fixed Interest Payments | Payments depend on deal structure |

| Interest payments taxed as income | Potential tax benefits such as depreciation |

| Limited Upside | Higher Potential Payout |

How Crowdfunding For Real Estate Works?

When people look into crowdfunding their investments, they may wonder how it works and what the process looks like. Well, crowdfunding real estate is not as complicated as many think! The following steps explain how crowdfunding occurs:

- The deal sponsor or real estate developer identifies the property to be acquired based on several assumptions made to ensure the project is successful.

- The target property is listed on the crowdfunded real estate platform so potential investors can have an opportunity to validate the assumptions and select properties which meet their criteria. And the developer can raise capital for real estate investing.

- The real estate crowdfunding platform solicits funds from the investors on behalf of the real estate developer and disburses the funds once the project is fully funded. Some crowdfunding platforms have target-based milestones and will release funds only when specific criteria are met. For example: release 20% after completion of the plumbing activity.

- The crowdfunded real estate platform handles collection and disbursement of funds, regulatory issues, providing tax documents, etc., for a fee.

- The deal sponsor provides periodic updates of the project through the crowdfunded real estate platform and should return funds, including any profit, back to the investors after exiting the project.

What Are the Pros Of Crowdfunded Real Estate Investing?

Real estate exposure without needing to become a real estate expert

Although I know enough about real estate, have my rental properties, and talk about fixing and flipping or wholesaling real estate properties, there are many areas of real estate where I am not an expert. I would prefer to have an experienced real estate professional manage the acquisition, rehab or build, maintenance and management, and ultimate sale of the property for a share of the profit.

Benefits of investing in real estate without having to own, finance, or manage properties

I would rather spend my time improving my human capital on earning more money at my day job and not deal with tenants or contractors. Also, this commercial real estate investment is managed by an experienced management team with a prior track record. And I receive passive income insulated from the stock market volatility.

Crowdfunded real estate investing provides investors with a diversified investment portfolio

If I invest in traditional real estate projects, I can only afford one or two properties. The benefit of crowdfunding is that I can fund smaller amounts in multiple commercial real estate investments and thus be diversified for the same amount.

Real estate investors can diversify across crowdfunding platforms, deals, real estate developers, locations, and even property types to achieve the desired real estate portfolio.

Ability to invest in real estate with a low investment minimum

The minimum investment for most private real estate deals is $100,000. Crowdfunded real estate investment platforms allow any investor to get involved with real estate with a lower investment minimum. Some crowdfunded real estate platforms like Streitwise have a minimum of only $2,500.

Access to a wide variety of deals based on your criteria

I live in the San Francisco Bay area, and it is impossible to find cash-flowing properties which meet my criteria locally. Using a crowdfunded real estate platform, I can set my rules and select several investment deals, including farmland, office buildings, warehouses, etc. Commercial real estate investment would be virtually impossible for me to invest without crowdfunded real estate.

Ability to research

Crowdfunded real estate investing platforms have several deals which enable you to compare similar deals providing you data to determine if it is a good deal or not. Also, you have access to the historical information of past deals done by the developer to know how the projects fared.

I recommend signing up for all the platforms even if you do not want to invest since you now have more deals to compare before making an investment decision.

Convenience and efficiency of technology-driven transactions

Investing in real estate through crowdfunding is easy. You set up an account on a platform, select your investment, research the deal and send money to fund the deal! Everything takes place online without needing to visit a bank or a notary, or a title company for closing.

Since all the deals and the associated data are available online, I can invest in real estate projects located miles away without even visiting the property with only a few clicks.e

Many platforms also provide automated investments based on your investment criteria so that your idle cash is immediately deployed into earning returns.

Ability to select properties

Investing in REITs provides you some of the benefits listed above, but you lose the ability to pick and select where your money is deployed. REITs typically invest in hundreds of properties without providing you the ability to choose specific properties. With a real estate crowdfunding platform, you can focus your investments on a selected property.

Tax advantages of real estate

Investing in real estate crowdfunding deals provides many of the tax advantages of real estate. Investing in REITs doesn’t offer you all the tax benefits of real estate investments.

Tracking on your investment

Investing in REITs involves several holding companies and you have no idea what is being done with your money. When you invest in a real estate crowdfunded deal, the deal sponsor sends periodic updates on the project providing you full transparency on your investment enabling you to track how your money is being invested.

Opportunity to learn about other real estate sectors

Most of us are only familiar with residential real estate in single-family homes or fourplexes. After investing in a crowdfunded deal, you receive periodic updates from the real estate professionals, which provides a great learning experience about other real estate sectors such as office buildings, malls, warehouses, or even farmland. I now know how institutional investors do “value add” to apartment buildings, enabling them to raise rents. I now have some ideas to implement for my investment rental properties.

No ongoing commitment to add money

Anyone owning rental properties can attest that things get broken and need to be replaced at the most inopportune time. As long as you have enough money set aside for ongoing expenses and capital projects, owning rental properties is not an issue. Make sure you know how to evaluate rental properties.

However, the roof often needs replacement, the heater dies, and a tree falls on your property, all at the same time putting a strain on your budget. And you need to scramble for funds to take care of all of it.

With real estate crowdfunding, you generally need only to fund the projects at the start, and the operator usually has everything covered. There are rare instances when you might receive a capital call, but you can check with your sponsor on the probability of the occurrence before you invest in the project.

What Are the Cons Of Crowdfunded Real Estate Investing?

There are several disadvantages of real estate crowdfunding

Investments are not liquid

The biggest one is that you might not be able to get your money out at a moment’s notice. Investments in real estate crowdfunding are not liquid. Your money will be tied up for the agreed project duration. Don’t expect to access your funds before the deadline. Contrast that with publicly traded REITs, which can be sold anytime.

Crowdfunded real estate platforms are new

The crowdfunding real estate industry is relatively new, with most crowdfunding platforms operational only after 2012. Some real estate crowdfunding platforms simply act as brokers and do not own or manage the real estate themselves, in which case their bankruptcy should have minimal impact on your investment. Other crowdfunded real estate investment sites own and operate the real estate themselves, so you need to ensure that the real estate assets are held in a separate entity compared to the platform.

Management Fees

Real estate crowdfunding platforms charge management and advisory fees depending on the platform and investment vehicle you choose. I am okay with paying the advisory fees for the benefits offered, but you might not have the same viewpoint. In either case, it is good to be aware of the various expenses involved. Of course, if you do not want to pay fees, there are several ways to invest in real estate with little or no money, but all of them involve sweat equity and reliance on real estate mentors at the start.

Loss of control

Crowdfunded real estate platforms allow you to select deals, but after you fund the account, you are dependent on the sponsor to operate and manage the commercial real estate investment.

You do not have a say in how the operators run their business. You must trust the developer to meet goals and successfully manage all aspects of a project’s development process.

I am okay with this since I trust the deal sponsor to have better knowledge in running the commercial real estate investment and deciding when to sell. But if you are a type-A personality; who likes to micro-manage everything, crowdfunded real estate might not be a good fit. You are better off finding your deals and managing them.

Real estate crowdfunded platform might not have the highest returns

Finding deals on your own and managing the entire commercial real estate development could yield higher returns than a crowdfunded real estate platform as long as you spend enough time, expertise, and resources.

Accredited Investor restrictions

Although crowdfunded real estate platforms have lowered entry barriers and made real estate accessible to more individuals, they might need to restrict specific deals to only accredited investors based on SEC regulations.

The SEC recently modified its rules on how to become an accredited investor. I am hoping the SEC loosens the restrictions even further in the next few years. In case you still don’t qualify, some real estate crowdfunding sites like Streitwise have options for non-accredited investors, too

Real Estate investment carries risks

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. Returns are not guaranteed. When we rank the best passive income-producing assets, we see that risks and rewards are correlated. It is always good to step back and decide if you are okay with the risk of real estate investments. Don’t assume that crowdfunded real estate investments are immune from the local real estate market risks.

Tax Advantages Of Crowdfunding In Real Estate

If you invest in debt-only deals, you act like a “hard money” lender and receive periodic interest based on the loan details. Usually, interest received from debt-only commercial real estate investments does not have a lot of tax advantages since interest received is considered income and taxed at the income tax rate.

However, several tax advantages are available to real estate crowdfunded deals if you invest in equity deals. These may not be available in every commercial real estate investment, so check on your sponsor’s deal structure and details.

Depreciation

Depreciation is one of the most valuable tax advantages of real estate syndication. As per the IRS, any improvements made to the property can be depreciated over the property’s expected life. Typically the duration is 27.5 years for residential and 39 years for commercial real estate investment.

For example, if your rental property (the structure itself) is valued at $5,000,000, you would divide that by 27.5 years (~$181,818). You can now deduct $181,818 as a depreciation expense annually for 27.5 years.

The depreciation deduction allows you to report a smaller profit to the IRS, thereby reducing the amount you ultimately owe in taxes. In this way, you can significantly offset the gains.

Cost Segregation

If the sponsor maintains accurate records of improvements or performs a “cost segregation” study, they can depreciate certain items using an accelerated depreciation schedule.

With a cost segregation study, you can identify improvements that can be depreciated over a shorter period. For example, as part of renovating the kitchen to increase rent, you replace the fridge, microwave, etc. You can depreciate the refrigerator and microwave over five years compared to 27.5 years. Accelerated depreciation takes into account the time value of money. A dollar written off today is more valuable than 27 years later.

Bonus Depreciation And Section 179

IRS finalized the bonus depreciation rules as per The Tax Cuts and the JOBS Act. Businesses can accelerate the depreciation timeline and take it earlier in the lifespan of the property. Some rental properties can also use section 179. Details on Section 179 are available in IRS Publication 946.

Opportunity Zone

Specific properties on real estate crowdfunding platforms are located in opportunity zones. If you have substantial capital gains, look at investing in the Opportunity Zones.

Section 1031 Exchange

Section 1031 exchange is one of the best tax advantages of real estate investing, where the investor can roll over the gains from the previous real estate project into the next project. I have noticed some real estate crowdfunding deals offer section 1031 exchange benefits to a limited subset of investors. Using a Tenant In Common (TIC) entity and the usual investor LLC structure makes this possible.

Note that the sponsor needs to structure the deal differently to stay within the IRS guidelines. Hence it might not be as common as the other tax benefits.

Capital Gains

As a result of improvements made to the property and the resultant changes in cap rate, the sponsor should sell the property for more than the purchase price. Rates for long-term capital gains are lower than short-term capital gains.

Holding the property for the long term can prove advantageous when computing capital gains.

Mortgage Interest

The interest paid to service mortgage debt on rental investment is 100% deductible. The real estate sponsor provides this write-off benefit to the investors.

Refinancing

Refinancing would lower interest costs. Although it is not directly a tax advantage, the investors benefit from the lower expenses.

The sponsor can perform a cash-out refinance, which is a tax-free event.

An experienced sponsor will have tax professionals to maximize tax benefits for real estate investors. Please note that I am not a tax professional, and you should consult a licensed CPA for your situation.

Differences between Real Estate Crowdfunding vs. REITs vs. Rentals

We have covered many topics, so I am sure you must be wondering the differences between crowdfunded real estate vs. REITs vs. traditional buy-and-hold rentals.

For purposes of this comparison, when we mention real estate investment trusts (REITs) we are referring to the publicly-traded funds. The offerings from Streitwise, Fundrise and DiversyFund are private REITs.

| Crowdfunded Real Estate | REITs | Traditional Rentals | |

|---|---|---|---|

| Experience needed | Medium. We need to at least evaluate the deal. | Low since totally hands-off and index driven | High to select a good deal, close and operate the property |

| Types of deals | Debt or Equity | Equity | Equity |

| Cash flow | Payments depend on type of deal structure. Can have monthly periodic payments or no initial cash flow with a lumpsum at the end. | At least quarterly while some pay monthly | Monthly |

| Minimum investment | $1,000 debt deals $10,000 equity deals | $10 can buy fractions via platform such as M1Finance | Down payment and closing costs required |

| Ongoing costs | Management fee of sponsor | None except negligible ETF expense ratios | Rental repair expenses |

| Availability | Usually restricted to accredited investors. Limited real estate crowdfunding for non-accredited investors is available. | Available to everyone due to low costs | Highly restricted due to higher minimum investments and ongoing costs |

| Deal flow | High due to availability of several sponsors and no geographic limitations to invest in private market deals | N/A since index ETF is responsible | Low since it is harder for an individual to source several deals. Also limited by geography. |

| Diversification | Medium since you can invest in several crowdfunded real estate deals | High since each publicly traded REIT owns several properties. | Low since the high minimum investments reduce opportunities for other investments. |

| Deal selection | Ability to select particular deals | REITs don’t let you invest in individual properties | Ability to select particular deals |

| Liquidity | Low since you are locked for deal duration. Might be possible to surrender the stake to the sponsor | Very liquid as you can sell the ETF anytime on any exchange | Very low unless you are willing to sell at fire-sale prices |

| Tax benefits | Medium since you can avail most of the rental property investment tax benefits in equity deals. | Low since REITs have high dividends which are taxed at income tax rates | Highest |

| Self Directed IRA (SD IRA) | Opportunity to use SD IRA | Opportunity to use SD IRA | Not advisable to use SD IRA for rental properties due to risk of prohibited transactions. |

| Profit potential | High since you receive the tax benefits and sponsor manages the deal | Lower profit potential since REITs have limited tax benefits | Highest since you can select and manage all aspects of the deal |

Can You Make Money from Real Estate Crowdfunding?

Yes, you can get good returns in real estate crowdfunding; but like any asset class, returns are not guaranteed. Real estate is one of the oldest asset classes and a great way to build generational wealth. But there are many variables involved with real estate, making it hard to identify average annual returns. The real estate crowdfunding returns depend on several factors and vary from deal to deal.

You can also lose money in real estate. You need to research the crowdfunded real estate investment platforms, the sponsor, and each deal to make a judgment based on your risk profile. Follow your own vetting process.

Review the pros and cons listed in the article to decide if crowdfunded real estate is right for you!

How Much Money Do You Need To Invest In Crowdfunded Real Estate?

If you wonder, “how much does real estate crowdfunding cost?” the answer is as low as $10.

The minimum amount you need to invest in real estate crowdfunding can vary from $10 to $15,000, depending on the crowdfunding platform you use and the type of deal.

The beauty of real estate crowdfunding is that the amount will always be lower than if you would be investing in the property on your own!

What Are The Requirements For Investing In A Crowdfunded Real Estate Deal?

A few crowdfunded real estate investments allow all investors, but those investments allocate your funds to several different properties compared to one asset.

The majority of single asset crowdfunding is only open for accredited investors based on SEC requirements of net worth or annual income. To determine your net worth, you can link all your accounts using the free Personal Capital tool. Check my Personal Capital Review on how I use the free software for everything from budget management to retirement planning to net worth calculation.

How Can I Start Investing In Real Estate Crowdfunding?

If you want to get started crowdfunding your real estate investments, there are a few things you should know first.

- Some real estate crowdfunding platforms permit accredited investors. Others allow both accredited and non-accredited investors. Check if you qualify based on your income or net worth. Personal Capital makes it easy to check your net worth in minutes.

- Decide how much you want to start investing with and what your max investment threshold is. Don’t over-extend yourself.

- How long is your holding period? Invest after making sure you can hold the investment for the period specified.

- Define your criteria. As an investor, decide if you want to invest in debt or equity-type deals. New build or rehab? Do you prefer residential or commercial real estate development? If residential, do you want single-family houses or apartment buildings? Commercial real estate investment could range from warehouses to office buildings. Have you considered which are the best states for real estate investors?

- Sign up with the various real estate crowdfunding platforms to learn about the multiple types of deals each platform offers, how quickly the deals get subscribed, the history of the various sponsors, and their prior track records.

- It is also essential to research the crowdfunding platform thoroughly. Please find out about the business model and fee structure. And any feedback from users who have used them previously. Is the crowdfunding platform well-capitalized and has been in operation for several years. Are they financially stable?

- Pay attention to the process for vetting deals and sponsors on various platforms. Consider the deals vetted by the platform as only the first pass. Carry out your own due diligence on the sponsor and the commercial real estate investment. Feel free to refer to my 10 point checklist on evaluating real estate crowdfunding investments and add your own additional criteria.

- Start small. Use your initial investment as a learning opportunity before you decide to invest a lot.

- Diversify across several real estate crowdfunding sites and deals to reduce your risk.

Top Real Estate Crowdfunding Sites

You can do real estate crowdfunding through multiple different online crowdfunding websites. The best real estate crowdfunding platforms depend on your goals, investment amount, and the accredited investor qualifications. Different crowdfunding platforms have distinct strengths, and one investor’s needs may not work for another.

Crowdfunding Platforms For Accredited Investors

EquityMultiple is a real estate investing platform that gives accredited investors direct access to individual commercial property, allowing you to review, compare, and personally choose the deals that meet your investment criteria. EquityMultiple has a low minimum of only $5,000 investment. They are one of the few sites that claim to co-invest in every investment, ensuring “skin in the game” and the most significant incentive to do maximum due diligence. EquityMultiple has many different asset types: office buildings, industrial, senior housing, retail, residential, self-storage, student housing, data centers, etc.

CrowdStreet is a commercial real estate investing platform for accredited investors. It has a higher minimum of $25,000 per deal. CrowdStreet offers both single property investments and multi-property funds, as well as both equity and debt deals. Most commercial real estate investments on CrowdStreet have no investor fees (unless investing in a fund with underlying fees). CrowdStreet has the highest number of different asset types available for investing. Commercial real estate projects, including office buildings, industrial, hospitality, senior housing, retail, multifamily apartments, storage, schools, medical centers, student housing, data center, parking garages, etc., are available to invest directly.

Crowdfunding Platforms For Non Accredited Investors

A few options are available using the REIT structure if you wonder about equity crowdfunding for non-accredited investors. Note that these REITs are not the same as publicly-traded REITs. Unlike many publicly-traded REITs, the crowdfunded investments are typically privately held.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. I do like the high conviction to invest their own money along with other investors. You can invest in Streitwise as an Individual, LLC/Corporation, Trusts or IRA/401(k). The other advantage is that Stretwise is also open to foreign/non-USA investor. Minimum investment is $5,000.

The trade-off with low investments of Streitwise is that you cannot select one particular property; but rather an eREIT invested in several commercial real estate investments. If you are a fan of diversification, the investment spread over multiple properties reduces the risk.

| Investment Platform | Open to | Type of Investment | Minimum |

|---|---|---|---|

| EquityMultiple | Accredited Investors | Commercial | $5,000 |

| CrowdStreet | Accredited Investors | Commercial | $25,000 |

| Streitwise | Accredited and non-Accredited Investors. And also foreign/non-USA investors | Commercial | $5,000 |

If you do not qualify as an accredited investor based on financials, you can still meet the accredited investor qualifications based on knowledge.

Final Thoughts On Crowdfunding In Real Estate

Crowdfunding is a popular strategy for investing in real estate. As an investor, you can purchase partial ownership of commercial and residential building projects through several real estate crowdfunding sites. Or even farmland.

It is perfect for people who want to own rental properties but don’t have the high down payment required by traditional lenders. Real estate crowdfunding is also suitable for investors who do not want to deal with the hassle of rental properties but want all the tax deductions and leveraged returns. Make sure your investment aligns with your risk tolerance.

Payments depend on type of deal structure and one can have monthly periodic payments or no initial cash flow with a lumpsum at the end. The payment frequency could be an important factor when individuals are evaluating investments that generate monthly income.

Readers, have you considered crowdfunded real estate as part of your portfolio? What has been your experience with various sectors and real estate crowdfunding sites?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.