Nearly a Million People Risk Losing Over $1 Billion in Unclaimed 2020 Tax Refunds If They Don’t Act by May 17

Tick tock, the clock is counting down for nearly a million Americans who stand on the brink of losing out on a staggering sum of over $1 billion in unclaimed tax refunds from 2020. With the May 17 deadline looming, it’s a race against time to secure what’s rightfully yours.

Pay Attention to the Deadline for 2020 Refund

Normally, the IRS gives taxpayers a three-year window to submit their returns and secure any refunds owed. After this period, unclaimed refunds revert to the U.S. Treasury. Typically, the cutoff to claim past refunds aligns with the annual April tax filing deadline—April 15 for the 2023 tax season. However, for the tax year 2020, an extension was granted for submitting unfiled 2020 returns and claiming refunds through IRS Notice 2023-21, released on February 27, 2023. The notice extended the deadline to May 17, 2024.

Additional Credits May Be Available

The IRS estimates the midpoint for the individual refund amounts for 2020 to be $932 — that is, half of the refunds are more than $932 and half are less. This estimate does not include the Recovery Rebate Credit or other credits that may be applicable; the IRS has previously reminded those who may be entitled to the Recovery Rebate Credit in 2020 that time is running out to file a tax return and claim their money.

Don’t Miss Out on Earned Income Tax Credit

By missing out on filing a tax return, people stand to lose more than just their refund of taxes withheld or paid during 2020. Many low- and moderate-income workers may be eligible for the Earned Income Tax Credit (EITC). For 2020, the EITC was worth as much as $6,660 for taxpayers with qualifying children. The EITC helps individuals and families whose incomes are below certain thresholds. The thresholds for 2020 were:

$50,594 ($56,844 if married filing jointly) for those with three or more qualifying children;

$47,440 ($53,330 if married filing jointly) for people with two qualifying children;

$41,756 ($47,646 if married filing jointly) for those with one qualifying child, and;

$15,820 ($21,710 if married filing jointly) for people without qualifying children.

How Can I Know if the IRS Owes Me an Unclaimed Tax Refund?

Unfortunately, there’s no straightforward method for taxpayers to ascertain if they’re owed tax refund funds. The sole approach to find whether the IRS holds an old refund for you is by filing a return for that specific year.

Regrettably, the IRS Where’s My Refund tool is of no assistance in this matter, as it solely tracks the refund status of individuals who have already filed their taxes.

How Can I Claim My 2020 Income Tax Refund From the IRS?

To claim a refund for 2020, you will need to submit your 2020 tax return. Taxpayers seeking a refund for the 2020 tax year are advised by the IRS that their funds could be withheld if they haven’t filed tax returns for 2021 and 2022. Moreover, any refund for 2020 will be allocated to outstanding amounts owed to the IRS or a state tax agency, and may also be utilized to offset unpaid child support or other overdue federal debts like student loans.

What Should I Do if I Do Not Have Documents for Filing 2020 Tax Returns?

Even though 2020 may seem like a distant memory, the IRS emphasizes that taxpayers still have avenues to gather the necessary information for filing their tax returns. To ensure sufficient time before the May deadline for 2020 refunds, early action is key. Here are some strategies:

1. Request copies of essential documents: Taxpayers missing Forms W-2, 1098, 1099, or 5498 for the years 2020, 2021, or 2022 can obtain copies from their employer, bank, or other payers.

2. Utilize Get Transcript Online: Those unable to obtain missing forms can order a free wage and income transcript through the Get Transcript Online tool on IRS.gov. For many taxpayers, this proves to be the quickest and most convenient option.

3. Request a transcript: Alternatively, individuals can file Form 4506-T with the IRS to request a “wage and income transcript.” This transcript displays data from information returns received by the IRS, including Forms W-2, 1099, 1098, Form 5498, and IRA contribution information. While these written requests may take several weeks, individuals are encouraged to explore other options first.

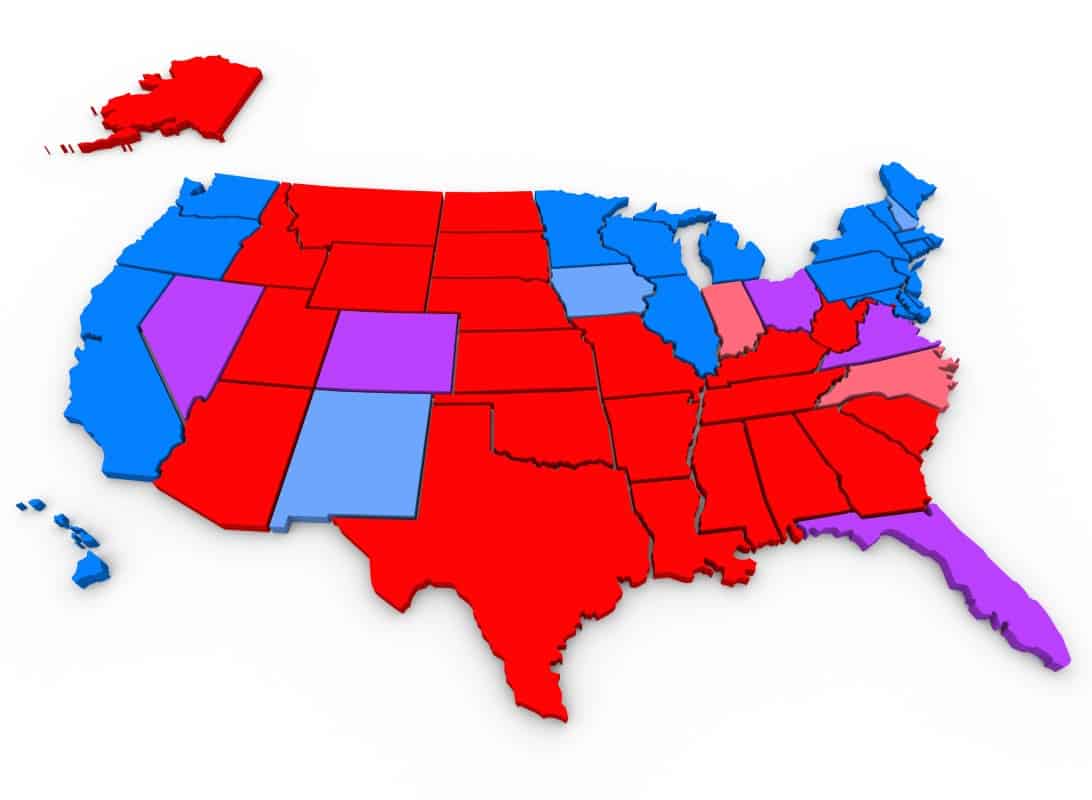

State-by-State Estimates Who May Be Due 2020 Income Tax Refunds

Texas has the largest number of potential refunds at 93,400 followed by California at 88,200.

In aggregate, residents of Texas have $107,130,200 in unclaimed 2020 tax refund and Californians are owed $94,226,300 in total.

Residents of Pennsylvania are owed the largest median refund at $1,031 followed by New York at $1,029. These number do not include the additional credits which might be due to the tax filers.

IRS Reminding You To Claim

Usually, the IRS isn’t in the position of reminding taxpayers to claim their refunds. With the arrival of each filing season, countless Americans eagerly file their tax returns, anticipating their refunds. However, there’s invariably a segment that misses out on submitting their paperwork, leaving their refunds unclaimed. Specifically, for the tax year 2020, IRS Commissioner Danny Werfel says, “There’s money remaining on the table for hundreds of thousands of people who haven’t filed 2020 tax returns. We want taxpayers to claim these refunds, but time is running out for people who may have overlooked or forgotten about these refunds. There’s a May 17 deadline to file these returns so taxpayers should start soon to make sure they don’t miss out.”

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.